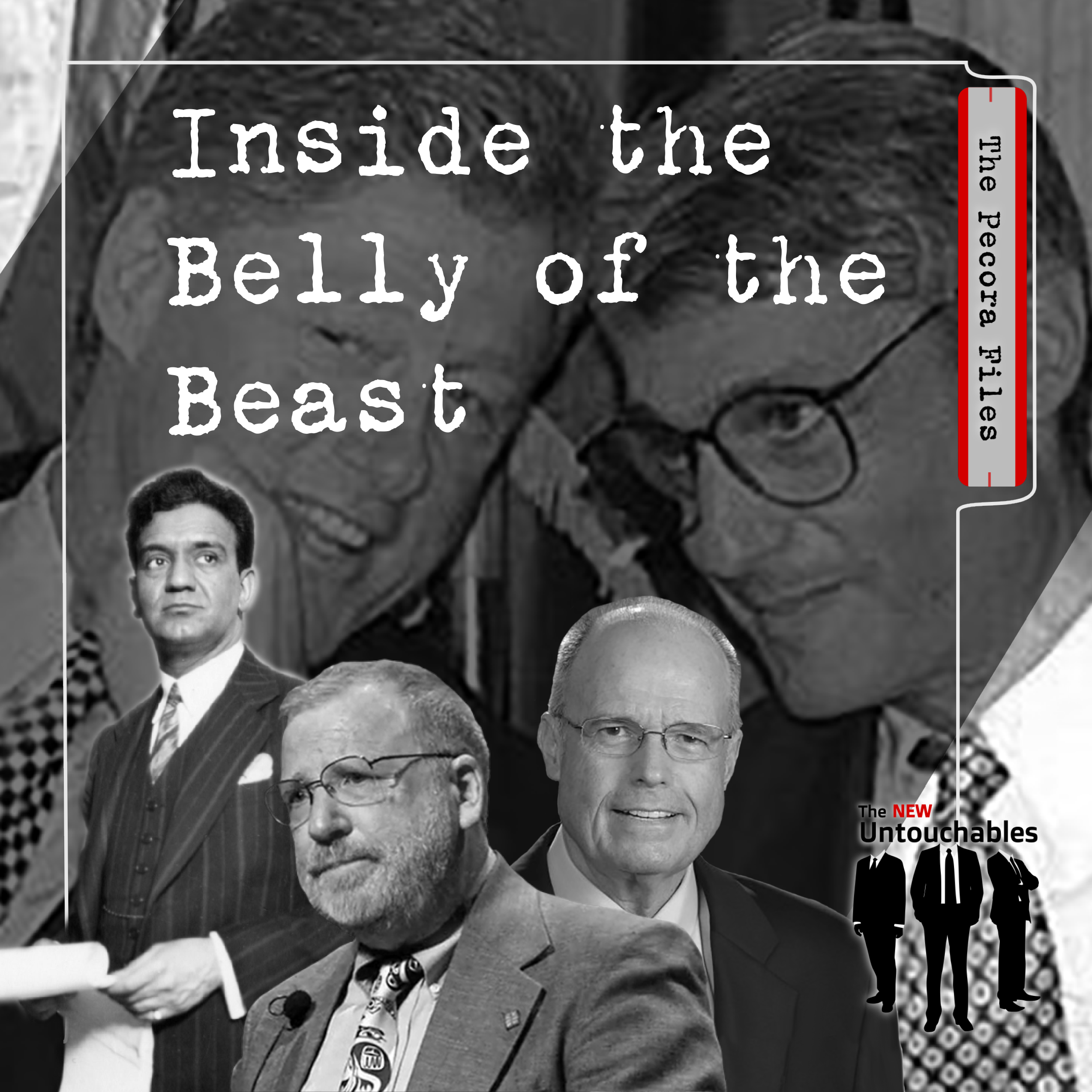

S1:E4 – The Pecora Files: Inside the Belly of the Beast

FOLLOW THE SHOW

Steve, Eric and Patrick are joined by William K. Black who reveals the curious case of Richard Bowen, former Citigroup VP and whistleblower, who blew the cover off the motherlode of fraudulent mortgages being sold through Citi.

Are you ready to ask the $50 trillion dollar question? You know what a trillion is? It’s a thousand billion. How many times have we been asked, “How are you going to pay for that? Meanwhile do you know how much the Fed has pumped into the financial system since 2009? That’s right: $50 trillion.

Richard Bowen, former Citigroup VP and whistleblower, and William K. Black, attorney and economics professor, present a step by step trial-style discourse regarding what happens when one speaks the truth but money wins the day.

For those of you who know how much M4A and Green New Deal might cost, let’s reconfigure the umbrella under a new yet old concept, and call it the Clean New Deal. Why? Because everything is as filthy as a heroine crash pad in Breaking Bad. Seriously. How do we know that? It was shared and communicated by Richard Bowen, a whistleblower who refused to “play ball” and was in the midst of one of the greatest frauds played out in a myriad of them regarding the 2008 Great Financial Crises as a senior executive at CITIgroup, that at the time was chaired by Robert Rubin.

Who was Robert Rubin? Rubin was once CEO of Goldman Sachs turned Treasury Secretary under Clinton who then spun out of government and back to Wall Street as Citi Group’s Chairman. Richard Bowen tried repeatedly inform everyone at CITI of the $80 billion fraud nuking the globe, destroying pensions of cops and teachers and other working-class folks.

You will learn the board wasn’t too interested in coming to grips with fraud, but were just fine taking in over $500 billion in direct bailouts from the Fed, bailouts that backstopped one of the largest criminal enterprises in history. You’ll want to stay glued to the broadcast as you hear William K. Black ask the questions of Richard Bowen, a witness always ignored. You may want to ask yourself why you never heard it like this and what stopped Congress from taking action.

Episode 5 – Those Who Would Have Drained the Swamp, airs Sunday, March 14 at 8 pm EST/5 pm PST on Real Progressives’ platforms.

The New Untouchables: The Pecora Files

Episode 4 – In the Belly of the Beast

March 7, 2021

[00:00:00.570] – Steve Grumbine

All right, and this is Steve with Real Progressives. This is episode number four of our series, The New Untouchables, our pathway to a New Pecora Hearing. And today on this particular episode, we have Citibank . . . This guy is a whistleblower, the largest proportion ever. He has a story that will blow the lid off of it all. He ties all the pieces of this fraud together.

And with that, first thing I want to do is go through each individual with whom we have Eric Vaughan, and we have Patrick Lovell again, and we have Bill Black rejoining us for this episode as well. We will also be joined by Richard Bowen. Richard has been credited by some as the most important whistleblower of our times.

