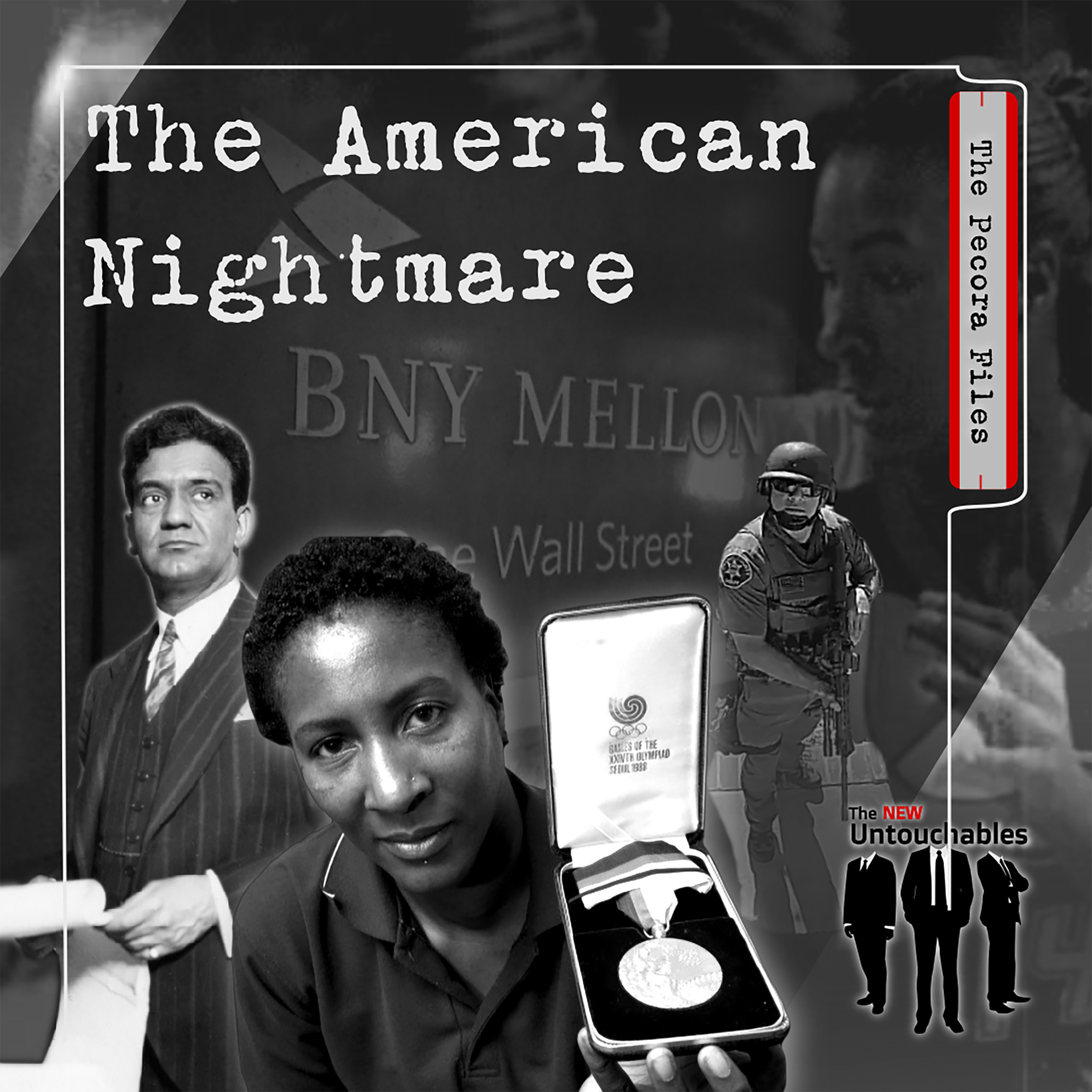

S2:E1 – The Pecora Files: The American Nightmare

FOLLOW THE SHOW

Co-hosts Steve Grumbine and Patrick Lovell will take you through Cindy Brown’s story as well as personal experiences with the legal and judicial system. The American Dream is now a nightmare and will remain so until we come to terms with how this system operates so we can once and for all demand an end to the corruption.

A nightmare of unprecedented magnitude destroyed millions of Americans and tens of millions of people around the world caught in the web of deceit and no way out. No matter one’s race, gender, or even economic status, let alone personal achievement, if they got trapped in the machine of corruption, no one was immune to the inhuman betrayal of a judicial system that rewarded the criminals.

The words “financial terrorism” is the only way to frame the horrific and tragic stories of people like Olympic Gold Medalist Cindy Brown, who discovered the truth and refused to yield to the lie. What it got her was a privatized swat team that forcefully removed her from her home at gunpoint using fabricated documentation to steal her home, forcing her into the streets and presumably oblivion while they liquidate her gold medals representing the United States to pay for fees to a corrupt machine that never stops. This is our collective miserable reality.

Co-hosts Steve Grumbine and Patrick Lovell will take you through Cindy Brown’s story as well as personal experiences with the legal and judicial system from attorneys Dr. Raye Mitchell, Esq., Kellee Baker, Esq., James Imperiale, Esq., Joan Jackson, Esq., and H. Elizabeth Johnson, NAACP Housing Chair as they reveal similar horror stories throughout the nation.

The American Dream is now a nightmare and will remain so until we come to terms with how this system operates so we can once and for all demand an end to the corruption.

The New Untouchables: The Pecora Files

Episode 6 – The American Nightmare

June 27, 2021

[00:00:02.880] – Cindy Brown [intro/music]

I’ve been saying it since 2005, that really it’s like an American holocaust where people of color who were being snatched out of their communities, out of their homes, and then they’re being pushed into a homeless situation or ghetto as they would define. And they’re leaving us without any hope.

[00:00:26.500] – Dr. Raye Mitchell, Esq. [intro/music]

If you’re going to defend the siege, you’ve got to reengineer how you attack them as they attack you. Facts don’t matter. Law does not matter. And the judicial system is manifestly corrupt. Those are three things that we know. However, those are all three things that we have.

