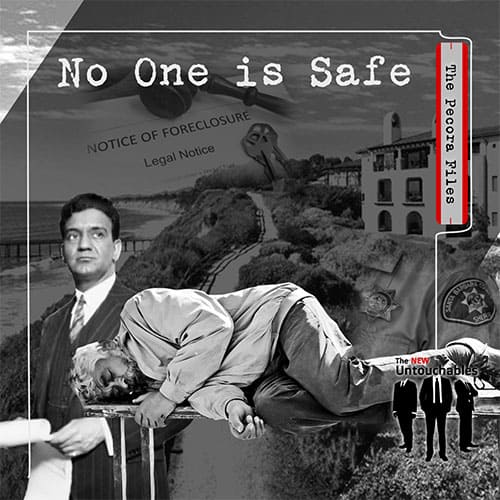

S2:E2 – No One is Safe

FOLLOW THE SHOW

Join Steve Grumbine and Patrick Lovell as they take you on a journey suffered by four victims, Margaret Carswell, Marina Read, Lynn Behrens, and Leslie James. This episode shows how the aftermath was insanely confusing, and for a reason.

Victims. Millions of them. No matter who you were and are, financial terrorism looms large. In the aftermath of the 2008 Global Economic Collapse, tens of millions of people around the world were thrown into upheaval. The immediate narrative shouted by mainstream media was people got greedy, or in over their heads, using their homes as ATM machines as if millions outwitted the system of global finance to destroy the world. If that were the case, why did trillions of dollars get funneled back into the system that created it, all while tens of millions of people had their lives completely destroyed?

Join Steve Grumbine and Patrick Lovell as they take you on a journey suffered by four victims, Margaret Carswell, Marina Read, Lynn Behrens, and Leslie James. This episode shows how the aftermath was insanely confusing, and for a reason. To this day very few understand what happened and we’re driving to change that.

Absorb Marina Read’s words from this episode: “What people aren’t realizing is they won’t stop until we stop them. Period. It’s a machine that has no heart, no soul. And cannot be satiated. Bottom line. And it doesn’t care what kind of collateral damage it causes. And that those who have had the power to stop it, to put integrity back in are part of the machinery.”

The New Untouchables: The Pecora Files, an extension of The Con, is here for everyone to learn how corruption has a stranglehold on our country. Will we #WiseUp and restore integrity? Will we join together in a mass civil rights-type movement to #PurgeCorruption and work toward liberty and justice for all?

The facts are in front of all of us. This is our chance. Be the spark that ignites the flame.

#NoOneIsSafe

The New Untouchables: The Pecora Files

No One is Safe

July 11, 2021

[00:00:05.600] – Margaret Carswell [intro/music]

Personally, I know hundreds of people who were forced out of their homes. Every single one of the stories is gut-wrenching. Every story is different.

[00:00:22.670] – Lynn Behrens [intro/music]

The fact of the matter is, the judge really made the decision the night before. She never even listened to me. She never wanted to listen to me. And her decision was to agree with Wells Fargo, even though I could prove I was current. I had all the proof. I had canceled checks. I had a statement from them that showed I was current.

[00:00:52.950] – Eric Vaughan [intro/music]

In a world of elite criminals, only people of elite character can protect our system. This is the new untouchables.

[00:01:05.060] – Steve Grumbine

So thank you all very much. This is Steve Grumbine, your host with The New Untouchables, season two of the Pecora Files. And we have just experienced some amazing information from our first episode. I hope if you haven’t heard it, that you’ll go back and listen to it. But in this second episode, I’m going to let Patrick Lovell, my friend, and co-host introduce the new players to us on this second episode, and we’ll get right to it. Patrick, thank you, brother.

[00:01:34.670] – Patrick Lovell

Well, Steve, again, I’m so humbled for what we just learned from our friends in the African-American community. And I think what’s going to be shocking to the rest of the world is now we’re going to introduce people from one of the most beautiful, affluent communities in the world who all experienced the same thing.

So for those who think that “Oh, well, I thought I was just dealing with predation of African-American communities,” you’re going to be stupefied to learn: “Wait a second. Santa Barbara, California, experienced the exact same thing? How could that be?” Well, until you hear from the people who have actually lived it themselves, you won’t be able to process it.

I’m going to do a quick overview first, and then I want to just direct the conversation to each one of these people, because each one of these people have stories that could last, honestly, we could talk for 24 hours and still not get even that much of their real story. But I want to start with Marina Read and Leslie James. They’re two terrific human beings that know this story intimately because they’ve experienced as excruciating a storyline as we heard from our previous guests.

Margaret Carswell, it’s almost a miracle that we have her on the call today. She’s living in Florida now. She was homeless for many, many months after falling from the highest of the high. I’ve been to her home in Santa Barbara. If you’ve ever been to Santa Barbara, my favorite song of all time is ‘Welcome to the Hotel California.’ I was ghosted by that. How do we even put it?

You can check out anytime you like, but you can never leave, always comes into my mind as I was doing these stories for The Con which are all season two. And Margaret Carswell really personifies this. She’s an attorney who lived at this beautiful home overlooking the Pacific Ocean. I mean, she’ll tell her story so much better than I can. But when you talk about the American dream and the apex of the American dream, she was there.

And to go from that to homelessness is like, how does that happen? And then Lynn Behrens is the way I like to describe her, based on, and I’ve watched your interview for what we have on tap for season two, probably a thousand times one. She is the ultimate Navy, let’s call it Reagan Republican, Southern California career in the Navy. Patriot through and through, red, white, and blue. When we think of July 4th and apple pie, Lynn Behrens is the personification of that.