Having been in banking and finance for four decades, Bowen rose through the ranks to become Citigroup’s top underwriter with a huge national staff. Bowen began discovering illegal packaging of MBS that led to an $80 billion a year in fraudulent activities. He tried desperately to end the practice that would devastate both the poor and working-class by going to his superiors, then upward to the board of directors and ultimately, Robert Rubin, former Treasury Secretary of the Treasury and former CEO of Goldman Sachs, before becoming chairman of Citi.

Bowen risked it all to try to end the practice within and then later went to the SEC and FCIC, which he was muzzled and obfuscated. The end result, Citi walked with $500 billion in bailouts and Rubin skated with $120 million. Bowen was then fired. With that, gentlemen, thank you so much for joining me for this episode. Let’s start with you, Patrick. Tell us, what about this episode is important to you?

[00:01:52.140] – Patrick Lovell

I appreciate that, Steve. And again, thank you to everyone, and especially Richard, for joining us. Again the idea is this concept, of course, is the New Untouchables, the Pecora Files. Nobody exemplifies the untouchables more aggressively in my opinion than Dick Bowen. I first discovered Dick on 60 Minutes when he was interviewed by Steve Kroft, where his testimony basically instilled in me and America writ large that what Citigroup had done was completely illegal.

Now, given the format and what 60 Minutes does, they don’t actually go that far. What they did was they make a beautiful porcelain sort of case where you can infer what you need to based on what was pretty clear from his testimony. That’s a far cry from an investigation that Pecora would have done, which, of course, would have laid out the transparency, the facts which we have learned from Bill Black from the very beginning.

So, when you talk about the apex of whistleblowers, there is no one that exemplifies this story more so than Richard Bowen. Richard Bowen was on the front edge of trying to prevent an $80 billion dollar a year securities fraud perpetrated by the largest bank in the world. In so doing, he put on notice because he understood the law, the CEO of Citibank, Citigroup, which was none other than former Goldman Sachs CEO turned Secretary of the Treasury under President Clinton.

Then went back into a position to play cover-up for this institution that would wind up going on to receive a half-trillion dollars in emergency backstops and lending, as a result, perpetrating the largest fraud in history. Well, on that note, I’d like to turn it over to my colleague Eric for some comments right before we go on to Dick about his thoughts.

[00:03:58.300] – Eric Vaughan

The important thing about Richard Bowen is that in terms of our docuseries, he connects everything that preceded it with the story of Addie Polk and the story of Dave Willan and how his story, Dave Willan’s brought, went up the food chain to Countrywide. And then, of course, we hear about all the different forms of fraud and predatory behavior that was coming out of non-bank lenders in the next episode and you hear Michael Winston’s story and about how he was able to see with a front-row seat, what the fraud machine looked like from inside the executive suites over at Countrywide.

Now, Countrywide was doing as much as they could as a non-bank lender, but there’s this whole other world in Wall Street and then beyond. And Richard Bowen is absolutely critical as far as telling the story that we tell, because he connects everything below to Wall Street and then everything above. And so, as like the main subject, shall we say of Episode Three, he’s actually properly placed because he is that bridge between the lending fraud down below, Wall Street fraud up above, and the government complicity that allowed it all to happen.

And so we are extremely fortunate to have a Richard Bowen and of course, William Black, who also allowed us to understand what Richard Bowen’s story meant when we were trying to put the story together. So, with that, Steve, back to you.

[00:05:52.120] – Grumbine

Very good. So, Bill, you know, this area of Wall Street is near and dear. We had Occupy Wall Street going on during this time. We saw people in the streets ready to take action. And you could say that this Occupy Movement kind of pushed into the Bernie Sanders Movement and so forth.

But we have not seen the kind of pressure that we need to bring Wall Street to its knees. In fact, we’ve seen Wall Street come back and double down and become even stronger. With someone like yourself and Richard Bowen, explain to us how this movement can build upon the things that have come out as a result of Richard Bowen’s experience and the things that he’s seen.

[00:06:43.400] – William Black

Sure. So I’m going to actually start in a slightly different way of why he hasn’t become the national face of the movement. Right? Because in any effective world we started discussing Pecora. He would have been Pecora’s first witness, a modern Pecora’s first witness. He would be famous across the world. Right? Instead, he, you know, we are twin sons of different mothers.

We’re both serial whistleblowers and we’re both expert at what at the big law firm I started at were known as CLGs. CLGs are “career-limiting jesters.” And so what Dick did wrong, a bit of confusion. He prefers to be called Richard, but he lets friends call him Dick, so we’ll do both and sorry for the confusion and he’s a nice guy who lets us get away with it. OK.

And by the way, his sport, when he was in high school was marksmanship. So don’t piss off Richard Bowen, that’s the type of thing. He won’t miss. And that’s the point. He could have been brought into court as a dead eye. How many courts have you testified in front of, Richard, about the great financial crisis?

[00:08:10.890] – Richard Bowen

None.

[00:08:10.890] – Black

How many Securities and Exchange Commission investigative hearings have you testified in front of?

[00:08:19.100] – Bowen

I testified before the SEC, but not in a hearing.

[00:08:24.710] – Black

Yeah, yeah, exactly. OK, so no actual court cases, right? No actual adversary hearings.

[00:08:33.950] – Bowen

That is correct.

[00:08:34.820] – Black

The ideal witness in the entire world. So tell folks briefly about the best job promotion you ever got and when it happened.

[00:08:46.110] – Bowen

Well, in early 2006, Citigroup consolidated all of their many diverse mortgage operation and into one business unit, and I received a huge promotion. I was responsible. I was named business chief underwriter, and I was responsible to make sure that the $90 billion dollars a year of mortgages that we purchased from other banks and mortgage companies.

Now understand these mortgages Citi did not originate that were in my area. They purchased them from other banks that originated them. And it was my job to make sure that these met our policy guidelines. And you want me to go forward with that or . . .

[00:09:33.230] – Black

No, let’s stop right there. OK, so that’s 2006. But you are a serial whistleblower. You had a career before Citi, and you also blew the whistle. Right? And you saved your bank a ton of money precisely because you blew the whistle and insisted on special protective measures so that the bank wouldn’t lose, right?

[00:09:56.360] – Bowen

Yes. This was back in the early 1980s. I was chief financial officer, as well as over operations for First National Bank of Oklahoma City, the largest publicly traded bank in Oklahoma. And we were a premier energy bank. Penn Square was there in Oklahoma City. I saw what was going on with Penn Square. As a matter of fact, many of my former employees were hired by Penn Square. And I basically predicted to my bank that Penn Square was going under, and I placed all of our business on a cash basis with them.

[00:10:38.030] – Black

Right. So let me break in. Maybe Oklahoma seems obscure to you if you don’t follow banking, but Penn Square not only blew up, but Penn Square blew up one of the largest banks in America. What was that bank, Richard?

