Modern Monetary Theory - MMT

What is MMT and how could it completely change your perception of life in a nation with a sovereign fiat currency? Looking for MMT resources in other languages? Try our INTERNATIONAL MMT RESOURCES page.

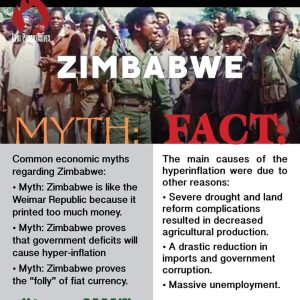

"If we just keep printing money, we'll devalue the dollar!"

"Printing money will cause inflation!"

"OhEmGee the National Debt!!"

We've all heard loads of rumors...now it's time to get the truth!

Use the arrows or swipe through the slides to learn more.

It's not something to implement someday, it is exactly how our money works TODAY!!

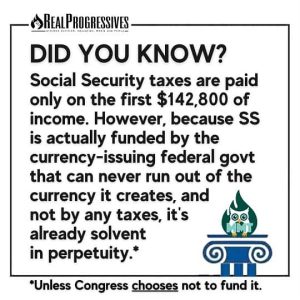

The currency issuer is not constrained to balanced budgeting in the same way as a currency user.

No matter what politicians or talking heads on TV say, when a country issues its own sovereign currency, it can never run out.

That would be like the scorekeeper in baseball running out of points! Crazy, right?

As a matter of fact, in order for us to pay taxes in the first place, the government, the CURRENCY ISSUER, has to create (or spend into existence) the money. Then, we CURRENCY USERS have to find a way to get some money to pay our taxes.

Most governments, most of the time, will run fiscal deficits. This is not a matter of concern, and is indeed a good thing, as it means most private sectors will be able to run the financial surpluses they wish to add to their net savings.

The government’s deficit is our surplus – we should be glad all that money hasn’t been taxed out of the economy!

Browse our MMT focused articles and filter them using the tabs at the top to find a specific topic.

Browse our MMT focused articles and filter them using the dropdown tab at the top to find a specific topic.

- All Articles

- Federal Reserve

- Hyperinflation

- Inflation

- Job Guarantee

- MMT 101

- MMT Academics

- MMT Rebuttal

- National Debt

- Social Security

- Taxation

- All Articles

- Federal Reserve

- Hyperinflation

- Inflation

- Job Guarantee

- MMT 101

- MMT Academics

- MMT Rebuttal

- National Debt

- Social Security

- Taxation

A Hyperinflation Hyperventilator Cannot Be Reasoned With

Steven D. Grumbine December 5, 2020 Economic Justice Editorial

Quite frankly… you are not worth the effort. Come back to me when you are ready to talk in good faith.

A Green New Tomorrow: A Survival Guide with Rohan Grey

Virginia Cotts October 10, 2019 Environmental and Ecological Justice Podcast

In part 2 of our interview Rohan Grey talks about debt, public banking, the Green New Deal, and the job guarantee. He dispels some notions about robots and the UBI. (Podcast)

A Framework for the Analysis of the Price Level and Inflation

Warren Mosler October 21, 2021 Economic Justice MMT Expert

Introduction The purpose of this chapter is to present a framework for the analysis of the price level and inflation. MMT (Modern Monetary Theory) is …

7 Deadly Innocent Frauds of Economic Policy

Warren Mosler September 11, 2016 Economic Justice Informative

The presumption of innocence by those perpetrating the frauds is characteristic of Professor Galbraith’s cynically gracious approach.

4 Key Ignored Points in the Inflation / MMT debate

Cian Walker November 4, 2021 Economic Justice

Inflation has caused great economic harm many times and in many places around the world throughout history. But, where we’re stood now, is this time and place one where inflation should be a concern?

Why we need to debunk the 'deficit myth' - BBC REEL

Government spending is increasing at an unprecedented rate to deal with the effects of the coronavirus pandemic. Many people worry this could burden future generations.

However, economist Stephanie Kelton, author of The Deficit Myth, argues that we need to rethink our attitudes towards government spending.

Could Modern Monetary Theory help us navigate our way out of this crisis – and even help build a fairer economy?

Producer: Dan John

Animation: Jacqueline Nixon

(Republished with permission from the BBC)

Weaponizing knowledge, one mind at a time.

Visit our seven focused Knowledge Areas.