by Phil Armstrong and Warren Mosler

Abstract

The hyperinflation in Weimar Germany in 1922-23 has become the poster child of mainstream economists – and especially the monetarists- when presenting the benefits of constraining governments by the rules of ‘sound finance’. Their narrative presumes that governments are naturally inclined to spend beyond their means and that, if left to their profligate ways, inflation ‘gets out of hand’ and leads to hyperinflation in a continuous, accelerating, unstoppable catastrophic collapse of the value of the money.

In contrast to this ubiquitous mainstream analysis we recognize a fundamentally different origin of inflation, and argue that inflation requires sustained, proactive policy support. And, in the absence of such policies, inflation will rapidly subside. We replace the erroneous mainstream theory with the knowledge of Modern Monetary Theory (MMT) identifying both the source of the price level and what makes it change. We are not Weimar scholars, and our aim is not to present a comprehensive historical analysis. We examine the traditionally reported causal forces behind the Weimar hyperinflation, along with the factors that contributed to the hyperinflation and to its abrupt end.

The purpose of this paper is to present our view of the reported information from an MMT perspective. In that regard we identify the cause of the inflation as the German government paying continuously higher prices for its purchases, particularly those of the foreign currencies the Allies demanded for the payment of reparations, and we identify the rise in the quantity of money and the printing of increasing quantities of banknotes as a consequence of the hyperinflation, rather than its cause.

Introduction

In this article, we dispute the mainstream view that the inflation of the Weimar Republic was caused by a proactive expansion of the stock of money by the German government acting in concert with the Reichsbank.

In part 1, we examine the source of the price level and causes of inflation, first from a neoclassical and then from an MMT perspective.

In part 2, we analyse the Weimar hyperinflation.

In part 3, we apply the insights of MMT to Weimar hyperinflation and present our alternative narrative.

In part 4, we conclude.

1. The Price Level and Inflation

The Neoclassical Approach

Neoclassical economists define the price level as the current level of nominal (money) prices in the economy. And while there have been theories which attempt to explain what causes the price level to change, there is no neoclassical theory which explains how it came to be. By default, it is assumed to be historic- the consequence of an infinite regression. Neoclassical models therefore simply assume an initial price level when presenting the quantity theory of money (QTM), the tautology MV=PT, where the money supply (M) multiplied by the velocity of circulation (V) = the average price of each transaction (P) multiplied by the volume of transactions (T). With M assumed to be exogenous (under the control of the authorities) and V assumed to be stable, it is then asserted that causality runs from M to P, giving rise to Friedman’s famous explanation of the cause of inflation: ‘Inflation is always and everywhere a monetary phenomenon in the sense that it is and can be produced only by a more rapid increase in the quantity of money than in output. …’ (Friedman 1956, emphasis added).

The presumption of a money supply fixed by the government, however, applies to a convertible, fixed exchange rate currency, such as existed under the gold standard. This relegates the applicability of the quantity theory of money to fixed exchange rate regimes and makes it entirely inapplicable to today’s floating exchange rate regimes (as well as in the Weimar Republic) where the government does not offer convertibility at a fixed rate.

After a decades-long search for an ‘M’- a monetary aggregate that correlates to and leads to inflation- mainstream economics today has moved on to its current position of inflation expectations being the cause of inflation. They continue to begin their analysis with an assumption of a given price level and assert that inflation expectations are the source of changes to that price level. Central banks have, in fact, developed intricate methodologies to measure inflation expectations to guide policy, while their researchers have struggled to find evidence of the validity of the theory.

Of further note is the fact that mainstream economists accept the classical dichotomy of real vs nominal (monetary) factors and contend that in a competitive marketplace the introduction of money is merely the introduction of a numeraire into a barter economy. Money is a ‘veil’ that improves transaction efficiency while leaving quantities produced and relative prices unchanged (Armstrong 2015; Armstrong and Siddiqui 2019). This assumption is known as the neutrality of money. However, the assumption of neutrality is obviated by the introduction of coercive taxation.

Modern Monetary Theory

Modern Monetary Theory (MMT) recognizes that the funds to pay taxes and net save come only from the government or its agents (Bell 1998); the currency itself is a public monopoly and therefore the price level, as a point of logic, is necessarily a function of prices paid by the government (Mosler 1993). Said another way, the value of the currency is a function of what economic agents must do in order to obtain it from the government and its designated agents, directly or indirectly. With the currency a public monopoly (imperfect competition) mainstream quantity theory, inflation expectations theory and the neutrality of money are not applicable.

