Originally posted on May 13, 2014 at the New Economic Perspectives blog.

What do you get when you drop taxes? Well, Bitcoins. Sometimes the only appropriate response to critics is embarrassment. For them.

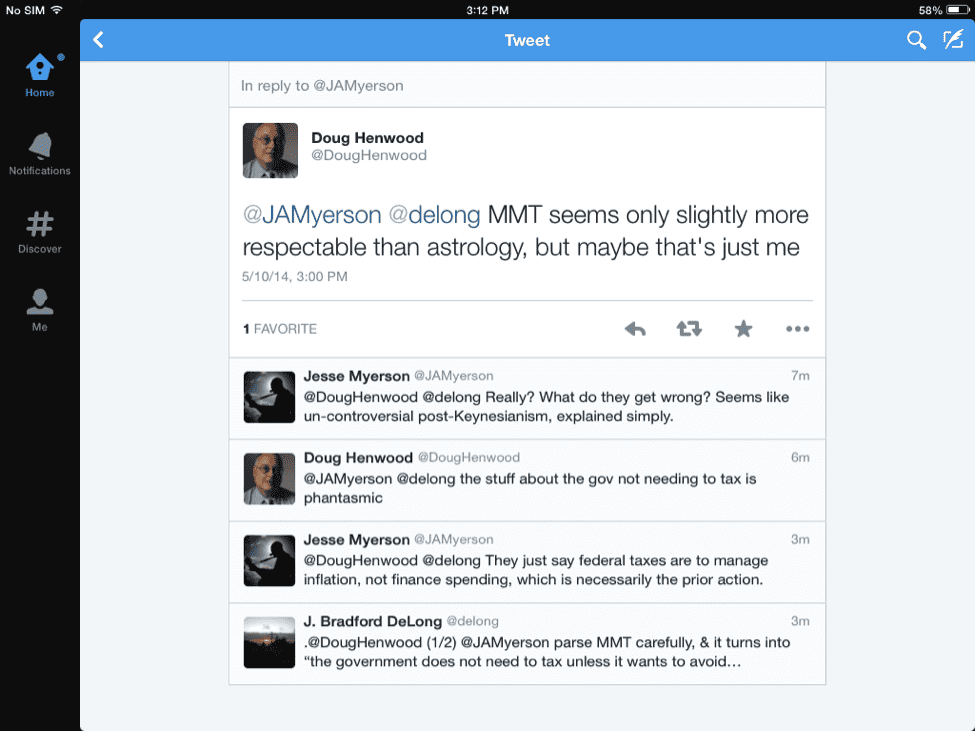

Witness the following exchange on twitter:

Full disclosure: I don’t twit, but someone sent this to me. I have no idea what transpired after that doozy of an exchange.

In that, Doug Henwood repeats a bit of silliness I’ve seen from monumentally uninformed critics: MMT claims government doesn’t need taxes. Where do they get this stuff?

How does every MMT explanation of government currency begin? Taxes Drive Money. Put the damned phrase into your favorite search engine. I just did it in quotes to limit the hits. I got 36,000. I did not scroll to the bloody end, but virtually all the links up top went to the MMT literature.

We emphasize over and over and over that without the obligation, acceptance of the government’s currency would come down to a Dumb and Dumber greater fool theory: I accept the currency because I think BiffyBob and BillySue will accept it.

Now, to be sure, taxes are not the only obligation that will drive the currency. As we’ve pointed out countless times, the farther you go back in history the more you will find that other kinds of obligations drove the currency—tithes, tribute, fees, and fines. History is on our side. There are very few examples of currencies that do not have such obligations behind them.

OK, there are Bitcoins. More later.

Jesse Myerson has this right—this is just Post Keynesian theory explained simply. Does anyone doubt that modern sovereign governments impose taxes? Does everyone notice that in almost all cases governments choose a money of account, impose taxes in that unit, and issue currency in that unit.

Is the following logic oh-so-difficult to understand?

From inception why would anyone except BiffyBob and BillySue accept a “fiat” currency if there were no better reason to accept it other than the dupe-a-dope expectation that someone else is dumb enough to take it? OMG if that works, I’ve got a stack of my business cards I’m willing to exchange for your Beemer.

No, we are not that stupid.

As Warren Mosler long ago realized, if he could impose a business card tax on his kids, he could get them to wash the car to earn the means of tax settlement. When he paid the business cards to them, his kids did not wonder if they could find dopes to take them. But they understood that if they didn’t pay their taxes they’d face punishment. Probably not prison, but perhaps straight to bed after dinner with no TV.

Taxes drive business cards. And currencies.

Now, did Warren need to receive his own business cards in tax revenue in order to pay the kids to wash the car? Of course not. He spent first, then got the tax revenue.

Yes, Jesse, this is Post Keynesianism for Dummies. (No disrespect meant; just a play on a common theme used for book titles.)

What, you mean government does not need tax revenue in order to spend? Precisely, Sherlock. Is that an outrageous statement? For anyone who has lived in the USA since its inception, it should be obvious. Except for seven brief periods, our government has always spent more than it received in taxes.

And that would mean exactly what? That the revenues were not needed for the spending, Sherlock.

Now, since we’ve established that government can spend without revenue, what is the danger of spending more than revenues?

Again, Jesse hit that nail on the head: a potential for inflation—if the economy is driven beyond full capacity. Hence, one response to such dangers could be to raise taxes. Another could be to cut spending. There are other responses that we won’t go into here—wage&price controls, rationing, importing, encouraging more production.

Well, if government can spend without tax revenue, why doesn’t it just eliminate taxes altogether?

It is elementary, my dear Holmes. Taxes drive the currency.

Another way of putting it is that taxes redeem the currency. All issuers of IOUs must stand ready to redeem them.

Redemption is important in both monetary and spiritual affairs.

Again, this is just good Post Keynesianism. It is actually a basic law of credit: you must take back your own IOU when it is presented to you in payment.

Banks do it, too. Believe it or not, debts to banks drive acceptance of “bank money”. That is the private money analogue to taxes.

Imagine if banks were willing to buy IOUs (we call that lending) but refused to accept their own IOUs (we call them demand deposits—or checking accounts) when debtors tried to repay their loans.

Would you be willing to accept the bank IOUs that the issuing banks would not accept in payment?

