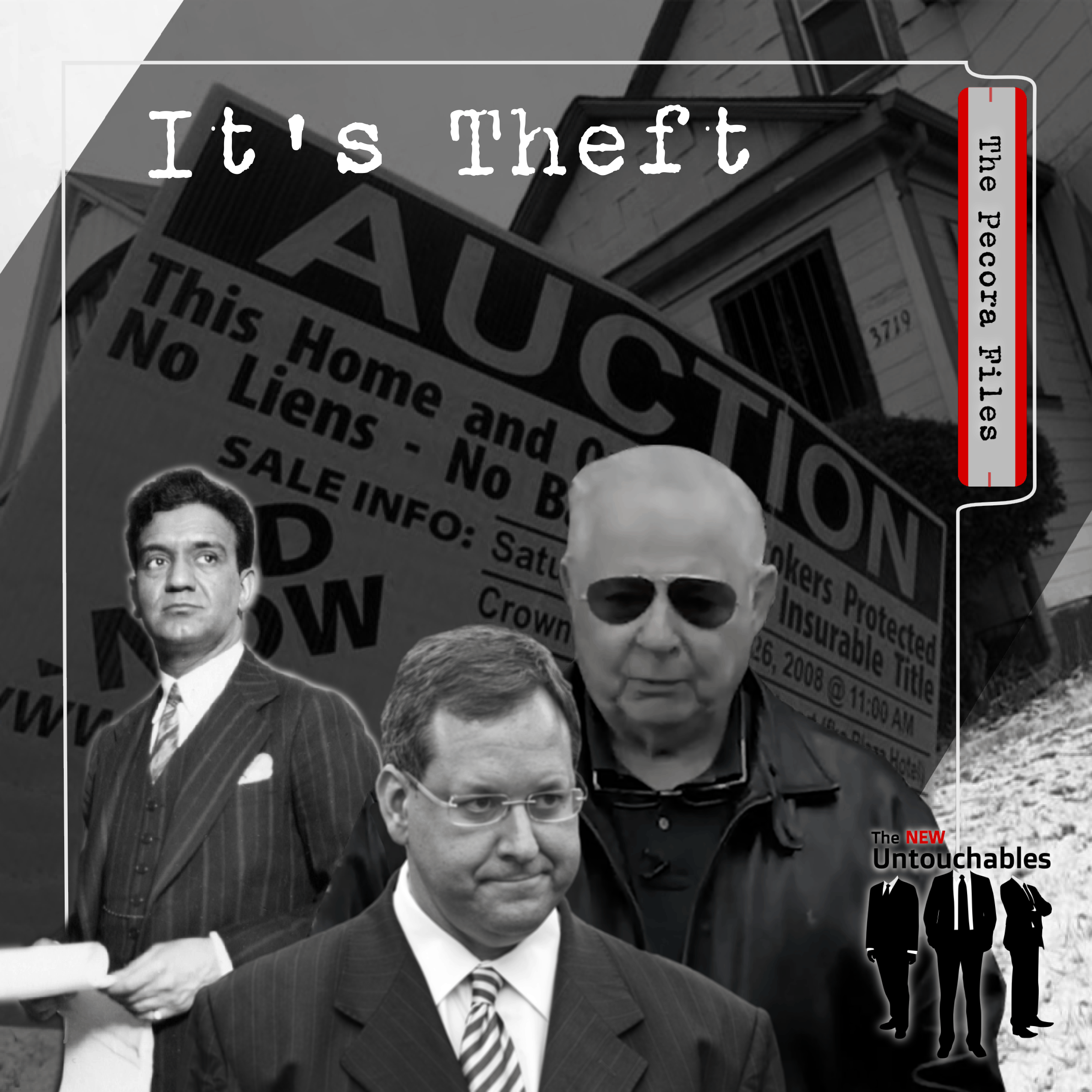

S1:E2 – The Pecora Files: It’s Theft

FOLLOW THE SHOW

Steve, Eric and Patrick connect with former Ohio Attorney General Marc Dann and retired detective Tom Murphy. They reflect on the lessons of their historic fraud investigation and RICO prosecution of Ohio-based predatory lenders in the wake of the 2008 financial crisis.

This episode brings Marc Dann, former Attorney General of Ohio, and Tom Murphy, the leader of the successful Cleveland and Summit County Ohio’s Law Enforcement task force, to tell their stories.

Dann was elected to the AG’s office committed to taking down mortgage fraud and put the resources of his office at the disposal of Murphy, a no-nonsense cop dedicated to rooting out crime.

Murphy’s team, with the absolute backing of Dann set to work understanding the criminal scheme they identified as a RICO violation (The Racketeer Influenced and Corrupt Organizations Act) and went to work doing their job. They were the only ones in the country to execute a RICO act in this mammoth crime. Why? They were dedicated, courageous public servants working for the people. Dann and Murphy knew crime when they saw it. They pieced together how the scheme was played out and went after the bad guys.

The New Untouchables: The Pecora Files

Episode 2 – It’s Theft

February 21, 2021

[00:00:00.500] – Steve Grumbine

All right, folks, this is Steve with Real Progressives. Today, we are going to be taking on episode number two of The New Untouchables. Folks, this is where you find out that financial crime has victims. It has real victims, real human victims. It’s not just digits on a paper. It’s not just digits in a computer somewhere. It’s not just, you know, nobody gets hurt, white-collar crime.

This is where you find out exactly the downstream fallout. The key with that is understanding that the facts are always right there with the bad guys try their best to hide them in plain sight. We are going to have some guests on tonight, today that will show you what the root of all that evil is, and you get to see the real impacts on human life.

So today, without further ado, our guests will include Marc Dann, Marc Dann is the former district attorney of Ohio. We’ll also have Tom Murphy, who is a special agent who helped Marc Dann put it all together. We also have Eric Vaughan and Patrick Lovell. And without further ado, I want to bring on Patrick. Patrick, tell us a little bit about this particular scene.

[00:01:24.940] – Patrick Lovell

Well, it’s truly a miracle, really built through devastation and tragedy that defies really explanation. So on our journey to explore what happened and to try to answer these burning fundamental questions that I had as being someone who got crushed in the 2008 great financial crisis, I just simply wanted to understand what happened and suddenly make it make sense. Right? And so Eric and I are on this incredible journey.