[00:00:52.950] – Eric Vaughan [intro/music]

In a world of elite criminals, only people of elite character can protect our system. This is The New Untouchables.

[00:01:05.820] – Steve Grumbine

All right, this is Steve Grumbine, this is the new season, season two of The New Untouchables: The Pecora Files. Season one we focused heavily on the technocrats, the people that were pulling the levers of power behind the scenes. This season we’re focusing on the victims and we have got some stories to tell you, folks. This is happening right here, right now.

This isn’t just something that happened a long time ago. The tools, the entire way of doing business has never gone away. It was never put out of business. People weren’t put in jail. The only thing that happened was that people lost their livelihoods. They lost their homes. They lost their families. They lost everything. In this season, we’re going to bring out their stories. So without further ado, let me bring on my co-host, Patrick Lovell. Patrick, tell us what we’re in for here, sir.

[00:02:02.430] – Patrick Lovell

Well, it’s a great honor to be with you, Steve, and to bring these stories to life. Our system, if you want to think of it as a machine, has done beyond science fiction in terms of covering up what I call financial terrorism. It’s not hyperbole. We have a system supposedly in this country of justice, particularly as it relates to the housing market and everything that determines the function of what we call “standing” in any sort of proceeding with regards to ownership and real estate.

And there’s a whole process involved. There’s a whole process of getting people involved with mortgages and home ownership. There’s a whole process involved in foreclosure. And what happened in the wake of the great financial crisis is we learned in season one that there was a pipeline of engineered predation and engineered fraud in which every piece of the puzzle was incentivized to lie, steal and cheat, to be able to approve loans in a way that created incredible volume.

There was an appetite around the world for securities. There was literally $70 trillion in 2005, sixish looking for investment opportunities, and Wall Street offered it over the course of many years in the form of mortgage backed securities. Now, anybody involved with homeownership understands that there’s a whole lot of different ways you can get involved with a loan.

There’s a whole lot of different ways you can refinance a loan. There’s a lot of different ways you can acquire real estate and you can use that as business operating expenses. And there’s a whole variety of laws that are baked into the system. But what we’re going to find out here as it pertains to, quite frankly, in this episode African-Americans.

There was a lot of directed predation that followed what we called redlining, which were decades and decades of basically preventing African-Americans from getting into homeownership. What we replace that with was a diabolical system of predation, and that works in a variety of different ways. And, of course, we were able to show in The Con through Addie Polk’s story exactly how that worked out.

In fact, I would like our audience to get their heads around the notion of straw buying because straw buyers could literally insert fraudulent paperwork to make themselves out to be somebody else, to steal equity in their houses, to literally steal the home. We showed that in our series. It happens over and over. And before I heard that, I thought, “Wait a second. You got to be kidding me” because we could all wrap our heads around street crime.

We could all wrap our heads around maybe auto theft, any variety of different kinds of theft. Right? But stealing a home through fraudulent paperwork, how could that be? Well, as it turns out, it was a multibillion-dollar business that the FBI was trying to root out as early as 2000. And by the time we get to 2008, the whole ship derailed. But what happens ultimately in these particular stories is a lot of people think that the 2008 great financial crisis is ancient history.

It’s not. It’s destroyed the lives of millions of people. And I’d say the percentage of people that fought in the courts successfully are probably like one in a thousand. Now, I don’t have the actual data in terms of what the corollary is, but center screen for me right now is a woman by the name of Cindy Brown. Cindy Brown is an Olympic medalist, gold medalist, played on USA Basketball.

She was a professional in the WNBA. Owned her home. And many, many years later, after being in a foreclosure situation. Well, instead of me tell her story, I’m going to turn it over to her. Cindy, thank you for joining us. Can you give us as brief a journey as you can and what your story is and what you want the world to know?

[00:05:52.340] – Cindy Brown

Well, you really hit it on the nail, and thank you for having me here to share this story, because I’m still on this journey of finding the truth as to what happened in my case. And it’s pretty clear that the person that took the loan out on the home was not myself. In fact, what they’ve done is they’ve perpetrated the identity theft in a lot of these cases so that they can get to the equities to the properties.

The whole scheme here is to use that straw buyer’s name, use your personal information so that they can access the equities to that property because they never intend to pay it back. They’re just going to get to the equity and then get the property in default and then they’re out of there and then the burden’s on that person who own the home. Now, I don’t know how many cases are out there that have entered the foreclosure forum like mine, but I recognize that identity theft is the biggest, the biggest fraud that’s going on right now.

And the courts are fully aware of it and they’re signing and forging documents and then submitting it to the courts. They’re not examining the documents. The courts allowing these documents to come in by presumption. You’re not able to object or rebut the documents. It’s basically like everything that you just said. It’s so shocking.

Today I’m still homeless about six or seven months now, and I’m trying to recover and participate in court. And it’s very difficult without having all the tools I need to litigate to bring forward the fraud. There’s a substantial amount of fraud being used to take over properties.

[00:07:54.700] – Lovell

I want the audience to understand who you are. OK? Cindy, you are literally based on the story that I’ve been able to delve into and why I’m so moved to bring this story to this country that refuses to listen to this nightmare of what I call financial terrorism. And again, it’s not hyperbole. You’re someone who is representative of what I construe as the American dream. You served our country as a representative on our US Olympic team, gold medal, to perform at that level and to become a professional athlete.

We have a fixation with professionalism in our country, particularly athletes. Can you convey to us and the average person what this betrayal feels like to you, encapsulated in the battle that you have waged in the courts and what you had to go through to wind up literally homeless? They came to your house, I believe, with a lot of people to foreclose on you. Can you paint all of it for us?

[00:08:58.440] – Brown

Well, that’s spot on again. In fact, it’s the greatest betrayal because that home absolutely represents everything that I have done for this country and they knew that when they entered that home to foreclose on November 16th of 2020. The placards, the gold medals, proclamations from the Olympics, everything displayed on the wall. I’ve invited people in to actually see these things, to inspire their kids, or to just see my journey through the Olympics.

