In 1933, roughly a month after his inauguration, Franklin Delano Roosevelt issued a proclamation suspending the gold standard, effectively rendering the US dollar a free-floating fiat currency. Over the next year and a half, according to the testimony of General Smedley Butler, a number of the most powerful actors on Wall Street endeavored with escalating enticements to recruit the two-time Medal of Honor winner for an attempted coup that would later become known as the Business Plot. Names associated with the plot include familiar ones such as J.P. Morgan, Prescott Bush, Al Smith, Irine DuPont, Alfred Sloan, John Rockefeller, and Howard Heinz. Butler blew the whistle, testifying under oath to a congressional committee about the whole affair. The committee made no referrals, the justice department handed down no indictments, and various interested parties decided the incident was best kept quiet, but the participants also attempted no further direct action. Much about the incident seems perplexing. Treason, a capital offence, appears to be a disproportionately high risk to take for a group of people with everything to lose over something as abstract as a temporary suspension of the gold standard. A number of books help shed light on the problem with relevant historical context, but the true Rosetta Stone in the matter is Clara Mattei’s new book The Capital Order: How Economists Invented Austerity and Paved the Way to Fascism. In that book, as well as a recent interview on Real Progressives’ own Macro N Cheese podcast, she sheds new light on why such powerful men might feel such an existential threat that they would be willing to attempt such a desperate ploy.

These men were clearly aware that the torches and pitchforks were out for them. The Pecora Hearings were in full swing, and the public demands that the powerful be held to account were growing. These men and others of their socioeconomic cohort were also very vocal about their fears that socialist revolution was at their doorstep. We also know that while there were many economic reasons why they were particularly attached to the gold standard regime, the changes in the system they would find truly alarming were many years into the future and far from inevitable. Threatening though it was, the danger seemed far from existential. In the shock of a catastrophe like the Great Depression it is easy to lose sight of the bigger picture. Mattei’s work shows us that their worldview was driven by the concerns of global capital and the events that shaped that view took place well before 1933.

The precipitating events shaping their frame of reference date back to the aftermath of the World War whose sequel had yet to occur. A stark reality had penetrated the public consciousness as sharply as though it had slapped them across the face: there was nothing inevitable about the existing capital order. The economic and social disparities, the power imbalance between capital and labor, all of it was a choice. Better, more just systems were possible. Once the public realized the proverbial emperor had no clothes, there would be no scouring the appalling image of his diminutive naked parts from their brain. The consensus even amongst relatively conservative thinkers was that some kind of transition to a “mixed” economy was inevitable. While the phenomenon was global, “The Capital Order” focuses on Italy and the UK, which were epicenters of particularly vibrant experiments with different modes of organizing production. They were also the epicenters of aggressive countermeasures by the powerful to restore and preserve the existing capital order. The most important revelation of Mattei’s case studies, however, is that the distinction between the liberal and fascist systems was one of degree, not of kind. They all agreed on the necessity of austerity, and if they could not impose it by creating a liberal technocracy removed from democratic accountability, an authoritarian fascist approach would do just as well.