[00:10:54.980] – Bowen

That was Continental.

[00:10:56.480] – Black

Continental Illinois causing what was then the largest run in U.S. history of $6 billion dollars and only a bailout by the Fed saved it from going glug, glug, glug. So this is a really friggin big case. And Richard did exactly what you would want someone to do. And you know what? We don’t want to prosecute people. We want to prevent the problems from ever occurring. Right?

And that’s what underwriting is all about, and that was what’s your title. And so the three C’s of underwriting are there so that we never have these disasters. One of the Cs is collateral. You heard that with Lori Noble, the appraisal process. Right? And she talked about the massive fraud in the appraisal process. Another one of the Cs is capacity. It’d be really nice that you actually have the financial capacity to repay a loan.

And Richard can tell you that Citi, in addition to all kinds of other insanity we’re about to describe, decided to make what the industry itself called liar’s loans, in which you do not check whether the borrower has the capacity to repay the loan. And the third C is one you’re familiar with, credit score type thing, right? So underwriting is a super important thing.

If you’re dumb, and you think it’s a cost center and something to be minimized, any expenses on underwriting, but if you understand banking, you know it’s the profit center. It’s what lets banks lend profitably and survive. So it’s a really good function. And as Richard just explained, if you do it right, you never have the losses. You don’t have to be bailed out by the federal government.

So he gets, on the basis of a lifetime of skills and professional skills, he’s an accountant. Indeed, he’s a university level accountant at this point, although that’s not really good news because he’s going to later tell you that he is unemployed and unemployable in finance 12 years after the great financial crisis for the high sin of what, Richard?

[00:13:21.660] – Bowen

I think it’s called blowing the whistle.

[00:13:23.730] – Black

Yes, being right and being honest and having integrity and courage, that’s what makes you unemployable in every financial firm in America, having that reputation. OK, so these things are important. And Richard and I and Michael, who you just met, were the co-founders of Bank Whistleblowers United. And I have this sweatshirt I’m wearing that we have for all this.

And it’s a riff off of the Transportation Security Administration TSA that you see at the airports. Right. That one says to recall, “if you see something, say something,” and that stops because the assumption is we all know that the third thing is, and TSA will promptly check on what you’ve told them – might be a terrorist attack. And the fourth thing is not only will they check, they’ll do something about it. They’ll prevent the attack. Right?

So you might think that when you tell the bankers, the senior bankers, “Hey, I’ve discovered a huge problem with this thing, underwriting, that’s designed to protect us from losses,” that your bosses would A – be concerned, not wanting to have those losses and B – would do something effective to stop them. But the third line on our sweatshirt says, “We saw something. We said something.”

Then things got very strange. What got strange in your case, Richard, when you repeatedly told folks that eventually 80 percent of the loans Citi was buying from these third parties were sold under fraudulent reps and warranties? Did they give you a gold star and a bonus for saving them from those losses and immediately stop buying them? That will be option A? Was that option A?

[00:15:36.910] – Bowen

It was not A. We can close that door.

[00:15:41.700] – Black

What was option B potentially?

[00:15:45.100] – Bowen

Actually

[00:15:47.320] – Black

Eventually

[00:15:49.210] – Bowen

I started issuing warnings in June of 2006 when I discovered we had huge numbers of mortgages that we were purchasing, which did not meet our policy guidelines, and yet Citigroup was turning around and selling them and guaranteeing, giving their representations and warranties that they met our policy guidelines.

[00:16:12.510] – Black

Oh, wait a minute, Richard, you were putting in writing in the files that Citi knew that those reps and warranties were lies.

[00:16:22.430] – Bowen

Oh, I did email. I made committee presentations. I even cornered people in the hallways.

[00:16:29.540] – Black

What do we call it when you make lies about representations and warranties to get people to buy things from you?

[00:16:37.340] – Bowen

I think that’s called fraud.

[00:16:39.020] – Black

I think so, too. And I’m a lawyer. Is that good, committing felonies?

[00:16:47.680] – Bowen

Not that I’ve heard.

[00:16:49.220] – Black

That’s not how we were taught, was it?

[00:16:52.090] – Bowen

No, not at all.

[00:16:53.010] – Black

We were taught we were supposed to prevent those things. So, again, you tell your bosses, and your direct boss says, “Yes, Richard’s right.” And then up above, you have this new concept, one of the new developments in finance called risk officers. And risk officers, as the name implies, are supposed to make sure that those operational elements don’t get too caught up in doing risky things, and it’s supposed to reduce risk, right?

[00:17:25.430] – Bowen

You mentioned, Bill, that my boss agreed with me and he did. He was the chief underwriter, and he would take my warnings and put his warnings on top of them, and send them on then to an even greater distribution list. And then sometime in 2007, he had all of his responsibilities stripped away, and he felt like he was compelled to retire. And that’s when my new boss was not real happy with all these warnings I continued to send.

[00:17:57.080] – Black

And above the new boss still was this risk officer type?

[00:18:00.860] – Bowen

Oh, yes. Oh, yes.

[00:18:02.330] – Black

And the risk officer, instead of warning against these kinds of risk and by the way, when you take a risk without underwriting, what’s that like? Let’s make a metaphor. What if I decided to walk across the street blindfolded on a highway? I might make it 20 percent of the time, which is about the loans that actually made it right, that were actually honest loans when you looked at the portfolio.

These people going to pay me more money for walking across the street blindfolded? No, there’s no reward for that. Right? What you do is you go bankrupt unless, of course, you’re big enough that you get bailed out?

[00:18:47.000] – Bowen

Yes.

[00:18:47.000] – Black

Maybe the federal government for the third time in modern history for Citibank, ah Citigroup, well, we might mention. OK, so you get it right. Boss get it right and you send the warnings up. Instead of people being happy and eager to avoid losses, they are furious, and they first smash your boss, and because, you again, are someone I treasure, your response, having just seen your boss decapitated, is not only to continue to issue the warnings but to, in legal jargon, escalate them up the corporate ladder.

[00:19:34.080] – Bowen

Yes.

[00:19:34.590] – Black

And who was at the top right then?

[00:19:37.320] – Bowen

At this point, I had been issuing warnings for a year and a half and I knew I had to get to the board of directors. And I read in the newspaper on November the 2nd of 2007 that they were calling an emergency board meeting for that coming Sunday. And it was rumored in the press that Robert Rubin was going to be replacing Charles Prince as the chairman of the board. And I thought that’s it. I’ve got to get my warnings to that board meeting.

So I sent an email actually Saturday morning sitting at my kitchen table. I drafted an email. I sent it to Robert Rubin, who was the next day he was named chairman of the board. I also sent it to the chief risk officer, the chief financial officer and the chief auditor. They all have legal responsibilities. I’m a CPA. I know this. They all have legal responsibilities under Sarbanes–Oxley to warn the board and to warn investors.

