Modern Monetary Theory - MMT

What is MMT and how could it completely change your perception of life in a nation with a sovereign fiat currency? Looking for MMT resources in other languages? Try our INTERNATIONAL MMT RESOURCES page.

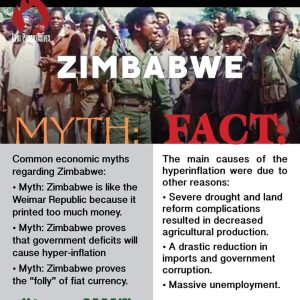

"If we just keep printing money, we'll devalue the dollar!"

"Printing money will cause inflation!"

"OhEmGee the National Debt!!"

We've all heard loads of rumors...now it's time to get the truth!

Use the arrows or swipe through the slides to learn more.

It's not something to implement someday, it is exactly how our money works TODAY!!

The currency issuer is not constrained to balanced budgeting in the same way as a currency user.

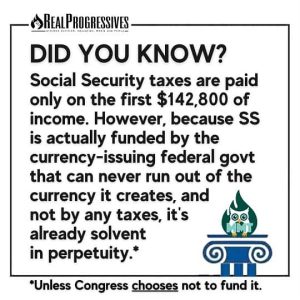

No matter what politicians or talking heads on TV say, when a country issues its own sovereign currency, it can never run out.

That would be like the scorekeeper in baseball running out of points! Crazy, right?

As a matter of fact, in order for us to pay taxes in the first place, the government, the CURRENCY ISSUER, has to create (or spend into existence) the money. Then, we CURRENCY USERS have to find a way to get some money to pay our taxes.

Most governments, most of the time, will run fiscal deficits. This is not a matter of concern, and is indeed a good thing, as it means most private sectors will be able to run the financial surpluses they wish to add to their net savings.

The government’s deficit is our surplus – we should be glad all that money hasn’t been taxed out of the economy!

Browse our MMT focused articles and filter them using the tabs at the top to find a specific topic.

Browse our MMT focused articles and filter them using the dropdown tab at the top to find a specific topic.

- All Articles

- Federal Reserve

- Hyperinflation

- Inflation

- Job Guarantee

- MMT 101

- MMT Academics

- MMT Rebuttal

- National Debt

- Social Security

- Taxation

- All Articles

- Federal Reserve

- Hyperinflation

- Inflation

- Job Guarantee

- MMT 101

- MMT Academics

- MMT Rebuttal

- National Debt

- Social Security

- Taxation

The Operational Reason Why Federal Taxes are Not Revenue for the Federal Government

Ellis Winningham June 29, 2017 Economic Justice Published

Since this is a major topic of interest for laypersons, I’m going to explain operationally why your dollars paid in federal taxes are not spent by the federal government on anything.

The National Debt and Other Red Herrings

Jonathan Kadmon January 15, 2022 Economic Justice

Discussions of inflation are often laden with an air of superstition and moral panic. Like all such things they can only persist in the face of misunderstanding and rumor.

The Myth of Debt

Chris Cook June 4, 2023 * New Economic Perspectives

From the latest cuts to the economic forecasts to the Italian elections to the gathering debate about how George Osborne should play this year’s Budget, all discussions about the financial system now lead swiftly back to the world’s sovereign debt problem.

The Mismeasure of Macro

Dave Pilkington August 28, 2020 Economic Justice Policy Essay

Sloan strives for one more scare tactic. MMT will cause the United States to lose its reserve currency status and all the foreign bondholders will dump their treasury securities. This may sound scary to the average reader but those versed in bond markets will immediately see through the farce.

The Millennials’ Money

J.D. ALT October 14, 2020 Economic Justice Reference Material

Modern fiat money, once it becomes a “visible reality” for more and more people, can’t help but become a force for positive change in our political discourse and collective future.

The Irresistible Allure of Debunking MMT Hit Pieces: A Response to Peter Diekmeyer

Allyson Drucker June 12, 2019 Economic Justice Policy Essay

So, tell me who has ALREADY made out big from MMT? Special interests. The big campaign donors. Decidedly NOT the people.

The Greatest Myth Propagated About The FED: Central Bank Independence (Part 3)

L. Randall Wray May 28, 2023 * New Economic Perspectives

There never has been the kind of independence supposed by orthodox economists.

The Greatest Myth Propagated About The FED: Central Bank Independence (Part 2)

L. Randall Wray May 28, 2023 * New Economic Perspectives

In this blog we look at the myth of Fed independence from its creator, the Congress and from the Treasury.

The Greatest Myth Propagated About The FED: Central Bank Independence (Part 1)

L. Randall Wray May 28, 2023 * New Economic Perspectives

It has been commonplace to speak of central bank independence—as if it were both a reality and a necessity…

The Five Stages of Money (and why we’re stuck at stage 4)

J.D. ALT June 18, 2018 Economic Justice Policy Essay

Given the pressing needs America and the world now face, which profit-making enterprise has no interest in addressing, the time for Stage 5 money is at hand. We have it in our grasp. The question is: when we will see what it is and how to use it?

The Federal Reserve is Not a Private Bank – A Response to Counterpunch

Hector Danson April 15, 2018 Economic Justice Policy Essay

Calling out the omission of facts from a recent Counterpunch article concerning the U.S. Federal Reserve.

The Fed’s Response to the Coronavirus Depression

Real Progressives April 8, 2020 Economic Justice Monthly Outreach Call

Nathan Tankus discusses how the federal government should respond to this crisis on our April National Outreach Call.

Why we need to debunk the 'deficit myth' - BBC REEL

Government spending is increasing at an unprecedented rate to deal with the effects of the coronavirus pandemic. Many people worry this could burden future generations.

However, economist Stephanie Kelton, author of The Deficit Myth, argues that we need to rethink our attitudes towards government spending.

Could Modern Monetary Theory help us navigate our way out of this crisis – and even help build a fairer economy?

Producer: Dan John

Animation: Jacqueline Nixon

(Republished with permission from the BBC)

Weaponizing knowledge, one mind at a time.

Visit our seven focused Knowledge Areas.