And lo and behold, Eric relocates from California to Ohio, and in the process, he’s just looking and researching personal stories of tragedies from the 2008 financial crisis. And he comes upon a story of Addie Polk. Addie Polk is a senior, African-American widow, and she seems to be kind of a amplification of what Bill Black was teaching us in terms of who the targets were in the great savings and loan crisis, widows primarily, and also in the great financial crisis.

And to me at that time, I didn’t understand predatory lending. I thought that if you get a loan, you’re lucky, right? You checked off all the boxes. You have a job, you can get a loan, you can get into a house, you can afford college, all of these types of things. It never occurred to me that a financial institution would loan money to anyone who A – didn’t meet their criteria or B – couldn’t afford to pay it back, which is one and the same, of course.

And, so I’m just learning and reorienting my entire life around with something. I mean, the stuff just is counterintuitive. And when Eric discovered Addie Polk, it was incredible because we had to work really hard to get the sheriff who arrived the day that she had shot herself, and we interviewed him and by the way, he didn’t want to be interviewed. He refused the interview. Our colleague, Alex Tennent, literally went to the door, knocked on Sheriff Fatheree’s door, and said, “We need you to recreate the situation because we’re doing this television show, and without you, it’s not going to fly.”

Lo and behold, Eric actually offered some more comments and Fatheree agreed to go on camera with us. And at the end of that interview, as he’s taking off his microphone, he says, “There’s some guys that I want you to meet.” And as it turns out, he introduces us to this task force that was created by Marc Dann and led by Tom Murphy. And as I’m reading this article that was done by, I think, the Cleveland Plain Dealer, it answered this question that Eric had asked from the very beginning of our journey.

He said, “Why wasn’t this great financial crisis pegged as a RICO racketeering and corrupt influences organization like the Mafia?” Many of us have talked about the idea of “mafiacracy.” Well, suddenly here we are staring it straight in the face and I’ll leave it at that to turn over to my colleague Eric to fill in further blanks.

[00:04:37.820] – Eric Vaughan

What was really striking about the Summit County task force and about the work that Marc Dann Tom Murphy and Sheriff Barry and all the rest had done was that they did the most simple and basic thing, which was they identified that crimes were happening. They decided to investigate it. They gathered information, was able to prosecute, and was able to get actual incarceration from it.

That is basically what most of us think is how the system is set up and how the system works. If somebody committed the crime, they pay for their crime. And what was really amazing about Summit County is that this was a lot of really complex financial mortgage-related things where the entire task force had to ramp themselves up, and I’ll let Tom Murphy describe this in more detail.

But the point is, is that similar to what happened during the Pecora Hearings, it didn’t require people who were experts in finance and in mortgages and what have you in order to successfully prosecute these crimes. What it took were people who understood crime, criminality, corruption, scams. And so that kind of goes against what we so often hear as far as why we need to have somebody from a bank who’s running this particular agency or whatever the case might be, all the different excuses that are made for the revolving door.

Well, no, what you need are people who know how to prosecute, who know how to recognize crime when they see it, and actually do something about it. And that’s exactly what the gentlemen on this podcast did. And, so I’ll go ahead and get back to you, Steve, and have you introduce them.

[00:06:46.930] – Grumbine

Absolutely. So, Marc Dann, please tell us about how you came into this role here because this, you know, obviously the story of Addie Polk, which is the shining light of the entire docuseries, The Con brings about a real human story, shows the real life and death that is brought on the tragedy, if you will, that’s brought on by the predation you guys uncovered. So, talk a little bit about what brought you here.

[00:07:20.080] – Marc Dann

Sure. Well, we started pretty early, I mean, we actually started in 2007, and so, you know, things don’t really, things were happening here in 2007. In America, things don’t matter until they happen on the coasts and in New York. This didn’t hit New York and California until closer to 2008. But in 2007, we started seeing a dramatic increase in foreclosures going on in the state. We had been in a fight over the . . . in the years I’d spent in the legislature over predatory lending regulations.

And so we knew that there were people out there that were very passionate about making sure the law didn’t impede them from issuing loans to people that they couldn’t afford to repay. And so when I became attorney general, I made it a priority right from the very beginning. In fact, when I did my swearing in, I talked about how if people were going around the state with guns, taking people’s homes, we’d have a dragnet, and we’d shut the borders down and shut the airports down until we caught him, put him in jail.

But because people are doing it with a computer and a smile, somehow that wasn’t the same thing. We needed to treat this, what people were treating as a civil problem, as a criminal problem, that it actually was.

[00:08:41.230] – Grumbine

Very good. And with that, you had a friend that helped you here, and that would be Mr. Tom Murphy. I mean, Tom, welcome. Thank you so much for joining us today. Can you tell us a little bit about how you got involved in this?

[00:08:55.750] – Tom Murphy

Well, I work for Dann and Dann came in and had a real interest in this. And as Dann said, predatory lending at first made . . . it doesn’t make sense to me. But I know theft. And so when we put a task force together, all of the people around the task force, law enforcement types, we don’t know anything about predatory lending. Just went to the blackboard and put the elements of theft up there.

That’s all you have to know. You can call it anything you want, predatory lending, I don’t care what you call it. It’s theft. So Marc had a commitment to it, which I commend, and OK, and he said, “You tell me whatever you need, you can have it.” And I’m thinking, “Yeah, right.” You know, but everything I asked for, everything I got. And as the members of the task force started to understand predatory lending, the staff, it’s one of the very first targets we hit on was a real entrepreneur, and he went into stock fraud, this guy went into everything.

He just took it to a whole new level. And as I would talk to Marc at his house on the phone every . . . He said, “Keep going, keep going.” And the task force guys who are law enforcement types, and what you should understand is that law enforcement types don’t have criminal intelligence. They don’t have access to what organized crime in the attorney general has. We have our own intelligence unit. We have our own evidence people, etc.

So I had access to it, and as we put the thing together, the law enforcement types started to think, oh my God, this is huge. You know, you’re talking five, 10 million. You know, I’m not saying it’s chump change, but when you’re looking at 200, 300 million. That’s a lot more than five or 10 million and Marc said just keep going. And that was the largest case I had ever had. [crosstalk 00:11:36] That’s correct. He was involved in that.

