The prevailing theory of banking for the past century holds that banks function as intermediaries, collecting deposits from depositors and lending them out for interest. This view is maintained, with minor differences, by all neo-classical schools of economic thought regardless of ideological bent. Austrians, Monetarists, and New Keynesian economists alike operate under the assumption that commercial banks merely lend out money which they have first obtained from depositors or the central bank. Paul Krugman, Nobel-prize winning Neo-Keynesian economist writes:

“As I (and I think many other economists) see it, banks are a clever but somewhat dangerous form of financial intermediary… For in the end, banks don’t change the basic notion of interest rates as determined by liquidity preference and loanable funds… Banks don’t create demand out of thin air any more than anyone does by choosing to spend more; and banks are just one channel linking lenders to borrowers.” (March 27, 2012, Banking Mysticism, New York Times)

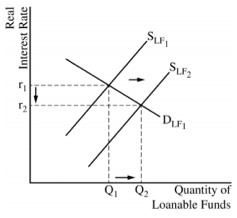

Many core neo-classical models, such as the “Loanable Funds Theory”, which posits that banks extend credit based on a limited supply of loanable funds and therefore private investment may be “crowded out” by government deficits, depend on the intermediary theory of banking. This view is so pervasive that the reader likely has difficulty imagining how banking could operate any other way. If banks do not obtain money first, how can they lend it out?

A closer analysis of banking operations reveals the intermediary theory of banking to be false. Rather than lending out existing deposits, commercial banks create new deposits when they extend credit. This view, known as the credit creation theory of banking, has long been held by so-called heterodox economic disciplines such as Modern Monetary Theory (MMT) and many post-Keynesian economists. Despite fierce opposition from economists like Krugman, this credit creation model is rapidly displacing the intermediary theory as overwhelming evidence mounts in favor of the formerly heterodox position. In recent years, a steady flow of academic papers and reviews by central banks, including this paper from the Bank of England, have contributed to the paradigm shift in economics. Even many mainstream resources outside of academia, such as Investopedia, have now published articles affirming the veracity of the credit theory of banking.

How Lending Works

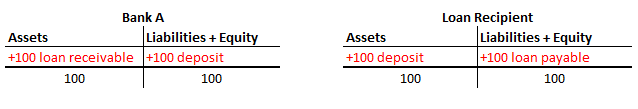

A cursory knowledge of double-entry accounting is useful, but not essential, for understanding how bank lending creates money. The utility of accounting for this exercise lies in the fact that the financial position of both the bank (lender) and loan recipient (lendee) are best visually displayed by T-accounts which represent the balance sheet of each entity. This is doubly important for banks because the journal entries described below are actually made on the bank’s books. For non-accountants, here are three simple rules to keep in mind:

- The accounting equation is: Assets = Liabilities + Equity

- Assets increase when they are debited whereas liabilities and equity increase when they are credited

- Total debits and credits must be exactly equal for all accounting entries

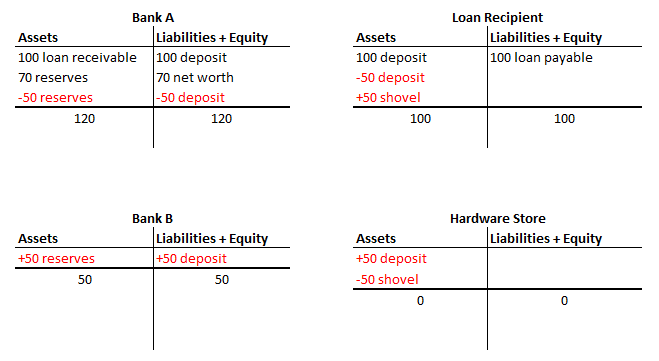

So, what happens when a bank makes a loan to a customer? The bank marks up the customer’s deposit account (crediting the bank’s liability account), and simultaneously marks up its accounts receivable (debiting the bank’s asset account). That’s it. By the very act of lending, the bank has increased the volume of outstanding deposits in the economy. I.e, the bank has created money. No pre-existing money was necessary for the transaction. From the loan recipient’s perspective, the customer realizes an increase in cash deposits (debit asset) and accounts payable for the loan (credit liability). See the balance sheet changes for a $100 loan below:

