Episode 173 – Inflation: The Fed’s Crash Landing with L. Randall Wray

FOLLOW THE SHOW

L. Randall Wray explains the causes of this current inflation and its effects on ordinary people as well as developing countries. He also takes a deep dive into the workings of the Fed.

Real Progressives and Macro N Cheese are committed to bringing MMT to activists and folks with no background in economics. Many of us were only interested in learning how MMT disrupts the concept of taxes funding federal programs, but the more we know, the more we want to understand. MMT is funny that way.

If you’re new to MMT, this week’s interview with L. Randall Wray might appear to be wonky and intimidating. But we urge you to listen and promise it will be worth it. We’ve had a few episodes dealing with inflation in recent weeks because that’s where we are at this particular time in history. We believe it can’t be talked about often enough because we’re surrounded by misinformation in the mainstream media and lies from the mouths of so-called experts.

Steve invited Randy to talk about the recent paper he co-authored with Yeva Nersisyan, another friend of this podcast. The title speaks volumes: Is It Time for Rate Hikes? The Fed Cannot Engineer a Soft Landing but Risks Stagflation by Trying. To put it bluntly, confronting inflation by raising interest rates is dangerous. Randy describes the catastrophic chain reaction – causing bankruptcies at home and tanking the economies of developing nations. He explains in detail how this happens, both to individuals and nations.

The ‘experts’ love to blame government spending for today’s inflation – especially the paltry stimulus checks disbursed during the pandemic. Wages are another favorite culprit. Listeners to this podcast know these are not the causes. (How long ago were those damn checks?) However, both the pandemic and the current war have brought us supply chain disruptions. We can also look to corporate manipulation of prices and markups:

“And they’re very open about this. When they have their meetings with shareholders and others, they say, look, our customers are not going to blame us if we hike up the markups and take more profits, because they realize that inflation is creeping up. So, they’re not going to blame us. So, let’s do it. And they are.”

Randy defines stagflation and its causes. He compares today’s inflation to that of the 1970s along with the actions of the infamous Paul Volcker. He explains why the Fed’s “tools” for fighting inflation are no tools at all. He suggests a legitimate role for a central bank includes protecting the public from banking fraud. He replies to Steve’s question about eliminating the interest rate altogether:

“This was actually Keynes’s proposal to have a zero overnight interest rate. His proposal was to euthanize the entire rentier class. You all know what euthanize means. Mercy killing of the rentier. That is the class of people that live off collective interest. He saw them as functionless in the economy. They don’t serve any useful function. So, let’s euthanize them now. Keynes didn’t really mean kill.”

Steve talks of people’s desperation as they look for solutions to the real-life problems that are not on the Fed’s radar. Inflation could be addressed with targeted spending on behalf of the public using the fiscal power of Congress. Expecting the Federal Reserve to fix it with interest rate adjustments is like giving a child a fake steering wheel in the back seat and expecting them to drive the car.

L. Randall Wray is a Professor of Economics at Bard College and Senior Scholar at the Levy Economics Institute.

Macro N Cheese – Episode 173

Inflation: The Fed’s Crash Landing with L. Randall Wray

May 21, 2022

[00:00:03.960] – L. Randall Wray [intro/music]

If wages are growing slower than inflation, wages can’t push inflation up. So, patience still would have been the best strategy, is my point. There’s no reason to kill the economy in order to fight inflation that is caused on the supply side.

[00:00:25.580] – L. Randall Wray [intro/music]

In our paper, we actually have a graph of the capacity utilization rate for the economy as a whole. We’re only at 75% of capacity. We used to reach 95% of capacity when the economy was booming along. So, we’ve got 20 points more to go.

[00:01:35.220] – Geoff Ginter [intro/music]

Now, let’s see if we can avoid the apocalypse altogether. Here’s another episode of Macro N Cheese with your host, Steve Grumbine.

[00:01:43.050] – Steve Grumbine

Alright, this is Steve with Macro N Cheese. Today’s guest is none other than Randy Wray, whereas you’ll see him on his written work L. Randall Wray. Randy is one of the original developers of Modern Monetary Theory, an actual student of Hyman Minsky, and currently a professor at Bard College. He works a lot with Yeva Nersisyan, whom we’ve had on recently.

And for those of you who know MMT, you know who Randy is. But for those of you who are just coming in for the first time checking out this, you don’t want to miss this because Randy is where a lot of the good work that makes up the body of knowledge that is Modern Monetary Theory comes from. In fact, let me just state unequivocally that Randy’s work at New Economic Perspectives, his blog, the actual MMT Primer, is where I learned the vast majority of the Modern Monetary Theory knowledge that I have today.

Him, Warren Mosler, Bill Mitchell, Stephanie Kelton, Scott Fullwiler, Matt Forstater, guys like Fadhel Kaboub and Rohan Grey, so many good people out there to learn from. But today we have the pleasure of talking with Randy, and Randy and Yeva recently wrote a paper called “Is It Time for Rate Hikes? The Fed Cannot Engineer a Soft Landing but Risks Stagflation by Trying.” So without further ado, let me bring on my guest. Randy Wray, thank you so much for joining me, sir.

[00:03:15.570] – L. Randall Wray

Hi. Good to be back.

[00:03:17.630] – Grumbine

It’s been almost a year. When I looked through our backlog and I said, “Has it really been since July of 2021, since we’ve talked to you?” And sure enough, it’s been that long and close to coming up on a year. It was time to get you back in the saddle, my friend. We miss having you around here. And it couldn’t be more timely. This paper that you wrote recently, I think really for a lot of us, the mainstream media puts a lot of stuff out written in the common tongue of Paul Krugman. Not MMT, unfortunately.