With the currency a public monopoly, in the context of a market economy the government need only set one price as market forces adjust all other prices to express indifference levels, or what is also referred to as relative value (Tcherneva 2002).

The value of the currency is defined by what a given amount of it can buy. So, for example, if the government increases purchases at current prices, regardless of the quantity of money spent, that additional (price constrained) spending has not driven up prices, and the value of the currency has not been altered. However, if the government instead pays more for the same items purchased, the value of the currency, by definition, has become lower, as it takes more of it to buy the same quantity than was previously the case1.

As a practical matter, governments utilize buffer stock policies. With a buffer stock policy, the government sets the price of the buffer stock item, while market forces result in all other prices expressing indifference levels to the price of the buffer stock item (we further recognize that there are additional institutional structures that influence the determination of a vast array of prices). This logic underpins both fixed and floating exchange rate regimes. For example, with a gold standard the government sets the price of gold and conducts fiscal and monetary policy so as to retain a credible buffer stock of gold, while offering to buy or sell gold at a fixed price and allowing other prices to continuously adjust and reflect relative value2. With today’s floating exchange rate regimes, governments use monetary and fiscal policy to maintain a credible buffer stock of unemployed workers to stabilize wages, while allowing other prices to adjust to reflect relative value. Inflation is therefore, in the context of buffer stock policies, a continuous increase in the price set by the government or its agents, directly or indirectly, for the buffer stock item (Mosler and Silipo 2017).

With the German mark a non-convertible state currency in the Weimar Republic, interest rates were set by policy. And, ironically, the radically higher policy rates intended to support the mark instead worked to exacerbate the inflation through two channels. The first is the interest income channel, where interest payments by the state are additional income for the economy that add to deficit spending and aggregate demand. The second is through forward pricing, where prices of goods and services purchased for future delivery increase in line with interest rates.

2. The Weimar Republic Hyperinflation

Reparations and Inflation

Two avenues of discussion arose out of the war reparations demanded from Germany following the 1919 Armistice. The first is ‘the budgetary problem’, questioning whether Germany was fundamentally capable of paying the monetary sums demanded for reparations (Keynes 1919; Rueff 1926; Mantoux 1946). The second is ‘the transfer problem,’ which reflects a concern over the conversion of the German money to foreign currency for payment to the Allies. (Keynes 1929; Ohlin 1929). ‘The Dawes Committee divided the payment of German reparations into two parts – into the Budgetary Problem of extracting the necessary sums of money out of the pockets of the German people and paying them into the account of the Agent-General, and the Transfer Problem of converting the German money so received into foreign currency’ (Keynes 1949 [1929]: 161, emphasis in the original).

Keynes stresses the significance of the transfer problem and argues that even if the German authorities had been able to reduce German domestic consumption sufficiently by taxation, the resources thus freed would not necessarily have produced the increase in exports required to fulfil the Allies’ reparations demands. Keynes argues that something in addition is required, German wage rates must be lowered sufficiently to make their potential exports competitive. ‘The expenditure of the German people must be reduced not only by the amount of reparation taxes which they must pay out of their earnings, but also by a reduction in their gold-rate of earnings… The Budgetary problem depends on the wealth and prosperity of the German people; the Transfer Problem on the competitive position of her industries on the international market’ (Keynes 1949 [1929]: 165, emphasis in the original).

Keynes was pessimistic that the transfer problem could be solved. He considered that significant wage reductions would be required if German exports were to be raised sufficiently; he notes, ‘My own view is that at a given time the economic structure of a country, in relation to the economic structures of its neighbours, permits of a certain “natural” level of exports, and that arbitrarily to effect a material alteration of this level by deliberate devices is extremely difficult’ (Keynes 1949 [1929]: 167).

Ohlin disagreed with Keynes’s view, arguing that relatively small price declines may lead to significant increases in export sales, ‘…many German goods on the border line of “exportability” may be sold in large quantities if their prices fall 10 per cent. With this background an increase in exports by 30, 40 or 50 percent does not seem impossible’ (Ohlin 1949 [1929]: 176). He also felt that Keynes greatly overestimates the extent of the challenge facing nations who wish to increase their exports, ‘I suspect that one of the reasons why most people are inclined to exaggerate the difficulty in creating a German export surplus is the impression of the “practical” business man, who has already a large export trade, that it is difficult for him to increase his sales abroad. This impression, however, is misleading as it is based on a tacit assumption of unchanged demand conditions and fails to take into account that many firms may pass from exporting practically nothing to considerable sales abroad during a period of five or six years’ (Ohlin 1949 [1929]: 176).