And she ends up at the end of a barrel of a sheriff’s rifle in an illegal foreclosure. And her story will mystify you. Steve, that’s just a brief overview. But let’s just start. I think I want to start with Margaret. Margaret, first of all, I’m so glad to see you face to face. I want to cry. Can you tell us your story? This is a brief, encapsulated time, but can you give us a sense of what you’ve had to endure?

[00:04:29.590] – Margaret Carswell

Well, maybe you’d guide me. It’s a huge chunk of my life. So as a lawyer and watching the political shenanigans that were going on in 2007-8, in January of 2009, I suddenly came face to face with the realization that what was happening was fraud and that I was being targeted as a victim of this as well. And very soon thereafter joined forces with another lawyer whom I knew for quite a while in which all of my friends here know, Douglas Gillies, and the two of us partnered up.

Douglas was a trial attorney and he has also been foreclosed on and has quit the bar in disgust and is homeless. I follow him as closely as I can. I’m concerned about him. At any rate, the two of us joined forces and I took on the political aspects and Douglas became the trial attorney and did all of our legal work. We wrote our own legal pleadings, but he was the one who was in court.

And we started filing lawsuits and I started reaching out. I remember reaching out to the Realtors Association and telling them what I had discovered and expecting that they would be so upset and in arms and would want to start working with me. And that was not at all what I got. Not at all. They didn’t want to hear anything about it at all. And I found that the more business people I reached out to, the more prevalent this attitude became.

It was like, “Get out of here. We don’t want to hear this.” So I rented a space and decided to take what I knew to the public. I think it was probably at that time that I met Marina. I think that was pretty early on. And over these, what, eight, 10 years, I worked with hundreds. I joined forces with the WaMu Chase Homeowners Association, a nationwide group, and still in contact with them. So personally, I know hundreds of people who were forced out of their homes.

Every single one of the stories is gut-wrenching. Every story is different. My story is kind of a poster. It was the bank that foreclosed. I had no contract with. I’d never had any dealings with whatsoever. The fraud part of it is so clear. I don’t think I even need to go into that. And I think you’re more interested in my personal story. So I fought valiantly. I wrote articles.

I’ve had them published in local papers and magazines across the country and talked and radio shows and all of the kind of media, trying to get the word out from our point of view. And in the end, I would say that probably the worst of it all was the unlawful detainer action in the Santa Barbara court. Unlawful detainer in plain English is eviction.

Why California uses that expression, I have no idea of that. At any rate, it was absolutely clear that the judges were totally biased against us. Marina, you can start shaking your head here. And we just saw this over and over again. It didn’t matter what law we could provide, what proof, what testimony, how many witnesses. None of that mattered.

There was nothing that we could do that was going to stop the courts from handing over our homes to these predatory people. And so I was forced out of my home. They came, a sheriff and six other male goons. I was in my nightgown when they arrived. They started treating me like a criminal. In order for me to be able to get dressed there was a man there watching me. It was just unbelievable. Thrown out.

And the way I had lived my life, I had acquired and my property in 1992. I have a nonprofit corporation that is dedicated to lending support to any activity that will better the life of humankind or the planet. And so I’ve done work in education, alternative energies, water, soil farming, et cetera. And I bought this beautiful property, two acres, as Patrick said, overlooking the ocean.

And I tore down the house that was there. I designed and built a beautiful home as ecological and environmental as I could make it. And this was my business. I was involved in green business. I had a green construction. Cleared the land. I planted the land. We had an orchard of 60 fruit trees. We had recaptured water and recycled water and greywater and alternative energies and everything that you can imagine was incorporated into this property and land.

And I invited people and taught what I knew using my home and land as an example. And I also had Airbnb and other ways. So what I’m saying is that my income was derived from my land and my work was really derived from my land. So when I was forced off and I just have to say that I never believed it would happen. Even on that day, we had prepared documents that by law would have given us protection.

And the sheriff took the documents and ripped them up, lied to the sheriff’s department and to the courts. Anyway, so I was out. So I found myself overnight, homeless and destitute. And it got worse before it got better. I actually, for a while was taken in by Catholic Charities, who is a wonderful, heartfelt organization, and I got my food at a pantry there.

What I did is I thought, well, these people are more down-and-out than me and they didn’t know about food, so I ended up starting to teach people in the pantry about the food that was there and how to cook it. Anyways, I’m slowly starting my way back up in life. I’d like to get back to my comfort level. I realized last December that, well, two things happened that I just couldn’t make it. There was just no support coming from Santa Barbara for me to stay on.

And by the way, I lived in Santa Barbara my entire adult life. All three of my children were born and raised there. I co-founded the Santa Barbara Waldorf School. Was very, very active in the community all that time. And in the end, there was just no support that could enable me to stay. So I had this voice that came into my head that said, “Would you consider moving to Florida?” And I was like what?

Anyways, the events that have happened in the five months since then have been absolutely and totally positive. So I’ve just followed guidance and I’m in Florida. So I say I made my exodus from Santa Barbara and I’ve come to the Promised Land. But I’ve never given up on my property. The one of the very last things I did before I left was to go to my land and just be there with it.