Notice here that deposits are a liability of the bank and an asset of the customer. Deposits are a bank liability because the bank owes the customer transaction clearance or redemption for the amount of the deposit. I.e, if the customer wants to spend her deposit or withdraw cash, the bank is obligated to clear the transaction. I will briefly outline this process in the following section. One paradox which the reader may have noticed is that while assets increase on the debit side of the T-account, and cash is an asset, making a deposit to one’s checking account is listed as a credit on one’s bank statement. This is because the bank statement is from the bank’s perspective. The bank is crediting the customer’s deposit account on its books, which represents an increase in the bank’s liabilities.

Clearing Transactions

While I will focus on the Federal Reserve and its member banks, the payments system of all modern economies share nearly identical characteristics. Just as customers have deposit accounts at commercial banks, commercial member banks have accounts at the Fed. The US Treasury also maintains an account at the Fed known as the Treasury General Account (TGA). The Treasury, Fed, and member banks comprise the Federal Reserve system which serves as the basis for the payments system in the United States.

Just as commercial bank deposits are the assets of customers, bank deposits at the Fed are assets of commercial banks and liabilities of the Fed. These deposits are called “reserves”. Reserves are the fundamental banking currency with which transactions between the Fed, Treasury, and commercial banks are cleared. You cannot touch or feel bank reserves. Like all deposits, they are numbers on a spreadsheet. They can be redeemed for cash or used to clear transactions. They are also stuck in the banking system- you cannot have direct claims on reserves without an account at the Fed, which is limited to member banks and the Treasury. Reserves are created by several methods, but the most common are listed below:

- The Fed buys Treasury securities, mortgage-backed securities, or company paper (corporate bonds)

- The Fed pays interest to member banks on excess reserves

- Banks borrow reserves from the Fed at the penalty rate

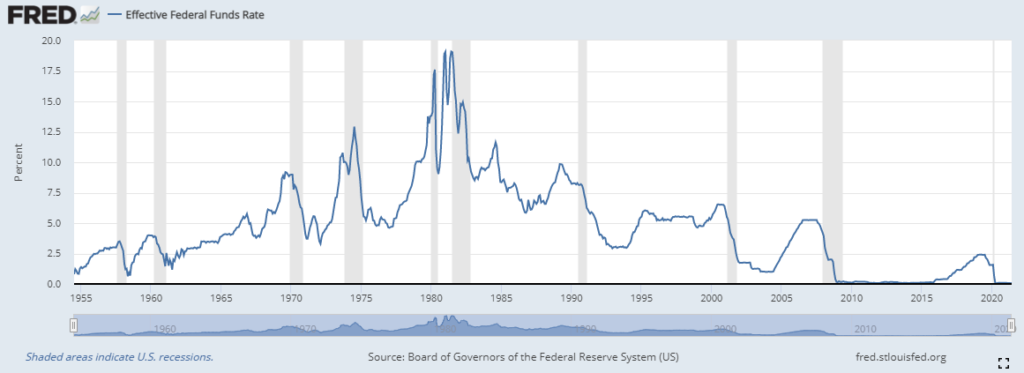

Banks may also borrow reserves from each other at a rate called the Fed Funds Rate (FFR) or “overnight” rate. This is the target rate that the Fed sets and is frequently reported in the press. When you hear about the Fed “raising rates” or “lowering rates”, this is the rate in question. The Fed also pays interest on excess reserves (IOER) held by banks, and offers a penalty rate from which banks may borrow reserves directly from the Fed if they cannot get them elsewhere. These are the lower and upper-bound rates which help the Fed hit its target rate. Consider this: the FFR will never fall below the IOER rate because banks will not lend out reserves at a lower rate than they could earn from the Fed. The FFR will also never exceed the penalty rate because no bank would borrow reserves at a higher rate than they could borrow from the Fed. Within this lower and upper-bound window, the Fed conducts open market operations (buying and selling Treasury securities) to manipulate the supply of reserves in order to hit its target rate. Buying Treasurys increases the supply of reserves and drives down interest rates, whereas selling Treasurys drains reserves and increases interest rates.