Or, more relevantly to our taxes-drive-money question, what if banks bought your IOUs by issuing demand deposits (again, we call that lending—and this is the way it works in the real world, even though some very famous economists, including one PK, deny it) but then told you “Oh, you don’t need to ever return those demand deposits to us.”

In other words, you could sell your IOUs to get demand deposits issued by banks without ever being required to “redeem” them (and yourself) by repaying banks?

How much would those bank demand deposits be worth? You and everyone else could run down to the banks to sell your debt to banks—without you or anyone else ever needing the bank IOUs for repayment of your loans.

Just how long would you be able to dupe some dope into taking the bank IOUs in payment?

Probably not too long. Same story with taxes. Abolish taxes and see how long the dopes who don’t need US currency to pay taxes will continue to sell stuff to get US currency. Oh, it could go on a while. If PT Barnum was correct, there’s a dope born every minute. Sixty an hour. It adds up.

Witness Bitcoins. ‘Nuff said.

I don’t need Bitcoins to make any obligatory payments. And no Bitcoin issuer is required to take them back. Bitcoins are not redeemable.

Unless you are involved in illegal activity or trying to hide income and wealth, there’s really only one compelling reason to accept them: you really do believe in the greater fool theory. You’re going to dupe the dopes and ride that Bitcoin up and pray that a) you don’t lose your wallet; b) your exchange doesn’t go bankrupt; and c) you can sell out of Bitcoins before the whole thing crashes.

So, to sum up.

MMT says that taxes and other involuntary obligations create a demand for the currency—so long as that currency is needed to pay taxes.

This means government can buy stuff by issuing its currency since taxpayers need it. Others will accept it—not because they think they can dupe BillySue, but because there are a lot of BiffyBobs out there who owe taxes.

Are taxes needed to “pay for” government’s spending? No. Taxes are needed to create a demand for the currency.

Now, I’ve heard even a prominent Keynesian say: “But I never think about taxes when I accept the currency. I accept it because I think BiffyBob will take it.”

Obviously, not a particularly deep thinker, that one.

This comment was made before an audience of legal history scholars, who broke out in hysterical laughter at the apparent shallowness of economists. That is to say, those who are supposed to be studying the economy and its institutions.

I saw the look of sheer terror on his face. He’d killed with this line dozens of times, before audiences of economists. The ultimate take-down of MMT. But here he was, in front of people who actually knew the history of money, who could cite the court cases going back to Roman times that delineated the sovereign’s power to issue a sovereign currency. Guffawing at him. He looked for the exits.

They all yelled at him: “It’s all about the taxes!”

I was embarrassed for him. Forty years of studying economics down the drain. Not just economics, but macroeconomics. Not just macro, but monetary economics. “I accept dollars because I think BillySue will take them.” It was all he had. He mumbled as he left “I guess I’ll have to think about this a little deeper.”

(True story.)

I wonder how many Bitcoins he’s got in his wallet?

TDM (taxes drive money) is a secret only to economists. Time to break it loose.

We are not making this up. Read Marriner Eccles, Beardsley Ruml, and Frank Newman. All of them — FDR’s Fed Chairman, President of the NY Fed and former Deputy Secretary of the US Treasury, respectively, have said EXACTLY the same things we’re saying when we talk about the role of taxes.

I’ll continue this thread.

40 RESPONSES TO “DO WE NEED TAXES? THE MMT PERSPECTIVE”

- Robert Avila | May 13, 2014 at 8:42 am |The idea at the center of their thinking is “Taxes Finance Spending.” For them the idea that it might be true that “Taxes Drive Money” is a possible, curious side point. The key issue is the old King John / Sheriff of Nottingham issue of the government wanting taxes to pay for its wonton spending. The only thing worse than “Taxes Finance Spending” (which as we know is right up there with “Death ends Life”) is “Debt Shifts Taxes.”

- Robert Searle | May 13, 2014 at 9:48 am |If we had a far more accurate understanding of economic than presently exists it is perfectly possible that taxes could be phased out altogether. How this could be achieved is indicated my evolving project of Transfinancial Economics

- micky9finger | May 13, 2014 at 10:15 am |1st: Robert Avila. Huh?Poor L. Randall Wray is starting to lose it. Understandable. He’s crying out in the wilderness.

The problem is that the twitterers don’t read MMT. and PK either it seems. - Jerry Hamrick | May 13, 2014 at 10:32 am |Well, do I feel like a dope. I asked about taxes on another blog post on this site a week or two ago. Nobody responded, I guess they were just trying to be nice, and I really do appreciate their consideration. But even though I recognized myself as one of the targets of your harangue, I took no offense. I really do understand that it is hard to maintain one’s patience over extended periods when confronted with people who just don’t get it. And far be it for me to make any suggestions to you, and ordinarily I wouldn’t, but because what the MMT approach can bring to the People (I assume you think it would be good for the People to properly integrate MMT into our systems), I feel compelled to make a few observations.I am an old man. I first heard of MMT ideas in 1949, and the same discussion about taxes, inflation, etc. happened then. I heard similar discussions fairly often until I went away to college. There I learned to keep my mouth shut because the powers that be did not like MMT-type thinking. I taught math, and later went into computer systems. This now brings us to the present. For 9 years now I have been working on a design of a system that would employ MMT ideas. In the meantime I have been watching you and others who are in the lead on MMT and I want to tell you that I am very disappointed. I want your ideas to be a big success, and believe it or not, I am trying to make them a success, in my own oblique way. And, also believe it or not, I have made other unusual ideas a success many times before. So, I have been hoping that you and your associates would do a champion job of promoting MMT, but you haven’t. You do a really poor job, and this blog post is the latest example. But this is not the first time I have seen this situation. Lots of people have no idea how to sell an idea.Frankly, it just wears me out to see you guys spinning your wheels. In the years I have been watching you, you have gained no ground.But, back to money and taxes. There are ways to control inflation other than taxes and you mentioned several here. But you are crippled by the current systems–you just can’t seem to break out. There are other ways to create demand for the fiat currency without imposing taxes of most kinds. Some taxes would be needed for other purposes, but not to control inflation and not to create demand for the currency. But you know this already. What you apparently do not know is how to design a system that will work without taxes. And what is more you do not know that such a system will have several societal benefits that are not part of MMT but are part of building a society wherein all persons can live very long lives that are worth living. In short MMT is just part of a process that can produce even more transformative changes than you folks seem to envision.But, I understand the frustration that must be yours. To know that your ideas are sound and would be good for the People, and have the powers that be not only reject your ideas but actually ridicule them. I would be angry too.But I am working on my own projects and I am very old, so I don’t have time to waste. I am getting to launch my own project, and there is no doubt that you can make my life easier if you suddenly decide to do a first rate job of promoting MMT. If I can help just say the word. I am not kidding. I made my living by making something out of nothing but an idea.