And I still think of it every single day. It will be four years in June. And it was Camelot. It was a beautiful, wonderful place. All three of my colleagues here were there are many, many times. I think most of the mortgage fraud meetings of Santa Barbara and of the top-level thinking ones happened around the big table in my dining room. So, that’s my story. I’d be happy to share my little poem if you want to, Patrick.

[00:13:52.030] – Lovell

I do, but I want to come back to that, Margaret, just from the standpoint, because this is just the beginning and the primer for all of your just unbelievably tragic but yet heroic stories. I mean, Steve, I want you and your audience to understand what I experienced firsthand when we filmed in Santa Barbara was probably the most shocking experience I’ve ever had in my life from the standpoint that, again, I know Santa Barbara well and it is paradise.

But yet there’s an underbelly in Santa Barbara, too, by the way, which they’ll all attest to. The homelessness in Santa Barbara has been pretty extreme for some time, but now it’s like probably through the roof. Much of which is based on this. What people have to understand is that these are people that pre-2008 there was a lot of different ways we were kind of working with The Con and like Margaret just so brilliantly elocuted.

And I know that we’re going to get for this from Marina Read specifically. We’re entrepreneurs. You’re built within the system. You’re working the angles of how things work and you can leverage and you’re doing just what actually corporate America is doing. Right? A lot of independent business owners are doing rentals and they’re getting lower interest and they know what they’re doing. I mean, these are smart people that are engaged.

And there’s so many different aspects of this story. Right? We’re going to get into it. For example, in Lynn Behren’s, and she’ll tell you what kind of equity she had in her home. It’s devastating and shocking that there’s not a one-size-fits-all here except for the law was never worked in any of these cases within the court. They were ignored. They were fabricated, document fabrication, judges, judiciaries from Miami to frickin’ Sarasota to Prince George’s County to Detroit to Cleveland, to Salt Lake City, to Vegas, to Phenix, to LA.

All of them! The entire judiciary system ignored the law. And it got everybody. And so they don’t want to talk about it. We want to talk about it. I’m going to talk. America needs to hear now from Lynn Behrens. Lynn, please tell us your story. And I don’t want to put you on the spot. I don’t want you to feel rushed. I just, I need people to hear your story.

[00:15:58.610] – Lynn Behrens

OK, in 2014 I started getting junk mail about a foreclosure. Bud and I had bought our home in 2000 and we bought it for $600,000. We put $200,000 down and we had chunked away at it because our desire was to completely pay that home off. And part of the way we were doing that is it had an attached apartment. So all that rental money was going towards the house. We never borrowed against it to improve it or anything.

We did improve it a lot, but we always just saved up. And when we had enough money to do this or that, we did that. Anyway, he had passed away in 2010, but after he passed away, for 51 months, I walked in the house payment into Wells Fargo, took it in physically every month. And I was current. I could prove I was current. So I started getting this junk mail about they’re going to help me with my foreclosure, you know.

So I took that into the bank with me when I made a couple payments and they looked at my loan and said, “We don’t know what it is, just junk,” you know? And it kept coming and it made me very, very anxious. So I hired a P.I. that specialized in mortgage fraud. And he went to the Wells Fargo Mortgage Office with me in February of 2015. And we just gave them the property address. I didn’t give them my name or anything.

They looked up that property and said, “No, that loan was current.” In fact, I was such a good customer that they probably could lower my interest rate. Now, this was not a subprime loan. It was a regular qualified loan. So, I left that day thinking, “Well, it was just junk mail.” So I made my March payment and that was fine. So I went in to make my April payment and they said that that loan no longer existed. They had foreclosed on my home in March. So,

[00:18:02.430] – Grumbine

Whoa!

[00:18:03.060] – Behrens

I didn’t even find out what had happened until part way into April because I went out to the county and it didn’t show anything, but I understand now that it takes a while for that to happen. So I kept going to the mortgage office. They said they didn’t know anything about it. I kept writing them. I have many letters that they kept extending. “Well, we’ll let you know by June.”

And then finally, that letter later that summer that I had to have a subpoena to have any information. And they kept asking to talk to Clark Paxton, who was my partner, who had been dead since 2010. But my name was on the property. My name was on the loan. There wasn’t any reason for them not to talk to me. So they did the unlawful detainer on me in that fall.

I hired an attorney in San Diego, Ken Calgary. He filed a suit in November against Wells Fargo and against Cal Western, which was a company that was supposed to do the foreclosure and did ask for discovery. We didn’t find out until January that the amount due that they were after was $12,000. Well, I could have cut a check. Number one, I would have wanted to know what it was for.

But secondly, I could have cut a check for $12,000 to cure that had they been willing to talk to me, but they refused to talk to me. So by this time, my whole life is in chaos. And he’s right. I’m a red, white and blue girl. I wasn’t in the Navy. I was raised in the Navy and in my retirement now, what I do is do work to support active duty military and their families. But anyway, the thing is, I’m a rule follower. I’ve always been a rule follower. So this was all traumatic to me.

And in April, I went down to file a lien on the house to show that I had an interest in. It escapes me now, but three different times, the D.A. refused to let me file. Two times, they refused to let me. Kept saying I couldn’t file that, which I knew I could. And they show up with a guy. And he’s packing a gun from the D.A.’s office, telling me I can’t file that. So, April 22nd, I finally, I don’t know whether he wasn’t in or something, but anyway, I did file it on April 22nd.

So I got that filed. So I kept going and Ken Calgary in San Diego was trying to get the discovery. Well, in January, we find out that they foreclosed on the amount of $12,267. I only owed $326,000 on a house worth over a million dollars. So I had that much equity and I was just terrified because I’d always, you know, followed the rules. So I lost the unlawful detainer and I went and appealed that.