The actual eviction was unlawful. They forged up paperwork and had the sheriffs to sign off on it. But the way in which they did it was so traumatizing that my ring video caught the experience, which the sheriffs didn’t know about, but how they staged it was so traumatizing. It was very hard for me to put together all the ring video links because it’s just something you would never think as an Olympic athlete – you’re going to be stormed by 15 to 20 sheriffs with military-grade AR 15s surrounding the whole house with other deputies in other persons’ yards.

They’re breaking security cameras and spray painting the lenses so that they can’t be seen. Sounds to me like what criminals do. Then they use battering rams to enter the property and by the way, they couldn’t get to the threshold, so the panel of the door caved in, so they had to crawl through a hole. I mean, it’s just when you go through the first link in November 16, it’s going to explain everything.

They’re actually talking about it, how they’re going to access and enter the home. And screaming through the whole entire house when they know it’s only one African-American woman and a dog, why, in which they had the animal control out there, which made me to believe they were going to shoot her. Luckily, I have her in my car because they would have destroyed her. It’s just appalling how many people standing in that home gloating, laughing, high-fiving and bumping fists like they had accomplished a goal.

Because they’ve been trying to get that home for years, for years. And I’ve reported crimes against that home for years and not one of them, not one agency took the initiative to investigate the way that I have to find that a serious crime had been committed. I even have the canceled checks front and back, so it makes it easy as to find who the equity stripper is. But see, that further gave me a clue who is participating and working together.

[00:12:21.240] – Lovell

This is shocking, shocking stuff, right? And we’ve got the video and we’re going to be able to ingest some of that as we move forward in this process. But I want to just briefly ask Miss Mitchell just to chime in. And I know there’s legal here that represents you that we’re going to get a little further into the details of your story, Cindy. But as an overview, Miss Mitchell, can you give us an understanding, a little bit of background on who you are, and from your vantage give the public some further awareness of what Miss Brown is conveying here?

[00:12:53.500] – Dr. Raye Mitchell, Esq.

Thank you for inviting me to participate in this very important conversation. One little caveat, I am a lawyer, but I’m not giving legal advice or counsel. Secondly, and as importantly, Miss Brown, I feel you. I feel your outrage, and I can’t even imagine how horrific your experience was and is and will continue to be, and you really start with the whole idea of what’s the policy behind this type of experience.

And as you were speaking, I wrote down some concepts because I’ve been on same and similar cases that are horrendous. And they all start with the notion of this systematic effort to strip you of your dignity. The entire uncivil justice system, which is a podcast system I’m bringing forward, is built on the notion of dehumanizing you for your failure to comply with them.

I’m not a conspiratorist. I’m not anything like that, but you have to understand that the entire civil justice system was built on the notion of us versus them, has versus the have nots. And while there are laws and rules on the books, the interpretation and the execution of those laws are driven by who they want to see to succeed. That’s the endpoint.

So as I navigate these issues and I don’t really litigate a lot, I do a lot with policy and I’m writing and I’m doing some other advocacies. I’m working to educate people, particularly African-Americans, about the law of homeownership because it goes well beyond unlawful detainers. It goes light years ahead of the notion of foreclosures.

It starts with the notion of property that started in this country – who can own property. In law school, I went to Harvard Law School. I’m blessed to have had that privilege. The very first day in real property class, and I’m going to be short and finish. The question was: who is allowed to own property? And when you start with that notion that some people are allowed to own property and others are not, you will walk head into why you’re treated the way you are being treated, whereas somebody else is not.

So the policy behind all of this disastrous conduct comes down to the failure to comply, the dehumanization of those who don’t comply, and the effort to strip you of your dignity, because if they take your dignity, you can’t fight back. Stay strong. And that will let you prevail.

[00:16:01.860] – Brown

Thank you.

[00:16:02.670] – Lovell

I deeply appreciate that, Miss Mitchell, as well as your accolades. Again, thank you for being a part of this, because if anybody is going to try to poke holes in a situation that’s typically in this country, particularly in mainstream media, I’d love to go to people from the Ivy League. Now, I personally think a lot of people in Ivy League aren’t talking about this issue, so thank you for doing so.

But I want to bring this back to this notion. And Cindy, we’re going to come back to your story specifically with the folks here that have represented you and close to your case. But I want to give it an opportunity because you folks are on the West Coast. Miss Mitchell is out of the Bay Area. You’re down in the Inland Empire and actually Orange County, I believe, right, Cindy?

Anyway, we’ve got Miss Elizabeth Johnson from the NAACP in Maryland, as well as Miss Baker, a law firm that has dealt with a lot of foreclosures in a county called Prince George’s County, Maryland, which I believe is one of the more affluent African-American communities in the United States and I believe, have been decimated, decimated by this foreclosure machine that I think, Miss Johnson, if the stats are correct in my mind.

I think something in the case of 75,000 foreclosures in Prince George’s County alone. Miss Johnson, can you share with everybody that’s on this call what it looks like from where you were sitting and dovetail into what Miss Brown is talking about as it relates to what’s happening in your neck of the woods?

[00:17:26.160] – H. Elizabeth Johnson

Thanks a lot for having us and I’m so delighted to see everybody else and not to feel that it’s just us in Prince George’s County are the only ones who are fighting this kind of a battle. What we’ve gone through here in this county is absolutely incredulous. And I’m not going to step into Kellee’s Avenue with the courts. I just want to tell you some things about the human kinds of things that we’ve seen here.

I got into this battle myself because I built the house that was supposed to be a generational house for me and my kids, you know, to leave them something when I go to the great pizza parlor in the sky. And before I could even live in the house, it went into foreclosure and I really didn’t know what was happening.

And also in my personal business, my small business, I work with developers and builders and architects and all of my clients were just falling like flies and they didn’t even know what was going on. And so I just thought that surely you weren’t after me. You didn’t mean to foreclose on my house. So my loan was with IndyMac Bank, my construction loan was with IndyMac, and as you may recall, it was the first bank to belly up.

And IndyMac was acquired by Steve Mnuchin and his gang of henchmen. And what they probably did was they started to foreclose on everybody who ever had a loan with IndyMac. That’s what I surmise. So with that, I joined the NAACP because I thought, surely we need to have a voice in this. And I just started talking to various people and talking to legal people and the few people who really were not only concerned about what was happening but wanted to do something about it.