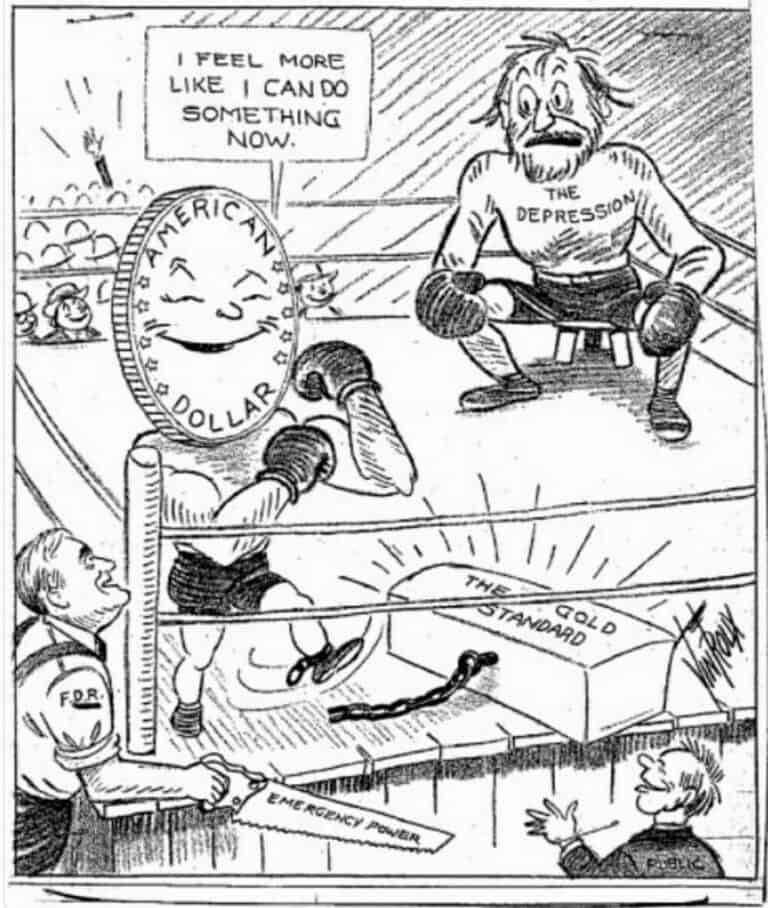

For the plotters, it was never about the money itself. The money would spend just the same whether it was linked to gold or pure fiat. It was always about the artificial constraints a gold standard placed on the government’s ability to spend more than tax receipts, a set of golden shackles that in effect forced austerity. Those unnecessary fetters made “inevitable” policies that favored the interests of property owners over renters, of creditors over debtors, and of capital over labor. At its root, the maintenance of the existing power structure was always dependent on the foreclosure of alternative possibilities for the majority of the population. If the majority were free to choose, which of them in their right mind would sell their labor for a fixed wage while the owners of capital siphoned off most of the value to grow their own wealth? Even the thoughts of alternative possibilities were a subversive threat. Hence, the illusion of inevitability in the public consciousness was as critical as the actual foreclosure of options. The wealthy and powerful had successfully convinced the public and even elected officials that the removal of the gold standard would cause financial meltdown, but they knew that the president’s move would not cause the sky to fall or the dollar to collapse in an inflationary death spiral. What they actually feared was that the president had just demonstrated the opposite to the general public, and that the illusion of inevitability had been punctured.

The more damaging effect, from their perspective, was that it allowed the government to dispense with the myth that its hands were tied when it came to spending for the public good. It punctured the lie that the government needed to balance its budget like a household, when in fact it was the source of all currency. It took power out of the hands of unaccountable elites and restored it to accountable elected officials, at least some of whom believed they had a duty to serve the public and work for the general prosperity. In a world where the US government was free to spend public money on the public interest, a much broader range of possibilities existed. These were the very possibilities that the power elite of the capital order had worked assiduously to foreclose since the enclosure of the commons began in England in 1604. It made possible a new deal and a level playing field, a re-balancing of the power structure that could enable true democracy. It enabled the government to act independently of wealthy private actors and to intervene in areas that had previously been the latter’s exclusive domain. Arts, infrastructure, education, housing, social safety nets, and most importantly employment. Few things inspired greater terror in financial elites and owners of capital than that scenario: an unthinkable possibility in which the people they exploited could choose to deprive them of their position, power, leverage and sources of vast unearned wealth. The plotters reflected the fears, far from unfounded, that they were losing control of the liberal technocratic regime they had set up to maintain their order. They believed it was time to shift their gaze from the British liberal model of capital retrenchment to the Italian fascist one.

By Butler’s own account, the agents who approached him spoke of travelling to Europe to study methods of organizing fascist paramilitary groups from organizations of veterans. The scheme might have worked, had they not approached the wrong man for the job. Butler’s decades of military service had made him cynical and wise enough to take an anti-imperialist turn and describe his career accomplishments as acting as a “gangster for capitalism.” His whistleblowing foiled the plot but resulted in no indictments or consequences for the plotters. The financial elites retained enough power under the neoliberal version of the capital order to protect themselves. With the authoritarian path closed to them for the time being, they used the tools of their existing order to play the long game and to put the genie back in the bottle. Central bankers and economists, first via the Bank of International Settlements and then via the Bretton Woods System, worked to create a system of “sound money” that behaved as though the gold standard were still in place. This was sold to the public via an old folk myth, long debunked and little better than superstition, that money was fake and unsound unless backed by gold and subject to supply and demand. Various networks of elites from within and outside the government worked to subvert, co-opt, and eventually roll back the gains made during the depression and the war. The powerful were once again constraining options and presenting that constraint as inevitable. Within a generation all thoughts of full employment, a powerful labor movement, and a government unconstrained by revenue were erased from public consciousness.