And so when people read the news, they’re trying to make heads or tails of this. And it’s really challenging even for people that have been around the block a few times. So why don’t we get started? Let’s set the stage for what’s happening. The Fed’s talking about tightening monetary policy, raising interest rates, and we see the housing market already going crazy. But now, the cost of credit is going up even higher. What’s happening?

[00:04:17.920] – Wray

Well, so. It’s sort of typical for the past 50 years to think that the Fed’s main job is to prevent inflation. And so we can go into why people believe that and the story about how that became the Fed’s main role. But everybody knows prices have been going up for a little bit over a year. And they’ve gotten up to a pace of six or 7%.

We can quibble about the way they measure inflation and so on, but it’s pretty obvious that prices are generally rising. And people don’t like inflation. It’s politically very divisive. So all eyes turn to the Fed, and it was inevitable that the Fed eventually would start raising interest rates.

[00:05:20.950] – Grumbine

Well, the Fed raising interest rates, I guess, is really the next question is what did they think they’re going to accomplish by doing that? Is that really the answer? It seems like killing the economy to bring down inflation is a fool’s errand. It seems like there might be another way to do that.

[00:05:39.040] – Wray

Yeah. Well, you’ll notice that they deny they’re trying to kill the economy, and that’s why they use this term “soft landing.” It would be nice, but we’ve never had a soft landing. Every landing we have is a crash landing. So I think the Fed probably understands that. And they just aren’t going to admit it publicly. So the idea is that if you increase the cost of borrowing, people will stop borrowing so much.

And that means they will spend less. And that will pressure prices down because all the firms, stores and so on that are trying to sell output, will have to stop raising prices to induce people to come back shopping again. There are so many holes in this argument we can poke at. Okay, first, people are not borrowing to buy gasoline.

People are not borrowing to buy meat. People are not borrowing to pay their rent. People don’t borrow before they go to the restaurant. Okay now, all the items I just mentioned are the ones that are driving inflation.

[00:07:08.490] – Grumbine

Right.

[00:07:09.570] – Wray

So, not one of those is something people normally go into debt in order to buy. Now, we do have a housing bubble in many parts of the country. It will surprise people to hear that actually does not feed directly into inflation. House prices can double. They can triple. That is not going to, by itself, raise our measured inflation rate. Okay? So that’s a separate issue. It is not tied into inflation.

Housing prices could well be a problem. A housing bubble could well be a problem, especially in particular cities around the country. And we might want to do something about that. But that is not why the Fed is raising interest rates. They’re trying to reduce the rate of growth of these items I just mentioned that are all contributing to our measured inflation rate.

[00:08:10.060] – Grumbine

By definition, does that not simply take cash out of our wallet, so to speak, and make it so that we can’t buy things? Isn’t that kind of the thinking anyway?

[00:08:21.480] – Wray

Well, let me just say, in general, all economic empirical studies, that is, actually looking at the data, find that spending is not very interest rate sensitive. In other words, raising interest rates by 1, 2, 3, 4%, doesn’t actually directly influence spending very much at all. It does influence home purchases, but other than that, spending is not very interest-sensitive.

And this is why it takes really large rate hikes to have a measurable impact on the economy. So, we’re increasing by half of 1%. That by itself is not going to do anything. And the Fed tells us, well, we’re going to keep doing this for month after month, year after year. Once we have started to move in this direction, we’re going to keep moving in this direction.

So, what actually will happen is, you’re going to start to get people whose interest rates go up, especially on mortgages, but other kinds of debt too. People who have floating-rate debt, those interest rates are going to start to go up. And what happens is they go bankrupt. Yes. They go insolvent. And when they get in trouble, their creditors can get in trouble, too.

Credit and debt are two sides of the same coin. And if I can’t pay my debts, your credits, that is, your financial wealth is no good. And so what we can do is cause a financial crisis. So a financial crisis will take a lot of wealth out of the economy because in a financial crisis, financial assets fall in value and people don’t make payments on their debts. That causes those assets to fall in value.

And that is what causes people to stop spending because they’ve gone bankrupt or they’re afraid they’re going to go bankrupt. And that’s why we get crash landings. That’s why there’s no such thing as raising rates to get a soft landing, because people don’t just gradually slow down the rate of increase of their spending as you increase interest rates.

You have to raise them enough to cause financial distress throughout the economy. That is how Volcker did it. It caused half of all the Savings and Loans in the United States to fail. And we had failures that spread through the economy. So you wipe out the financial system. And then you can get a recession deep enough that inflation finally is broken.

[00:11:20.400] – Grumbine

Let me ask you two questions on this. One is kind of looking backwards to help people understand what actually raising rates means. And the other one is talking about this Volcker aspect. Let’s start with Volcker, since you just brought him up. Obviously, rates were super high during the OPEC crisis, which for those that don’t know, Volcker was the chairman of the Fed at the time.

Raising rates was a means to try to stave off this huge petroleum war that we’re going through with the price gouging of OPEC. Did they beat their chest over this? What did it solve in their mind? Obviously, it brought prices down, but weren’t prices kind of a man-made construct to begin with? There was nothing empirical that costs had gone up. It was just simply they brought out a pen and jacked it up and raised rates. Right?

[00:12:11.730] – Wray

Yeah. Our two previous really high inflation episodes were after the 1974 oil price hike and then after the late 1970s oil price hike. And oil goes into the production of almost everything. And so if oil prices quadruple, which they did, it’s going to raise prices all through the economy. And so you’re going to measure the inflation rate going up as those prices adjust to the new higher price of oil.