- MRW | May 13, 2014 at 10:36 pm |Jerry,You are not the target of the harangue. (And I think this harangue is useful and I welcome it.)Well, do I feel like a dope. I asked about taxes on another blog post on this site a week or two ago. Nobody responded, I guess they were just trying to be nice, and I really do appreciate their considerationThat’s because the UMKC teaching staff are busy grading papers or traveling to give talks, not because someone is avoiding you. Don’t be offended and don’t take it personally. Now, there’s a new wrinkle. WordPress, or maybe neweconomicperspectives, cuts off the ability to reply within a set amount of hours/days, so if someone can only read the comments over the weekend, they are frequently out of luck responding to comments.Have you checked out the Rimini talks (Feb 2012)? They’re on youtube and the slides on Slideshare. Some of the transcripts are on media roots.org.Do you know about the http://www.modernmoneynetwork.org series at Columbia Univ? Click on The “Money” Series on the left and start with 2012. Some of the presentations are complicated, some not. But all incredibly useful and good to know that Columbia law students are getting their fill of this before they graduate.

- MRW | May 13, 2014 at 10:51 pm |Google: Rimini Kelton Hudson Black Parguez

or google separately:

Rimini Kelton

Rimini Hudson

Rimini Black

Rimini Parguez (this guy is really fascinating. describes the dark history of the Euro. Hard to understand, but worth every minute. I downloaded and speeded him up to listen to him.) - Jerry Hamrick | May 14, 2014 at 10:19 am |I think that people like me were the target of the harangue. But, as I said, it really does not matter. But the harangue revealed deep frustration and when one sets out to embarrass other people, as the author declared he was going to do, while it may be fun, will not get one anywhere.And that is the more important issue. Just where does the MMT school of economic thought want to go? Does it want to have influence over policy making? Or does it want to remain as an afterthought barely listed as one of the heterodox schools of thought? Because that it is what it is today. And I think that is a great shame. I think MMT can be of immense value, and if you and the leaders don’t think so, then why bother with the harangue?Everything I see convinces me that the leaders of MMT want to be respected and they want their ideas to be adopted. They want to make the world a better place. So do I, and as corny as it may sound, I am working hard every day trying to make that happen. I have been doing it for decades…So, if the people who believe in MMT want to create worthwhile change, and if they have been at for a few years now, why hasn’t the change taken place? Is it too soon to expect change? If so, when will it take place? How long must one wait before one reevaluates one’s approach?I think it is time to reevaluate, and perhaps the harangue is an indicator that someone is ready to do that–or ready to give up. Both are possible.It is clear to me and has been clear for years now that the current process will not work. Let me repeat: it will not work. The effort seems to be to prove who is the smartest rather than what is the best way to serve the People. Big difference. All the difference in the world. If one wants to make the world a better place by implementing MMT then one needs a different approach. But every time I try to start this conversation with someone from MMT I get shunted off to a side track.So, let me come at it another way. Just suppose that I am not a fool, and suppose that I am not as stupid as you think I am, (even though you have been nice about it), and suppose that I can persuade lots and lots of people to look seriously at MMT. Would I do it? No. I would not. The reason is that there will be only a limited chance to persuade these people and therefore MMT has to have a story to tell them. And MMT does not have a story. It has a bunch of nonsensical-sounding responses to the nonsensical-sounding pronouncements of the current rulers of academic economics. That is going nowhere.MMT is in a great place. The People already are convinced that the current economic process is a pile of steaming, stinking crap. All MMT has to do is forget about pointing at that pile of crap and saying, “See, we told you they were wrong!”, and turn to point at a garden of flowers. But MMT gets down and plays in the crap right along with all those people they rightly believe to be wrong.Now, I am trying to get lots and lots of people to take a serious look at MMT ideas, and I probably will fail. But I have succeeded before with the same approach. I have been able to get people to look at new ideas and in most cases adopt them. So as things stand right now I can’t tell them to look at this website, I can’t tell them to read your books, I can’t tell them to watch your various videos. The people I am talking about are not interested in economic jibber-jabber they are interested in the bottom line. They want to know what MMT can do for them. So, that is how one sells something. You find out what the people want and you deliver it. The people want a sweeping new economic paradigm and they can’t find what they want. I have such a paradigm already designed and while I was doing that work I hoped that MMT would get its act together so that I could point at the group here and say, “See, here are some experts and they have built the intellectual foundation for the new economic system that I have designed.” Don’t worry that it doesn’t exist, everybody knows that we don’t have it. What they want to see is a design of what it would look like and what it would do and how it can be implemented. That kind of thing is the thing that America can get excited about. And, as you surely must realize, the powers be are not even part of the equation. I speak frankly when I say that I would like to put a lot of the current economic rulers out of business.But that is not my main motive. I declare that I want to replace the current economic system with one built on MMT ideas. I want to build a better world. Where is the declaration of MMT’s goals? Why is it not emblazoned across the top of this website? Do you guys mean business or are you just playing at being grownups?I will wait for you reply.