And as we got into it. I got to tell you, this guy was a real entrepreneur, and he started it. He started to morph this thing into everything, and we were undercover. We were in an undercover location. And even as we would send subpoenas out, and Marc said, “Just do it.” And as we’d send subpoenas out, attorneys would call, or try to call, and organized crime is not listed in the phone book, so they would have to call Marc or somebody else, and (they would say) “We just got the subpoena. What do you do?” (Answer) “Well, either honor the subpoena or go to jail, whatever.”

[00:12:28.590] – Lovell

[inaudible 00:12:28] What did you have to be able to do to build the apparatus? And can you quantify the team you put in play and characterize what they were all about to be able to achieve this incredible revelation that the entire world needs to understand?

[00:12:42.510] – Dann

Well, so we mobilized. And look, cops are not used to dealing. They’re used to dealing with blood and robberies and drugs. And so to a certain extent, we had to take some smart old cops and retrain them in financial matters. We actually pulled people from the county auditor’s office who were in the valuation business because for tax purposes, the county of Summit, which is where this investigation was, they every three years they value property. So, we had government employees who were . . . .

So I went to the Summit County auditor or Summit county executive and asked them to loan me some people who weren’t in law enforcement at all but who were accountant nerds to be able to review that. We hired outside forensic accountants and put them on the team because there wasn’t . . . that expertise doesn’t exist in law enforcement, at least at the state and local level. It certainly does, it certainly does at the FBI.

I mean, they had all those . . . they had all that stuff in-house. I mean, and that’s what we need. When you get frustrated in thinking about this, it’s they had at their fingertips the FBI and the US Justice Department had all the stuff. I had to piece it together. Like I was like, you know, like I was building a rat trap house or something. I mean, but we took people, and got them assigned and borrowed people from law enforcement. We asked the government, the federal government for help, and they didn’t give us much.

I think they assigned an agent or two every once in a while for projects that we had to do, but really, we took regular cops and retrained them to be able to look at this kind of crime. And what was really fun to watch as we went through the process, none of this was fun because it was tragic, but was guys like Tom Murphy who whose eyes, you know, who all of a sudden realized, holy shit, this is a lot worse than the stuff we’re used to investigating. This is affecting thousands of people at a time.

[00:14:40.890] – Vaughan

Before we get too far into that, can you tell us how you identify that there were crimes going on to begin with?

[00:14:49.070] – Murphy

Well, you don’t have to know too much except what you know – what theft is. You know, Marc put me on the trail and you start looking at this thing and maybe this is just a little off the track here. I went in and saw the police chief for the city of Akron, and I said, “You know, I have this $100,000 home on X, Y, Z Avenue.” And he said, “Mr. Murphy, that street isn’t worth $100,000.” So I just showed him the loan. And he said, “Oh, my God. How are they getting the money?”

And I know, Eric, you’re from California, but a home in Ohio is maybe 60, at that time, $60 to $100,000, you know, just a regular home. So that’s the kind of a loan value you are going to get, maybe 40 to 60. Well, if you took that and you sent that loan out to California, in California, a garage is $100,000. So they knew that and they would send it out to the big, bigger mortgage companies who would package them. And they were packaged here, then sent them out there and they were packaged there.

Oh, my God, this is pretty slick. Yeah, well, I should I suppose I should take a different tack to explaining that, but you know, Marc was there the whole time. “Go, keep going, keep going, get more, get more.” And then as they were running out of money, day to day money, the one guy from Evergreen, he started an investment. You buy stock, we were in a one or two percent world, and he was paying eight to 10 percent. Well, not only were you sticking the people that were buying the mortgages, he was decided he would get money and give these people eight to 10 percent back and started a pyramid scheme.

[00:17:06.320] – Lovell

Which is exactly right, which is a Ponzi scheme, and I was struck, Tom, the first time that we talked, it was extraordinary to me to learn that when you guys put this facility together to take a deep dive, A – you had incredible secrecy, but B – you had this group of guys that Marc Dann just described that came together to unpack what was obviously a criminal conspiracy.

And you did it at the board by figuring out it was theft, but obviously was theft by deception deceiving both the consumer and the investor. So can you walk us through what it looked like, that incredible operation that you had, and what level of secrecy you had to contend with?

[00:17:53.950] – Murphy

Well, the level of secrecy was . . . Ohio Organized Crime is under Marc Dann, and it’s a separate unit in the entire state. It’s separately funded. It isn’t even in the office, the office tower where the AG’s office is in Columbus. It’s somewhere else. And everything was separate. So nobody knew anything. And we got an undercover location where we pay rent and computers, and you do have to get a host agency, if you will.

And that was Summit county who really got hit hard, and they decided, “We’re going to take this on. We’ll take it on with you.” And but then who wouldn’t if the AG says, “I’m paying for it.” And so we had cars, trucks, whatever, we needed, supplies. And it’s a big deal. It’s a big deal. We had a computer, we had an evidence room. We had investigative rooms. We had a finance room. We had a cafeteria, if you will, our conference room where we met for lunch.

And that’s where a lot of the stuff would come. We would share at lunch, if you will, and the finance guy, we had a forensic accountant, as Marc said, who came on, and we had different people from different areas of government. And we even had a civilian that had a business and was retired but was working part-time for the county of Summit. And his job, if you will, was to question everything. “No, that’s business. That’s not business, that’s theft.”

But he would keep it on. You know, he would ask the questions like a businessman would ask questions, and we being law enforcement would say “theft” and somebody was going to win as it worked out. He figured it out right away. That’s theft.

[00:20:09.360] – Dann

What I learned very quickly, especially when seeking the cooperation and the collaboration with the federal government, the US Justice Department was in and frankly, other state attorneys general who ultimately ended up with some action that was, that ended up being good, but not what it could have been, and that was that they couldn’t envision a world in which the guys they went to Harvard with or the guys they went to Yale with or the guys they went to, who graduated from Wharton School of Business, could possibly be serial criminals.

They could, and to this day, the folks in the Justice Department, whether it’s been the Clinton or the Bush or the Obama or the Trump Justice Department, and I see nothing different coming from the Biden Justice Department at all. Nope. They can’t look this week, just this week, Boeing was fined a billion and a half dollars for killing 300 people on an airplane, on airplanes, that they, that human beings who worked in the company knew were dangerous and allowed them to fly.