My point is, if Volcker had done nothing, inflation would have gone away. But it’s possible he ended inflation slightly earlier than it would have. But the cost was tremendous in the United States and around the world, because when interest rates in the United States go up, they also go up around the world, especially in developing countries.

So not only did we get the financial crisis in the U.S. where half of our thrifts failed, but the crisis spread to the developing world that had a lot of debt and a lot of that debt was in dollars. The interest rates on their debt went up and they had to default on their debts. So we had a developing country debt crisis, which then blew back to the United States because guess who is holding Mexican dollar denominated debt?

Yep. Americans. The big banks. So then our big banks were insolvent. And so the aftermath of the Volcker rate hikes lasted for the entire decade of the 1980s and into the early 1990s. The blowback was so huge that we didn’t really get out of this until the 1990s. And he is remembered as a hero for doing that. Jerome Powell, who now chairs the Fed, names Volcker as his big hero. And so you get the idea, well, he wants to do that, too.

[00:14:22.670] – Grumbine

So with that in mind, you’re talking about raising interest rates. And I’m so glad you brought up the developing countries angle because that goes through the IMF, mostly through the IMF anyway. I want to ask you, what does it mean to raise rates? What are we raising rates on? It’s not like the Fed chief is raising rates on credit cards.

He is raising rates on the cost of money. Explain to me what the hierarchy of raising rates is. Start from…once Jerome Powell says, “yes, we’re going to raise rates.” Yeah. What is he actually raising, and where and how does that expand the rest of the economy?

[00:15:02.730] – Wray

Yeah. So the rate that the Fed uses as its policy tool is called the Fed funds rate, federal funds rate. And since it has that word federal in it, it makes you think, oh, this must be the interest rate the government lends at, or something. But actually it is the rate that banks lend reserves to each other. And this is entirely controlled by the Fed.

But it’s not actually the rate at which government lends money, it’s the rate that banks lend money to each other. And it’s going to be the base rate, the base of which all other interest rates in dollars are set. So every other rate will be above that one, because that’s the safest rate, it’s just banks lending to each other overnight. Okay?

It’s risk free and it’s very short term. So it’s the lowest interest rate we have. As that one goes up, all the other rates that are above it will also go up too, and maintain relationships with each other and all of those rising as the Fed funds rate rises. So it will push all the rates up. And things like credit card rates. I don’t know what they are, but say 18%.

If the Fed pushes up the Fed funds rate by four percentage points, which is in the conventional wisdom, that’s about what the Fed has to do in order to fight inflation, or I would say, cause a financial crisis. Other rates are going to go up proportionally to that. So you could say your credit card rate will go to 22% or something like that.

[00:16:59.350] – Grumbine

So now I’m a developing nation and you’ve raised the Fed funds rate and that ends up going out to those debtor nations now, such as the Global South that has taken a dollar-denominated debt through the IMF. Can you explain that?

[00:17:14.760] – Wray

Well, yes, a lot of countries issue debt denominated in dollars and their debt is riskier than ours because there’s no U.S. government backing it up. So if the safe rates are going up, the riskier rates have to go up, too. And so they will go up. Now, even if they’re not borrowing in dollars, even if they’re borrowing in their own currencies, their rates are going to rise because they are sort of competing in financial markets with U.S. dollar-denominated debts.

So if they’re borrowing, let’s say, in pesos, they have to compete in international financial markets against a dollar bond that is paying a higher interest rate on dollar-denominated debt. So they’re going to have to pay a higher interest rate on peso-denominated debt, too. So it will push up rates even if they’re not denominated in dollars.

[00:18:13.810] – Grumbine

Okay. So when the costs go up in those nations, if I’m a developing nation, I have my own currency tied to or pegged to the U.S. dollar, and the Fed funds rate goes up and now the price of that money goes up. I have to pay more to get reserves in my country to be able to facilitate trade on debts denominated in U.S. currency.

Because even though I’m spending my money, I have to have reserves in the foreign currency to be able to offset that equal amount. Am I in the right vicinity here?

[00:18:50.000] – Wray

Yeah. So there are several bad implications for a developing country. And let me just say, I’m not a development economist. And I’m definitely not an expert on developing economies. So, what I’m giving you is the best I can do without being an expert on those topics. So first, the debtors, including, let’s say, the government of a developing country, will have government bonds that are denominated in dollars.

They’ve got to come up with more dollars in order to service higher interest rate debt. So one of the things they’ve got to try to do is increase their net exports. There’s two ways to do that. You can export more, which will be hard if the U.S. is slowing its economy down, which is the purpose of raising interest rates.

It becomes harder to export if the U.S. slows down because the U.S. is the biggest buyer in the world. Or you can reduce your imports. And the main way you reduce imports is by slowing your own country down. So either way, they’re worse off. They can’t export more and they’ve got this slow their economy down to try to reduce imports.

And on top of that, they’re paying higher interest on their debts. So there’s this saying, “if the U.S. catches a cold, the developing world gets the flu.” The problems in the U.S. will be much more magnified in the developing world. And that’s what happened with Volcker.

[00:20:38.160] – Grumbine

I’m looking at the write up of your paper. Is it time for rate hikes? And one of the things that I noticed in specific, and it’s just in the overview, so I can keep it concise. It says, in their view, this inflation is not centrally demand-driven. Rather, dynamics at the micro-level are playing a much more central role in driving the price increases in question.

So we already kind of touched on that a little bit, but to me this sounds very much like the praxeology, libertarian-minded thinking that’s not really understanding things in aggregate, and it’s completely the wrong-minded way of doing things. It feels like dystopian, almost, and I got to wonder who wins. Somebody always wins when there’s a calamity. Who are the winners when they crash the economy? What is the net result of that?