The fact of the matter is, the judge really made the decision the night before. She never even listened to me. She never wanted to listen to me. And her decision was to agree with Wells Fargo, even though I could prove I was current. I had all the proof. I had canceled checks. I had a statement from them that showed I was current. So anyway, I was evicted in 2016. And as a last-ditch effort, I filed a bankruptcy just to protect my house, not for any other reason.

And I had a bankruptcy stay on the door and Remax and two off-duty sheriffs, and I didn’t know they were off duty at the time, came and pounded on the door one morning and evicted me. They said I had five minutes to get out. This hunk guy was screaming at me, barely let me get together. I had some dogs and at the last minute, I realized that I didn’t have my medication.

He almost didn’t let me go back and get my medication. So I was homeless and I was so traumatized. If you understand, I was raised around uniforms. I’ve respected uniforms and have people in uniforms throw me out of my home was like the trauma. I still have bad dreams about it. Anyway, so I have a little place to live now.

I spent all my retirement savings, everything I had trying to defend myself between attorney’s fees, actually my rent now is more than my house payment was. So it’s a situation of it’s a nightmare. I’m 74 years old now. I’ve spent the last seven years battling this thing and I’ve chosen not to give up. But the trauma is very hard to describe the trauma.

[00:22:59.250] – Lovell

All right, I got to jump in here just because I want to get Marina and Leslie in as well. But Miss Behrens, thank you for sharing that with me. Every time I hear that I feel like I have a physical revulsion. I mean, it’s so horrific to me to think that this country and everything that we believe that we have values and principles and honor and integrity in a system that we depend on would literally for a woman who had very little payments left and equity that she wasn’t behind, would end up at the end of a sheriff’s gun and forced out of her home.

They stole the home, Steve. They stole the home of someone who gives to veterans. OK? There is nobody safe. OK? Nobody’s safe. Once you get ensnared in it, they will destroy you and they have destroyed everybody in the way. You’re just seeing a handful of people. We know there’s millions, but this is the first time the voices are going to be heard by audiences around the world to get this thing in a way that people can hopefully get to their freaking thick heads that we live in a system that’s corrupt.

[00:24:04.110] – Grumbine

I want to say something. One of the things that jumped out at me most about her story is the contradictions, if you will, in terms of the average person’s belief in who gets foreclosed on and who doesn’t get foreclosed on. Most people don’t have the resources that Lynn had in the beginning. Most people don’t have any of that. And so when they hear stories like this, a lot of times they can check themselves out and say, “Oh, that’s not me.”

OK, but here we go. We see end to end. We’ve seen poor people. We’ve seen rich people. We’ve seen people in African-American communities. And we’ve seen people in affluent white communities. We’ve seen Democrats. We’ve seen Republicans. We’ve seen people of independent character, all of which have been impacted by this. No one is safe and no one is talking about this. I think this is very vital.

[00:24:58.780] – Lovell

OK, and on that note, I wanted to ask you, Marina, first, because Leslie has a particularly curious and incredibly important way to tie this up. But, Marina, your story is epic and huge and we could talk to you for literally days. Obviously, we have a limited amount of time and we have. But I’m so grateful you’re on the call. But you know what people need to hear. Please tell us, what is the world not listening to and what was your story in the context of that?

[00:25:26.680] – Marina Read

What people aren’t realizing is they won’t stop until we stop them. Period. It’s a machine that has no heart, no soul. And cannot be satiated. Bottom line. And it doesn’t care what kind of collateral damage it causes.

[00:25:45.520] – Grumbine

Hey.

[00:25:45.520] – Read

And that those who have had the power to stop it, to put integrity back in are part of the machinery. And yeah, that’s that big piece.

[00:25:58.270] – Lovell

OK, so I’ll cue you up from this standpoint. You were a woman who was an entrepreneur. You had several properties, you understood cash flows. You were doing just like any business person would do. In fact, I’ve got friends that are developers right now getting zero percent interest doing the exact same thing many people did back in the 2002 through 2006 era. Give us kind of a sense of your business model, but then ultimately where it led and then ultimately what you were up against, and then what were the consequences of that?

[00:26:27.340] – Read

I was a single mother of a daughter and my dream was to obtain a real estate portfolio, you know. And I got trained in that. I was training to become a private lender in the course of all this foreclosure, which dragged on for about five years. In spite of all that, I became a mortgage broker with underlying real estate license.

If I wanted to stay close to the industry to find out what was going on, I purchased a home with the intention of renting out to tenants so that would help pay the mortgages. That was that perspective. I went from zero to three and a half million dollars worth of property. I had two properties in Santa Barbara and some commercial property in Bakersfield with the intention of right at the edge of switching those over to what’s called a 1031 Exchange to move into commercial property for having apartments and things of that sort.

Ultimately, the banks stole all of my properties. Like Lynn on one property, I didn’t even know it was foreclosed on. I had short sales, buyers ready for it. They were on their desk. The lenders ignored those facts, just went for foreclosure. I then was going to make sure it didn’t happen to a second property and brought them another one.

And I had to take it all the way up to the president of that lending association, which lending association, which was Aurora at that time. And threatened to take them to the media and all that. My home, ultimately, I got backed into a corner and it was the last one. I was at the beginning of the fault, them taking the paperwork, destroying the paperwork, requiring me to do it again, do it again.

