Modern Monetary Theory - MMT

What is MMT and how could it completely change your perception of life in a nation with a sovereign fiat currency? Looking for MMT resources in other languages? Try our INTERNATIONAL MMT RESOURCES page.

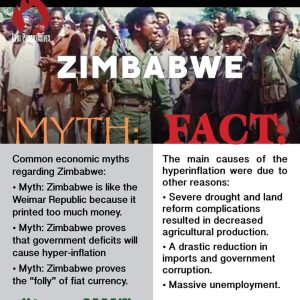

"If we just keep printing money, we'll devalue the dollar!"

"Printing money will cause inflation!"

"OhEmGee the National Debt!!"

We've all heard loads of rumors...now it's time to get the truth!

Use the arrows or swipe through the slides to learn more.

It's not something to implement someday, it is exactly how our money works TODAY!!

The currency issuer is not constrained to balanced budgeting in the same way as a currency user.

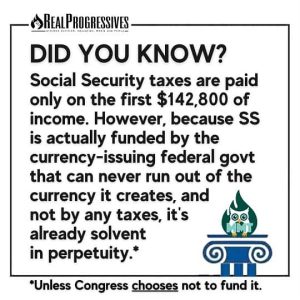

No matter what politicians or talking heads on TV say, when a country issues its own sovereign currency, it can never run out.

That would be like the scorekeeper in baseball running out of points! Crazy, right?

As a matter of fact, in order for us to pay taxes in the first place, the government, the CURRENCY ISSUER, has to create (or spend into existence) the money. Then, we CURRENCY USERS have to find a way to get some money to pay our taxes.

Most governments, most of the time, will run fiscal deficits. This is not a matter of concern, and is indeed a good thing, as it means most private sectors will be able to run the financial surpluses they wish to add to their net savings.

The government’s deficit is our surplus – we should be glad all that money hasn’t been taxed out of the economy!

Browse our MMT focused articles and filter them using the tabs at the top to find a specific topic.

Browse our MMT focused articles and filter them using the dropdown tab at the top to find a specific topic.

- All Articles

- Federal Reserve

- Hyperinflation

- Inflation

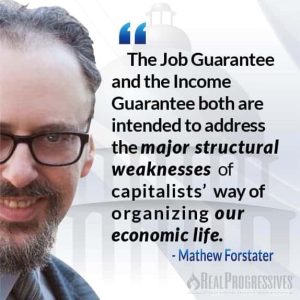

- Job Guarantee

- MMT 101

- MMT Academics

- MMT Rebuttal

- National Debt

- Social Security

- Taxation

- All Articles

- Federal Reserve

- Hyperinflation

- Inflation

- Job Guarantee

- MMT 101

- MMT Academics

- MMT Rebuttal

- National Debt

- Social Security

- Taxation

Money and Banking (Part 6 – Treasury and Central Bank Interactions)

Eric Tymoigne September 17, 2021 * New Economic Perspectives Economic Justice

This post studies how the Fed is involved in fiscal operations and how the U.S. Treasury is involved in monetary-policy operations.

Money and Banking (Part 5 – FAQs about central banking)

Eric Tymoigne September 16, 2021 * New Economic Perspectives Economic Justice

This post answers some FAQs about monetary policy and central banking.

Money and Banking (Part 4 – Monetary Policy Implementation)

Eric Tymoigne September 15, 2021 * New Economic Perspectives Economic Justice

While details in operating procedures have changed through time, the federal funds rate has progressively gained in importance as a relevant operating tool since the 1920s.

Money and Banking (Part 3 – Monetary Base, Reserves, and Central Bank’s Balance Sheet)

Eric Tymoigne September 14, 2021 * New Economic Perspectives Economic Justice

Now that we have an understanding of how the balance sheet of the Fed works, it is possible to go into the details of how the Fed operates in the economy in terms of monetary policy.

Money and Banking (Part 2 – Central bank balance sheet and immediate implications)

Eric Tymoigne September 13, 2021 * New Economic Perspectives Economic Justice

Part 1 reviewed basic balance-sheet mechanics. This post begins to apply them to the Federal Reserve System (Fed).

Money and Banking (Part 1 – Balance Sheet)

Eric Tymoigne September 12, 2021 * New Economic Perspectives Economic Justice

If you cannot put your reasoning in terms of a balance sheet, there is a problem in your logic.

Modern monetary theory and inflation – Part 1

Bill Mitchell July 7, 2010 Economic Justice

It regularly comes up in the comments section that Modern Monetary Theory (MMT) lacks a concern for inflation. That somehow we ignore the inflation risk. …

Modern Monetary Theory – A Presentation for the Lavender Greens

Giovanna Laine March 12, 2019 Economic Justice Policy Essay

The only constraint on spending by the US federal government is resources. Or, as Dr. Stephanie (Bell) Kelton puts it, the federal government can buy every American a pony, if we breed enough ponies.

Modern Monetary Lens

Brad Sandler August 18, 2021 Economic Justice Equality with Justice

The point has been to make it clear that using the MMT lens and choosing to look for public purpose solutions yields full employment and a path to a progressive society.

MMT: Report From The Front (Part 3)

L. Randall Wray May 29, 2023 * New Economic Perspectives

The colorful commentary and spicy rebuttal of critics continues in part 3 of Randy Wray’s review of the 3rd annual MMT conference.

MMT: Report From The Front (Part 2)

L. Randall Wray May 29, 2023 * New Economic Perspectives

Comments and critiques from the front lines at the 3rd annual MMT conference – grab some popcorn!

MMT, Models, Multidisciplinarity

Pavlina Tcherneva May 31, 2023 * New Economic Perspectives

The attacks on MMT are taking a comical turn. Don’t miss this rebuttal complete with an AMAZING list of reference links.

Why we need to debunk the 'deficit myth' - BBC REEL

Government spending is increasing at an unprecedented rate to deal with the effects of the coronavirus pandemic. Many people worry this could burden future generations.

However, economist Stephanie Kelton, author of The Deficit Myth, argues that we need to rethink our attitudes towards government spending.

Could Modern Monetary Theory help us navigate our way out of this crisis – and even help build a fairer economy?

Producer: Dan John

Animation: Jacqueline Nixon

(Republished with permission from the BBC)

Weaponizing knowledge, one mind at a time.

Visit our seven focused Knowledge Areas.