[00:21:34.110] – Wray

Yeah. Well, let’s back up just a little bit. So, we got $5 trillion relief packages from Presidents Trump and Biden after the pandemic hit. So there’s $5 trillion of government spending that went into the economy. When the pandemic hit, and people couldn’t go to work, and we had to shut down a lot of our economy, we had the deepest recession the U.S. has ever had. We just fell off a cliff. Okay?

That pandemic relief actually brought us back to life. By the end of last year, we actually got GDP, which is our measure of output as a whole, back to where it had been predicted to be before the pandemic. So if you take the predictions of where we would be that were made back in 2019, we were there. We made it back. Okay? Now, the economy wasn’t fully recovered.

And the reason we were back was because the government had put so much money into people’s pockets that they could go out and buy stuff. But that was the end of the relief. We haven’t had any more relief since then. It all went away. And of course, the virus did not go away. So a lot of people want to claim that this inflation was because of too much government spending.

This is mostly the more free-market anti-government types who now, because the Democrats are in office and up for election soon, have a real political agenda at blaming the current president. They’re not going to be blaming Trump for what happened. To say, look, Biden caused all this inflation. Because he sent all those relief checks.

We should have kept the government small, kept the government out of the economy. Everything would have been okay. But now we have inflation. “It’s all the government’s fault.” So that is a big part of the story about inflation and why we need to do something now about it. However, it’s not just them. So the most vocal person out there has been Larry Summers who’s a favorite of every Democratic administration as far back as you can go, who started arguing that “there was too much relief, aggregate demand is too high, it’s going to be inflationary.”

And this is more than a year ago. He is arguing this. And at that time the Fed was saying, “look, we know there’s a little bit of inflation pressure, but we’re going to be patient. It’s only temporary. It’s transitory. It’s going to go away.” Okay. For once in his life, Larry…was right, at least partially right…one time. The inflation was not transitory. Now, is it because of too much demand? The answer to that is clearly no.

The “stimulus relief package,” whatever you want to call it, was gone a year ago. There is no more. And Congress will not give any more. It’s not going to happen. Inflation started rising last March, and not this year, March of last year. It started rising after the relief was over, and definitely there was not too much aggregate demand. So it’s been going on quite a while. It is coming from the supply side.

It was coming from oil, largely, over the past year. And now with the war, it is more widespread in food, in wheat supplies, and other kinds of supply chain disruptions. But in our paper we look at where is the inflation? Where’s it come from? It’s pretty clear it’s from supply chain disruptions. It’s from shipping problems.

And then finally, it’s from firms taking advantage of rising prices to raise their markups because they think they can get away with it. And they’re very open in this. When they have their meetings with shareholders and others, they say, look, our customers are not going to blame us if we hike up the markups and take more profits because they realize that inflation is creeping up.

So they’re not going to blame us. So let’s do it. And they are. The surveys of what they’re doing and what they’re planning to do all show that any firm that thinks they can get away with a price hike that will increase their profitability, whether or not their costs are going up, they are taking advantage of it right now.

[00:26:52.700] – Grumbine

Let me just jump in there. The Guardian put out a great piece on April 27: “Inflation—corporate America increases prices and profits.” And there’s a grid midway through the thing. And folks, if you go out there and search for it, you’ll readily find this article. It says “Companies’ Profit Growth Far Outpaced Workers Wages.”

Guardian analysis of 100 top U.S. companies, percent change from the most recent reported quarterly profits to two years prior. Steel Dynamics 809% up. Albertsons Food and Grocery 671%. Amazon 333%. Chevron 144%. U.S.. Worker wages 1.6% compared to that, just as a perspective. So it’s hard for me to look at this and not say I see somebody in a smoky room making decisions.

So let’s raise prices and we’ll get away with it and we can blame it on Biden, like you said. Now, I’m no Biden fan. Let’s be crystal clear. He’s out there celebrating deficit reduction. I call that murder by policy. I don’t have a lot of love for the guy. That said, this is ridiculous. There’s no way to justify that. How in the world do you justify steel going up 809%? That tells you some of these guys are gouging us. Yup. That alone? 809%. How does that even happen?

[00:28:32.060] – Wray

See, the thing about the markups—and I’m not justifying them at all, this according to, actually, a White House report, the markup has tripled since 1980. So the markups have been on this long-term upward trend, and now they are boosted by the current circumstances where firms think they can get away with it. So the markups are going up.

But as you said, wage increases are well below the inflation rate. And my point is, what that means is that we don’t have any realistic danger, at least right now, of a wage-price spiral. So, markup-led inflation will peter out. If wages are growing slower than inflation, wages can’t push inflation up. So patience still would have been the best strategy is my point.

There’s no reason to kill the economy in order to fight inflation that is caused on the supply side, either because of supply chain problems or because of OPEC’s boosting the price of oil or even of our own firms raising the markup. You don’t need to fight that by killing the economy because you don’t need to reduce demand.

What you need to do is tackle inflation on the supply side, and you don’t do that by destroying economic growth. The way that you tackle inflation on the supply side is you boost growth. More growth is the answer. More competition, bring new firms in to compete with the monopolies and oligopolies that are boosting the prices. And with regard to oil, the answer, of course, is get off oil.

Transition to a green economy. We need to boost production, not cripple it with higher interest rates and a damaged economy. We need to boost growth of the green part of our economy, get alternatives to oil so that oil can never again cause inflation in the United States.

[00:31:12.980] – Andy Kennedy [intermission/music]

You are listening to Macro N Cheese, a podcast brought to you by Real Progressives, a nonprofit organization dedicated to teaching the masses about MMT or Modern Monetary Theory. Please help our efforts and become a monthly donor at PayPal or Patreon. Like and follow our pages on Facebook and YouTube and follow us on Periscope, Twitter, Twitch, Rockfin, and Instagram.