[00:20:50.910] – Black

Just stop one second. Why do we have Sarbanes-Oxley and that specific clause that you just talked about?

[00:20:57.880] – Bowen

The Sarbanes-Oxley, it was actually put together after the Enron scandal to prevent the frauds that they had discovered that came out of the Enron . . .

[00:21:09.370] – Black

And that was a good idea. It was supposed to prevent fraud.

[00:21:13.030] – Bowen

Absolutely.

[00:21:14.350] – Black

And this was a huge fraud. And you wanted to make sure that the top leadership of Citi didn’t commit a fraud and put themselves on the hook as well. Right? The individuals would be on the hook.

[00:21:29.280] – Bowen

I knew, Bill, under Sarbanes-Oxley that under Sarbanes-Oxley the executive officers have to swear, they have to certify every quarter that the internal controls are effective. And what did I did? In this e-mail, I said internal controls are broken because I knew that would, you know, that would set the hook.

[00:21:54.340] – Black

And indeed, underwriting is the central internal control of banking. And you were the what was your title again?

[00:22:04.360] – Bowen

Business chief underwriter.

[00:22:06.160] – Black

Oh, yeah. So the absolute top specialist who has a track record of getting this right doesn’t commit a career-limiting gesture. This is a CEG, this is a career-ending gesture. He has the intestinal fortitude to clean up the usual language we would use for this. To put on written notice Bob Rubin, who is not only about to become the top person at Citi after, by the way, for years serving, as he phrased it, “I have no job responsibilities, but I get $11 million dollars a year,” that Bob Rubin. But before that, what was he?

[00:22:52.350] – Bowen

He was Treasury Secretary under Clinton.

[00:22:55.410] – Black

And before that, what was he?

[00:22:57.220] – Bowen

I think he was co-chief operating officer of Goldman Sachs.

[00:23:01.350] – Black

Indeed he was. So he brought it all together. And what did go what does the repeal of Glass-Steagall allow Citi to do?

[00:23:11.790] – Bowen

Basically, it allowed them to merge.

[00:23:15.630] – Black

Oh, and they, in fact, had already merged. Right?

[00:23:18.930] – Bowen

They had already merged under waivers from the Fed.

[00:23:22.050] – Black

. . . . with Travelers making the largest financial merger in history.

[00:23:27.670] – Bowen

Yes.

[00:23:27.670] – Black

And if you had had to unwind that merger, which ultimately would have been unlawful under Glass-Steagall. Would that have been a good thing for Citi?

[00:23:37.450] – Bowen

No, absolutely not. And as Treasury Secretary Rubin basically led the, as I recall, led the charge to repeal Glass-Steagall.

[00:23:49.630] – Black

Yes, he did. And then he promptly left Treasury to take a position with who? Oh, Citi, that $11 million dollars for no job responsibilities.

[00:24:03.600] – Bowen

That’s what I understand.

[00:24:07.270] – Black

Baseball’s been very, very good to me and so has politics. So you decide to take on the most powerful person at Citi who is the most politically connected person in America. And you get this chilling, not only reprisal, but then eventually, years later, the Financial Crisis Inquiry Commission, the most amazing testimony in chilling terms by Bob Rubin. What did he say when he was asked about you by the Financial Crisis Inquiry Commission? He assured what?

[00:24:53.050] – Bowen

Well, he admitted after he thought about it that he had gotten an email from me and that he gave it to somebody, but he wasn’t sure who. And he knew that they took action on it.

[00:25:06.950] – Black

No, they said they took care of it.

[00:25:10.180] – Bowen

Oh, yeah. OK.

[00:25:12.640] – Black

And, did they? How did they take care of it, that infamous mob language?

[00:25:18.610] – Bowen

Well, I was told not to come back to Citigroup.

[00:25:23.950] – Black

Oh, by fixing the problem, because obviously, you are the problem, not the $80 billion dollars in fraudulent loans yearly.

[00:25:33.310] – Bowen

Apparently.

[00:25:33.980] – Black

Who are they selling that to overwhelmingly?

[00:25:37.250] – Bowen

Oh, they went into mortgage securitizations and of course, those went into pension funds and everything else.

[00:25:44.060] – Black

Oh, workers retirement type.

[00:25:47.000] – Bowen

There we go.

[00:25:48.610] – Black

Like Fannie or Freddie, maybe?

[00:25:50.560] – Bowen

Oh, oh, yeah, a large part of them also went to Fannie and Freddie.

[00:25:54.550] – Black

Did we have to bail them out, too?

[00:25:56.350] – Bowen

Oh, absolutely because of the bad loans that they had purchased and in turn guaranteed.

[00:26:03.920] – Black

OK, so that’s really a good working system, right?

[00:26:09.130] – Bowen

It’s across the board.

[00:26:10.370] – Black

OK, so first we could have prevented the problem entirely. And by the way, just to back up for 30 seconds. Citi, as you said, bought 80 to 100 billion bucks, including the crappiest of the crap liar’s loans, which were known to be massively fraudulent during a time period where the appraisers had warned that appraisal fraud was endemic. How much underwriting did it do before it bought the loans, Richard?

[00:26:43.380] – Bowen

Ah, actually none.

[00:26:45.030] – Black

Oh, well, gosh!

[00:26:48.240] – Bowen

They relied solely on the representations that were given to them by these selling mortgage companies.

[00:26:54.390] – Black

OK, as an old country lawyer type thing, we call that buying a pig in a poke. Is that how you taught people to do banking? You know, loan officers . . .

[00:27:07.380] – Bowen

No, it’s not.

[00:27:07.380] – Black

. . . .Buy it, make the loan first, then we’ll check.

[00:27:11.810] – Bowen

Well, they purchased it based upon the representations and warranties of the seller and then immediately sold them before they were even a sample of who was underwritten, and when they sold them, they gave their representations and warranties.

[00:27:27.290] – Black

And again, when you did your sample review, which they kept on hammering you to make, look at smaller and smaller amounts. Right?

[00:27:34.790] – Bowen

Right.

[00:27:35.930] – Black

You found 80, eventually 80 percent of the loans . . .

[00:27:39.800] – Bowen

In my largest area, which was predominantly most of that in my area, I started out discovering in 2006, 60 percent did not meet our credit policy. And as I continued my warnings through 2007, the volumes kept increasing and the rate of defective mortgages increased to an excess of 80 percent. And I put and I put all of that in the letter to warn the board of directors and Robert Rubin.

[00:28:11.860] – Black

So you were trying, as you had successfully done with your bank in Oklahoma, to do exactly what your job function is, right?

[00:28:22.870] – Bowen

Well, silly me, I thought it was my job.

