Originally published January 18, 2012 on the New Economic Perspectives blog.

Thanks for comments and questions. As I had already intervened, I addressed the main points related to this week’s blog already. Let me pick up a few loose ends, and reformat my earlier response.

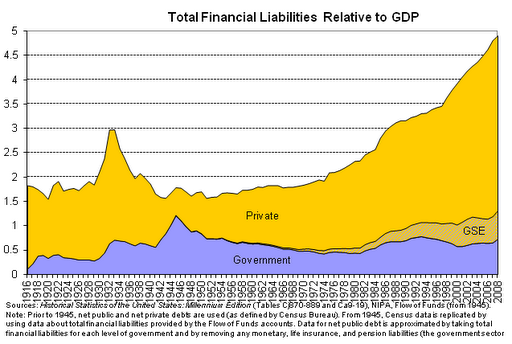

Q1: When you said US Debt/GDP reached 500% was that all private debt? And how can the private sector get out of debt?

A: No. Here’s the data break-down. You can see that it is certainly private debt that has exploded, however. This ends in 2008, and after the GFC hit and the US slowed down, government debt started growing rapidly and private debt came down a bit as a percent of GDP so it would look a bit different today.

How does the private sector get out of debt? If GDP and income grow, households can service more debt all else equal, and the ratio will decline. They can pay off debt. And yes they can default. Note how sharply the debt ratio came down after the Great Depression—as all 3 of those things happened. The most important was economic growth fueled by government spending (and record govt deficits of 25% of GDP during WWII). It can also go down as the economy uses export-led growth but for the US that is not likely. The best way would be to ramp up government spending today.

Q2: Several questions on US current account deficits, foreign accumulation of US Dollar assets, and so on. Also on the Bretton Woods System.

A: I have discussed that a bit previously and we’ll do a lot more of it in coming weeks—so let’s hold off. With respect to BW: it was a mistake. Failed. Worked in the beginning because ROW needed US exports after WWII and US lent dollars so they could buy them (Marshall Plan). More coming in the MMP on exchange rate regimes. But briefly, both the BW system and the Sterling system (pre WWI) failed. Such international pegged systems do not work—they always generate crises and then collapse.

Q3: Didn’t Clinton announce he would retire the debt? Did he believe it?

A: Yes Clinton appeared on TV and announced all govt debt would be retired. Who knows or cares what he believed? I think it was Rubin who pushed the idea. But what matters is that all Democrats after him think that was the right thing to do, and claim Bush Jr blew it by not continuing with the surpluses. And so they want to bring back the good old Clinton-Rubin policy as soon as they can get through this crisis! They learned no lessons from the death of Goldilocks. Clinton’s tight fiscal policy killed her deader than Elvis.

Q4: Didn’t budget deficits of big-spending Democrats in the 1960s cause high inflation?

A: Deficits of the 60s were miniscule. Don’t take my word for it. You can checkit out. Until Obama, no Democratic administration ran big deficits after WWII. Again, check it out. Yes there was some inflation in the late 60s. Big wars usually do generate some—but the war against Viet Nam plus the wimpy and failed “War on Poverty” did not create big deficits because the economy grew fast enough to generate tax revenue. Republicans have always had the biggest deficits—not necessarily due to big spending, but due to their rotten economies that do not grow. Coincidence? Me thinks not.

Q5: Don’t you accept the dollar because you can convert it to gold?

A: Hah: I’ve never done so and would never consider it. Gold is a fool’s gamut. We all accept Dollars because there is a tax system that requires them.

Q6: Later Friedman said inflation results from excessive money supply.

A: Yes, and he was wrong then and he’s still wrong. His functional finance paper is probably the only thing he ever got right. And nobody reads it!