By the time Nixon took the US off the Bretton Woods system in 1971, there were few left who remembered enough or understood enough to challenge the self-evidently false sound money charade. Monetary policy became once again a ritual performed by a priesthood of economists and central bankers, interceding to the money gods on the public’s behalf, about which ordinary people had no literacy or democratic voice. There were few who recognized the myths of the “golden fetters” era to be the fraudulent pretext they were for austerity policies that siphon wealth upward to owners of capital and suppress labor. As the brutal effects of this come into focus for an ever-growing percentage of the population, so does the realization that what we’ve been told about how such things work isn’t true. History shows us that the gold standard, “sound money” austerity, and deficit hawkery are all wicked lies designed to take power away from the ordinary people to whom it belongs and give it to a self-appointed nobility caste. Modern Monetary Theory and rebel heterodox economic theories show us how the system actually works and what we can do to achieve our true potential.

We live in a world where everything seems to be a scam or a lie. This is not accident or happenstance, but a natural outgrowth of a system where the power imbalance is so heavily skewed toward the elites of what Mattei refers to as the titular capital order that the rest of us have no recourse. But some of the biggest lies of all are the ones that have been part of our lives for so long that they are part of the background, no longer questioned. They are structural, the very institutional firmament that has governed the machinery that powers our economy and the very money that flows like lifeblood through it. We are trained not to inquire. If we do, we are lied to about its workings. We are told that’s just the way it is, that our current reality is inevitable. This sacred knowledge is approved only for a special priesthood, vetted and approved by the capital order, or what C. Wright Mills called “the power elite,” to serve its interest. Those lies are the shackles that have bound us for generations, the fetters the powerful live in terror that we will one day see through and break. Mattei’s book tells us why they’re afraid and what their scam is. The story of the Business Plot shows us what they are prepared to do should we break free of our chains and demand better. It shows the lengths to which those in charge will go to put that genie back in the bottle. In a sense, it’s difficult to blame them. Few would envy their position when the people they’ve oppressed, who endured their plight believing they were chained to a wall, discover that their fetters have been unlocked the whole time.

From a leftist perspective, #FDR was far from perfect. That said, the #CapitalOrder namely those who were advocates of #SoundFinance still considered him to be enough of a threat to their #profits to want him replaced with one of their lackeys.

Of course FDR was not perfect. Who is or ever was? And he often said that himself. But learning about the real man and the era, contrary to the across the board, gross distortions of it in the appallingly bad modern histories show him and the New Deal as far more to the left and far more successful than the omnipresent revisionist history has it.

The overwhelming majority of modern “Leftist” (and other) books and literature on FDR and the New Deal are far more imperfect than they were. Garbage is a succinct and accurate characterization. (Though historiography has finally started slowly changing for the better in the last decade after 50 years of deterioration). Would be nice if FDR were shown half the objectivity shown to Hitler. A major purpose seems to be character assassination, the main method is reading each others crappy books and copying their selective, out of context citations, in a game of “telephone”. Achieving progressive distortion culminating in complete reversal of basic facts, which by now have become nearly unknown. Primary sources are never consulted or searched for, except as a show, over the most microscopic issues and events of minuscule import. Generally, “left” histories – especially starting with the 1960s New Left, take the literature of the extreme Right, the “Roosevelt-haters”, the supporters of the Business Plot – and sell them as amazing! new! super-radical-left! “discoveries”.

Non-USAns often write the best books, but they lack the gut understanding that writing about your own country gives. The best history is perhaps the final volume of Page Smith’s People’s History of the USA. (Not Howard Zinn’s comparatively crappy later book taking the title of Smith’s far superior 8 -volume 10,000 page work.)

The capitalists are a lot smarter than such Leftists. They have no fear of Lefties here or elsewhere who are more “perfect” than FDR, for their very “perfection” is what makes them so easy to handle, hoodwink, destroy and manipulate, generation after generation. But they are terrified of another FDR, another New Deal, because they know that is pretty much the death knell of capitalism, and the rise of a hegemony of the working class, the common people.

I got my introduction to MMT through Randal Wray’s class “New Economic Perspectives”, it has been like I am addicted to the truth every since. I judge politicians and speakers and books and my friends by the MMT standard. If a person has a yearning for truth, they will be drawn into MMT and the light that it shines on the future. It will happen, it is as inevitable as the rising sun in the mornings.