[00:28:25.920] – Black

In fact, it was, but that was the nominal job from your superior’s standpoint, right? So they were not, as you said, real happy with you and they forced you out of the organization. And then one of your lieutenants found not only had they engaged in this form of fraud, after the great financial crisis, it was really hard to get any home lending. So, which federal agency stepped forward.

[00:28:58.620] – Bowen

You’re going to have to help me on the . . .

[00:29:02.100] – Black

The FHA, maybe?

[00:29:03.780] – Bowen

Well, that was part of the fraud that she identified. That was only a small part of it still going on. And this was four years after I was gone.

[00:29:14.940] – Black

Oh, you mean they continued it after they took care of the problem? By pushing you out.

[00:29:21.730] – Bowen

Yes. And that came out in her testimony.

[00:29:24.970] – Black

OK, so this went on for years, despite you, your boss, one of your chief lieutenants, despite the great financial crisis. And the FHA, by the way, when you cheat the FHA, who are you cheating? Oh, that be the federal government that was giving you the bailout, right?

[00:29:45.350] – Bowen

Yes.

[00:29:45.950] – Black

Yeah, that would be fun. OK, now you’re just trying to do your job. And then they remove you and they make it impossible to do your job, so you do the next thing as a citizen, right? What you’re told to do, speak truth to power. And so you alert the Justice Department and you alert the SEC.

[00:30:17.610] – Bowen

I went to the SEC. I testified for two days before the SEC and this was three months before bank bailouts.

[00:30:27.470] – Black

Uh huh. And, of course, they made use of your information where you gave them on a platinum platter, the most ideal case. And which SEC action should we read?

[00:30:40.460] – Bowen

Well, I gave the SEC over 1,000 pages of documents, many of the warnings, and all of the documents showing what was going on.

[00:30:50.810] – Black

Right. So there’s an SEC complaint that has all this in it, right? That we can go read those?

[00:30:56.870] – Bowen

Well, they told me . . .they got very excited when I talked to them. I visited with some of the prosecutors and their enforcement division, and they said, “Mr. Bowen, we are going to pursue this.” And then I never heard from them again.

[00:31:15.280] – Black

Oh, so there isn’t actually an SEC complaint where we can read the document?

[00:31:19.420] – Bowen

No, as a matter of fact.

[00:31:21.610] – Black

But then you asked for the documents, right?

[00:31:24.280] – Bowen

Many people have asked for the documents.

[00:31:27.640] – Black

What happened to them?

[00:31:28.600] – Bowen

Under Freedom of Information Act . . .

[00:31:30.700] – Black

Oh . . .

[00:31:31.300] – Bowen

And the SEC has replied that these documents are confidential in trade . . Citigroup trade secrets. So I guess that includes the fraudulent representations which were given to the purchasers of mortgage backed securities, which I printed off the SEC’s own website, where they, where you registered the mortgage backed securities.

[00:31:59.470] – Black

So they took publicly filed information.

[00:32:03.220] – Bowen

Yes.

[00:32:03.700] – Black

And declared it confidential trade secrets of Citi?

[00:32:08.110] – Bowen

That is your Securities and Exchange Commission.

[00:32:10.690] – Black

Don’t you love it when people have a sense of humor? OK, so this is why in our family, we have a rule that it’s impossible to compete with unintentional self-parody.

[00:32:26.060] – Bowen

And again, this was three months before the bank bailouts. So you can sort of understand what was going on, because if they ever did release any of the documents that I gave them, it would indicate that the US government had knowledge of the massive fraud that was going on before they bailed them out.

[00:32:49.460] – Black

You think . . .You might even think people would have been upset about those kind of disclosures.

[00:32:54.990] – Bowen

Someone might have been.

[00:32:56.420] – Black

They might have not simply said the system’s rigged. They might have said, “Hey, Richard Bowen has provided us with an explanation of exactly how it was rigged, and the how it came together, both with corporate corruption and elite political corruption to create a system where they were able to cause damages measuring in the hundreds of billions of dollars.

[00:33:25.310] – Bowen

Yes.

[00:33:26.030] – Black

And requiring massive federal funds. Americans might have been slightly upset about that.

[00:33:31.550] – Bowen

Possibly.

[00:33:32.570] – Black

Possibly. And you weren’t done. You went to the Financial Crisis Inquiry Commission as well to testify.

[00:33:39.980] – Bowen

Oh, and I actually testified in late February behind closed doors before their senior investigative and their legal staff.

[00:33:50.360] – Black

I bet they were interested, too.

[00:33:52.160] – Bowen

Well, before I even got there, Bill, I had talked to them on the phone and I told them about this treasure trove of documents at the SEC [crosstalk 00:34:01] they had overlooked. [crosstalk 00:34:03] led all of their investigators over to the SEC. And they spent two days digging through the thousand pages of documents that I had given the SEC. So when I got there, they already knew the story, but I told it to them anyway, and I gave them some additional stuff.

[00:34:22.970] – Black

OK, and you were open to any questions they had at whatever length they wanted, right?

[00:34:28.670] – Bowen

Well, that was at the hearing. This was at the . . . when I was there personally behind closed doors before their senior legal and investigative staff. They were . . . They got excited. They got more excited than the SEC did. And they said, “Mr. Bowen, this is very compelling. We may ask you to testify in a hearing.” And I said, “Well, OK.

[00:34:54.050] – Black

It’s almost like there’s a pattern.

[00:34:58.500] – Bowen

And then we got to the hearing.

[00:35:02.360] – Black

And a funny thing happened on the way to the forum, apparently.

[00:35:06.980] – Bowen

Well, they told me in a letter and in inside conversations that I could give them . . . not only did they want it in my presentation, which was going to be carried on national television, but they also asked me to give them up to 30 pages of written testimony, and they even told me what they wanted me to include in the testimony, you know, the damning evidence I had given the SEC, and I had told them about.

[00:35:36.740] – Black

Oh, good, good. What pages of the report can we read that on?

[00:35:41.270] – Bowen

Well, that’s just it. You know, I sent them my 28 pages of testimony. And when they received it, they said, “Yeah, Bowen. Yeah, we know we told you 30 pages, but, you know, it’s too long. And so we would . . . you need to edit it, and we will tell you exactly what to take out of your testimony.” And with that, they told me to take out much of the damning testimony that they had originally told me to put in.

[00:36:18.880] – Black

You were living Alice in Wonderland twice.

[00:36:21.930] – Bowen

I will tell you. I spent an entire night in prayer on this and I made the decision it’s better to get something in writing than nothing because I was, I had a very onerous confidentiality agreement with Citigroup, but Citigroup had specifically exempted me from that confidentiality agreement.

I could tell the congressional commission anything, but if the commission didn’t allow me to testify, didn’t allow me to go before the commission that I could never tell anyone anything and the commission knew that. So I made a decision. I made the requested edits and I sent them my 20-page edited testimony. And that became my official testimony. And in that you won’t see much of the damning stuff.