And just to segue a little bit to get into what Miss Brown was saying when she describes that scene of the police coming, I’m sort of harkened back to a scene whereby one of the people with whom I was involved was evicted and her mother was sick, an elderly mother was sick. And when the sheriffs came and evicted them, they took the mother literally out of the bed, put the bed out on the lawn, and put her in the bed out on the lawn.

[00:19:31.740] – Grumbine

Wow!

[00:19:32.600] – Johnson

It was just unbelievable. I thought she was lying to me. And I also have another story that’s very near and dear to me, where a woman had 20 acres of what they call heir property in Cecil County, which is a rural county of Maryland. And she had 20 acres of land and she was fighting her case in the court. And unbeknownst to her, her house was sold and all her 20 acres of land, two houses, two tobacco barns, and a cell phone tower that was on the property.

And they stormed in her house on the 16th of December and evicted her. So she took what she could take out of the house and put it in her car. She had nowhere to go. So for two weeks, she slept in her vehicle in the driveway of a house where she was reared, she and her brothers and sisters were reared. And she slept in her car for two weeks and didn’t dare go near the house.

She was afraid they would try to get back in the house. So those are a couple of the stories that I don’t want to take up all your time with all the stories that I’ve known and seen because I’m sure Kelle’s going to talk about some as well. But here in the courts, no matter how hard we fight, we don’t seem to be able to get justice.

And it was not until I saw The Con that this took all the wind out of my sail because I thought, “Well, what the hell? What can we do? What can we do when the whole entire system there’s an entire system out there that says, “No, you are not going to be able to prevail, you black folks.” So, I mean, for about the past two weeks after Patrick finally got me to watch it, you know, I thought, “Oh, I don’t have time to watch that. Who has time for it?”

And also when I began to give it to some of my colleagues, I really have just been sitting here in my chair just trying to figure out what the hell is the next move because this is so profound because even the people with who I’ve been working over the years have finally decided to look at it. And they’re calling me saying, “Liz, what can we do?” I’m like, “I don’t know.”

It’s just so profound. And I want to thank you guys, Patrick, and your team for doing what you did because it gave me a new awareness about what needs to be done, what we should be doing and what we should be shooting for. So then I’ve got a bunch of notables to whom I’m sending The Con with the hope and mind and encouraging them that until you see this, we can’t even have an intelligent conversation.

We really can’t, because I can’t tell you all of this. And we had been working with MSNBC, I think I might have shared with you, Patrick, and they were asking us questions and things like that. And I so naively thought that the story that you told was one that we could tell. And it’s the story that I felt needed to be told, but we just didn’t have the wherewithal, the know-how. We didn’t have your access, we could not have done that.

So without The Con, you know, I believe my trajectory and everything has changed and I’m just going in a different direction in terms of seeing what we can do. And certainly, it occurs to me that what you have said, we need 20 million people talking about this because to go and try to fight the way we’ve been fighting is just useless.

And Kellee has some bright ideas we were talking on that she may share with you today that she and I were talking about yesterday as to how to proceed. But one thing that’s for sure, until this is out in the open again until 60 Minutes airs it, and until it’s on HBO until we’ve got thousands of people screaming about this, it’s just not going to go anywhere. We’re not going to get any help.

[00:23:14.140] – Lovell

And I couldn’t agree with you more. And I’m going to bring it back to you in a minute, Cindy, again. And I know I want to get to everybody. Please have a little patience. I apologize. We do have a lot to get through. But, Steve, I want to ask you to respond to what you’ve seen so far based on what you know, what we’ve laid out in season one of The Con when you hear something like Cindy say she’s literally accosted by almost like a paramilitary force.

And when you find out the details and realize, well, who knows who they are to begin with, it’s like what in terms of it potentially being a criminal racket, which it is. But you’ve got the same stories in your neck of the woods, Steve, in Pennsylvania, in Maryland, I mean, on overdrive. And we’re going to get into the details of the courts as this goes on and you’re hearing it all over the country. Tell our viewers what you’re sensing right now.

[00:23:56.980] – Grumbine

Well, so first things first. My focus on pretty much everything that I’ve done in my activism has been unearthing the truth of how our monetary system works and understanding Modern Monetary Theory and that conversion between what Patrick and Eric and Bill Black and the others that put together The Con, the combination of Modern Monetary Theory and understanding how this stuff works at the Federal Reserve and the whole business model that Wall Street employs to make these things happen is very complex.

It’s very behind the scenes, is very shady, and yet happening right in front of your face. And the average person, even a well-educated person, people from Harvard, as we’ve seen, people that have years of experience, people that are well known publicly, like Bill Black, who has been in front of Congress, and others like Richard Bowen who have been in Congress, have made no advancements in getting this thing taken care of because they don’t want it taken care of.

And the most challenging thing is the fact that they predate on all of our ignorance, not just some, but all because if it was just predating on the ignorance of black buyers and black communities, it wouldn’t be so widespread. But it is absolutely a real epidemic, a pandemic similar to what we’re going through with covid in the sense that this has happened in every state in the country.

It’s happened to people of all walks of life. But we’ve noticed specifically that the people that did the work within each of those companies is pop up tent companies that were sending these young kids out to sell, sell, sell these subprime loans and all the straw buying, that they did this with knowledge, with intent and targeted African-American communities. And one of the best books I’ve ever read was “Race for Profit” by Keanga Yamata Taylor of Princeton.

She outlines everything that happened once redlining ended the present. And it’s really terrifying to see that this fraudulent model has been going on now for a very long time. The players keep shifting and changing. And what I’m seeing from these individuals is much more of the same. But yet the most important thing that I heard out of all this is nobody’s listening. Nobody’s paying attention. HBO won’t touch it.

[00:26:28.390] – Lovell

Exactly, Steve, because this umbrella of the people that we’re talking to today is extraordinary from the standpoint that what Americans have got to wrap their heads around is that the story never ended because it got drawn out in the courts. I’ll give you guys a quick example. Goldman Sachs right now, of course, the famous Matt Taibbi called him the great vampire squid.

