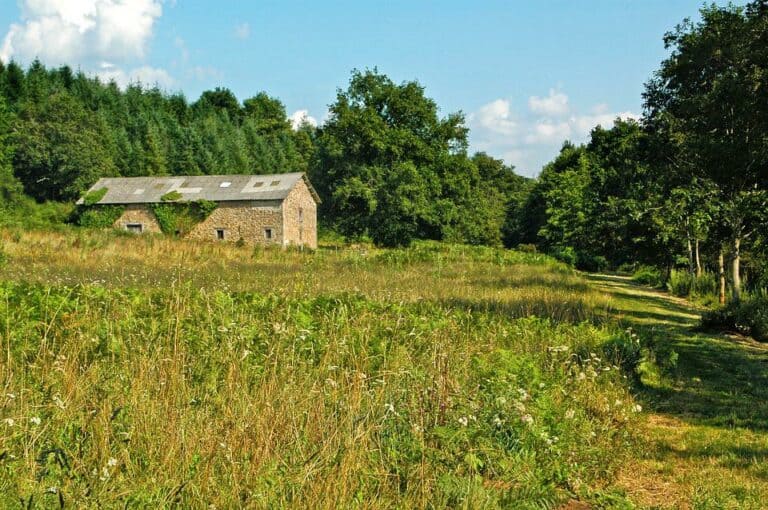

About thirty years ago, I moved to France with the frankly ludicrous idea of setting up a centre for permaculture. Up until then I’d spent my life in Edinburgh and in universities, and so knew next to nothing about the countryside. An immediate problem was the brambles and sloes that had taken over the 20 acre decrepit farm we’d bought. Brambles are bad, but sloes are ten times worse.

Meeting our neighbour, I asked his advice on how to clean up our land. His French was appalling – he’d clearly never learnt it at a Scottish school, but I eventually understood that I needed a tractor and a giro. I didn’t have a tractor and I didn’t know what a giro was.

The next morning, I was woken at some distressingly early hour by a dreadful clanking noise. I looked out of the window and there was the neighbour with his tractor chewing his way across our meadows, battering down the brambles and sloes with an enormous spinning blade. I dashed out to ask what was happening, but he waved me away and kept on driving.

Hours later, the noise stopped and I got the chance to ask him the all important question – how much was this going to cost. We’d never discussed any of that. His answer was ‘nothing’! As you can imagine, this was very unnerving for a well-brought-up Scot. Neither a borrower nor a lender be. What could I give him in exchange? In the rural economy, where people don’t have much money, these exchanges are best described as a gift economy. In France it’s called entraide – helping one other.

But of course, this is how the world has always worked. Community and trust and obligation are established by giving. There are cultures where your status depends on how much you give away, whereas in our culture, status is based on how much you can grab for yourself. My neighbour was saying that he was happy to trust that at some future date, I would pay him back … somehow.

Doughnut Economics

Kate Raworth’s book Doughnut Economics urgently calls our attention to the need to look after ourselves and our planet properly. The time of grabbing everything for ourselves is over.

Permaculture is about design, and Raworth’s book is a call to redesign economics – the management of a household – so that we stay within her Doughnut of life: the inner ring being the basics so that every living thing gets what it needs; the outer ring being the constraints of a finite planet with finite resources.

My experience of a countryside gift economy in France got me into thinking about how our current money system works, or doesn’t, and how poorly aligned it is with the Doughnut model. Mostly, I’ve realised that we way think about money is wrong. A survey of politicians [A] indicates that 85% of them don’t have a clue where money comes from … and they are supposed to be running the show. Ha!

It is hard to design a better system if you don’t understand how it currently works. What I am going to say here is very challenging. If you know the film The Matrix, you will remember that Morpheus offers Neo a choice between two pills. If Neo takes the red pill, he will begin to see the world as it really is. If he takes the blue pill, the familiar everyday world will carry on as before.

For Raworth’s Doughnut Economics to work, I reckon that we need to shed the mythology of money that keeps us trapped, swallow the red pill, and begin to see the world as it really is.