And helped each other deceive the government regulators about the dangers that those passengers were facing in the hands of the pilots, not the pilots, in the planes that they created [crosstalk 00:21:39] an ability [crosstalk 00:21:40] that was a lot of money, but nobody went to jail.

[00:21:43.190] – Lovell

But it’s expendable. And same with your cases involved with the nature of the huge Sackler family settlements and everything else, you know, with the opioid crisis, it’s that the consumer, i.e. citizen is expendable for the bottom line, which is short term. And it’s all baked into this black box casino of deception.

[00:22:03.840] – Dann

Right. But Patrick, the point you make about not learning from history is so important because also this week, our capital was occupied by a group of American citizens, I think that most of them were citizens anyway. I think they were all citizens probably. I think they had that going for them. But I got to tell you something, and I would bet you that more than half of those people that were arrested had a foreclosure issue in the past 10 years.

The anger and the sense that we have to think about both cause and effect. The reason so many people in the working class and the middle class feel so disillusioned is because they believe in their heart that the government doesn’t give a shit about them and that the crimes committed against them don’t matter – exactly what you said.

And ironically, they have much more in common, the folks that stormed the capital, in terms of how they got to their political class, they have much more in common with the people that were marching in the streets on behalf of Black Lives Matter than they do the folks on Wall Street that are screwing both of them. And so if this is, if you want to lay blame for what happened this week, you certainly can look to Donald Trump. But really he’s a symptom, not a cause.

[00:23:27.890] – Lovell

This whole story is so counterintuitive because especially for those of us who went through it, I mean, really, the idea is, look, if I can qualify for a loan, and I can move my family and create a lifestyle that’s safe and, you know, I can afford to repay this loan, then, you know, that’s all upside. Right? But what we find out through this incredible sort of parsing that there is another side of that. And when we refer to, you refer to predatory lending, and what you saw, particularly in the timeline, because Ohio had been dealing with this for some time, long before the coast did.

Can you even further maybe qualify kind of all of the amalgamation of things that were just bubbling to the surface in Ohio that made you so clear that something like this was a possibility into the metaphor you just laid out that stealing someone’s home with a gun is no different than stealing someone’s home with a calculator.

[00:24:31.410] – Dann

Now that look what was going on, on multiple levels. First of all, women like Addie Polk and tens of millions of Ohioans like me, when I was a young lawyer, I remember going to the bank to apply for my first mortgage. And my fear was not that I wouldn’t like what the bank offers, but that they wouldn’t want me. I had to put 20 percent down.

I was self-employed, so I had to show that I was making income. It was, I was, it was a white knuckle experience. But at the end of the day, I came out of there convinced 30 years ago that if the bank thought that I was a good risk, then this was probably a safe deal for me to get into. And and so, Addie, that was her experience going to a brick and mortar bank and having those kind of conversations.

And so the idea that somebody would offer her a mortgage that didn’t make any sense was completely foreign to her and to most rational Ohioans. But I started to see that the problem with it again before I became attorney general as we were debating predatory lending legislation. What had happened is Cleveland passed a very, very aggressive predatory lending law.

And, of course, the movement then in the legislature, which has become kind of typical and in the age of ALEC and the, in conservative legislatures, was to create passé Ohio-based statewide law that would pre-empt Cleveland’s very, very good law to protect consumers. And so in that debate, I remember the meeting with the, calling up the bankers myself . .

After New York, Ohio at that time was the second largest headquarters of banks. We had National City, we had Key Bank, we had the Third Bank out of Cincinnati. US bank has a huge presence in Ohio. Chase was a huge player in Ohio. And I call the lobbyists and I said, “Look, we’re going to do something great for you.

We’re going to drive all these homeowners back to your brick and mortar bank in order to get their loans, so A – because we know that you’ve got a reputation and that you are ethical, corporate citizens, and you would never issue these predatory loans. And two, we can put these other folks out of business and level the playing field for people who are doing things the right way.” And they were like, “Oh, no, no, we’re for preempting that law. We don’t want to have predatory lending restrictions in Ohio.”

And it turned out later I learned as we got through this investigation that they each one of those banks had their own subsidiary that was out peddling these predatory loans and those that weren’t were buying them from mortgage brokers and the people, you know, the scum of the lending world, like New Century Mortgage and Long Beach Savings and Loan and all the terrible players.

So they either had relationships to buy those loans or they were actually in the case of National City and Key Bank, they had their own subsidiaries that were in the business of going door to door in neighborhoods like Addie Polk and convincing senior citizens who had equity in their home to cash in that equity at risk of losing their home, which is, of course, what happened in her case even more tragically and lost her life as a result of that. So, that’s what we were up against.

It was not just these small players. It wasn’t just, you know, the bad guy, Angelo Mozilo, that was running Countrywide Mortgage, the whole industry, and it ultimately turned out, all of Wall Street knew exactly what was going on. They were providing billions and billions of dollars of capital and they didn’t and they didn’t want their money back.

They were loaning this money to these originators like Countrywide and Countrywide, if they wanted to pay the money back with cash, the investment banks wouldn’t take it. They wanted loans because they would then take those loans; they would pool them into pools, and then they would resell them on the bond market and they would pool, and without any attention to the quality of the loans.

So, on one end, they were screwing the homeowner by taking the equity of their home; on the other end because they didn’t they had no idea what they were selling to the bondholders, they were screwing the bondholders on the other end. One of the ironies of the foreclosure crisis is that the investors had, were just as hurt as homeowners.

They actually, their interests were about the same because they trusted the way that homeowners trusted that the folks that were running the engines of the financial business in this country, we’re going to be honest and fair. And we thought with the SEC, and the Office of the Comptroller of the Currency and there were lots of . . Federal Reserve. I mean, banks were very well regulated for the most part.

Many states had very strong state regulation of lending and yet none of those protections worked. And in fact, the big banks and the small banks and everybody in between ignored those rules and went about the business of maximizing their profits at the expense of working class and middle class Ohioans. And that’s what from the very beginning of my time as attorney general, talked about it in the campaign.