Ormazabal (2008) unifies the budgetary and transfer issues, criticizing both Keynes and Ohlin. He recognizes that taxes would have to be raised to reduce German consumption so that sufficient goods and services would be available to transfer to the Allies: ‘It is understood that the Germans cease to consume because they part with money’ (Ormazabal 2008: 10). He further reasons that if the need for German money to pay for the German exports equalled the German currency the Agent General3 converted into foreign exchange, the transfer of German money for reparations to the Agent General would not destabilize the foreign exchange markets. However, if taxes are not sufficient to reduce German consumption exports revenues will not be sufficient, causing the exchange rate for the mark to fall. And a fall in the German exchange rate would make it increasingly burdensome for Germany – via the Agent General – to obtain the required foreign currency to meet its reparation liabilities.

We, in general, agree with this summation, enhanced further with MMT insights. Due to taxation being set at too low a level, payment of reparations resulted in higher levels of German deficit spending. In addition, the higher interest rates implemented to fight the inflation further increased the deficit (a point missed in orthodox narratives; see Appendix 2). We would also point out that this deficit spending was not only for purchases of real goods and services and payment of interest, but also for purchases of foreign exchange by the Agent General. Purchases of foreign exchange (and gold) are, functionally, deficit spending, even though they are not accounted for as such but only as asset purchases by the central bank. Thus, we argue that, as a practical matter, the stated accounts underestimate the size of deficits. Importantly, with both insufficient tax liabilities and compliance, German purchases of foreign exchange could only take place at continuously higher prices. MMT provides important insights here, namely that it was the higher prices paid that were the cause of the increase in the price level, and only if real wages had been sufficiently lowered to the point of reducing domestic consumption and increasing exports could Germany have bought the required foreign exchange without paying higher prices.

The London Ultimatum, the French Invasion, and the 1922 -23 Hyperinflation

While wholesale prices were 17 times higher by February 1920 than in 1913 (Hetzel 2002: 4), the price level was relatively stable after March 1920, and Hetzel argues that the tax reforms introduced by Matthias Erzberger (Minister of Finance), assuming the current annual level of reparations of 2.24 billion marks, could have delivered a balanced budget: ‘Given stable real expenditures, growth in the economy would have increased revenues and balanced the budget’ (Hetzel 2002: 5). We would argue, however, given the importance of interest rate payments in increasing deficits, that this positive prediction presupposes the implementation and maintenance of a low policy interest rate.

In any event, with the London Schedule (also known as the Ultimatum) of May 1921, reparations demands were dramatically increased4, including requirements for higher taxation to further reduce domestic living standards from already low levels. The German government, in defiance of the demands, failed to sufficiently raise taxes. Instead, deficit spending was allowed to increase and, consequently, continuous exchange rate depreciation followed. And as the Agent General paid continuously higher prices for foreign exchange, contributing to further exchange rate falls, the German price level continuously increased (see Appendix 3). As inflation accelerated during 1922 and into 1923, the government responded with increased spending (including heightened interest expenses following from the high interest rates which were applied as an attempt to stem the ensuing fall in the exchange rate5) at increased prices. Considerable currency speculation contributed to further significant falls in the mark and increases in the price level (Hetzel 2002: 5).

Making matters worse, Germany’s failure to meet French demands for payment late in 1922 prompted the French (with Belgian support) to invade the Ruhr in January 1923 and exact payment in goods, notably coal. In response, the German government continued to financially support Ruhr workers and businesses via deficit spending despite the fall in output that followed the invasion. Consequently, the hyperinflation which had begun in August 1922 accelerated and continued until November 1923 (Cagan 1956) (See Appendix 3).