[00:32:03.950] – Grumbine

With decreased economic activity…this is the type of thing that brings on the seeds of recession and depression. And in your paper, you talk about risking stagflation. Now, I know this term because I’m a child of 69, so I was around in the seventies. I got to sit in the long, odd/even plate days with my mom getting gas.

I remember the gas lines, but stagflation was a term I heard when I was a kid. Had no idea what it meant. Can you please explain to us what the risk of stagflation means so that everyone can get on the same page?

[00:32:42.430] – Wray

Yeah. So the definition is stagflation means that you’re growing so slowly you’re not creating jobs. So you have unemployment. And at the same time you have inflation. Stagflation was a new phenomenon in the seventies. I graduated from college when stagflation hit and I was buying the jerry cans to carry in my pickup so that I would have gas.

Stagflation is caused by fighting inflation that comes from the supply side by depressing demand. That’s exactly what we did in the seventies. So our inflation all came from the supply side. And so the way that we fought it was, “let’s increase unemployment.” And so what did we end up with? Inflation and unemployment, because we didn’t tackle the source of inflation, which was oil prices and food prices and imputed rents.

That was 1974. That was 1979, and that is 2022. All three of those high inflations are caused by those three inflation problems. Oil prices, food prices, and imputed rent on shelter prices. That’s what drives inflation now; that is about 6% of our measured 7% inflation rate right now. And back then, it was also the vast majority, 70% of our inflation was those three items. None of those is remedied by raising the interest rate. Raising the interest rate does not get OPEC to reduce the price of oil. It’s pretty simple.

[00:34:33.740] – Grumbine

So this brings me to something that I think you’ll definitely be interested in responding to is the attacks on Modern Monetary Theory. We have inflation, so “MMT, what’s your answer?” And we’re frequently out there saying the limit of spending is inflation, is real resources. Things of that nature you just talked about.

We attack it on the supply side, but they often say, “hey, but you said you have inflation, you’ll have to raise taxes.” This is the simplistic go to response. They think they got us by throwing this non-sequitur at us, when in fact, what I just heard you say quite clearly is that the way to address a supply chain issue, we have higher prices on whether it be supply based or whether it be of any number of other ways base but a supply chain way.

The answer to that is not to cut spending or raise rates, but to in fact, boost production and boost competition. What do they get right? What did they get wrong? I think I understand it, but I’m interested in your take on that common trope.

[00:35:37.410] – Wray

Yeah. Well, if we were to undertake a huge Biden “build back better” plan, it’s possible that the spending would exceed our capacity, and in that case, we might need a tax. So that’s what we say. If you get inflation that comes from too much spending, too much demand on our productive capacity, too much demand for our national resources, then you use taxes to free up some resources for the plan.

So this is exactly what we had been recommending for a Bernie-style “Green New Deal.” It’s possible we might have needed some taxes and other methods of reducing aggregate demand in order to implement that. But that’s not what we’re doing and that’s not what our inflation came from, because obviously we didn’t get Bernie’s plan. We didn’t even get Bernie.

[00:36:44.810] – Grumbine

Right.

[00:36:44.810] – Wray

And we didn’t get Biden’s plan because there are two Democrats who will not allow it to go through. So, our problem now is not because of a huge infrastructure spending bill that never happened. Our problem now is that the supply side of the economy crashed. And we were still quite a ways off getting that back up to speed. And maybe it never will, and maybe that’s not a bad thing.

That’s another topic that we could go into. Whether we really should have global supply chains or not is now in question because they’re too fragile. But anyway, they had not been restored. And then we got the war and the sanctions against Russia and so on. So they’re not coming back in the near future. Our problem is on the supply side.

So this isn’t a case where you need a tax hike. So, it’s true. MMT does advocate possibly raising taxes, if you have so much spending that you’ve exceeded your productive capacity. But we have not done that. In our paper, we actually have a graph of the capacity utilization rate for the economy as a whole. We’re only at 75%. We’re at 75% of capacity.

We used to reach 95% of capacity when the economy was booming along. So, we got 20 points more to go. Now, it’s questionable whether we could get to 95% because of the shape the supply chains are in. But that just tells you what the real problem is. We need to focus on, either, restoring supply chains or finding alternatives to them through domestic production and so on.

So, this isn’t a time for tax hikes, and you don’t hear these critics of MMT advocating tax hikes either because they’re not that stupid. They’re just trying to make an easy point—completely wrong—but say that, “See? MMT would say you need to raise taxes now,” but we wouldn’t because this is not a case of too much demand.

[00:39:05.160] – Grumbine

One of the other things that has come back at me, the zero interest rate policy that MMTers often advocate. I know Warren advocates for low or zero permanent interest rate policy or ZIRP. I’ve listened to countless talks you’ve given where you’ve described that we should stop selling bonds and that these are really outdated things from a gold standard era, no longer really applicable to modern society.

What would be the implication on this overall economy today if we took this out of the Fed’s hands? They don’t have bonds to work with. They weren’t part of the tool package, or if they were, they were short-term bonds. What would an MMT-informed, macroeconomy-minus-bonds and a zero interest rate policy look like if we were to do that right now? Would that be an answer to this problem or would that exacerbate it?

[00:39:54.540] – Wray

It’s not going to make the problem worse. But look at it this way. The Fed has a number of jobs to do. Some of those are completely reasonable jobs, I think. If you had a run on banks, the Fed is supposed to be the lender of last resort. That’s a perfectly sensible thing for the Fed to do. It can do it. It has done it. It works. It’s a socially useful thing to do.