And then I talked about it, and then talked about it when I got sworn in. And then we went to work. We harnessed our organized crime task force. So in Ohio, the attorney general doesn’t have a lot of direct prosecutorial responsibility, just a couple of exceptions. One of the exceptions is, is that the attorney general in charge of the Ohio Organized Crime Commission, the Organized Crime Commission, is a, was set up so that resources of various law enforcement agencies could be pooled to take on bigger criminal enterprises like drug traffickers.

[00:30:48.100] – Lovell

But, Steve, think about some of the themes that you’re hearing here right. In the investigation you have to have the commitment. You have to have the courage. What does that mean? Well, you have to have vision. You have to have the determination to fund this thing because you can’t guarantee a prosecution. What it comes down to is you got to prove the crime, right? And it’s so easy.

For example, one of the things that stuck in my craw throughout this whole process was President Obama went on 60 Minutes to say that, well, while Wall Street, what they were involved with was unethical, they didn’t break any laws. Now, we could spend an afternoon parsing about how that is disingenuous, not correct, or could be correct under certain legal sort of variables. Right?

But in terms of the actual crime itself, what you heard from Tom Murphy is exactly what it’s all about. He knows theft when he sees it. So how do you prove it? And so they put together this ginormous apparatus that was super, hyper secretive because they had the vision to know that they had to represent the people. What a crazy idea, right, Steve?

[00:31:54.600] – Grumbine

Absolutely. You know, as I listen to this, it just reminds me that once again, the bad guys have so much more power because we’re afraid of them. We’re afraid of them. The political will is not there. The quote-unquote “champions of progress,” the champions of the people are afraid to take this stuff on. They lack courage. They lack the political will. And you watch this as they pander.

You see them on television. What goes on behind the scenes, I can’t tell. I’m not in those smoky, dark rooms having to wheel and deal, try and get things done. I recognize that that is a skill that I don’t have. But I also recognize the fact that in order to uncover and to shed light on these things, as Bill Black said, we must have the courage, we must have the courage, we must have the will, and we must have the backing.

You must have the energy to take on these very, very powerful interests. And so, you know, hearing this at a micro-level through Tom’s view and understanding inside of Ohio and inside of this specific investigation what it took to do that. Imagine extrapolating that out across 50 states and territories and looking at every one of these predatory situations. Number one, we already know it’s underfunded. We already know that it’s understaffed.

We already know that they aren’t given enough tools to survive through this process. And then we wonder why these things keep happening. And I think probably the most frustrating thing is the platitudes salad that we get from our politicians and from the media pundits who just wring their hands and act like, oh, there’s just nothing more we can do. There’s so many partisans out there that simply will not call out their party.

Their party is their family, it’s their religion. And unfortunately, this is a nonpartisan issue, this rises above politics and it becomes a matter of life and death. And you see that right now currently in the political climate today, people are talking about Nancy Pelosi, Mama Bear, and all these other things. And these are the very people who have done the Texas two-step to keep us from uncovering this and attacking it where it stands.

So this is really important. And the Obama failure is every bit as egregious, if not more than the Bush failure, simply because Obama came in with hope and change and so many people believed him, were hoping that he was going to save us from this. And in fact, in many ways, he put some fertilizer on the same corruption and allowed it to continue. So, yeah, absolutely.

[00:34:38.430] – Lovell

Well, to that point though, let’s go to Tom, because, Tom, again, let’s talk about where the rubber meets the road. You’re a career civil servant. Your job is to protect the people. How does that go into the formula here as this process is coming to fruition?

[00:34:55.190] – Murphy

Well, the way it worked out is . . . When you’re the director of a task force for organized crime, you report to the attorney general, well, to the commission, but to the attorney general. And as I would meet with local, or as you would run into local politicians say, and or local big shot attorneys, because they were very, very upset. They’d say, “Well, who do you report to?” (Murphy) “I report to the attorney general.”

(Attorney/big shots) “Well, we want this done.” (Murphy) “Well, good for you, but I report to Marc Dann, and if you want to change, you call Marc Dann.” Well, if you know, Marc, you’re not going to call him. They’re not calling him because he’s the guy that told me to do it and I’m doing it. And when you have that kind of backing, and they knew it, I was just a soldier, but they couldn’t get to the soldier because they didn’t want to go to Marc.

They were afraid. And Marc, “Just keep going. You’re on the right track, keep going.” And as it got bigger, to be perfectly honest, when it got bigger and bigger and bigger, that was Marc’s purview. It was not mine. I knew that Atlanta had it. I knew that Indiana had it. I knew that Florida had it. But that was not mine. You know, Marc had to deal with those people, not me. And unless Marc said, “Hey, you’re going down to Cincinnati to give a talk.” (Murphy) “Well, ok.” Time and date, and then I had to block that out.

[00:36:38.190] – Vaughan

I was just wondering because as Patrick was talking about how some people were saying, I believe, that what was going on was just unethical and not illegal. When did you in your investigation, let’s focus specifically on the Dave Willum’s case that’s featured on The Con. When did it become clear that this wasn’t just unethical? It was illegal?

[00:36:59.730] – Murphy

Well, when you take the word. I don’t want to hurt anybody’s feelings, but if you take the words predatory lending. And you just erased them and put theft down, and put the elements of theft up there, it comes pretty quick. It comes real quick when you got [crosstalk 00:37:17]

[00:37:17.610] – Vaughan

What do the elements look like?

[00:37:18.930] – Murphy

Well, it’s taking something of value, taking it from people. So what they would do is they would inflate the property value. If a house that was worth $8,000, or they bought for $6,000 and put some lipstick on that pig, you know, they put a couple of windows in and something. And then they said, “OK, this thing is worth $70,000.”

And they would just get a street urchin to sign up for, quite honestly, had a wife maybe and two kids and it was going down to 30 degrees or 20 degrees. They had to put those wife and kids someplace. “Just sign here.” “Well, I don’t have that kind of money.” But we had the mortgage agreements. “So where did you come up with that?” “Well, that was babysitting money, that we make about $4,000 a year.”

“Well, who put $30,000?” “Well, they did.” Well, oh, so they wouldn’t fight us, so we knew right away that they were all doing something wacky. And then they would take this piece of paper, and they would forward it on to California, the big mortgage lenders who would get that money and what the big mortgage lenders were doing. I mean, you could call predatory lending. It’s theft. That’s exactly what it is. They were stealing money.