And there’s a reason for that. They’re in the Supreme Court right now, which they were able to elevate a case of Goldman Sachs versus the Arkansas Teacher’s Pension Union and the American Plumbers and Pipefitters of America Union, which had done a class action against Goldman for a $13 billion class action based on illegal reps and warranties.

So everything that we’re looking at here and we’re talking about in terms of Cindy’s process what Miss Mitchell is telling us what Miss Johnson told us so far is that Cindy Brown is a professional athlete. She was worth a lot of money. She’s college-educated, very smart. There was a lot of bad loans that got generated through this business.

Miss Brown wasn’t one of them, but the thing was so gigantic that the good loans got put in with the bad loans that ended up blowing up the global economy, that ended up getting bulldozed in the courts after the government literally had a $25 billion national mortgage settlement predicated on illegal reps and warranties and all these things that we’re talking about.

But the public doesn’t understand it because the media doesn’t understand it. And then ultimately, guess what? The Supreme Court doesn’t understand because they’re not looking at the facts of what we’re going to present to you today.

[00:28:07.570] – Intermission

You are listening to The New Untouchables, a podcast brought to you by a collaboration of the creators of the docuseries The Con and Real Progressives, a nonprofit organization dedicated to teaching the masses about MMT or Modern Monetary Theory. Please help our efforts and become a monthly donor at PayPal or Patreon, like and follow our pages on Facebook and YouTube and follow us on Periscope, Twitter, and Instagram.

[00:29:01.840] – Lovell

And on that note, I’ve got to turn to you, Miss Kellee. Your law firm has worked within the context of Prince George’s County. Can you give us an idea of what Miss Johnson is talking about in terms of things that you’ve seen in the court and how crazy it is that illegal foreclosures are happening all the time? Can you put that into context?

[00:29:19.840] – Kellee Baker, Esq.

Well, sure. A little bit about me, I started out as a real estate agent out of college back in 2002 and then graduated law school in 2006. And so throughout law school, I conducted a lot of sales in Prince George’s County. And by 2008, by the time I had my law license, the real estate clients were coming back with foreclosure issues.

And so I signed up to volunteer with nonprofits in Maryland that were trying to stop the bleeding, but no one really knew what was going on. And I took on a few cases pro bono to start. What I found was initially is that the facts didn’t matter. And so no matter what fact pattern you had and no matter what challenges the homeowner had, the narrative was “was there a loan, was there a default and OK, you got to go.”

And so I didn’t quite understand what was going on at that time. And I do want to mention the woman that Miss Johnson spoke about that was evicted on December 16th, had to sleep in her car. Mind you, they foreclosed on her father’s loan. He supposedly took out a reverse mortgage when he was most likely incompetent with Alzheimer’s.

And so she’s yelling to the court, “My dad couldn’t have signed this. He had Alzheimer’s for the last five years. How could he sign a reverse mortgage?” Secondly, with the commercial cell tower on his property, you’re not eligible for a reverse mortgage because that’s commercial property, not residential. And so even with the facts in hand, the judges turn their eye.

And I love what Miss Mitchell said when she said, who can own property? I’m going to tell you. When I’m in Prince George’s County Court, even though there are black judges, even though in our county there are black legislators and black representatives, I feel like three-fifths of an attorney and I feel like my clients are three-fifths of a resident of our county.

And so to be the most affluent black county in the country, we are still three-fifths of the most rural white county in America, as far as I’m concerned, because our judges are programmed not to listen, to turn the other cheek and they are actually robo-stamping denials no matter what your fact patterns are. And so that’s what I found. In our county, I would say that what I see a lot of is the American dream lost.

And so there were a lot of people who sold their townhomes, their condos. They had a lot of equity. The market was booming. They put a 100,000, 200,000 down payment down on their dream home, an $800,000 home built by a reputable home builder. What these home builders said was “Use our lender and you’ll get a $10,000 credit”. I’ll put the bank out there. It was Wells Fargo on the majority of these new home communities.

What I found is here are people making six figures. I mean, I’m talking households making $250, $300,000 a year. Why did they have such bad loans in the first place? That was the only loan that was offered to them. When I had someone who moved into the same neighborhood, she was adamant that she was going to go to her credit union and they almost wouldn’t let her go to settlement because she wouldn’t use Wells Fargo.

She said “They didn’t even have a 30-year fixed option.” But other homeowners, when you’re given a teaser rate, “We can give you three percent, four percent, so don’t worry about it or it’ll adjust.” Well for people’s loans, adjust from $4,500 a month to $8,000 a month. And most people are not prepared to deal with that. And so . . .

[00:33:01.650] – Grumbine

What?

[00:33:02.490] – Baker

Yes, even though people might say, oh, cry me a river, you guys are making six figures. It stole the equity there. A $100,000, $200,000 down payment is gone. All the houses that were worth appraised for $800,000 are now $400,000 on the short sale market. They can’t refinance. Oh and let’s not forget because watching The Con did jog my memory about people who held on to those great credit scores because you know, “All you have, you’ve got to keep your credit score.”

They call their lender. “I need help. I can’t pay $8,000 a month. We’re working people. We bring in $12,000 a month. We have two children. We have this. We have that. What can you do?” “Well, just stop making payments. We can’t help you until you stop making your payment. All right. And after three months, then we can work with you.”

So what happened is people thought they were dealing with their bank and they’re dealing with this servicer who represents God knows who. And when they go into default after the 90 days, then next thing, “Send in your paperwork.” So what I saw as an attorney and this is still around 2010. Only because I have so many people, every single person said.

“They keep losing my paperwork. And I sent it in and they said they didn’t get it.” And I sent it in again, and they said they didn’t get it, and they need this. And so they’re playing this rat race of, OK, I’m turning it in, I’m turning it in. I’m employed. I had good credit, you know, just work with me, neighborhood bank. But it’s not your neighborhood bank.

So finally in court, they have in Maryland, it’s quasi-judicial. And so a lot of the process occurs outside of court. You just file, the plaintiff’s trustees file, and say there was a default and unless you reach out to the court, they’ll just railroad you and you’ll be out of your house. So, assuming you were served, assuming that you challenge anything, the next step is mediation.