[00:37:17.230] – Black

So, Richard, why do you and me and Michael, why do we have to make these difficult moral decisions?

[00:37:25.920] – Bowen

That’s, that’s . . .

[00:37:27.760] – Black

Why doesn’t Rubin have to make the difficult moral decisions?

[00:37:31.980] – Bowen

That is beyond me. That’s just . . .

[00:37:34.960] – Black

- So we’re OK now despite all of this, at the end of the day, the Financial Crisis Inquiry Commission chairman insists on a whole series of criminal referrals. Right?

[00:37:49.180] – Bowen

The bottom line is the . . . . We only learned this when the congressional commission, you know, they sent all of their documents over to the National Archives. As a matter of fact, you can go to the congressional commission and you will find a list of the hundreds of names of witnesses that they interviewed. And you can go down the list of all the witnesses and you can click on a name and you can download the complete transcript, everything they told the commission.

But if you go down that list of all the witnesses, you won’t find the name Bowen. That is because the congressional commission made the decision that all of my testimony, that is behind closed doors, including everything that I told them behind closed doors, everything I gave them, everything including my original written testimony, had to be, they had to stay confidential.

So it was sent to the National Archives with instructions that it could not be read for five years, and it was only at the end of the five years in 2000, what was it, 2016, when the National Archives started releasing documents that we discovered that the National Archives actually made 11 criminal referrals.

[00:39:25.150] – Black

The Financial Crisis Inquiry Commission?

[00:39:27.060] – Bowen

Yes, the commission made 11 criminal referrals. Now, they were charged with doing this by Congress if they found evidence of fraud. And they made 11 criminal referrals and sent those to the attorney general of the United States, which was the charge from Congress, including one criminal referral, which was based solely on my testimony and evidence.

[00:39:50.060] – Black

So wasn’t it’s great. You’re the most special witness ever in front of the Financial Crisis Inquiry Commission with unique treatment called the Deep Six Treatment, right?

[00:40:03.890] – Bowen

And in fact, much of the, much of what I had given them is still in the National Archives. They refused to put it on their public website. And in fact, you actually . . .

[00:40:16.890] – Black

Because the public reads the public website, Richard. Are you slow?

[00:40:20.810] – Bowen

You go to the National Archives physically to read a lot of the evidence that is there. Or you have to know specifically the document file name to ask for.

[00:40:35.960] – Black

Or you have to watch The Con.

[00:40:38.180] – Lovell

I was going to say or you watch The Con.

[00:40:41.480] – Black

OK, so. You are this gold mine. You have direct information. You have records. You’ve been doing the right thing at every step of the stage at Citi. You have a track record of doing the right thing, and you look like you and present like you. Right? You are someone who is serious about integrity and morality. So if I put my law hat on, you’re the perfect witness. So how many criminal cases have you testified as a witness for the Department of Justice?

[00:41:29.380] – Bowen

Well, understand that the Department of Justice did nothing with the criminal referrals while the five-year statute of limitations expired.

[00:41:39.340] – Black

In light of the rest of your story, that shocks me. The SEC let the statute expire as well, right?

[00:41:47.660] – Bowen

Ah, apparently so, yeah.

[00:41:50.050] – Black

OK, so I ask again, how many criminal cases did the Department of Justice sponsor you as a witness in, in response to the great financial crisis?

[00:42:02.480] – Bowen

Zero.

[00:42:03.730] – Black

And you’re an accountant, so you’re really good at numbers. And that was probably an easy number.

[00:42:10.410] – Bowen

Zero is an easy number.

[00:42:12.670] – Black

OK, so my phrase for this is you brought the case on a platinum platter in the entire savings and loan debacle. Actually, I don’t recall a single major whistleblower as a witness where we get over a thousand convictions. We got those convictions without any whistleblowers. Are you the only whistleblower out of the great financial crisis?

[00:42:42.470] – Bowen

No, there’s many in other banks. I know Michael Winston is one from Countrywide.

[00:42:49.430] – Black

And Michael Winston, he’s a person of low integrity, right, obviously, as well?

[00:42:53.790] – Bowen

No, he’s a terrific guy. There were many whistleblowers in other financial institutions that experienced the same thing.

[00:43:05.050] – Black

And were you a disgruntled employee who got bad job reviews? Oh, no. You got the promotion of a lifetime, isn’t that what I heard?

[00:43:15.290] – Bowen

Yes, I was lauded as an exemplary employee, went to the annual employee meetings that were lauded throughout Citigroup as being an outstanding employee. That is until this happened.

[00:43:30.850] – Black

Of course, until facts intruded. Unfortunate facts. Michael Winston just told people about three promotions he got in a short time period. And as you say, many, many other. Whistleblowers come in all kinds of flavors. Right? Some of them already were having problems and such. Some of them were eager to go public. Did you rush out to the papers?

[00:43:55.810] – Bowen

No. The very first time anyone heard of this was when I testified before the Financial Crisis Inquiry Commission.

[00:44:06.580] – Black

Because you did exactly what Citi told you to do. Right? You inform people of what you found within the Citi chain of command.

[00:44:17.890] – Bowen

as well as the SEC.

[00:44:20.050] – Black

Well, eventually, that’s right.

[00:44:22.340] – Bowen

Oh, the SEC was immediately after my leaving Citigroup. So, and that was before the bank bailout.

[00:44:28.660] – Black

Right. But you didn’t run to the SEC as soon as you found this either, right? [crosstalk 00:44:33]

[00:44:33.370] – Bowen

No, absolutely not.

[00:44:34.840] – Black

That was a year and a half or more later.

[00:44:37.300] – Bowen

It was close to two years after I started screaming about it.

[00:44:41.320] – Black

OK, so you’re not someone that was in this for the publicity and you sure as hell weren’t in it for the money and such. Would you have liked to work in finance?

[00:44:54.630] – Bowen

Ah, yes, I obviously would have would.

[00:44:57.690] – Black

Would Michael Winston have liked to work in finance?

[00:44:59.880] – Bowen

I’m sure he would.

[00:45:01.590] – Black

Got any job offers for that at high level.

[00:45:05.550] – Bowen

No. And don’t get me wrong. I became a professor at the University of Texas at Dallas. And I will tell you, I attribute that to my keeping what little of my sanity I have left.

[00:45:20.250] – Black

We all understand exactly that. Right? We are treated as the ones who’ve gone crazy.

[00:45:26.400] – Bowen

Yeah.

[00:45:27.300] – Black

Because the world becomes Kafka-play as soon as we tell these people these things in senior management. Nothing is done the way it should be anymore. It becomes instantly surreal, and the craziest batshit stuff becomes the norm.