The rugby match

My first challenging thought is to say that money is essentially a scoring system. Thinking of the French gift economy, there may have been no money involved but I was clearly in my neighbour’s debt, and woe betide me (socially) if I didn’t remember this. At some point, I would reciprocate, and the debt would be cancelled. In a more complex economy, a more sophisticated scoring system is needed.

I find it helpful to have an analogy at hand. The rugby match is a good one. The teams rush about and the referee awards points. No one asks where the points come from; no one worries that there won’t be enough points left to play another game tomorrow; no one suggests the referee should borrow some points from another game – such questions would be daft.

And yet we are immediately led astray by Theresa May telling nurses there is no magical money tree that can be shaken to pay them properly; we somehow accept that the question ‘where is the money going to come from’ is sensible and that it acts as a gatekeeper on anything we may decide needs to be done. End of.

Returning to the rugby match, there are two actors in the game of points: the referee is the issuer of points, the teams are the users. The only way for teams to gain points is to score tries. The referee has no such constraint – the referee tells the scorekeeper to mark up a point, and the number appears on the scoreboard.

The UK money system works identically: the government is the issuer of the points, and is unconstrained in its spending. It pays nurses by typing numbers into their bank accounts. These points are just numbers, but once in the hands of the public, the numbers can be used as money in the normal way. Money is not stuff; it is not bits of paper with someone’s head embossed on them; nor is it gold – we left the gold standard 90 years go, and yet our thinking always harks back to those bygone days.

Like the teams in the rugby match, you and I have to think of money as a limited resource, but not so the government. Anything the government decides to do, it can, and so the outcomes are determined by policy (aka ideology).

If you doubt the ability of the government to spend whatever it likes, consider the billions the government has spent waging war in foreign lands; bailing out the banks during the 2008 financial meltdown; and – currently, in the Covid-19 pandemic – the huge sums being spent to keep people from starving and countries from shutting down completely.

Disclaimer: These arguments only apply to countries that issue their own currencies. They do not apply to the countries of the Eurozone, which are unfortunately constrained by disastrous EU policies.

You probably won’t be too impressed by my analogy between a rugby match and the economy. So much seems to be missing. What about taxation?

The second challenge is to accept that taxation has got nothing to do with paying for things. If you managed to swallow the argument so far, you will perhaps accept that the government can spend as much as it likes, irrespective of taxation. So why not set the tax to zero? Or spend like there’s no tomorrow.

Back in the day the government aspired to do more than feathering the nests of its friends; the state needs to acquire real finite resources for the public good. It builds hospitals and employs nurses, for example. Having a (legalized) monopoly of violence, the state could just grab what it wants. Instead the state levies taxes to reduce private spending power, leaving space in the market for it to buy the material and the workers it needs to build the hospital and then staff it.

If it gets the level of tax wrong, too little tax will mean too much private spending power, pushing up prices; too much tax and stuff will remain on the shelves not being bought, business confidence will collapse and people will be laid off.

Understanding this should hopefully make it clear that the argument used by ‘the left’ – that they will tax the rich to pay for things – is quite wrong. First, the state can spend whatever it likes, irrespective of taxation; and second, reducing the spending power of the rich is not going to have much of an effect on everyday prices – even the rich can only use so much toilet paper!

This is not to say that we should not tax the rich – we should, but in order to reduce inequality and to reduce their economic and political power – not in order to pay for things.

Taxation is of course also used to pursue other objectives: penalty taxes on tobacco, gambling and alcohol; and the pretence of redistributing wealth, for example.

The financial and the real world

There is the real world and there is the money world. The money world obsesses over financial outcomes, like budgets, whereas the real world is constrained by the limited resources of a finite planet. The neo-liberal myths that we have adopted since the 1970’s trap us into thinking only in terms of the money world, and because money is so confusing, we are easily led astray.

Much of the talk by politicians and the media revolves around the supposed problems of the ‘deficit’ and the ‘national debt’ – the need to balance the budget.

A highly seductive myth from the money world is that the government’s management of finance is just like the management of a household budget: a household cannot spend more than it earns, and if it runs out of money, it has to borrow. The ‘left’ is now so ensnared in the myths of the money world that it itself has adopted these same concerns: balancing the ‘deficit’ and reducing the ‘national debt’ are seen as fundamental priorities.