Now, you go to this mediation; 99 out of 100 times there’s no resolution reached. However, turn in your paperwork one more time and I’m sure we can work with you. And within that 30 day period, your house is already on the auction block. Next thing you know, your house is sold. Everyone thinks they’re alone. “I thought they were working with me. I don’t understand what happened.”

You called the servicer. “Oh, it’s out of our hands, our attorneys.” So everyone thought their story was individual to themselves, but when I hear this story, 50, 60, 70, 100 times, it’s the same story. And so . . .

[00:35:36.850] – Grumbine

Every time.

[00:35:38.140] – Baker

Yeah. Exactly. In Prince George’s County, we have 23 judges in our court, but they assign every foreclosure to one judge. Usually all cases are spread among the judges. Maybe you have a fair shake. But this one judge was specifically assigned to deal with foreclosures and she specifically denied every single challenge.

And so unless you have the money to appeal, which requires a bond and things of that nature, then you are out of luck and the sheriffs are coming to your door and you call to find out when. They won’t even tell you. It’s a mess.

[00:36:13.000] – Lovell

You nailed that brilliantly. I got to tell you, I’m so grateful you hit all those touchstones because I’m going to bring this back to you, Cindy, and I want you to guide us through the rest of this and ask any questions, some of the folks on the panel if you want to. But I know you’ve got some specific things that we need to roll out before we’re done with time.

And I just want to wrap a couple of things up here real quick, guys. Listen, there were 16 million filed foreclosures by 2012. OK, now we know and we’re going to lay out this in our podcast. We know all the tricks of the trade. We know exactly what all the big guns, and I’m talking about the vertical lenders from Goldman, with what they call the warehouse pipelines.

And I’m talking Chase and Wells Fargo and everything else all the way through down the pipeline through perverse incentives to the brokers on the field searching everybody. And what Miss Baker just said was exactly right. Let’s say you’re an African-American attorney or doctor in Prince George’s County. You came out of Georgetown Law School.

Even you could get set up in this whole thing right where you got put into these subprime frickin loans because the brokers were making more money. It’s called high yield spread premium, as you know from Bill Black, Steve. It’s all about control, fraud, through the whole system. And it’s amazing that nobody understands what we’ve been trying to get to them.

But, of course, like you were saying in our first podcast, Steve, it was all technocratic stuff with whistleblowers that could tell you all the ins and outs of what was going on. And they did. But now America is seeing these folks tell you what’s happening on the front lines in the courts. And I’ve got to turn this back to you, Cindy.

Look, take us home. Walk us through your people here. Tell us what the country needs to know. And like I said, you’ve got some heavy duty people on this call. If you want some questions, I would recommend you ask them questions as well. But it’s all up to you right now.

[00:37:55.150] – Brown

You know, everyone is so spot on. It’s just it’s so rewarding to hear this fight is really finally starting to blossom where people can actually get in and compare notes. And we’re all saying the same thing. I’ve been saying it since 2005 that really it’s like an American holocaust for people of color who are being snatched out of their communities, out of their homes, and then they’re being pushed into a homeless situation or ghetto, as they would define.

And they’re leaving us without any hope. Well, spiritually. I can say that. They can take us from out of that box, which they call a house, but spiritually we are stronger people. We are so powerful that we combine and we unite and we take a stand and we push back. And though they think they’re winning, they’re not winning because we’re all here in this forum right now talking about it. We’re strategizing.

We’re getting the details together so that we can formulate a team how to get inside that court and how we can get to the floor, change the laws. Legislators need to know what’s going on out here because we’re the evidence. We are the evidence and there needs to be a policy change. And I’m just so excited. I feel like I’m on a team.

And Joan Jackson and James Imperiale, who’s also here, there are also special appearing attorneys that work with me and several other homeowners in the community that can’t afford to get inside the courts. They are some of the greatest advocates out here in San Diego because we also work with other people who are experiencing disabilities.

And these disabilities, it is so overwhelming when you come out of the court. You’re traumatized, the post-traumatic stress, anxiety, the withdrawals of your cognition functioning. I’m a certified administrative coordinator for the American Disabilities now nationally, and I became a certified coordinator because of all the trauma that I have been going through these 16, 17 years.

I felt like something was missing and it was the unprotected elderly, senior citizens, people of color, people who had preexisting conditions. It just goes hand in hand with the fight with advocates, these fine attorneys who are willing to take a stand, and I stand there right behind them and I push and I get in there and fight with the judges and let them know that we need access to the courts.

You don’t get to discriminate and pick and choose who can get justice and who’s not. I think this is part of the other reason why the courts have really kind of shown and fluffed and puffed their chest out at me because I stand with the people.

And we’re still currently in court and we’re fighting, but it’s this group that has combined together that’s really going to give us the push to get back in that court and open up. Imperiale and Joan Jackson come in because they can tell you from firsthand and personal knowledge what they’ve seen inside better than I can.

[00:41:41.320] – Lovell

Joan and Mr. Imperiale, why don’t you tell us what you have? I’m so sorry, because we’ve got a tight window here, but you guys please lay out what we need to hear.

[00:41:50.690] – James Imperiale

I mean I can tell you that I spend my time in the courtroom every day. I had three cases on Friday. I believe that if I was someone who grew up in the 1960s, I would have fought for the civil rights of that era. It’s important to understand now that housing civil rights are the rights that need to be fought for in this era. I’ve paid dearly.

People have burned down my building in downtown Cincinnati. I’ve had multiple fires lit outside my office in the last couple of years. Doesn’t mean I’m gonna stop what I’m doing. But there’s a lot of opposition when you’re trying to change the course of where the money is going to and what the thieves are doing. It’s a lot of unjust enrichment taking place.

And part of the biggest problem is that the government is complicit in it because when the houses are worth more, they get more tax revenue out of them, so they’ve been incentivized for years and years through the tax structure to have artificially inflating the price of these homes well beyond what the average salary of an American is.

Back in about 2003, 2004, you had a wild divergence between the average price of an American home and the average salary of an American. The homes went up. They’ve never come back down and until they do, or until the average salary of an American comes back in line with them, people are going to remain homeless. We’re going to have to continue to fight this with the courts.