[00:45:52.840] – Bowen

Well, as it’s been explained confidentially to me, you know, companies want team players, and we have demonstrated that we are not team players.

[00:46:05.890] – Black

Actually, companies are incapable of wanting anything – that’s personification. CEOs who are committing frauds want team players who will not blow the whistle. In fact, their greatest fear is on screen now. And was on screen in the earlier episode – Richard Bowen and Michael Winston. Because Citi was so big and such a major purchaser, what would have happened if you had put back 80 percent of the loans and filed damage actions and made criminal referrals to the Department of Justice about the 80 percent loans which were, after all, being sold, had been sold to you under false reps and warranties?

[00:46:54.540] – Bowen

It would have shut down the massive schemes that were going on.

[00:47:00.270] – Black

That’s right. In other words, it would have maybe not prevented because this was 2006, the great financial crisis, but would have prevented the hyperinflation of the bubble in 2006 and 2007.

[00:47:14.650] – Bowen

Absolutely!

[00:47:14.650] – Black

So even if there was a great financial crisis, it would have been much smaller.

[00:47:19.380] – Bowen

I totally agree with that.

[00:47:21.030] – Black

And we know from exponential growth, everybody understands that concept now with covid. There was exponential growth of the worst mortgages.

[00:47:30.660] – Bowen

Yes.

[00:47:32.330] – Black

. . . in that period. So it wasn’t a little addition, it was a massive addition, and all of that could have been stopped if Citi and if Countrywide. Was Countrywide a small purveyor of nonprime loans?

[00:47:46.850] – Bowen

Oh, no. Oh, no. Very, very substantial.

[00:47:51.430] – Black

Biggest, in fact, in the world?

[00:47:53.200] – Bowen

We used to purchase pools of mortgages from Countrywide.

[00:47:57.880] – Black

And so if Countrywide had listened to Michael?

[00:48:01.000] – Bowen

Obviously, they would have, well, understand, Bill, you know, if anyone took action based upon my warnings, then they would have shut down this very profitable business model of buying and selling mortgages. And that would have meant significant incentive compensation that would no longer be doled out to management.

[00:48:24.680] – Black

I’ve never heard of that concept. Tell us about it.

[00:48:26.560] – Bowen

There was tremendous incentive of management not to pay attention and ignore my warnings, as well as Michael Winston’s warnings, as well as the other whistleblowers warning.

[00:48:39.580] – Black

You mean you could get $11 million dollars a year for no job description only if the fraud continued?

[00:48:48.870] – Bowen

All I’m saying is that it was a very, very, very profitable business model.

[00:48:54.480] – Black

That’s what I said. Baseball’s been very, very good to me. OK, so. That’s basically the story that I wanted to get across. I’ve been talking a lot or at least asking lots of questions. Would others like to jump in.

[00:49:12.390] – Lovell

I would like to chime in just for a second. I want to toss this to Steve because . . . So I’ve been in the ship that’s been getting this information for years now. And it’s just stupefying to me to know that this is even a possibility. I mean, we could see in Bill Black’s examination just the sheer lunacy of it all. And then, of course, the testimony and the integrity and the credibility of the witness of Bill Black is at the apex of what is obvious to everyone now that they’ve heard it.

[00:49:46.710] – Black

No, no, Richard Bowen.

[00:49:47.610] – Lovell

My question to you now, Steve, after you’ve now seen this much put together up until this point. Give us your thoughts, bud.

[00:49:57.590] – Grumbine

I think it’s more frustrating than ever, because the people that do know this, I mean, there are lots of people that I know, for example, I know for sure that know Bill Black and that have access to high ranking politicians that are in office that have the ability to bring these things out if they thought it was worth bringing out.

However, it brings a lot of questions to my mind. Why the hell have they not brought these things out? What is the real game behind the scenes? So I’m enraged. I mean, number one, I’m enraged. It was humorous to watch the exchange just because you know these are two guys that have been through this so many times that it’s almost like ping pong. But for us . . .

[00:50:46.380] – Black

Table tennis, please.

[00:50:48.390] – Grumbine

There you go. Table tennis. But for those of us who are just now really absorbing this, you know, watching this happen and literally, you know, after watching the series, The Con, you know, I was so enraged and upset. And I look at people like Elizabeth Warren and I look at people like Bernie Sanders, quite frankly, who I love him. I mean, I fought my butt off for this guy.

And I look at people like AOC and I look at these others, the squad and others that are supposed to be leading this progressive charge through. This is ground zero. This is why Bernie Sanders is not in a different place because you watch a Neera Tanden, who I’m sure is complicit to this or excited to be involved with these individuals. I watch the different types of people they’re putting in power once again. And I say to myself, nothing has changed. Not a damn thing has changed.

We got the same people back in charge that have been doing it. And I look at this and I say to myself, if our government isn’t going to take care of this directly, if the people are the ones that have to raise this up, my God, we’ve got the media against us. We’ve got the newspaper, which is the media against us. We’ve got the televisions, all that stuff. But we also have the entire deep state political apparatus that keeps this whole thing going against us as well.

[00:52:17.340] – Lovell

Steve, I got to point this out to you, and this is incredibly important to the listeners out there and why you’ve got to see The Con because of what Dick Bowen just explained. Right? We went to the National Archives with Dick Bowen with our cameras. Now, let me explain to you. Do you guys remember the scene at the end of Indiana Jones, Raiders of the Lost Ark, where they hid the ark in this huge army warehouse where it was never to be seen from again? Right?

So imagine trying to pinpoint where the location of the ark would be if you didn’t have the information. It would have been impossible. We went to the National Archives knowing because of Dick understood where they were, you get a specific amount of time to be able to find the exact file, to find the exact testimony that you might have a question about. Without that, you’ll never do it within the time parameters that they give you because you’d have to be searching through thousands and thousands of pages of docs.

Two things came together that day, right, Dick? One was we got lucky because we literally opened up the testimony to the exact day that that meeting took place, where the board of directors met, where we were able to identify how Robert Rubin was able to maneuver around what would have made him liable under Sarbanes-Oxley. Dick, can you please address that to Steve.

[00:53:41.110] – Bowen

Very briefly, what we looked at was, and they were not publicly available outside of the National Archives, we looked at the minutes of the director’s audit committee meeting, which took place on October the I’m sorry, on November the 4th, which was the day after I sent my email. And this was this took place immediately after the board had approved Robert Rubin to be made the new chairman.

But what we discovered was that he wasn’t made chairman until the next day. That was never made apparent. And the reason was because at the director’s audit committee, that is where the director’s audit committee approves signing the Sarbanes-Oxley certification, which has to be made again, certifying that the internal controls are effective.