Do they again, do it again, flat, submit paperwork. They told me I had to go delinquent for three months and I said, well, that’s going to ruin my credit. I had a stellar credit to be able to do those things. And they said, well, that’s what you need to qualify, show hardship. I did that. What I didn’t know at the time was that two months, this was three months, with two months, they can claim insurance and get the full value to pay off the loan.

[00:28:47.600] – Intermission

You are listening to The New Untouchables, a podcast brought to you by a collaboration of the creators of the docuseries The Con and Real Progressives, a nonprofit organization dedicated to teaching the masses about MMT or Modern Monetary Theory. Please help our efforts and become a monthly donor at PayPal or Patreon, like and follow our pages on Facebook and YouTube, and follow us on Periscope, Twitter, and Instagram.

[00:29:42.110] – Lovell

Let me interrupt you for just one second, because it’s important, because we heard in our previous show and Steve, I want to make you aware of this. You’ll hear this over and over and over, all over the country. This is known as dual tracking. They told all of us, “Hey, miss your payment for three months, we’ll put you in default. Then we can negotiate modifications, loan mods.”

That’s all wrapped up in another section in terms of the loan modification, the $25 billion. But here you’re hearing it in California. We just heard that in Prince George’s County, Maryland. Right. OK, so sorry to interrupt, but I just wanted the audience to realize this isn’t just an isolated incident. This is what happened to everybody. So please continue.

[00:30:18.860] – Read

So they take the money after two months through insurance, which is why AIG collapsed, and at three months in the state of California, they can then begin foreclosure. And I have some important things to say around that. And so while I was submitting for modification, they started submitting for foreclosure documentation through the recorder’s office that ensued. Eventually, they foreclosed.

They did trespass against title. I was involved with IndyMac Bank, Deutsche Bank, One West Bank, which now is Mnuchin, head of the US Treasurer. I don’t know how much time we have, but I did a deep, deep dive for three years, like Patrick. How did this happen? And the fraud I found from the securities, I had no law background and I dove into real estate law, contract law, securities laws, trust laws, a bunch of other things, document fraud.

While I was fighting this, while I was being a single parent, while I was meeting Margaret, and while we were doing presentations to the public, we were a force to be reckoned with as far as anti-bank fraud activists. I submitted a 200-page report to the County Board of Supervisors, the district attorney’s office, the sheriff’s department, the grand jury, to Kamala Harris, the strike force team showing the devastation to Santa Barbara for billions of dollars that they were stealing for the monthly extortion that they were having through monthly mortgage fraud.

Because what I found that when I did the research in the recorder’s office, I found that many of the institutions that had crashed and burned, they were still originating loans under their name. So these loans, this paperwork was absolutely illegitimate and people were paying faithfully, like Lynn was talking about following the rules, making their monthly payments to entities that did not exist. Talk about a black hole slide of a revenue stream.

And if you didn’t make your payments of extortion, let’s call it real straight. If you didn’t make your monthly extortion payments, they would come after you to foreclose on you, to then to take your asset after they have been paid by the insurance companies in full, and the homeowners not knowing any of this that’s going on the background. They were doing this across the country and Santa Barbara was a goldmine for them.

And law enforcement refused to look at this. Margaret, for over a year, was always with petitions and signs, many of us in front of the courthouse at the auctions to try to raise awareness. And we tried to educate everybody and they closed their doors on us. The district attorney even went to our board of supervisors for our district the day before we were going to meet as her constituents. And the message was, ‘don’t meet with them.’

So we met with the underling and we refused to meet with the underlying, you know. No, we have an appointment with our government representative. They did not want to meet with us because we needed their go ahead, their green light to get onto the meetings for the county board of Supervisors. So they did not want to hear any of that. And that’s just on the activist side, that’s just on that.

I want to go in two directions. So please remind me, Patrick, I want to address the color of authority of the D.A., the sheriff, our judges, and the state bar because they’re all rogue and illegally operating based on California law. I did a lot of constitutional law research as well. But back on my situation, I have been in eight lawsuits.

I’ve had to represent myself because I did not have the resources to go on because they take us down to zero and then we have to defend ourselves. So that. I also interviewed 35 attorneys in the very beginning to see who might take my case on. And what I found was they didn’t know what was going on. This fraud scheme by the financial institutions was a new kid on the block in a way.

Everybody didn’t believe that such a thing was going on. They didn’t believe what we were all pounding the pavement saying. They didn’t hear that it was person after person after person because the narrative that they created, these institutions created, were that we were deadbeats. And that they were being injured and that they had actually done loans, which they hadn’t. All it was was digital numbers and that’s another whole thing. They never put any skin in the game. They don’t sign the documents so there’s not a legitimate contract. On and on and on in that arena.

[00:35:10.690] – Lovell

And they multi-pledge your assets. We could get into the details and we will lay a lot of this out in season two. And I do want to redirect you slightly. But Steve, let me just touch upon something that she said extremely important, ok? As we’ve demonstrated in season one, and this is the reason we built it that way.

It was all built on this fraud recipe, this control fraud that created perverse incentives to where the least knowledgeable brokers, quite frankly, were hired to basically churn as much volume as they could in these institutions like Wells Fargo and Goldman Sachs and so on and so forth. They had built-in predicated sales, engineered schemes to get people approved regardless.