- MRW | May 14, 2014 at 11:42 pm |@Jerry,Just to be clear, I am not part of this blog, nor am I an economist. I’m just a regular schmoe trying to understand MMT. When you made similar complaints on another thread, I wrote a long reply to you and the blog owners saying that I thought they should listen to your complaints, because you were right. By the time I was ready to click Post Comment, the right to reply had disappeared. ;-(So I am going to post this quickly before it gets lost. Hey, the reason why I know this ‘harangue’, as you call it, isn’t for you is the Doug Henwood tweet that starts it off. Henwood squawks about the economy and what he thinks it is on his own Public Radio show in San Francisco; he has a bully pulpit. Wray is losing his temper with “economic” or “business” writers or broadcasters like Henwood who claim to know what they are talking about, or who adopt positions vis-a-vis heterodox ideas without investigating them. And I am 100% behind him giving them a kick in the ass because it is their sorry-ass writing and broadcast pontificating that is keeping good ideas from reaching the public. (How someone like Erin Burnett gets to comment on the economy is beyond me. She doesn’t have a clue what she’s talking about.) And the other proof you need are Wray’s references at the bottom to Eccles, Ruml, and Newman to convince know-nothings like Henwood that there are experts out there he knows nothing about.I too think they should clean up this blog, and make it more accessible to people who don’t know what MMT is. Right now their working audience is academics who sniff if the language isn’t scholarly. I think they should remove all political stuff (Mosler makes it a distinct point to always separate politics from what he is talking about) and I think they should remove the climate change/environment stuff. And we can throw religion and the need for clean bath water in with it. The argument for MMT needs to be made cleanly without issues that annoy people on one side or the other. The fastest way to have a new idea killed is to attach it to something the public has already got an opinion about; it’s brain-dead stupid.Gallup poll after gallup poll shows what the American people are concerned about. #1 is the economy. So are #2 and #3. I would love to see Scott Fullwiler reduce some of his complicated explanations of how the US Treasury works to just simple illustrations that drove it home. Thing is what Scott describes is complicated; however, Scott is the guy who made that great graphic of the sectoral balances that shows the public, private, and foreign sectors in either surplus or deficit. If he can do that, he can do the US Treasury. Easy-peasy.

- MRW | May 14, 2014 at 11:42 pm |@Jerry,Just to be clear, I am not part of this blog, nor am I an economist. I’m just a regular schmoe trying to understand MMT. When you made similar complaints on another thread, I wrote a long reply to you and the blog owners saying that I thought they should listen to your complaints, because you were right. By the time I was ready to click Post Comment, the right to reply had disappeared. ;-(So I am going to post this quickly before it gets lost. Hey, the reason why I know this ‘harangue’, as you call it, isn’t for you is the Doug Henwood tweet that starts it off. Henwood squawks about the economy and what he thinks it is on his own Public Radio show in San Francisco; he has a bully pulpit. Wray is losing his temper with “economic” or “business” writers or broadcasters like Henwood who claim to know what they are talking about, or who adopt positions vis-a-vis heterodox ideas without investigating them. And I am 100% behind him giving them a kick in the ass because it is their sorry-ass writing and broadcast pontificating that is keeping good ideas from reaching the public. (How someone like Erin Burnett gets to comment on the economy is beyond me. She doesn’t have a clue what she’s talking about.) And the other proof you need are Wray’s references at the bottom to Eccles, Ruml, and Newman to convince know-nothings like Henwood that there are experts out there he knows nothing about.I too think they should clean up this blog, and make it more accessible to people who don’t know what MMT is. Right now their working audience is academics who sniff if the language isn’t scholarly. I think they should remove all political stuff (Mosler makes it a distinct point to always separate politics from what he is talking about) and I think they should remove the climate change/environment stuff. And we can throw religion and the need for clean bath water in with it. The argument for MMT needs to be made cleanly without issues that annoy people on one side or the other. The fastest way to have a new idea killed is to attach it to something the public has already got an opinion about; it’s brain-dead stupid.Gallup poll after gallup poll shows what the American people are concerned about. #1 is the economy. So are #2 and #3. I would love to see Scott Fullwiler reduce some of his complicated explanations of how the US Treasury works to just simple illustrations that drove it home. Thing is what Scott describes is complicated; however, Scott is the guy who made that great graphic of the sectoral balances that shows the public, private, and foreign sectors in either surplus or deficit. If he can do that, he can do the US Treasury. Easy-peasy.

- Jerry Hamrick | May 14, 2014 at 11:00 am |Yes, I am aware of many of those resources, and in fact, I will bet that I have listened and viewed and read more of MMT’s resources than most people. I will bet that most people walk away quickly. They don’t need the aggravation. But I was convinced more than 60 years ago that the ideas of what is now called “MMT” are sound and can be the basis for a new economic system. When I first heard these ideas they were called “Rocky Mountains Made of Gold.” But there is no school of economics that is called the “Rocky Mountains Made of Gold School” so I started looking for the next best thing, and I found MMT. Imagine my frustration when I found that MMT adherents seem to feel that they are superior to everyone else and that the unwashed need to be bathed in this book or that audio file or that video. And imagine my frustration when, upon bathing in those waters, I find that I am not cleansed, I find that no clear path to a better world emerges. So, you prophets need to listen to the unwashed, you may learn something.MMT adherents are missing the point. They seem to think that people that ask questions are stupid. They, the MMTers, know that their ideas are simple and straightforward and they therefore cannot understand why people keep asking questions. The point is that newbies do understand MMT’s ideas, but they want to then move to a discussion of how those ideas would be applied. And MMT does not have an answer and avoids even discussing it. That turns people off, and if you want to turn people off, and if you want to frustrate, insult and embarrass them, then you have got the formula. It works very well.When people like me come to your blog, they come because it is personal to them. They think that you may have the answer they have been searching for. So, try to remember that. By helping people get what they want, you may get what you want.

It is a better formula than the one you have now.

- MRW | May 13, 2014 at 10:51 pm |Google: Rimini Kelton Hudson Black Parguez

- Gus | May 14, 2014 at 2:46 am |Jerry Hamrick: Hmm, what do you mean by “properly integrate MMT into our systems”? As far as I can tell, the main thrust of MMT is getting people to recognize how the system already works at present, through essential concepts of chartalism, sectoral balances, endogenous money, etc. (backed up by history, logic, and empirical results/operations).What is the main project that isn’t being properly marketed here? It seems like the crucial step is just getting more & more people to engage with these concepts until they click, where people can then correctly prioritize goals (as Kelton has been saying, “balance the economy” rather than “balance the budget”). Once you grasp the MMT understanding of macroeconomics, then you can follow down the path of more enthusiastically supporting moral projects like job guarantee, universal basic income, rebuilding infrastructure, creating a green/sustainable 21st+ century system, etc.