[00:38:56.260] – Grumbine

Absolutely, you know, you talk about theft, and we talked about this and let me, let’s lay the cards down. You know, these houses were oftentimes completely worthless. They were very, very low value. And they would inflate the actual asset price of it. They would provide loans at that price. Those loans were unpayable. They were, they would blow up.

They would have balloon endings on them that would just completely . . . And then they would be right there to pull it right back and steal it away from them. And in more nefarious cases, actually have people that behind the scenes taking enough personal private information to act as an attorney, if you will, or acting as their representative and go ahead and fill out fraudulent loans to do this stuff behind the people’s back. And they didn’t even know it was going on.

And then take that property from them, cash in on the bonuses, the huge bonuses, and literally walk away scot-free. And that, to me, is the definition of theft, just exactly as you stated. Let me piggyback on that real quick with Marc Dann. Marc, at a macro level, at a much larger level, we clearly see that this took place over a period of time and throughout the country. What, if any, conversations did you have between other states as you were going through this? Did you get to see this happening elsewhere? Were you privy to seeing the larger picture from your seat?

[00:40:39.670] – Dann

So we had crime victims, and we had a crime, and we investigated the crime, and we put people in jail. I don’t think that was anything very, very special. Honestly, that’s what I was elected to do. That’s what every prosecutor in the country is elected to do, and why they didn’t do it is as beyond me as you. And the fact that the Democrats running the country at the time, I can almost understand why Bush didn’t.

He was, he ran on behalf of the banks, and they spent eight years trying to preempt state regulations and then eliminate those regulations of businesses. But when the Democrats took over and there were Democrats running the Justice Department, they were just as subservient to their Wall Street masters, and the law firms that they were, had come from, and that they would go back to after their few years in government, that even when the professional staff, as you proved in The Con, were coming to them and saying, “Hey, we’ve got something here. There’s a massive crime wave going on.”

And they were like, “Oh, that’s not really crime. That’s more of a civil kind of a violation.” You know, and then the whole thing gets even more exacerbated. And this is where the hate and the anger that we saw this week comes from is when we then judges all of a sudden when these, when the bottom fell out and all these houses went into foreclosure, and the judges didn’t know what to do, but they couldn’t imagine – the same thing.

They couldn’t imagine that Wall Street, that a bank like Chase Bank in Ohio or Fifth Third would could possibly present to them in court a note that they didn’t have the right to enforce. It was stunning and it was really interesting. And this is particularly easy to see in the smaller counties where there are one or two judges who actually have a little bit more time and they can read the Constitution and stuff.

And so after I left office, and I was defending people in foreclosures, I remember a really great conversation with the judge because, “You know, when, before this all happened, I would never, it would never dawn on me to doubt what’s in the paperwork filed by a bank to foreclose on a house. Because now, after what we’ve learned over the past three years, I don’t believe anything they put in front of me.”

[00:43:02.530] – Lovell

That’s insane, considering that not a lot of those judges have come forth, at least together, to speak in unison about what they actually . . .

[00:43:10.960] – Dann

What they actually saw. Well, but because in the big counties, so in the small counties, justice was possible because there was time. And in a county where there’s 100 foreclosure cases a year and it went to 200. In Cuyahoga, it’s easy when Cuyahoga County, where it went from, you know, from 3,000 to 30,000 foreclosures in a year, all the judges were thinking is, “Holy shit, how am I going to do anything else?”

You saw Florida, and you saw, those are the judicial states. Those are the places, Patrick, where people have had due process protection. But places like California and Utah, where you live, those are non-judicial states. There was no due process at all.

[00:43:55.410] – Lovell

During the Obama administration, we thought we got a president who came in riding a populist wave to clean up the mess that he was in, and I dare say, he had a popular mandate from the people very similar to FDR. And the first thing he does is he puts Eric Holder in charge of the Department of Justice. Where did Eric Holder come from? Covington and Burling, who wrote all of the legal representations of MERS, which was a huge, huge part of this stuff. It happened to be Covington and Burling as well.

[00:44:26.040] – Dann

And then, of course, Eric Holder went back to Covington and Burling after he left office. So it was just seamless. And he was there to serve the interests of himself personally and their client. And it wasn’t, again, for whatever, we know why it wasn’t a priority for the folks in the Obama administration.

They blew another huge opportunity, which was as part of their relief bill, as part of the HAMP Bill, there was a proposal initially that Obama supported as a candidate to allow first mortgage loans to be modified in Chapter 13 bankruptcy. And Obama punted on that, he gave that up in the negotiation and that frankly, would have saved the bankruptcy courts, were in much better position to be able to adjust these mortgages and to salvage some rationality from what was going on.

And they just they walked away from that. So they walked away from this potential civil remedies that would have helped people in favor of a plan that really just subsidized banks and paid them interest on the bad loans that they had originated to begin with. That’s really with what the TARP and the HAMP program ended up doing for homeowners and for banks, and walked away from the ability to fix it civilly when the Justice Department had the opportunity and was presented on a silver platter, a case of criminal conspiracy, a classic RICO organized crime enterprise, they chose to walk away from it.

We didn’t in Ohio. And just because our guy, as I said at the time, just because our guy was wearing a loud sport coat instead of a $1,000 Bespoke suit, doesn’t mean that the guys in the Bespoke suit did anything better. They were just smoother. And they’re still there, by the way, Patrick. All the folks at Merrill Lynch and who were at Deutsche Bank and were at the biggest investment banks in the country, they’re still sitting in their corner offices making a million dollars a year bonus, doing the same thing.

[00:46:30.070] – Grumbine

You know, I interviewed a lady named Keeanga-Yamahtta Taylor who wrote a book on the absolute problems of redlining and post redlining America and so much of this played into making housing available to minorities, and they gave them houses that were run down already. And this is before this concept, or at least before some of the stuff that we’re talking about happened.

But if you look at it, this is happening in the 70s and even the 60s and 70s as they moved into and started showing predatory inclusion, predatory inclusion, gave way to predatory lending. And when you look at all of this stuff here, it shows how they targeted minorities. And I guess, Tom, this question goes to you, sir. Can you talk about how your research showed them attacking minorities in particular?