Like, for example, we covered this in the last call. You could be worth $600,000, if you were African-American, they’d still put you in subprime loans because of the yield spread premium. We could get into all of the different tricks of the trade and we will because we’re going to lay that out. But would you just said was so extremely important because every single step of the way was a conspiracy that should have been handled under RICO.

- And let me reveal to all of you guys what I know, because I’ve gone back to over 300 plus hours of footage that we shot that includes you guys. And I’ve got guys from Policy Institute in Washington, D.C. that told me that during 2002, Linda Thompson of the Office of the Comptroller of the Currency laid out to the attorneys general around the United States, including, of course, Kamala Harris at that time, that, look, you’re not going to be able to use your predation laws in the cases of these wrongful foreclosures because they were going to stop paying the bonds.

Wall Street was going to stop paying the bonds of every county around the country if they couldn’t do their grand design. And then, of course, policy-wise, at that time, they did interstate banking deregulation. They created a massive pipeline of warehouse lines from the $72 trillion demand into the safest thing that they could possibly find. But what they ended up doing was they needed volume to feed the beast based on what we call perverse incentives that were leading to executive compensation.

So you have these CEOs at the top of Wall Street. And I know, Leslie, we’re going to get into this, like Jamie Dimon and so on and so forth. They’ve got these huge short-term quarterly basis based on this fictional process that’s all built on literally racketeering from the ground up. Right.

And then on the backside of this whole thing, once they decided to short it and then they created the $29 trillion backstop by the Federal Reserve, then they had to get rid of it in the courts. Which brings me back full circle to you, Marina, because you understood what was going on. You challenged them. You realized it was racketeering. What happened?

[00:37:40.720] – Read

Well, as I said, eight lawsuits have taken up to the state Supreme Court, up to the federal Supreme Court twice, and they just shut us down. I’ve done RICO action. I still have another RICO action to file.

[00:37:52.580] – Lovell

But they came after you, Marina. Didn’t they come after you?

[00:37:55.420] – Read

Yes. When they did the eviction, a SWAT team was sent out. I was in court that day for the fifth, eighth time, to get a stay on the property, showing the fraud, showing the evidence of that. Meanwhile, they sent out five undercover cars. They came in tactical gear with semiautomatic rifles to evict on my household.

My daughter was there as a teenager. She’s still traumatized every time she recalls that incident. We were very peaceful. We had everything out sitting there. But the banks, I told them that we were sovereign citizens. So that’s how they came out to extract us from our properties at gunpoint.

[00:38:35.710] – Lovell

There’s a lot baked into that and I don’t want to take any shortcuts. But what’s important here, and I’m going to leave it to Leslie here for a second, because as you can see, America, you’ve got three very sharp, intelligent . . .

[00:38:47.890] – Grumbine

Aha.

[00:38:47.890] – Lovell

. . . . women that ended up under siege by sheriffs at gunpoint or the way Margaret discussed it, five goons that showed up with guns. Tell me, guys. OK, Steve, do they look like they should warrant that sort of threat response? Unless what possibly?

Maybe they were too close to the truth? What would warrant a SWAT team in the case of a woman or I mean, I’m sorry, I hope it’s on grand display. But on that note, Leslie, obviously your name could be misconstrued by someone as potentially you’re a woman. What happened to you, Leslie?

[00:39:25.720] – Leslie James

Well, my story was very, very similar and my background is similar to Lynn’s story and hearing what Marina’s just said and Margaret also reminds me of what happened to me, because, quite honestly, we’re trying to forget about this stuff, not live with it all the time.

But I also I’m an immigrant. I came from Ireland. I arrived in this great country by walking across the Buffalo Bridge in 1966. I landed in Malibu and then worked my way up to Santa Barbara, where I rented my first property in 1969 for just a few months. And then I sort of dropped out

[00:40:07.090] – All

[laughter]

[00:40:07.090] – James

. . . I was going through marital difficulties. Exactly. Anyway coming back to town and I always felt, Santa Barbara, it throws you out, it throws you back. I got sort of used to it. So I came back again to Santa Barbara and had finally I was a qualified stockbroker.

I’m also a US Coast Guard licensed captain, and I had a nice little marine business here where I would take my classic boat out with clients from the Four Seasons, Biltmore, the Bacara in Toledo. And I had enough money going, so I was able to acquire property in Montecito. My second one, my first one a long time ago is a middle road.

[00:40:54.140] – Lovell

Let me just introduce real quick. Steve, just so you know, Montecito is like literally the most glorious neighborhood in the United States. I mean, for example, Oprah Winfrey lives in Montecito. I think it’s Hollywood stars galore, right? I mean, it’s like $26, $30 million properties. And I mean, it’s heaven on earth. This is where Leslie lived.

[00:41:12.970] – Read

And this is where Harry and his wife now live in Montecito.

[00:41:19.812] – Lovell

Right.

[00:41:19.909] – Grumbine

Ah!

[00:41:19.680] – James

There with Richard Minos, who knows them all very well. But anyway, when Lynn and Marina mentioned how the banks conniveD them to take out a modified loan, the loan modification program, that’s what happened to me. I drove up my driveway one day, which was quite elevated with beautiful views in Montecito and rustic as well, of course.

And Jamie Dimon’s crew called me and said, “Leslie, you’re one of the select few here because you have what’s called a jumbo loan. And we have a special program for you guys.” And I said, “You’ve got to be joking.” He said, “No, we’re serious.” And so I sat down and I said, “All right, let’s go for it.” Bottom line, they wanted me to delay my payments for at least 60 days so that they could activate this program.