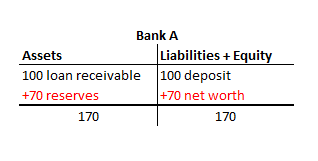

In order to clear payments, banks must obtain reserves by any of the methods listed above. Let’s use our original example to understand what happens when our customer loan recipient uses loan funds to purchase a $50 shovel from a hardware store. The customer’s bank is bank A and the hardware store’s bank is bank B. The $100 loan from the prior example will carry over. For purposes of this example, we will assume Bank A has earned $70 from interest on excess reserves. For simplicity, we will also assume the shovel is purchased at cost. First, changes from reserve interest revenue:

And now the purchase of a $50 shovel:

Here we can see that $50 of the deposit created by the original bank loan has now ended up in the account of the hardware store. Bank A fulfilled $50 of its obligation to the loan recipient by clearing the transaction (debit liability), but also gave up $50 in reserves by transfer to Bank B (credit asset). Bank B on the other hand makes the exact opposite accounting entries as it has received both a $50 asset in the form of bank reserves and $50 liability in the form of deposits owed to the hardware store. The accounting equation holds as assets = liabilities + equity for all entities.

Loan Repayment

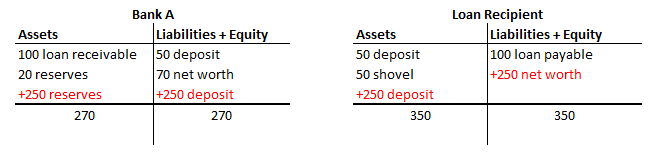

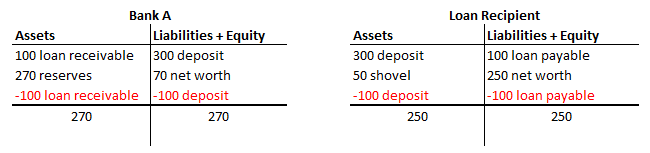

Finally, we will see what happens when the loan recipient pays off her loan. We will imagine that our recipient has just received a $250 paycheck (concurrently her bank has received $250 in reserves from her employer’s bank) and pays off the entire loan balance. For purposes of simplicity, this was an interest-free loan. I have consolidated prior balances from our running example. First, $250 in paycheck income to the loan recipient from her employer:

And now full repayment of the $100 loan:

After loan repayment, the outstanding deposit created by the original loan has been completely eliminated. Our recipient’s net deposits are $200 ($250 paycheck less $50 shovel purchase). While Bank A holds $270 in its reserve account at the Fed ($70 interest earned less $50 transfer out to Bank B plus $250 transfer in from the recipient employer’s bank), total spendable deposits in the economy has been reduced by exactly $100. All money created when credit was extended has been extinguished upon settlement of the account.

Discussion and Implications

This is how payments function in the modern economy. The vast majority of money is created endogenously via bank lending and circulates through commercial transactions facilitated by the Federal Reserve payments system. Banks do not lend out deposits they have first collected from customers. Rather, banks extend loans to credit-worthy customers and later obtain reserves within the banking system to clear transactions. In fact, the loan-making and reserve-management operational centers within commercial banks are often entirely segregated as they perform only loosely related functions.