Challenging thought number three: the UK for example needs to run a deficit, perhaps forever, and neither the deficit nor the national debt are things to worry about.

Returning to the rugby match, in March 2020, Scotland scored 28 points, while France scored 17 points. If points were gold, you would say that the scorekeeper now had a ‘deficit’ of 45 points while the teams together had gained 45 points. You might worry about how the scorekeeper would top up their stock of gold to score the next game.

This is the way we tend to think when we worry about the state’s spending – we are confusing points with gold and confusing the money issuer with the money user. Luckily in rugby no one cares about the 45 points in deficit – this is a meaningless figure.

By analogy, what we call ‘the budget deficit’ is better described as ‘our savings’ – the net savings of the non-government sector. The ‘budget deficit’, or its accumulation as ‘the national debt’, is the money spent by the state that has not (yet) been taxed back. This money could be taxed away, but do we want our savings to disappear?

As argued above, government spending is nothing like a household. The government’s job is to keep the economy in balance – keeping prices in check while ensuring the best use of the country’s resources. As always, understanding things involves ‘following the money’. Who is it that benefits from stable prices and high unemployment: the rich – inflation degrades savings; unemployment quells labour unrest and limits demands for higher pay.

Having lost control of finance and crashed the economy, the subsequent ten years in Britain have seen the neo-liberal establishment pursuing policies that are diametrically opposite to those needed to recover the best use of the country’s resources. The idea of ‘austerity’ is based on the notion that the country is a household that has overspent and needs to cut back, whereas the state should have spent to bring unemployed resources back into play.

Conclusion

Having swallowed the red pill, and unplugged from the mythology, I now see that the state has been captured by finance and the corporate world, and so the state is little more than a pantomime designed to amuse and distract the blue pill world, while the real levers of power are manipulated elsewhere. Lucky that we have media stars and buffoons to match!

In the red pill world, all of the arguments above seem obvious, but from the blue pill perspective, they will just seem mad. Such is the power of mythology. Given that the state has been captured, all wealth and power accrues to those that reinforce and perpetuate the myths. No wonder that no one was censored for crashing the world’s economy; no wonder that the 1% become ever richer at our expense.

Sadly, politicians only respond to what the public is prepared to hear. We can’t rely on the captured political class to respond to the needs of the Doughnut.

During the 2008 financial meltdown, a review examined more than 400 scientific papers to identify key things that contribute to our wellbeing. Echoing the familiar ‘five a day’ message about fruit and veg, the authors came up with a simple set of five ideas to help build wellbeing into our lives: Connect, Be Active, Be Curious, Keep Learning, Give. Many of these prompt us to actively find out for ourselves what the world is really like, rather than letting myths continue to overwhelm our thinking.

We need to swallow the red pill and re-design our money to match the world we will reclaim and recreate.

2 thoughts on “Redesigning Money for a Donut World”

Pingback: Redesigning Money for a Donut World – Critical News Autoblog

I enjoyed the anecdote about rural France. The only thing ever given to me free by French rural types was a severe beating, for having had the temerity to set up my tent in a wood without asking (or so I presumed – my assailants’ French was similarly atrocious). But the point of the anecdote is that it is an excellent description of social credit in action. If my temerity may be forgiven on this occasion, it’s too bad that subsequent discussion of ‘where money comes from’ is not centred on money’s relationship with real credit, or: the actual and potential capacity, including ecological capacity, of the community to provide people, as efficiently and as close to home as possible, with the goods and services that they need to survive and flourish. In anything even remotely approaching ideal conditions, we would call that ‘the economy’, but of course it doesn’t sound anything like the actual economy. The critical thing in any attempt to change that situation is to understand how money can act to extend the principle of social credit geographically and over time, and through innumerable complex exchanges involving, ideally, all members of a community, without the debt trap. I don’t believe in magic. If you believe in magic I am very sorry. And no magic is necessary if the money tree is firmly rooted in real credit, and those tending it are continually assessing and re-assessing both its potential for economic justice, and its limitations.