Central banks often regulate banks, try to keep them safe, try to keep them from perpetrating fraud on their customers. The Fed has the authority to do that. Unfortunately, for some reason, it doesn’t do it. It looks the other way. The thing that the Fed cannot do is control inflation. It has no tool to do that. The Fed funds rate doesn’t do it.

If the Fed raises it high enough—Volcker went above 20%—so, the overnight interest rate in the United States was above 20%. If you do that, you can destroy the financial system and there will be repercussions such as a deep recession here and around the world. So, they can do that, but they can’t fight inflation. They don’t have a tool for it. The Treasury fiscal policy has the tools that we need to fight inflation when demand is too high. We just went through one of them, which is, yes, you can increase taxes if you need to.

[00:41:35.300] – Grumbine

Right.

[00:41:35.900] – Wray

And there are other things they can do to. Congress has the power to legislate wages and prices if they need to be controlled. We have done that in emergencies before, such as in World War II and even a Republican President Nixon used wage and price controls. I’m not saying that we should do that now. Our inflation is not entrenched in the economy. We don’t need to do that.

But I’m just saying, the Fed does not have a tool to fight inflation, so it makes no sense to sic the Fed on inflation. It can’t do it. So for MMT, a policy proposal that’s related to MMT, but I wouldn’t say it’s a necessary result of thinking about things the way that MMT does, is to adopt a zero overnight interest rate target. This was actually Keynes’ proposal to have a zero overnight interest rate.

His proposal was to euthanize the rentier class. You all know what euthanize means, mercy killing of the rentier. That is the class of people that live off collecting interest. He saw them as functionless in the economy. They don’t serve any useful function. So, let’s euthanize them. Now, Keynes didn’t really mean kill them. I want to make that clear. He just meant remove that income.

Keynes had no problem at all with people earning interest if they were taking risks. But there is no risk on the overnight interest rate, which I had said earlier. You are not taking any risk if you’re holding a U.S. government bond. There is no default risk on that. So, Keynes opposed paying people interest if they’re not taking any risk at all, okay? Now, I wouldn’t quite go that far.

I think there’s a public interest in paying interest, to lower income, middle income savers, to parents who are trying to save for their kids college, and people trying to save for their retirement. And I would rather the people have an option, let’s say a public option, over a Wall Street option. You can give your money to Wall Street and you can hope that they don’t lose all of it or we could offer safe savings bonds guaranteed by the federal government.

So, I actually prefer that. Let’s preserve some government bonds to serve that public interest. But I would limit who could buy them. So, let’s make it saving for college education, saving for your retirement, and saving for low and middle income Americans.

[00:44:42.490] – Grumbine

One of those statements in the white paper, you said, indiscriminate stimulus spending of the type we engaged in over the past couple of years is not the best approach. Instead, we need to use a more targeted approach. And that’s kind of what you just spoke to in terms of saving, in terms of bonds approach to spending, where demand is directed to the unemployed through a job guarantee program and to the parts of the economy where demand is insufficient.

When you go on to say further, fiscal policy can be used to direct investments into particular areas of the economy with the goal of increasing our real resource base for the long term. And I’m going to dare say infrastructure, this kind of one-belt, one-road, China. They made some great strides in ensuring they can move product all over.

They completely made themselves efficient and they’ve done great, great work. That One Belt, One Road initiative has been nothing short of amazing. And to see us struggle to even make the most basic point of facilitating that seems preposterous to me. Now that we’ve closed the world down and we’ve gotten rid of this globalization through the Ukraine / Russia scenario, where we pretty much gone back 20, 30, 40 years.

I’m curious what your thoughts are in terms of how we might leverage targeted fiscal spending, both to keep us as a good global citizen, not a predator, and to be able to lift all ships. Where would we want to target here?

[00:46:20.140] – Wray

Yeah. So let’s go back to 1974. So, this is our first high inflation outside of war. We had some inflation in World War II. So in 1974, the U.S. and Japan were just about equally energy intensive. So, we took about the same amount of energy to produce something like a car as Japan did. Then we have an oil price shock.

OPEC quadruples the price of oil. So what does the U.S. do? Let’s have a recession. Let’s slow the economy down. Raise unemployment enough that we can wipe out the inflation. Well, no, we ended up with stagflation. What did Japan do? They started to economize on oil because they don’t produce it, okay?

[00:47:15.270] – Grumbine

Right.

[00:47:16.020] – Wray

So, let’s go to 1980. Japan is twice as energy efficient as we are. So, we have to use twice as much oil to produce the same amount as Japan does. And how does Japan do in the 1980s?

[00:47:33.650] – Grumbine

Very good.

[00:47:35.030] – Wray

Tremendous. I was older than you and I can tell you, America was scared to death. Japan was taking over the world, okay? And I think late 80s, 17 out of the top 20 banks in the world were Japanese. Everyone was worried Japan was buying New York and Hawaii. Instead, oh, we got Volcker. So, we had a terrible decade.

And then, in the early nineties, we had not high inflation, but we had what people were calling a secular stagnation. And then we had the silent depression. And we really only started to recover around 1996. So, we had a very long period of slow growth. And about half of that was also with high inflation. What if we had gotten off OPEC’s oil after 1974?

I worked at the Energy Commission of California under Governor Jerry Brown. He’s called Governor ‘Moonbeam’ because he wanted to shift to alternative energy in the 1970s. So, the mainstream media all wrote him up as this crazy guy, all right? Because he had a vision. Let’s get off oil. If we had done it then, we wouldn’t have had the second OPEC price hike and Volcker.