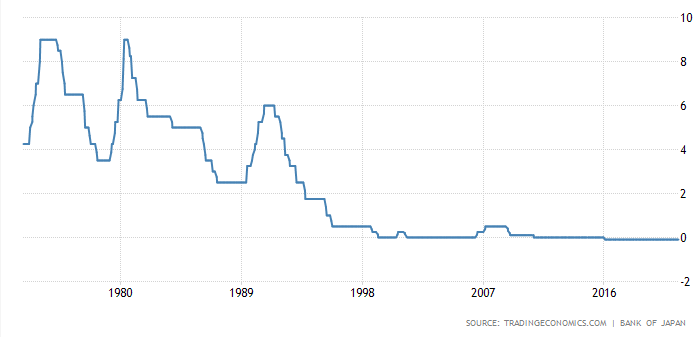

This credit creation model of banking poses serious problems for neo-classical models like the “Loanable Funds Theory” which posits that bank lending is reserve-constrained and that banks must compete for a limited supply of reserves to lend out. This theory is essential to the financial “crowding out” hypothesis, which assumes that government bond issuance to finance deficits will “crowd out” private investment by soaking up reserves and spiking interest rates. Understanding banks through the credit creation lens refutes both of these concepts which have been used for decades to justify fiscal austerity. Bank lending is not reserve-constrained: banks first make loans and then obtain reserves to clear transactions when necessary. Further, the Fed has ample tools to set the Fed Funds Rate wherever it wants with precision. There is no risk that the FFR will escape the Fed’s target window. Those familiar with Modern Monetary Theory (MMT) know that the natural FFR is 0% and is only higher due to the Federal Government’s decision to match deficit spending with bond issuance and the Fed’s decision to pay interest on reserves, neither of which are necessary. I have written in more detail about MMT here. Numerous examples from the global economy continue to support this understanding of central banking in direct refutation of the neo-classical model. Most notably, Japan’s sustained long-term policy of 0% and even negative overnight rates set by the Bank of Japan despite a debt-to-GDP ratio multiple times that of the United States. Per neo-classical intermediary banking theory, this should be impossible.

MMT-informed readers will also know that money is created in another fashion: deficit spending by the Federal Government. Unlike private money creation where both the offsetting asset and liability are held by the non-governmental sector, deficit spending creates net financial assets for the non-governmental sector because the liability is held by the government in the form of a tax credit. As I discuss in the article linked in the above paragraph, this holds true whether or not the government issues bonds to match its deficit spending. Because all privately created money nets to $0 upon loan settlement, the sum total of dollar-denominated net financial assets available to the non-governmental sector (foreign + domestic) is exactly equal to the cumulative sum of historical deficits by the Federal Government. I.e, it is equal to the National Debt.

Conclusion

The fundamental character of money is debt and credit. In the real world, banks do not extend free loans as used in our example, but instead extract economic rent from consumers in the form of interest. The increasing financialization of the economy in the neoliberal era is no mistake. Privatization of public assets coerces individuals into exploitative debt arrangements to afford what might otherwise be public goods. Healthcare and higher education are the two most egregious examples in the United States, but other industries such as childcare, transportation, media, housing, and technology are subject to the same forces. Even Europe, which is home to the most robust social democracies in the world, is constantly facing down creeping privatization.

The purpose of austerity from capital’s perspective is to convert the commons into a market from which it can extract profit. The neo-classical model of banking has, for nearly a century now, blinded economists to the financial sector’s incentives related to this process. Banks are not mere intermediaries of currency subject to depository constraints and in competition with national governments for a limited supply of loanable funds. Rather, they are active agents with an incentive to promote austerity not because government spending inevitably spikes interest rates, but because government spending provides financial and social assets to individuals which might otherwise yield profit to financiers in a private market.

It would be naïve to think the current paradigm shift in economic thought regarding banking will produce tangible policy adjustments on its own. After all, the far more pressing climate crisis has been well-understood by mainstream science for nearly half a century, and yet major world governments seem content to settle for predictable catastrophe. A shift in academic models of banking is comparatively arcane. “Loans create deposits” is a confusing slogan, and its implications for public policy are even more obscure. It is up to academics and informed lay-people alike to alter the understanding of banking in the public consciousness. The role of banks is to serve as chartered agents of the State for the purpose of endogenous money creation in that State’s unit of account and subject to the State’s prerogatives. This lending should be strictly regulated, and any additional activity should only be permitted if it can convincingly be shown to serve the public purpose. The financial sector for the past 40 years has enjoyed unbridled reign to disastrous effect in the form of increasingly calamitous financial crises. As the intellectual justification for austerity and financial deregulation collapses, we should be prepared to provide the alternative solution.

Originally published on the author’s Medium Blog.

2 thoughts on “How Banks Create Money When They Lend”