[00:47:26.230] – Murphy

Yes, I can. And it was obvious who is being targeted and unfortunately, we couldn’t get enough people to say that. Because it did raise it to another level and we knew they were going after minorities and we couldn’t, although I think that the preponderance of evidence proves that. You know, you called it inclusion or whatever you called it. But it’s theft.

I don’t get with the fancy names, you know, predatory lending, inclusion, whatever, you’re stealing money and that’s all I had to know. And then when I turned it over to the prosecutors, they could call it whatever they wanted. It was theft. They were stealing money and when they started the Ponzi scheme or the pyramid scheme, you could call it anything you wanted with stock, it’s theft.

You know, he was selling them or selling them something of value they thought was of value. And he wound up sticking a lot of people. And to be quite honest, they weren’t happy with us. As Marc said, they weren’t happy with the AG’s office. And thank God, the way it worked out is they didn’t have my phone number. But we were busy. You couldn’t get a hold of us.

And it was, you know, Marc was going at the larger level, but we knew that they were targeting minorities the entire time or people that couldn’t afford anything. And they were getting out of the cold. Hey look, most people are one paycheck away from there, most people are. So and that’s how myself and the people on the task force looked at it. You know, we’re real close to being them.

[00:49:32.060] – Lovell

So, Steve, put yourself in my shoes. Right. So here I am kind of a product of what our generation would have thought of as upward mobility, right. I go to college, I get my education. I come out, I become a producer. I do whatever. I get into my first home, and then suddenly my world is in the spin cycle in 2008. Right. And I’m just asking questions, and I’m trying to figure this out. And I’m reading The New York Times and it’s not telling me the story.

I’m watching President Obama. He’s not telling me this story. Nothing makes sense. Right? And then suddenly I meet a guy like Tom after this incredible journey, and he’s saying it just like it is. It’s theft. But I’ll take it a step further, because it’s theft by deception. That’s what fraud is. That’s criminal. So there’s a way that that can be dealt with as, of course, these heroes.

[00:50:19.540] – Dann

Let me just make one point, Patrick. Millions of Americans, from the results of the 2008 financial crisis, lost their faith in the rule of law. Addie Polk believed that there was right and there was wrong and there was justice and there was injustice. The members of her church believe that. But when they saw that the rule of law didn’t apply to Addie Polk, that the rule of law didn’t apply when they were being victimized, when the shaman of QAnon lost his house, he did, he probably did.

Maybe when he was, got that mortgage and was proud and had his wife and family living in the house, he felt a degree of pride in American citizenship, his citizenship and a belief in the rule of law. But when the rule of law didn’t protect him and didn’t protect millions of other people, millions, millions of people in the African-American community, millions of working class people of all colors and all backgrounds and of all origins, that’s the tragedy. And we never fixed that. And that’s why we have what we have right now.

[00:51:37.560] – Lovell

Before everything derails and the train wreck gets even worse than it already is, what can people of professionalism within the system who understand, what do they have to do to be heard, to be able to reset the table so that we can reset our society?

[00:51:54.690] – Dann

Well, they need to hold the power you have is with your vote and to hold the elected officials accountable, but the elected officials need to also recognize where they come from, and they need to be able to, and we need to stop this revolving door in and out of government. I mean, I think that’s a huge, a huge factor.

We have to insist that our office holders appoint people of courage to important jobs like prosecutors or assistant prosecutors or US attorneys or US attorneys general who are committed to not just justice for drug dealers, but justice, economic justice and fairness in people’s lives and in recognizing that. And I think we need to, I think we need to pass laws that are frankly much more direct and much more specific that go to what’s allowable and what’s not.

One of the tragedies of this, Patrick, is in 2007 if you wanted to start the Ethical Mortgage Company, and only offer loans for actual value on people’s houses, you wouldn’t be able to compete. You wouldn’t have been able to start the Ethical Mortgage Company. And so what we forget and what Republicans sometimes forget and people who are like or the pro-business Democrats is that serious enforcement, enforcement of antitrust laws, enforcement of consumer protection laws, enforcement of laws regarding lending practices and having a strong consumer financial protection bureau, which is one of the good things that came out of the 2008 process and hopefully will be reenergized with new leadership shortly protects ethical business people.

Because these CEOs, especially in public companies, they have a duty to their shareholders to maximize profits, and if they’re not at risk of something of going to jail, if they commit a crime, then they’ve got a huge incentive to do whatever it takes to maximize profit. And so that makes it impossible for honest, ethical people to compete. Somehow we got to bring that to an end.

[00:54:10.000] – Vaughan

If somehow magically, Marc, you and Tom were put at the head of the Department of Justice in 2007-2008, what would you have done?

[00:54:20.730] – Murphy

For me, we were told. You’re never going to solve this. We’ve looked at it and I think it was Atlanta. If I’m right, Marc, maybe you know that. They said, “No, you’ll never get it. You’ll never get an appraiser. You’ll never get a lender.” You’ll never get this. You’ll never get that. Well, you know, and they were talking to police, if you will. But they really weren’t talking to police. They were talking to a department of organized crime that had criminal intelligence, that had forensic accountants, of course, nobody knew that.

And as we started to put it together, they still didn’t know because we weren’t talking to them. But when this thing started to pop, they came back out and said, “How did you do it?” Well, we went out and got an appraiser. We got lenders. We got everybody we needed, you know, and we do just what law enforcement does. Well, isn’t that interesting? Yeah, I guess, but you do have to, I’m not blaming cities. Cities could never, ever put together what Marc and myself, if you will, put together.

[00:55:43.210] – Dann

But look, like in any organization, you have to make people believe, even if you’re asking them to do something different than they’ve always done. You know, the two challenges in government are always we’ve always done it this way, or we’ve never done it this way. And those are those, that’s the inertia that somebody who wants to bring kind of radical change to processes faces when they come into a government office.

This was an issue that was of particular importance to me. We kept our eye on the ball. Tom Murphy and his team kept their eye on the ball. They worked incredible hours for much less pay, I can tell you, than the people that they were going after, who were living a very, very, very luxurious lifestyle, worked out of an abandoned church school for a couple of years to bring this all together. And but they believed that they were doing the right thing.