[00:43:16.390] – Lovell

You hit a very important part there. And I’ll briefly just talk about that because we show that soup to nuts in The Con. And there’s a reason why we have appraisal fraud because lenders loan against the value of the home. That’s the entirety of our system.

The Federal Reserve gives trillions of dollars to the black box casino that are controlled by what we call the asset managers, which are BlackRock, Blackstone, and all these guys that came in after the great collapse and bought all of these foreclosed homes for pennies on the dollar that they hyperinflate, and we’re right back in this bubble economy again.

We could go on and on, but you’re right that at the very end of the day, follow the money. Who’s making the money and why? And you’d be shocked to find out that it’s the Treasury and the Federal Reserve that has become the demand when the foreclosures happen. And when you have an understanding of what that spread is, they’re incentivized to foreclose on people as opposed to what we had right after the Great Depression, which was to modify the loan.

And that was the whole purpose. Miss Jackson, I want to give you a chance to pipe in here because you’ve been so patient with us. Can you give us a sense of what you told me on the phone of what you’ve seen? I think that’s a great way to close this up. What have you seen firsthand in terms of the soup to nuts process that you’ve observed?

[00:44:26.630] – Joan Jackson

I think they messed up when they decided to target Cindy Brown. She’s an Olympic gold medalist. She does not know how to quit. And I nicknamed her the Terminator. Her story is here now today because she has prevailed over 15 and 16 years of this trauma. I got involved because what was being done to her in the courts was so wrong that I couldn’t stay on the sidelines.

They have systematically denied her any kind of investigation, she’s gone to the FBI that’s been denied her and the court system tried to deny her legal counsel. I’ve tried to help her by just e-filing when they closed the court doors in her face because of covid. And they made it impossible literally for her to litigate after she’d been removed from her home.

And I e-filed documents for her, and the court system came after me to sanction me for e-filing when I wasn’t technically representing her. They would allow the attorneys on the other side to do all kinds of criminal acts inside of the court system, abuse of process, and they wouldn’t even get their hands spanked. So when she got her TRO to stop the eviction while she’s litigating her case regarding the title, another set of attorneys swoop in and remove the case to federal court.

They did not comply with any of the requirements for removal, and they waited until her TRO lapsed as a function of law in federal court. Didn’t even tell the state court that they had removed the case. When she goes in for the preliminary injunction hearing, they’re like, “Ha, ha! Remove the case to federal court. Too bad.” And the judge is like, “I can’t do anything. Sorry, it’s been removed.”

Like Kellee said, facts don’t matter. The judges aren’t trying to promote justice. Everybody treats wrong as though it’s normal. Cindy has been in her car for six months, sitting in front of her house, living in her car for six months to keep them from further damaging her camera systems, stealing her property inside. And everyone treats it like it’s normal.

In the midst of covid trying just to find a bathroom, Cindy is driving around, is hit and run, car accident, nobody cares about her story. Justice has no role in this. And I’m watching judges say, “Oh, yeah, you know what? Mr. Mays, you were wrong for removing the case without doing X, Y and Z. But you know what? We’re going to let that stand anyway. We’re not going to address your bad behavior.

Too bad for Miss Brown.” My goodness. This is a federal court judge who without any underlying state records, said in her hearing, “Mr. Mays, you were wrong. You even conspired with county council to force the sheriffs to evict Cindy because they weren’t willing to do it. You went back, you threatened county council, you affected this wrongful eviction, but we’re going to let her stay in her car.”

But you need to explain yourself to me. And I show up and I say, “My God, I read your ruling judge, and it was so bad that I went ahead and e-filed for Cindy so that she could try to get relief.” And the judge says, “I’m going to spank you, Miss Jackson, because you had no business e-filing for Cindy. You’re not representing her. So now you show up, I’m going to spank you and now you just go away because we can’t have Cindy having lawyers actually caring and fighting for her.”

So I get spanked. I’m officially admonished for e-filing. While this attorney, who was not even the attorney of record, removes the case to federal court, doesn’t abide by providing the underlying documents. And this judge makes a ruling, a substantive ruling that says literally, I understand the defendant’s frustration. They’ve waited years to get access to their house.

And I’m like, oh, my God, is this woman signing her own indictment by deciding that she’s going to favor the defendants, the bank, and she doesn’t even have the underlying documents in her court. And so when the attorney from the other side calls me and says, “Oh, by the way, you’re about to have problems because you e-filed for Cindy.”

And I told the attorney, “I’m not worried about this judge. She let you do what you did. She didn’t sanction you. So I should be fine.” But sure enough, within three days, the judge came after me. So I did my declaration. I said I started off to be a civil rights attorney because I wanted to make a difference. And Cindy Brown is the exact reason why I went to law school. This wrong is so horrendous. I have no choice but to act.

And if you want to sanction me for e-filing, you go right on ahead. And I told Cindy, I said, if she spanks me, she better beat this other attorney to death. And you know what she did? She did nothing to him. She gave him 21 days to explain himself. And all this time is passing and she does nothing to this other attorney. And then finally, Cindy gets it back into state court and the judge acts like everything that the other attorney did was all legitimate and OK.

Nobody is addressing his criminal actions, literally abuse of process. Everybody is treating like this wrong is just normal. And we’re saying get Cindy back in her house. You realize she’s still on the streets in her car and they’re just arguing points, distractionary points that these other law firms have brought forth. I have seen more criminal behavior among the judges and the attorneys than I ever could have imagined.

It is horrendous what’s going on. And all of these legal actors, judicial actors are on board with this criminal conspiracy that’s been going on. And I’m so happy that you’re shining light on the situation. I know it’s not going to make on 60 Minutes. They’re not going to have it because there are all these folks out there that are meant to catch this information before it gets out to the public.

And it takes programs like yours, podcasts that get out there for people to understand just how big and how horrible this is. But mainstream media is not going to put it out there because they’re part of keeping it concealed. So thank you.

[00:50:29.640] – Grumbine

Mr. Imperiale said that there was an issue with the states inflating the prices of these houses so that the states can receive that additional tax money.

[00:50:40.170] – Lovell

That’s another revenue stream, yup.