- Jerry Hamrick | May 14, 2014 at 9:39 am |Gus:I don’t know who you are. I was writing to the leaders of the MMT school of thought several of whom are bloggers here, maybe you are one. I have seen several of them on television, I have read some of their papers, and seen some youtube type videos here and there. They seem to all be engaged in trying to get the system changed from what it is today to what it could be under MMT. Some of their books are quite explicit about this. So, your idea that MMT leaders are simply trying to educate the public about how the present system works, I think, is no goal at all.But no matter what is being marketed, it is not be marketed very well. Go to the NYT and search back to 1851 for the variations of MMT and you will find that mentions, even in recent years, are few and far between, and most of them are negative. The television appearances likewise. In general it seems that the public is not aware of MMT and policy makers really do not take it seriously.Now if you want to be taken seriously, and if you want to make the world to be a better place ecnomically, and if you think you have just the right idea to accomplish all that, then you better change the way you are trying to sell it.The process being followed here by the big boys and girls is weak, shapeless, and hopeless.

- Jerry Hamrick | May 14, 2014 at 9:39 am |Gus:I don’t know who you are. I was writing to the leaders of the MMT school of thought several of whom are bloggers here, maybe you are one. I have seen several of them on television, I have read some of their papers, and seen some youtube type videos here and there. They seem to all be engaged in trying to get the system changed from what it is today to what it could be under MMT. Some of their books are quite explicit about this. So, your idea that MMT leaders are simply trying to educate the public about how the present system works, I think, is no goal at all.But no matter what is being marketed, it is not be marketed very well. Go to the NYT and search back to 1851 for the variations of MMT and you will find that mentions, even in recent years, are few and far between, and most of them are negative. The television appearances likewise. In general it seems that the public is not aware of MMT and policy makers really do not take it seriously.Now if you want to be taken seriously, and if you want to make the world to be a better place ecnomically, and if you think you have just the right idea to accomplish all that, then you better change the way you are trying to sell it.The process being followed here by the big boys and girls is weak, shapeless, and hopeless.

- MRW | May 13, 2014 at 10:36 pm |Jerry,You are not the target of the harangue. (And I think this harangue is useful and I welcome it.)Well, do I feel like a dope. I asked about taxes on another blog post on this site a week or two ago. Nobody responded, I guess they were just trying to be nice, and I really do appreciate their considerationThat’s because the UMKC teaching staff are busy grading papers or traveling to give talks, not because someone is avoiding you. Don’t be offended and don’t take it personally. Now, there’s a new wrinkle. WordPress, or maybe neweconomicperspectives, cuts off the ability to reply within a set amount of hours/days, so if someone can only read the comments over the weekend, they are frequently out of luck responding to comments.Have you checked out the Rimini talks (Feb 2012)? They’re on youtube and the slides on Slideshare. Some of the transcripts are on media roots.org.Do you know about the http://www.modernmoneynetwork.org series at Columbia Univ? Click on The “Money” Series on the left and start with 2012. Some of the presentations are complicated, some not. But all incredibly useful and good to know that Columbia law students are getting their fill of this before they graduate.

- Tyler | May 13, 2014 at 11:17 am |In the words of Hyman Roth, Henwood is “small potatoes.” I’d aim directly at DeLong.

- Tom | May 13, 2014 at 11:20 am |Paul Collier – the development studies specialist – has a thing about the informal economy as a disaster for “developing nations” because it does the exact opposite of taxation – it undermines the relationship between State and people. He says taxation is vital for formalising the economy, for creating a basis for an accountable government. Bitcoin is informalism, and quite possibly just as negative as a hollow State unable to tax the informal economy.

- Mick StJohn | May 13, 2014 at 3:16 pm |Jerry Hamrick: On the contrary, MMT ers are banging the drum at all levels of understanding. The problem is political and self-educational. Few want to be educated preferring to be spoon fed ideas by the followers of the status quo. That is orthodox economists and politicians of most all stripes spouting commonly accepted but proven false beliefs.Many of these accepted beliefs are proven to be wrong but are, as PK has labeled them, zombie ideas. They can’t seen to be killed.

- micky9finger | May 13, 2014 at 3:18 pm |see above. AKA micky9finger

- Nick Edmonds | May 13, 2014 at 3:21 pm |“….debts to banks drive acceptance of “bank money”. That is the private money analogue to taxes.”Does it make sense to say that taxes drive state money and bank debt drives private money, given that we have a system where they are fully convertible at par. Surely, you only need to drive one and it drives the other.

- financial matters | May 13, 2014 at 7:59 pm |There is still an hierarchy of money. State money, sometimes called high-powered money, backs bank money. Banks can fail and may need to be restructured or bailed out by the state if they make imprudent loans. We made the big mistake of bailing out banks that made fraudulent loans.

- Nick Edmonds | May 14, 2014 at 10:16 am |You seem to be suggesting more of a kind of backing theory as regards bank money. Does that mean you disagree with what Wray is saying here? Why would you say people accept bank money?

- financial matters | May 14, 2014 at 4:08 pm |No, this is essentially taken from his primer on MMT. And he has suggested that the Fed give up it’s regulatory role as it has shown no interest in it.

- financial matters | May 14, 2014 at 4:08 pm |No, this is essentially taken from his primer on MMT. And he has suggested that the Fed give up it’s regulatory role as it has shown no interest in it.

- Nick Edmonds | May 14, 2014 at 10:16 am |You seem to be suggesting more of a kind of backing theory as regards bank money. Does that mean you disagree with what Wray is saying here? Why would you say people accept bank money?

- financial matters | May 13, 2014 at 8:26 pm |It’s also probably useful to add a qualifier to the statement that Fed reserves don’t ‘go anywhere’. It’s true that banks create loans first and then the reserves are created to back these loans. But this makes the apparently incorrect assumption that the Fed is also capable of regulating banks to make prudent loans which don’t injudiciously drain Fed reserves.

- lrwray | May 14, 2014 at 11:04 am |yes on right track. as minsky said, one of the reasons why we all accept bank IOUs is because most of us owe the banks.

- financial matters | May 13, 2014 at 7:59 pm |There is still an hierarchy of money. State money, sometimes called high-powered money, backs bank money. Banks can fail and may need to be restructured or bailed out by the state if they make imprudent loans. We made the big mistake of bailing out banks that made fraudulent loans.

- James Cooley | May 13, 2014 at 9:38 pm |In our federal system of government, taxes may be essential to initially establish (drive) the currency, but because states, counties, municipalities, and yes, even private businesses including banks, are users of the national currency and impose their own taxes ( or interest in the case of banks) on most earners of the currency, I think federal taxes could be largely eliminated and the currency would still be valued. Perhaps not reduced to zero, but certainly reduced greatly.

