Taxation

Shoring Up the Green Party

Many people are hopeful at the prospect of a 3rd party in US politics, but without a shift from current neoliberal austerity policies and outdated gold standard thinking, there can be no real change.

Tax Bads, Not Goods

Once we understand what taxes are “for”, we can start to think about what kinds of taxes make sense.

An Alternative Meme for Money, Part 6: Alternative Framing on Inflation

If there’s no inflation danger, there is no point in taxing the rich before keystroking the poor.

An Alternative Meme for Money, Part 5: A Spending Meme

Wherever this flag’s flown, We take care of our own. 🎵 Progressives need a new meme for money. This series is addressed to them.

A Meme For Money, Part 4: The Alternative Tax Meme

Let us continue to develop an alternative frame for money. As you know, MMT says that “taxes drive money”. Let’s develop that further.

A Primer on Government Surpluses

It is difficult to believe that our economy can continue to grow robustly as the government sucks disposable income and wealth from the private sector by running surpluses.

A Meme for Money, Part 3: Framing the Alternative Approach

We need to let go of the myths and begin with the state and its money.

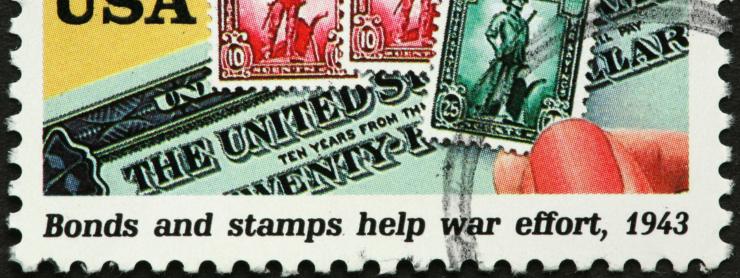

How To Pay For The War

Remarks by L. Randall Wray at “The Treaty of Versailles at 100: The Consequences of the Peace”, a conference at the Levy Economics Institute, Bard College, May 3, 2019.

What Are Taxes For? The MMT Approach

Sovereign government does not really need revenue in its own currency in order to spend.