Now, it had to be activated before 90 days went by, otherwise, of course, I’m subject to foreclosure as we know. So I was asked to stop paying for a couple of months, which I did. And I got the program, signed all the documents. I got the approval for the loan modification.

[00:42:34.942] – Grumbine

[Laughter}

[00:42:36.130] – James

And I was so thrilled. I couldn’t believe it because actually all of my houses, my four properties at the time, two in Oregon and one in Santa Barbara City with Wells Fargo and the other two with miscellaneous lenders up in Oregon. They’re rural but beautiful, 20 acres, 25 acres. So basically, I know that the banks are up to nothing good.

So I made sure that I paid JP Morgan Chase in cash at their bank in Carpinteria because I had a little gallery there at the time. And on the first of the month, not the middle of the month, I wanted to get in and done in hard cash. For the next three months, five days after I make my payment, a U.P.S. van comes up my driveway and throws packages.

I was there are a number of times when they were doing it saying that I was in default and that I haven’t made my payments. It was impossible to win. I was terribly fortunate. I had to close my little gallery, a little dinky art gallery in Carpinteria because every single level on the counter was covered in loan modification papers. I had four properties all going to court all at the time. I would have lost my Oregon properties if the state of Oregon didn’t institute a division to assist us.

And the whole thing has taken about five or six years. I still, fortunately, have my properties’ rent in Oregon. But I’m like Lynn. We’re both sailors. She’s a member of the same yacht club that I’m a member of and she’s a very senior member. I may be one, years of age and now, unfortunately, I’m having difficulty even staying on my yacht in the harbor. It seems that I’m going to be evicted next Monday at noon.

[00:44:38.990] – Lovell

If you’re listening to all these things. It’s so overwhelming in terms of the information and questions can start to elicit. You know, Leslie, you told me a story on camera that I’ll never forget because I was meeting all of these women around the country. And my story started with this woman in Ohio who ended up committing suicide as a result of being a victim of straw buying.

She wasn’t aware that somebody else had stolen her papers and that’s part of predation and so forth. But in your particular case, you had mentioned to me, because your name’s Leslie, that that had a specific sort of ring for you with regards to the modifications and everything else. Can you explain to our viewers what your hunch was there? And I’ll finish with that.

[00:45:14.410] – James

All right. I noticed that many of the people in Margaret’s classes at her house and in the other venues here in Santa Barbara that we all attended, the great majority were women and many of them elderly. And I would see them in the courts sometimes immediately in front of me and the judge, elderly women who are losing their homes. In one case, the woman had paid her mortgage off and merely owed a homeowners association fee and the judge right in front of me evicted her from her home.

[00:45:48.860] – Grumbine

Wow.

[00:45:49.550] – James

It was unbelievable. I then, because I’m a Starbucks freak, I go to Starbucks in the morning. The next day in the middle of winter, by the way, and I was evicted in the middle of winter as well. Rain, everything is the worst. They’re in Starbucks, covered in a plastic sheet, shivering, having slept on the ice plant on the beach here in Santa Barbara. And every morning there are four ambulances on Cabrillo Boulevard every morning, cause I’m a very early riser. It’s a horrible thing and it’s continuing to this day.

[00:46:23.690] – Lovell

But what he means is that women were being foreclosed upon and they go homeless to the beach and then wind up. I mean, these are women of Santa Barbara. This is like I’m telling you guys, it’s the crown jewel of the United States in real estate. And like Marina said, it was a target. And the system itself was making a gold mine on these things.

But I mean, we could go. But I think really the genesis of these stories we’re going to put up in these podcasts information on who you are, where they can get more information from you guys. We want to tell more about your detailed stories. Like I said, we could talk for hours and hours and hours, but the pain, the suffering, the homelessness. Of women.

And Leslie, this is the United States people, this is how we’re treating everybody across the board and have been and people in this country have to understand and wake up that our judicial system has completely turned over on itself to maintaining a revenue supply from, quite frankly, Steve, the Federal Reserve, the black box casino, to backstop these assets once again.

And these are real people that are being crushed by the system. And I think I have to just ask Margaret, if you will, again, these stories are so horrific, all of you, that you end up homeless. And I don’t even know how you’re still living today, given everything that you’ve gone through. But it inspired you to write a poem based on a wonderful James Taylor song. Would you share that with us as we close out of this?

[00:47:49.550] – Caswell

I don’t know why I’m still alive or how I’m still alive. It’s amazing to me, given what happened. I do know that my spiritual teachings say that when Leslie talked earlier about being a victim, that this actually gives us the opportunity to prove that we can be victorious. And I’m certainly intending that all of us will ultimately be victorious.

So anyways, I about a year after I was forced off my land, I started having dreams where the words that came were in pieces on the ground, in pieces, on the ground night after night, and I thought, what does this? What does this mean? And so I put in that phrase on my computer.

And eventually, I ended up in the James Taylor song Fire and Rain. And I read the lyrics and it just struck me how similar his story for those who don’t know. His story was about a suicide of his friend Suzanne and how difficult this was for him. So I took the lyrics and I rewrote it and sing it to myself when I really I’m the most homesick. So I can share that with you.

[00:49:27.170] – Grumbine

Please do.

[00:49:28.790] – Caswell

So I call it ‘The Ode to My Querencia.’ And querencia is the Spanish word that refers to that area in the bullring when the bullfighters . . . where the bull returns to as its safe place. It’s understood that the bullfighter will not aggress the bull when it goes to its querencia, and the term is coming to be used as one’s sacred, safe place, one secure place. And my home of 28 years was absolutely that. So here’s what I wrote.