[00:50:41.370] – Grumbine

Let me explain to you why this is so mind-blowing to me. And I can’t believe I didn’t even think about this before now because I typically am focused on the federal level, because the feds have been the ones that have basically backstopped the entire thing from Obama and Bush and Geithner and Paulson.

But then to realize that the reason why the states allow what Miss Jackson just eloquently laid out is because this is a funding mechanism for the state. And so this is the race to the bottom. The states are cash restricted. They have literally cut the bottom out of the tax rate because they’re trying to lure businesses into their state.

So they got to find revenue by any means necessary. And what they have done is they’ve enabled a criminal syndicate to predate in their own communities that they live in to allow this to happen for funding for the state when this could all be solved quite easily at the federal level by them simply providing block grants to states to keep them solvent so that the states are not left trying to play these horrific games where they destroy lives in the process of receiving a few extra tax dollars.

I find this to be one of the most important things that I’ve gotten out of this. It may be a technocratic point, but it fuels all the evil that I see, all the pain.

[00:52:07.710] – Lovell

That’s the point. I want to leave this for the last comment. I want to give it back to Miss Mitchell for a second, because, look, first of all, I want to say from the bottom of my heart, as we close this segment out, Miss Jackson, you just made the hair on the back of my neck stand up. Thank you. My God. Miss Johnson, Miss Kellee, Mr. Imperiale, of course, Cindy and everybody else.

We could go on, Steve, for hours. We’ve not even scratched the surface of Miss Brown’s case, let alone zillions that are out there. But you got some prescient points; it’s a setup in the courts are freaking in on it. What? Sorry. Miss Mitchell, let’s give some credibility to probably the most academically gifted among us to tell us what we need to know.

[00:52:49.630] – Mitchell

OK, well, I’m going to thank each and every one of you because you’ve enlightened me with your stories. And I do want to follow up with some members of the panel. In the last few minutes, I want to make this point. If you’re going to defend the siege, you’ve got to reengineer how you attack them as they attack you.

Facts don’t matter. Law does not matter. And the judicial system is manifestly corrupt. Those are three things that we know. However, those are all three things that we have. So for you, that’s on the front line and for you that are behind the line, you’ve got to use what they use against you. I’ve found success by reading every document of my opponent in every case where they have prevailed and you find the small points.

We’ve had a great conversation today about the big points, but you will take them down by finding the small point because from the judges to the big lawyers to the big banks, they all have one thing in common: what’s in it for me and how do I protect myself from the downfall?

You find that one little pinhole that will humiliate them, implicate them, or make it harder for them to do what they’re doing and you have wiggle room. And all we can ask for right now is a wiggle room to stay in the game. Whatever you do, you’ve got to stay in the game. And so my last word to everybody is stay in the game.

[00:54:37.590] – Lovell

We’re going to provide emails to everybody here on our website so that they know where to find Miss Mitchell’s information. I know that Miss Johnson shares my passion for creating a lightning storm around this country to where we surround the capital with 20 million Americans that say enough. Miss Johnson, take us home. What do we got to do? What do you want to see happen? Who needs to listen and why?

[00:55:02.880] – Johnson

Well, I love what attorney Mitchell had to say, and just as I said to one of the people on my team. OK, so what is the plan? How do we intend to do this? And so Kellee had a great idea that I was sleeping on the other day. Kellee should I tell them what it is. Or do you want to tell them?

Go ahead, let Kellee tell you what her idea was, because one of the kinds of things that I’m hearing, Miss Mitchell, you got to hit these people where they live and they live like WIIFM what’s in it for me? And the only language they understand is money. So then Kellee had a great idea where the money was concerned.

[00:55:40.530] – Baker

OK, well, Prince George’s County is in the process of suing Bank of America and Wells Fargo, saying that they caused the county financial strain for all of the bad loans and foreclosures, and other cities such as Miami and across the country have done this. And they get settlements from these banks and it doesn’t reach the people just like the attorney general money doesn’t reach the people.

However, I thought we could piggyback on our lawsuit and other cities’ lawsuits against Bank of America and Wells Fargo, and boycott them. Pick those two and we can piggyback on that. So we seem a little innocent, like, hey, our county is suing them, you’re against them. So shouldn’t we be? But I look at how much money is being held and the trillion in Bitcoin and other places.

There’s other places and credit unions. There’s other places to put your money. So if you do have money, maybe pick those two. Our county is picking that. Other counties have sued them. I think this is the very beginning of what could be some smarter contextual conversation between the professionals out there. I’m glad we can make the connection on this call, but we can never forget, of course, who it’s all about.

Love to see Miss Brown right there, front and center. You’re a hero to me, Miss Brown. I love you. I love anybody who fights for freedom and liberty and justice for all because that’s what we got to do. We got to overcome this corruption because it’s killing what we are. And if we don’t make everybody else aware of it, nobody else will. So I am deeply, deeply grateful for all of your time today. I hope we can do it again soon. I have a feeling we’re going to create a groundswell. Let’s keep pushing. Steve, take us home.

[00:57:17.100] – Grumbine

Absolutely, I want to thank each and every one of you for joining us for this broadcast. The facts are that millions upon millions of people have been affected by this and we’ve seen White House after White House not do anything about it. In fact, we even heard Obama say ‘What they did may have been morally wrong, but it wasn’t illegal”.

We need to make sure that we bring the spotlight to this and get the people in the streets and not let them slip away into the dark, but keep the light right on them and end this thing forever for everyone. So with that, thank you all very much. I really appreciate your time and can’t wait to talk to you again soon. Hopefully, we can talk about each of your specific issues in much deeper context.

With that I’m Steve Grumbine, Patrick Lovell missing our third wheel, Eric. We miss you, Eric. But with Eric will be back in future episodes. Have a good day. We’re out of here.

[00:58:16.380] – Ending credits

The New Untouchables is produced by Andy Kennedy descriptive writing by Rose Ann Rabiola Miele, and promotional artwork by Cristina of Paradigms and Revolutions Design Group. The New Untouchables is publicly funded by our Real Progressives Patreon account. If you would like to donate to The New Untouchables, please visit Patreon.com/realprogressives.