And we wouldn’t be where we are today with another oil price hike and we may only have ten more years of human survival on planet Earth. If we had started in 1974, we could be net zero now. We lost so much time. So, yes, that’s exactly what we should be spending money on. Instead of slowing our economy down, raising interest rates, we ought to be moving as quick as we can to get off fossil fuels, to transition to a national energy grid, as far as I know.

I’m not that kind of a scientist, but it seems like we’re going to have to have a national electricity grid. We’ve got to build that from ground zero, starting right now, and moving to all-electric and solar panels. So, that’s what we should be spending on. So what kind of programs? Bernie’s Green New Deal, the broad-based one that includes a job guarantee, Medicare for all, all of that stuff. That’s what we should be doing right now.

[00:50:21.650] – Grumbine

So, I want to ask you one final question because of what you just said. I think that that’s a whole separate podcast, honestly, that I’d love to really dive deeper into, because as a project manager, I keep looking at the IPCC saying 12 years, four years ago. And now we’re at eight years and we’re no closer to a solution than we were back then.

So, one of the other things that jumped out at me and this is for everyone that’s been listening to the midnight bitcoin blogs, etc., where there’s an ounce of something to this that our having dollar hegemony is a very big deal to our officials. They use the SWIFT system to be able to create sanctions. They use this for a multitude of things. A

nd the ability to have that kind of ubiquity throughout the world prior to the Ukraine / Russia scenario was used a bit like a blunt instrument. The concept of the petrodollar, which is kind of silly on its face, Warren Mosler would call it a numerator, etc. and refer back saying it’s not a matter of what they price oil in, it’s a matter of what people want to save and what countries want to save in.

And that kind of goes over my head at times as I think about this. But I guess the question is, by forcing people to get dollar reserves to be able to make purchases in U.S. dollars for oil purchases, doesn’t that change that we’re in the middle of, impact us on a different level as well. Does it change the fact that we can tax our own currency, therefore, we can buy anything for sale in our own currency which would bring production back home, possibly, and shrink the supply chain necessarily as we saw the fragility of that global system.

But with dollar hegemony being one of the big things in terms of the way we conduct foreign policy, does not the concept of anything that’s being forced to be used in that, to provide additional support for the high cost of low prices, so to speak, in the U.S.? Does that not have an impact as well?

[00:52:36.300] – Wray

Well, I don’t think that’s something that I could address quickly. I think the most important thing is to sit down with other countries and plan how we’re going to achieve a transition as quickly as we can. I think this is the most important thing that faces humanity. I think there are many, many problems with the globalization of production and of finance.

And I think that the virus, the destruction of supply chains, the war in Ukraine, and the U.S. response to that, have all brought to light many of the problems with this globalization, which I think is very much a neoliberal thing that is largely to break the power of labor unions.

[00:53:51.670] – Grumbine

They almost had us down, got Amazon unionizing. To what degree? I don’t know at this point. Chris Smalls was there talking to Joe Biden the other day, the young guy out there in Staten Island getting Amazon to unionize. A pretty bold step, all things considered and kind of small as it may be you even see Starbucks baristas unionizing.

So, there is a little bit of a heartbeat there. I think that we’re on life support, but I do see labor considering a resurgence. I don’t know if I’d be ready to hang my hat on it yet, but it does look like there is life in the labor movement. It would be great to see something catch fire. But to what degree do you think labors’ ability to unionize and organize would impact these things?

[00:54:42.220] – Wray

It’s going to be very tough going, especially if they have to organize one small workplace at a time. So, yes, it’s a good sign. But it’s very difficult going that way. So, I wish him the best.

[00:55:01.180] – Grumbine

I feel badly because everybody is looking for something to grab hold of, something to find hope in.

[00:55:07.750] – Wray

Yeah.

[00:55:08.170] – Grumbine

And everywhere you turn, it’s always too little, too late. I think the thing that burns me the most is what I see as an ideological religion of free markets and government laissez-faire that’s preventing us from doing the things we need to do to ensure that an ideology works on paper as opposed to actually making the economy work for people.

But I see people are desperate, struggling, trying to find anything to hang their hat on and looking at the movie, “Don’t Look Up,” it kind of really is timely to go hand in hand with the message you’re presenting here, which is there’s nothing greater that could stop inflation than targeted spending using the fiscal power of Congress versus interest rates at the Fed, which is largely like giving a child a fake steering wheel in the back seat and say, go ahead and fix inflation.

But I don’t see any appetite for meaningful change. I see no meaningful economic understanding from Congress. I see no one speaking publicly about it, really. I do know there are some people being advised, but I don’t see the evidence in terms of a lot of policy space or even in terms of really making it beyond the back office circles.

I don’t see the stuff making it out in public and, sadly, a lot of people, for whatever reason, require a politician to tell them it’s true before they’ll believe it. So, if you are trying to provide an ounce of hope to people that are searching, the answer is a green new deal is what I’m hearing from you. And, when we talked to John Yarmuth, he said I was one of the sponsors of this thing and there’s just no appetite for a green new deal. How is that even possible, Randy? I don’t know how that’s even possible.

[00:56:55.560] – Wray

Yeah. I’m not either good at politics or well enough connected to it to go into that. I talked to Yarmuth. I know he completely understands what we’ve been talking about, and I think his heart is in it. And I think a number of the other Democrats on the Budget Committee are also on board. But right now, the Senate is going to block anything, even if the House got behind it.

So, I think the answer is that there has to be a shuffling in the Senate. But, again, I don’t follow politics that closely. I don’t know what the probability of that would be.