And we had three of the folks that had received my email, the chief financial officer, the chief risk officer and the chief auditor were all at that director’s audit committee and basically told the audit committee, and this is in the minutes, that everything is fine, that nothing has changed since the last audit committee meeting, knowing that they had received my email the day before.

[00:55:08.350] – Black

And let me just emphasize what Richard has explained to us. Sarbanes-Oxley says explicitly that you must represent and warrant that the internal controls are effective. And Richard told them in writing they had collapsed.

[00:55:27.190] – Lovell

And Beth Howard, the chief risk officer, and maybe she was the chief auditor . . .

[00:55:31.360] – Bowen

She is the auditor.

[00:55:33.460] – Lovell

She is the auditor. How would you characterize her response?

[00:55:37.870] – Bowen

Well, she is very specifically quoted in the minutes as assuring the board members in the audit committee that there has been no new developments since the last audit committee.

[00:55:50.320] – Vaughan

Your email, it is a matter of record, that not only was it sent, but it was received.

[00:55:56.290] – Black

And again, as a litigator, it doesn’t get this good. Except in movies, right? In real life, it never gets remotely this good. This was not a good case, not a legitimate case, it was an overwhelming case that threatened the survival of the entire leadership team at Citi threatened them with justice, I might emphasize.

[00:56:29.120] – Lovell

But instead, what was the outcome?

[00:56:32.410] – Bowen

OK, what was the outcome?

[00:56:35.380] – Lovell

They walked away with half a billion dollars in bailouts and Robert Rubin moves on and maybe Robert Rubin and Larry Summers and everybody else was influential as they ever were. One of the first things that I ever discovered when I was researching you, Dick, was when I came across William D. Cohan’s epiphany on I think it was Bloomberg at that time where he was basically after the New York Times article saying, where are the subpoenas?

Are they covering up Dick Bowen? I mean, this did reach the highest levels. But then in the end, what you’re sensing here, Steve, and what everybody who is involved with this broadcast is, Dick always tells us: who runs the country, Dick?

[00:57:15.280] – Bowen

Well, it’s not us.

[00:57:18.890] – Vaughan

OK, I just have two quick questions. As far as Countrywide, you said they did a lot of business with Countrywide. Can you give us, and you also said that the defective loans in the pool that you were looking at were 40, 60, 80 percent defective. Were the Countrywide pools basically along the same line.

[00:57:44.110] – Bowen

Countrywide was actually worse, as it turns out. As a matter of fact, I actually led a buy at Countrywide where I went with my underwriters to review the files before we purchased them. And that was one of the very few instances before we purchased them. And we got up and walked out. We refused to even finish the buy. It wasn’t worth our effort. And again, that got me in a lot of trouble at home. But, you know, they were pretty bad.

[00:58:16.160] – Vaughan

So you were chasing after this for a couple of years before you were asked not to return. Was there any point during that two years where it’s like you basically understood inside your own mind that this was a business model and not a mistake?

[00:58:34.550] – Bowen

It was a dawning process. And yeah, it became clear after a while and there are many, many instances that that happened that exemplified that, but nonetheless, yeah, there was. I was being – no one could argue with me with regard to what I found. No one could argue with me. They would just say, “Well, these are just technical exceptions” you know.

[00:59:06.020] – Grumbine

What would you say the toll has been on your life for raising your hand and being a whistleblower?

[00:59:13.950] – Bowen

It’s pretty dramatic, quite frankly. Just very briefly, without going into too much detail. I mean, when I was at Citi, my stomach would turn in knots when I was in meetings arguing this. And it was after I had left Citi that basically, I had a ruptured colon, almost died.

And the doctors agreed that it was obviously stress-related. It’ll take a toll on you. I tell my students. It takes a toll on you personally. It’ll take a toll on you professionally. It will take a toll on you physically. And yeah, it’s very dramatic. I will tell you that at one point in time there was a great deal of concern for my personal safety.

[01:00:08.560] – Vaughan

Would you do it again?

[01:00:12.960] – Bowen

Yes.

[01:00:13.440] – Grumbine

Wow! You’re a true hero. You’re really a hero. Thank you so much for your time. I really appreciate this. This was an absolutely epic, untouchable moment. You are one of the untouchables. You’re one of the people that I think we should be gunning towards being a lot more like because we need a lot more of you out there. That’s for damn sure.

[01:00:36.570] – Bowen

Thank you so much, Steve.

[01:00:38.340] – Lovell

I hope the whole country understands the name Dick Bowen and sooner than later.

[01:00:42.810] – Bowen

Thank you.

[01:00:44.130] – Black

Let me just give you five seconds.

[01:00:46.350] – Grumbine

Yes.

[01:00:47.560] – Black

The reason we succeeded in the savings and loan debacle is because we investigated effectively. The very first thing we would have done is go to the Richard Bowens of the world if they were available to us. Every competent investigator would do that.

If they don’t do that, it’s not because they’re incompetent to that degree, it’s because leadership has decided there will not be effective investigations because they do not want the facts in the record, because if the facts are made public, they will have to act because the public will demand it.

[01:01:26.900] – Grumbine

Bill, let me ask you on that note. Obama knew this stuff, Eric Holder knew this stuff. They took no action. No one was . . . .nothing was done whatsoever. What does that say about our ability to get the highest office to take this seriously?

[01:01:50.790] – Black

We had to embarrass the Department of Justice into prosecuting in the savings and loan debacle. They weren’t eager to do it. We did it by making public every month how many criminal referrals we had made, and how many criminal prosecutions there were. And one number kept on getting giant very quickly and one number stayed very tiny.

And eventually, the Department of Justice got embarrassed at the highest levels and decided at the attorney general level, Thornburgh, that it needed to come in and create the top 100 list to get us off the backs. So I always expect the people in senior positions to be reluctant to do these things. Again, we have to motivate people by making things public to get the facts.

If you . . . Obama, this is in the literature, consciously decided not to try to be an FDR of his time. The times desperately needed Obama to be equivalent, and I don’t mean he should follow the path of FDR slavishly, but he needed to be the equivalent and he refused to even try.

So I don’t know exactly what he knows and how much was willful blindness that Holder made sure he didn’t know, so he’d have deniability, but it’s still on him. Truman was right. The buck needs to stop with the president.

[01:03:39.540] – Grumbine

With that, I want to thank every one of you for being a part of this episode. Bill, thank you so much for helping lead this charge here. Eric and Patrick, thank you once again. This is a great episode. Folks, thank you very much for this. We’ll be back with you, and see you next episode. We’re out of here.

Mentioned in the podcast:

Who is Richard M. Bowen III?

What are Mortgage Backed Securities?

Videos of Richard Bowen telling his story

Robert Rubin, Secretary of the Treasury

NYT, Two Plead Guilty to Bank Fraud

Sarbanes-Oxley (SOX) Act of 2002