- DeusDJ | May 14, 2014 at 1:19 am |I guess things got quiet enough for the New York marxist and his band of left coast Marxist elitists to comment on something that’s been digging at their heals for a while. Any set of theories or beliefs that doesn’t jive with the narratives that either Henwood, Jacobin, or other new york marxists like to push is beneath them, by definition.

- David Chester | May 14, 2014 at 4:19 am |There is so much rubbish being written and expressed about national macroeconomics that it is verry difficult to understand what is REALLY going on. But not impossible and it takes a detached person whose head in not in politics nor in investment nor in money nor in labor to really understand it. That is why my engineering style model of the national economy is the unbiased and simplist way (so far) of seing and subsequently analysing what is actually going on.see: Wikimedia, commons, Macroeconomics, DiagFuncMacroSyst.pdrwhich should be enlarged and printed in order to read and appreciate all 19 kinds of double flow activities within the system. Only this model is sufficiently accurate to properly cover the 3 factors of production of Adam Smith’s 1776 Wealth of Nations; (namely, Land, Labor and Capital producing goods and services and resulting in ground-rent, earnings, and interest or dividends). We have to catch up with 250 years of ignorance!

- BigRed | May 14, 2014 at 5:34 am |What I’ve always wondered about in this context (and finally dare to ask): this also implies that the state needs the monopoly of force (and the willingness) to punish those that don’t pay taxes, right?Which makes me wonder, if 1) governments that don’t punish tax evasion undermine their own currency, and 2) this relation might not be uncomfortably close to the anti-taxer statements about “men with guns” extorting them for taxes?

- Gus | May 14, 2014 at 10:09 am |Yeah I think the state money concepts do expose the ‘original sin’ of sorts, that the system does come down to the state imposing itself as a universal creditor through “fiat” taxation and threat of force. However, modern systems are at least a lot less barbaric than other possible systems (like the hut tax often mentioned). Once the official currency gets rolling, you can transition to progressive income taxation as the main money-driver / inflation-drain, so that the responsibility of paying taxes is relegated to those most able to do so. The primitive tribal alternative to abstract taxation was just that those who don’t participate and pull enough weight will get shunned or finally just ejected from their peers’ society. With the world gobbled up by national sovereignty (no more wilderness to be expelled to), that doesn’t quite work anymore, so most everyone existing is benefiting from being a member of their society.

- BigRed | May 15, 2014 at 5:29 am |@Gus: we still have threat of punishment though, and exile has been replaced by public shaming (which can be rather ineffective depending on society). And as much as I support progressive taxation, it also means that one tries and tax those more who can afford to circumvent the system best, so understanding how problematic tax evasion is for a fiat-currency issuers seems rather relevant for me.

- BigRed | May 15, 2014 at 5:29 am |@Gus: we still have threat of punishment though, and exile has been replaced by public shaming (which can be rather ineffective depending on society). And as much as I support progressive taxation, it also means that one tries and tax those more who can afford to circumvent the system best, so understanding how problematic tax evasion is for a fiat-currency issuers seems rather relevant for me.

- entreposto | May 14, 2014 at 11:03 am |You don’t really need to look very hard to find what happens to currencies where the state is either unwilling or unable to enforce tax collection and a large informal sector develops. Greece before (and some might say after) the Euro, basically all of Latin America in the 20th century, etc., are all sufficient examples and all experienced frequently (double-digit) rates of inflation and currency depreciation. Under the kings of yore, the “men with guns” were sufficient to collect taxes in their own highly inefficient manner, but modern states discovered they can collect much more efficiently and much more simply by providing representation and making the citizens think the tax payment is pseudo-voluntary. Even more modern states have discovered that modern technological payments systems can very efficiently be modified to apply taxation preferentially on those poor saps who don’t run the financial systems.

- BigRed | May 15, 2014 at 5:26 am |@Gus: I see the correlations, when it comes to South America, for instance, but I am not sure that there is causation. From what I’ve seen recently in Argentina, the main driver of inflation seems to be that expectation of inflation is self-fulfilling: Argentines are willing to buy dollars and euros at inflated rates, which then weakens the peso even further. The problem in this case seems to be more a storage-of-value one than a tax evasion one (I don’t have hard data for that

- BigRed | May 15, 2014 at 5:26 am |@Gus: I see the correlations, when it comes to South America, for instance, but I am not sure that there is causation. From what I’ve seen recently in Argentina, the main driver of inflation seems to be that expectation of inflation is self-fulfilling: Argentines are willing to buy dollars and euros at inflated rates, which then weakens the peso even further. The problem in this case seems to be more a storage-of-value one than a tax evasion one (I don’t have hard data for thaat assumption either, however).

- BigRed | May 15, 2014 at 5:27 am |Crap: should have been @entreposto

- BigRed | May 15, 2014 at 5:27 am |Crap: should have been @entreposto

- BigRed | May 15, 2014 at 5:26 am |@Gus: I see the correlations, when it comes to South America, for instance, but I am not sure that there is causation. From what I’ve seen recently in Argentina, the main driver of inflation seems to be that expectation of inflation is self-fulfilling: Argentines are willing to buy dollars and euros at inflated rates, which then weakens the peso even further. The problem in this case seems to be more a storage-of-value one than a tax evasion one (I don’t have hard data for that

- lrwray | May 14, 2014 at 11:09 am |Red: In democracies “we” (the big we) impose the taxes on ourselves; we elect governments that enforce the rules and punish the lawbreakers. However “we” (the little individual we) certainly do not enjoy paying those taxes (so much so that many of “us” will change behavior to evade–illegal– and avoid–legal– the payment of taxes. I do not see any inconsistency here. “We” all individually are anti-taxers but “we” collectively (at least most of us) support the government’s authority to impose and enforce them.

- BigRed | May 15, 2014 at 5:21 am |@Irwray: actually, I don’t see this as inconsistent at all.I just feel that first, this is a very important wrinkle: since taxation drives currency acceptance but effective enforcement is necessary for this to be applicable, there are in fact quite a few countries for which the fiat currency solutions might not be doable. In particular, I feel that there is a bit of a vicious cycle here: to become the kind of state that can develop itself by using fiat currency, one needs the kind of enforcement mechanisms and institutions that one cannot develop without, unless one has the raw fire power needed, in which case one might not be motivated to switch to a more modern system.And second, this leaves MMT open to an emotionally rather powerful attack: there’s a reason I picked up the “thugs with guns” phrasing. This becomes especially important since MMT rightfully renounces the “taxes as financing for spending” meme because then the “justification” for taxation seems to become weaker.