[00:57:42.090] – Grumbine

Understood. There’s no point in asking an economist to come on, I guess, to tell us about political strategy. But I still tried. So, I don’t disagree with you there. But I do want to say that I really appreciate the work you’re doing, and I appreciate that you continue to do it. I really love the work you and Yeva do, and it was very nice to have her on.

I also was able to get her to join us for a medicare for all discussion where she talked about the funding mechanisms for national, not state, but national medicare for all, which is the right way to go, of course, and had a podcast where we talked about the prior paper you guys put out right before this most recent one.

So, it’s nice to have her on there as well. It’s good to see you guys writing together. And I guess we’ll just keep pushing forward, try to get the word out. So, I really appreciate you taking the time to be with me today.

[00:58:39.150] – Wray

Yeah. Thanks a lot. It was fun.

[00:58:42.050] – Grumbine

Yeah, absolutely. Thank you so much. Once again, folks, this is Steve Grumbine with Randall Wray. Please check out our podcasts. We have transcripts for every one of them. Please use them. They are a resource for your debates out there. Come to Macro N Cheese and do the research. So, with that, I’m Steve Grumbine with Randall Wray for Macro N Cheese. We’re out of here.

[00:59:35.840] – End credits

Macro N Cheese is produced by Andy Kennedy, descriptive writing by Virginia Cotts, and promotional artwork by Andy Kennedy. Macro N Cheese is publicly funded by our Real Progressives Patreon account. If you would like to donate to Macro N Cheese, please visit patreon.com/realprogressives.

L. Randall Wray – Guest

A professor of economics at Bard College. His current research focuses on providing a critique of orthodox monetary theory and policy, and the development of an alternative approach. He also publishes extensively in the areas of full employment policy and, more generally, fiscal policy.

Hyman Minsky

An American economist, a professor of economics at Washington University in St. Louis, and a distinguished scholar at the Levy Economics Institute of Bard College. His research attempted to provide an understanding and explanation of the characteristics of financial crises, which he attributed to swings in a potentially fragile financial system

Yeva Nerisisyan

A Research Scholar at the Global Institute for Sustainable Prosperity and an Associate Professor of economics at Franklin and Marshall College. She received her B.A. in economics from Yerevan State University in Armenia, and her M.A. and Ph.D. in economics and mathematics from the University of Missouri-Kansas City. She is a macroeconomist working in the Post Keynesian and Institutionalist traditions. Her research interests include monetary theory, financial instability and regulation and macroeconomic policy.

New Economic Perspectives – MMT Primer

Paul Volker

An American economist who served as the 12th chair of the Federal Reserve from 1979 to 1987. During his tenure as chairman, Volcker was widely credited with having ended the high levels of inflation seen in the United States throughout the 1970s and early 1980s

Jerome Powell

An American central banker and former investment banker serving as the 16th chair of the Federal Reserve. He was nominated to the Board of Governors in 2012 by President Barack Obama, and subsequently nominated as chair by President Donald Trump to succeed Janet Yellen in the position,

IMF – International Monetary Fund

An international financial institution, headquartered in Washington, D.C., consisting of 190 countries. Its stated mission is “working to foster global monetary cooperation, secure financial stability, facilitate international trade, promote high employment and sustainable economic growth, and reduce poverty around the world.”

Larry Summers

An American economist who served as the 71st United States Secretary of the Treasury from 1999 to 2001 and as the 8th Director of the National Economic Council from 2009 to 2010.

The Guardian Inflation: Corporate America

OPEC – Organization of the Petroleum Exporting Countries

An intergovernmental organization of 13 countries. Founded on 14 September 1960 in Baghdad by the first five members (Iran, Iraq, Kuwait, Saudi Arabia, and Venezuela), it has, since 1965, been headquartered in Vienna, Austria, although Austria is not an OPEC member state

OPEC decisions have come to play a prominent role in the global oil market and international relations.

Jerry Brown

An American lawyer, author, and politician who served as the 34th and 39th governor of California from 1975 to 1983 and 2011 to 2019.

IPCC

The Intergovernmental Panel on Climate Change is an intergovernmental body of the United Nations responsible for advancing knowledge on human-induced climate change.

SWIFT

The Society for Worldwide Interbank Financial Telecommunication, legally S.W.I.F.T. SC, is a Belgian cooperative society providing services related to the execution of financial transactions and payments between banks worldwide.

Chris Smalls

An American labor organizer known for his role in leading Amazon worker organization in Staten Island, a borough in New York City. He is the president and founder of the Amazon Labor Union since 2021.

John Yarmuth

An American politician and former newspaper editor serving as the U.S. representative for Kentucky’s 3rd congressional district since 2007. His district encompasses the vast majority of the Louisville Metro Area. Since 2013, he has been the only Democratic member of Kentucky’s congressional delegation. Yarmuth chairs the House Budget Committee.

Related Podcast Episodes

Related Articles

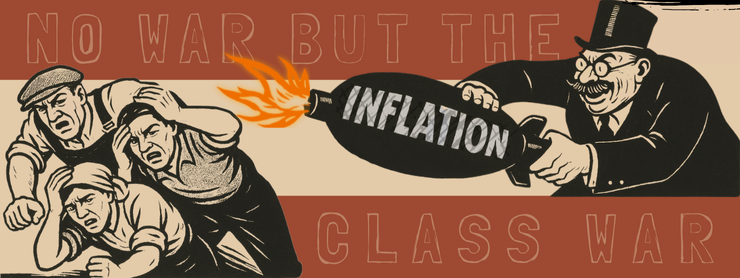

Inflation as a Weapon of Class Power: A Modern Monetary and Marxist-Leninist Perspective

Do Bond Sales & Borrowing Finance US Deficit Spending?