And once they got their mind around the idea that these people who they had always thought were respectable pillars of the community, the people that sponsored the scoreboard at the high school football game or who contributed to the something to the church raffle every year, those people can be criminals, too. And that once you started to peel the onion skin back, you could see just how tragic that it was.

And in our case, we’ve had both homeowners who were victimized and investors who were victimized at the same time. But they were, none of them were rich. All of them were people who were for whom it hurt. Losing your home hurt. Losing that whatever investment that was made, it wasn’t, these weren’t hedge funds or big Wall Street entities that lost their money. These were regular people who were meant to make an individual investment in something that was completely unsuitable and fraudulent.

And so that’s why, and we listened to them. And that’s the other thing. Government, law enforcement, they need to be better at listening to people and what they need and what’s happening to them. It’s very difficult sometimes. And these are very difficult crimes to prosecute. So while I’m proud of what we did and I appreciate the kind things you say about me as a recovering politician.

I have pretty much an insatiable ego. So I do appreciate that. But really, I never thought to do anything differently. I mean, this is, look, I’ve got this job. I can protect these people. I’ve watched them lose their homes. I’ve had them crying on my doorstep or in my law office or in my attorney, or at a time when I was giving a speech as attorney general.

I heard from the people who had the vacant houses next to them whose own property values went down, who didn’t get caught up in the web, but got caught up in the web because all their neighbors ended up foreclosed. The properties ended up abandoned and in disrepair, and suddenly they were living in a neighborhood that was no longer desirable or safe anymore.

So it wasn’t just the people there. The people when I walked down the block today in Cleveland, one out of four houses that I walk by, the value is less than the amount owed on the house. They’re still underwater here. This is where people were told, they were sold this American dream that, oh, your house is a great investment. Put your money in your house and improve your house. And then when you then you’ll have a big nest egg when you retire.

And they had no reason not to believe that. And it would have worked if they hadn’t if these predators hadn’t decided that they were going to, that’s the next way. They were going to churn these on Wall Street and then convinced the agencies that were put in place in the Depression after the Pecora investigation, the Federal Housing Administration, and the Fannie Mae and Freddie Mac, who were supposed to be the guardians and supposed to be the ones offering and buying the good loans and offering the good loans and their reaction, instead of saying, “Oh, those guys are, that’s all going to fall apart cause we know this business and this is what’s going to go wrong.”

They went out and started to compete with them, and they issued their own predatory loan. I mean, it was just outrageous, you know, and we attacked this not just from the in this RICO investigation. We sued Fannie Mae and we sued Freddie Mac because the state of Ohio’s pension funds were shareholders.

So we went after them for those stupid decisions, but it all fueled each other. Why? Because nobody at the Justice Department or thought that the guy that they went to college with or the guy that they went to law school with could possibly be the kind of criminal that Tony Soprano is. And in fact, in so many ways, they were worse.

[01:00:33.380] – Murphy

You know, you can call it or talk about it however you want, but these people, if you say, well, the people at the top didn’t know, you would have to start that story once upon a time to sell it to me. That won’t fly. They had to know.

All you have to do is walk down the street and look at those houses and, you know, this thing is worth $5,000, $6,000, and they got an $80,000 loan? Come on. You know, in this story doesn’t end that they all lived happily ever after. Maybe the people at the top did. But I will tell you this. Marc scared the hell out of a lot of them, too.

[01:01:22.910] – Lovell

Following the Great Depression, Russia went to Stalinism. Germany went to Hitlerism. We went to the rule of law, and we won because of that. Now, this many years later, we’re just going to go repeat the mistakes of history unless we get it right.

[01:01:39.080] – Dann

Well, and let’s hope that we do. And I think that there’s, we’ve had enough of a scare that maybe somebody will start to think about and hear some of the things that we’re saying here. You’ve got to start putting these corporate criminals in jail. I don’t care in what form they are because they can’t be above the law.

You can’t put the drug addicts in jail and the drug dealers, but not the manufacturers of opioids who knew they were addicting people under false pretenses. You can’t. You can’t put you’ve got to put the guy that builds the plane that kills the people in jail. You’ve got to put the banker that steals people’s homes in jail. And believe me, none of those people want to go to jail.

Nobody who went to Harvard wants to go to jail, I assure you that. I don’t know a lot of people that went to Harvard, but the guys I went to Michigan with, they certainly don’t want to go to jail. And they, but they also want to do their job and maximize profits. And if there’s no risk of consequences for criminal activity, then you’re almost incented to commit crimes, serial crimes.

[01:02:46.420] – Lovell

And, so I guess I have to ask the question: Merrick Garland, are you listening? Biden, are you listening? And most importantly, the American people, the American people need to listen to what Marc Dann is saying and then repeat everywhere in social media, everywhere in interactions. Marc Dann got a RICO conviction on what should have been the way the entire justice system took down a criminal Wall Street apparatus and didn’t. Until we do, we will continue to fail.

[01:03:18.090] – Dann

And I just hope we elect more people who are like me that I couldn’t even imagine a world in which that wasn’t what you get up and you put the bad guys in jail and particularly the ones that are stomping on the rights of your friends and your neighbors.

[01:03:33.960] – Grumbine

Well, hey, folks, I just want to thank you guys for joining us. Thing that really, really brings this all together for me is that I’m a project manager by trade. And when I think about the layers, inputs and outputs, and all the various components of this starting at the very bottom, you can see the chain of custody, if you will, of the fraud from end to end.

And it doesn’t just, I want to make sure I punctuate this. It doesn’t just sit on a computer somewhere. People die. And I have said this from day one in my other work, austerity is murder, and this is a form of fraudulent, just evil austerity, even though it’s not government-sponsored, it’s government complicit, and this is why Trumpers are so anti-government. This is why libertarians have the opportunity even to say we need small, limited government because government has failed to do the most basic thing, which is to protect the people.

And it didn’t do its job and it didn’t do its job in a bipartisan way in a very, very huge way. And the rest of this series that we’re going to be doing here will continue to build on this very structural building block. Fraud is not a victimless crime. People died. They lost everything. And I want to thank you, Tom, and I want to thank you, Marc, both for being with us. And Eric and Patrick, thank you so much once again. Folks, this is Steve Grumbine with Real Progressives. On to number three. Have a great day, everybody.

[01:05:21.470] – Murphy

Thank you very much.