- lrwray | May 15, 2014 at 10:26 am |Red: i cannot see how that leaves MMT open to the rather silly argument that money has to be driven by thugs. Rather, it leaves the whole idea of democracy questionable. If you were right, then civil government is not possible. This is not an MMT problem, but rather a rejection of any kind of government based on anything but force.

- BigRed | May 15, 2014 at 1:42 pm |@Irwray: that an argument is rationally absurd doesn’t negate its emotional impact. I find the MMT narrative that government is there to get stuff done that we can’t done on our own, and that fiat money is a great lubricant to achieve socially desirable goals, very convincing. I additionally find this a great reason for supporting organized government, currency issuance, and taxation to enforce currency acceptance. (even though I am a bit disillusioned with many current governments)But then, I am the choir.I don’t know where it was but I read a comment last year on an MMT post in which the writer told about how hostile his wife was to the MMT framing of taxes because she barely made ends meet and hearing that her taxes would actually not finance anything made her feel even more as if government taxation was a scam. Wed that to the idea that one needs enforcement for taxation to work and you have a rather large hurdle to surmount. This hurdle is not rational, agreed, but it is real, and one needs a counternarrative of at least equal strength to deal with it.And the same thing holds for the problem with monopoly of force: when I try and explain MMT to people, I am often subjected to the argument that this works fine and dandy if one is an country with a strong industrial base but that developing economies will quickly run into currency depreciation problems and won’t be able to afford necessities (or even developed countries: I’ve been told an Naked Capitalism that MMT solutions won’t work for Iceland because it needs to import pharmaceuticals). If MMT in addition depends on the ability to collect taxes, this seems to rule it out for a lot of countries. Now, I can think of ways to help those countries, and the EU and US cracking down on tax evasion in those countries would certainly help, but once again, without such a narrative MMT appears unrealistic.FInally, re: government by anything but force – I assume I don’t have to tell you that there are lots of people who in fact do not believe that democratic government can work long term. Given that MMT offers in my opinion one of the strongest arguments for organized government, I find it problematic that the purely functional narrative of currency acceptance so nicely aligns with the “silly” argument against government.

- BigRed | May 15, 2014 at 1:42 pm |@Irwray: that an argument is rationally absurd doesn’t negate its emotional impact. I find the MMT narrative that government is there to get stuff done that we can’t done on our own, and that fiat money is a great lubricant to achieve socially desirable goals, very convincing. I additionally find this a great reason for supporting organized government, currency issuance, and taxation to enforce currency acceptance. (even though I am a bit disillusioned with many current governments)But then, I am the choir.I don’t know where it was but I read a comment last year on an MMT post in which the writer told about how hostile his wife was to the MMT framing of taxes because she barely made ends meet and hearing that her taxes would actually not finance anything made her feel even more as if government taxation was a scam. Wed that to the idea that one needs enforcement for taxation to work and you have a rather large hurdle to surmount. This hurdle is not rational, agreed, but it is real, and one needs a counternarrative of at least equal strength to deal with it.And the same thing holds for the problem with monopoly of force: when I try and explain MMT to people, I am often subjected to the argument that this works fine and dandy if one is an country with a strong industrial base but that developing economies will quickly run into currency depreciation problems and won’t be able to afford necessities (or even developed countries: I’ve been told an Naked Capitalism that MMT solutions won’t work for Iceland because it needs to import pharmaceuticals). If MMT in addition depends on the ability to collect taxes, this seems to rule it out for a lot of countries. Now, I can think of ways to help those countries, and the EU and US cracking down on tax evasion in those countries would certainly help, but once again, without such a narrative MMT appears unrealistic.FInally, re: government by anything but force – I assume I don’t have to tell you that there are lots of people who in fact do not believe that democratic government can work long term. Given that MMT offers in my opinion one of the strongest arguments for organized government, I find it problematic that the purely functional narrative of currency acceptance so nicely aligns with the “silly” argument against government.

- lrwray | May 15, 2014 at 10:26 am |Red: i cannot see how that leaves MMT open to the rather silly argument that money has to be driven by thugs. Rather, it leaves the whole idea of democracy questionable. If you were right, then civil government is not possible. This is not an MMT problem, but rather a rejection of any kind of government based on anything but force.

- BigRed | May 15, 2014 at 5:21 am |@Irwray: actually, I don’t see this as inconsistent at all.I just feel that first, this is a very important wrinkle: since taxation drives currency acceptance but effective enforcement is necessary for this to be applicable, there are in fact quite a few countries for which the fiat currency solutions might not be doable. In particular, I feel that there is a bit of a vicious cycle here: to become the kind of state that can develop itself by using fiat currency, one needs the kind of enforcement mechanisms and institutions that one cannot develop without, unless one has the raw fire power needed, in which case one might not be motivated to switch to a more modern system.And second, this leaves MMT open to an emotionally rather powerful attack: there’s a reason I picked up the “thugs with guns” phrasing. This becomes especially important since MMT rightfully renounces the “taxes as financing for spending” meme because then the “justification” for taxation seems to become weaker.

- Gus | May 14, 2014 at 10:09 am |Yeah I think the state money concepts do expose the ‘original sin’ of sorts, that the system does come down to the state imposing itself as a universal creditor through “fiat” taxation and threat of force. However, modern systems are at least a lot less barbaric than other possible systems (like the hut tax often mentioned). Once the official currency gets rolling, you can transition to progressive income taxation as the main money-driver / inflation-drain, so that the responsibility of paying taxes is relegated to those most able to do so. The primitive tribal alternative to abstract taxation was just that those who don’t participate and pull enough weight will get shunned or finally just ejected from their peers’ society. With the world gobbled up by national sovereignty (no more wilderness to be expelled to), that doesn’t quite work anymore, so most everyone existing is benefiting from being a member of their society.

- Javed Mir | May 14, 2014 at 10:32 am |–that government can spend without revenue–If we suppose an economy having zero taxation then the only way left is printing of Fiat currency for internal transactions and export oriented foreign exchange for external payments.