[00:50:16.010] – Ode to My Querencia

Just yesterday morning, they let me know you were gone. Dear house, the plans they made put an end to you. I woke up this morning and I wrote down this song. Just can’t remember who to send it to. Oh, I’ve seen fire and I’ve seen rain. I’ve seen sunny days that I thought would never end. I’ve had lonely days when I could not find a friend. But I always thought I would see you again.

Been mocking my mind to the easy times, my back turned towards the sun. Lord knows when the cold wind blows, it will turn your head around. Well, there always was time on the telephone line to talk about things to come. Sweet dreams are shattered now in pieces on the ground. Oh, I’ve seen fire and I’ve seen rain. I’ve seen sunny days that I thought would never end. I’ve had lonely days when I could not find a friend. But I always thought I would see you again.

[00:51:31.850] – Grumbine

Beautiful, absolutely wonderful.

[00:51:38.150] – Lovell

I just want to pick up and again from the bottom of my heart to each and every one of you. You’ve always been in my heart since I’ve met you all. I’m trying really hard. I’m trying. I’m trying really hard to get the truth out there. We need to create a unified force of Americans across this great country who refuse to allow corruption to destroy us any longer.

You’re looking, America, at people who are the best among us. Were the kindest, the most gentle that wound up destroyed by what is nothing less than terrorism. And it doesn’t care who you are, doesn’t care what you look like. It doesn’t care for where you’re from. It doesn’t care what your education is. And all of the naysayers out there that pretend like everybody else had it coming to them.

The tricks of this diabolical system that could literally been 26 hours laying out for them. Right. We’ve done the first five hours in The Con, and we’re going to do the second five hours in the show. And I’ll leave it to you, Steve, because you’re an expert in fiscal policy. You’re an expert in what happened in the Treasury and the Federal Reserve. This is the consequence.

[00:52:51.410] – Grumbine

Yeah, and, you know, I think one of the things that jumped out at me is that every step along the way we talk about this and it’s going to be a recurring theme. But every step along the way, you’ve got a small veneer of people that really, really, really understand what the heck is going on, know inherently what is going on – the bad guys that know what’s going on, and then a few voices screaming in the dark, “Hey!” that know what’s going on.

And that would be people like who we have on the show right now. But the other thing is, is that the people writing the laws. Many of them are cowards. Many of them are ignorant, unbelievably ignorant, and they’re protected by paternalistic voters who worship and revere their politicians. They are protected by the party system itself. And we’re not getting any laws written. Glass-Steagall, when it was repealed and all the other laws that they’ve put in place to block the ability to get information from these companies and to be able to put that information into court.

Record statute of limitations, they have purposely done everything they can. And the people that could fix that are either underfunded as it is with the auditors or they are undereducated in terms of our politicians and also our local reps, because we’ve conditioned everyone in this country to believe that if you fall on hard times, it’s got to be your fault. Right?

Bootstraps, baby, it’s all about personal responsibility. And this fraud, it’s another fraud. They use that fraud. And they predated on someone such as Lynn, who is a notorious rule follower. To be able to once again lay bare that it really doesn’t matter whether you follow the rules or not. This is fraud. This is crime. And to quote our friend Rose, “It’s theft.” So to me, at this point, we’re going to see highs.

We’re going to see lows. We’re going to see middles because this was indiscriminate and it took down people. You saw women, elderly women predated upon – women that were ripe for being defrauded of their entire life savings. And you’ve seen it within the African-American community where homeownership had been deprived of them for so long.

And then in the 70s, and the present, we’ve seen people trying to get into this American nightmare or dream, as they call it, only to find out that there is a system and it’s rigged to take away everything you ever worked for in your entire life. And that, to me, is criminal. And that is what this show is all about. I’m hoping that we get 20 million people out in the streets willing to actually fight back against this. It doesn’t matter, Republican, Democrat, progressive, socialist, whoever, all of you.

This is about your families. This is about your life and your stories. I’m sick in my stomach. That’s why we do this show is because no one’s telling the story, and the few that are, are leaving out all the important stuff. So thank you all for your courage and commitment to doing this.

[00:56:08.880] – Lovell

I want to finish with just this note, and each of you represent this in your own life journey. Right? My father always taught me that integrity is what matters. Integrity matters. Now, Leslie James is a sailor. A ship doesn’t float unless it has integrity. I mean, It’s not rocket science. It either works or it doesn’t.

America, your system no longer has integrity. And when it doesn’t, it fails. And nobody’s safe. Nobody’s safe unless you decide in your heart that liberty and justice for all is what matters. And you’re looking at the people who have actually been destroyed by the system. Please don’t let them live like this any longer. Thank you.

[00:56:51.330] – Grumbine

All right. Well, with that, thank you all very much for joining us on this episode. My name is Steve Grumbine, Patrick Lovell, my co-host, and “miss you, Eric,” and to all of our guests, thank you so much once again. We’re out of here.

[00:57:08.650] – Ending credits

The New Untouchables is produced by Andy Kennedy, descriptive writing by Rose Ann Rabiola Miele, and promotional artwork by Cristina of Paradigms and Revolutions design group The New Untouchables is publicly funded by our Real Progressives Patreon account. If you would like to donate to The New Untouchables, please visit Patreon.com/realprogressives.