- lrwray | May 15, 2014 at 11:02 am |JerryH: We’ve had an endless stream of critics dropping by to tell us we’ve done an absolutely horrible job marketing MMT. Fine. We always welcome anyone to try to do a better job. I mean that sincerely. I am not a marketing major and make no claims about my ability to do that.

So far every critic who’s come along with this complaint has failed to do a better job than us–but I am sure it will happen, and we will bless the effort.

- Jerry Hamrick | May 15, 2014 at 1:27 pm |I accept your challenge. In fact, I was working on selling MMT-type ideas long before I heard of MMT. My efforts are continuing. In fact, I have a meeting Saturday with about twenty people who I think can advance my efforts. I will spend about five hours with them presenting my ideas for a new economic paradigm which does not include personal income taxes, and relatively few taxes overall.What has been missing from the MMT presentations I have seen and the MMT books I have read is the application of modern technologies to MMT ideas. These technologies make MMT easier to apply to our current system and they would change the playing field. Right now the economic powers-that-be are in control of the discussion, if it can be called that, but once you introduce new technologies then the discussion changes completely, and whoever drives the adaptation of technologies will be in control.These people I will meet with on Saturday, are not interested at all in what is wrong with the current system of economics, they are already convinced by their own experiences that it is abusive. They are only interested in how a new system could work and what it will do for them.I am excited. Which, by the way, is something that I have never seen in any MMT book or presentation. Excitement is contagious.I have worked on these ideas since the end of WWII, not MMT, that did not start until summer 1949, but on the general idea that our government systems needed a major overhaul. This idea was firmly planted in my brain by men returning from WWII. And I have worked on these ideas ever since. I have no doubt that I have spent 20 man years on the effort, not counting the things that I was learning in my work.My design of a new economic system has taken most of my time for the past nine years, nearly ten. And finally I am ready to launch. With the help of some others I will try to sell these ideas on several ways. And I will sell them to the customer. There will be no middlemen. If I do my job well, you will hear about it.But remember this, I am an old man, and yet because of this work, I go to bed each night full of plans for tomorrow. That is the way life should be.Anyhow, thanks for your response.

- Jerry Hamrick | May 15, 2014 at 1:27 pm |I accept your challenge. In fact, I was working on selling MMT-type ideas long before I heard of MMT. My efforts are continuing. In fact, I have a meeting Saturday with about twenty people who I think can advance my efforts. I will spend about five hours with them presenting my ideas for a new economic paradigm which does not include personal income taxes, and relatively few taxes overall.What has been missing from the MMT presentations I have seen and the MMT books I have read is the application of modern technologies to MMT ideas. These technologies make MMT easier to apply to our current system and they would change the playing field. Right now the economic powers-that-be are in control of the discussion, if it can be called that, but once you introduce new technologies then the discussion changes completely, and whoever drives the adaptation of technologies will be in control.These people I will meet with on Saturday, are not interested at all in what is wrong with the current system of economics, they are already convinced by their own experiences that it is abusive. They are only interested in how a new system could work and what it will do for them.I am excited. Which, by the way, is something that I have never seen in any MMT book or presentation. Excitement is contagious.I have worked on these ideas since the end of WWII, not MMT, that did not start until summer 1949, but on the general idea that our government systems needed a major overhaul. This idea was firmly planted in my brain by men returning from WWII. And I have worked on these ideas ever since. I have no doubt that I have spent 20 man years on the effort, not counting the things that I was learning in my work.My design of a new economic system has taken most of my time for the past nine years, nearly ten. And finally I am ready to launch. With the help of some others I will try to sell these ideas on several ways. And I will sell them to the customer. There will be no middlemen. If I do my job well, you will hear about it.But remember this, I am an old man, and yet because of this work, I go to bed each night full of plans for tomorrow. That is the way life should be.Anyhow, thanks for your response.

- slowsmile | May 15, 2014 at 10:20 pm |A very telling last sentence near the end of Jerry’s last post which I fully support.“There will be no middle men.”That small sentence incorporates everything I dislike about government and economics today. On the one hand you have the non-stop influence, corruption, cronyism and disloyalty of government to the rest of the American people for the sake of only special business interests(not for the sake of the ordinary citizen) and on the other side you have the ordinary citizens (and even some economists) who seem to so extraordinarily regard this sort of corrupt influence as perfectly normal and allowed or trivial at its worst in US politics and economic policy.But Jerry is right. Before you can implement any new economic measures that go directly against the wishes of these influential “middle men” you have to first create uninfluenced honest government. You will also have to change and educate ordinary Americans to this fact.I think that Jerry’s economics ideas are very noble and perhaps useful. But to actually implement his ideas would probably best be fairly described as The Mountain Coming to Mohammad. After all, in the current corrupt political environment, how do you change laws that are implemented by both Houses when most of their reps are already bought and paid for by corporate and financial interests? It’s almost an impossible task.Nevertheless, I wish Jerry the greatest success and luck in his economic endeavours.

- Jerry Hamrick | May 16, 2014 at 4:48 am |slowsmile:First, there is an actual model for the kind of government I describe. And my descriptions are much more detailed than these comments allow. In order to apply the methods and structure of this ancient model, all we have to do is apply modern technologies to their operating procedures. The model of course is the democracy of ancient Athens. (Now when I mention Athenian democracy, I almost always get slammed by observations that the Athenians had slaves and women were not citizens, etc. These facts are facts and I don’t dispute them. But in the process of designing systems one learns that good ideas can be found anywhere. The trick is to look with an unbiased eye. Just like MMT, ancient Athens has many good ideas. One of them was the way they handled a large, rich vein of silver in the mines of Laurium. They spent it on worthwhile projects that were good for the populace. And it paid off, their spending led to the victory at Salamis. Athenian democracy has many ideas that are superior to our Madisonian republic. I discuss the silver mines and nine other major Athenian ideas in my descriptions of my proposed systems.)As to your question about actually implementing change, I hate to say it, but what the heck. It will be very easy to do. It will take two election cycles (it could be done sooner, but plan on two) and the annihilation of our present corrupt system will be complete. I might even live to see it. But I know that I have a very good chance of seeing the beginning of the end of our Madisonian republic.Good ideas are like birds: they can be found almost anywhere and the occur in a wide variety.Just because you can’t think of a way to do something does not mean that I can’t–and vice versa.Thanks for the kind words.