Helferrich’s Weimar Hyperinflation Narrative

Helferrich6 in his famous work Geld (Money) sees the driving force of the post-war inflation originating from workers attempting to maintain living standards at pre-war levels even with the destruction of German capital, a drastic decline in labour productivity, and Allied reparations:

But claims were put forward and effectively pressed to raise the standard of comfort and at the same time to reduce the intensity of labour. This could have but one result – a race between wages and prices such as we have witnessed in the last few years. The social and political position of Labour was sufficiently strong to enforce higher wages notwithstanding the fact that less work was being done. As the profits of capital had shrunk to a minimum, the higher wages could only be paid if higher prices could be obtained for the products. But higher prices raised the cost of living and brought about fresh demands for higher wages, which in turn led to a further rise in prices (Helfferich 1969 [1927: 597].

This is consistent with the MMT inflation narrative, as the higher prices paid for labour by the government are an instance when the currency is redefined downwards. The higher prices paid for private sector labour are made possible, directly and indirectly, by the increased level of government spending at continuously higher prices.

Helfferich here outlines the effects of the decline of the mark on the general price level as a result of the higher prices paid for foreign exchange and also how the increase in the money supply followed the increases in the general price level:

The necessary and direct consequence of the soaring gold exchange rates, in which the collapse of the German currency found expression, was a corresponding rise in the prices of all commodities which Germany imported from countries with high exchanges. Owing to the importance of imports for feeding the population and for German industry, the high cost of imports would, of necessity, be reflected in wages and salaries, and ultimately, in the prices of goods produced in the country… The rise in wages and salaries, combined with the higher prices of all materials, led, of course to a rise in the expenses of the Reich and as the revenues of the Reich at a corresponding rate7, the floating debt, and accordingly the calls of the Reich upon were forced up… These enormously increased calls by the German public and by the financial maturities upon the Reichsbank could only be met by the bank by an increase in the note issue – from 173 milliard marks on the 7th July 1922 to 1984 milliard marks on the 31st January 1923’ (Helfferich 1969 [1927]: 600-1).

Helfferlich recognizes that, in contrast to neoclassical or monetarist economists, the end of the gold standard allowed the money supply to follow the rise in prices as it accommodated the increased demand for money necessitated by the rise in prices. This was essential for the technical functioning of the payments system and had nothing to do with the inflation. (Helfferich 1969 [1927] 597-8). Helfferich continues, ‘…in the twenty months which followed the acceptance of the London Ultimatum …the note issue of the Reichsbank [increased] 23 times, the wholesale index number for home products [prices] 226 times, that for imports [prices] 353 times, and the dollar rate 346 times’ (Helfferich 1969 [1927] 598-9, parentheses added). He further notes, ‘… in fact, it is immediately obvious that in the case of Germany the increase in the note circulation did not precede the rise in prices and also that [it] followed it but slowly and at some distance of time…. A conception of the general and comprehensive outline of the interplay of causes in these developments can, in fact, be obtained only if foreign exchange is made the starting point’ (Helfferich 1969 [1927]: 599, parentheses added).

Hefferlich argues that the increase in circulation had failed to keep in step with the depreciation of the German currency, so clearly the increase in note circulation could not be the primary cause of the depreciation of the mark. Ironically, despite the huge increase in printing of banknotes, money was scarce. ‘This also explains why the catastrophic collapse of the mark, which began towards the middle of 1922, was, notwithstanding the avalanche of notes, accompanied by an acute shortage of money’ (Helfferich 1969 [1927] 599).

Helfferich backs up his argument that money printing was not the cause of the inflation by considering the events of 1923; he points out that following an improvement in the exchange rate of the mark, prices fell even though the volume of notes issued continued to rise significantly;

prices fell with an improving exchange8. The fall was most marked in the prices of imported goods, which previously had directly and completely followed in the wake of the rise of the gold exchanges. The fall in the prices of home produced goods was less marked as these had not previously adjusted themselves to anything like the same extent to the higher rates of exchange. Yet while rates and prices fell, the note issue increased threefold during these ten weeks [the end of January to April 1923]’ (Helfferich 1969 [1927]: 602, parentheses added).

Helferrich was well aware that, for the German state, refusing to increase the money supply to match the demand for banknotes was not a feasible option. Rather than controlling inflation and currency depreciation, it would have instead resulted in the immediate termination of the operation of the entire payment system and the economy:

But such reactions [refusing to match the supply of money to demand] would have taken place, if at all, at the cost of uncontrollable crises and catastrophes; because if we were to follow the good advice given to us, and lay aside the note-printing presses, whilst the factors which adversely affect the German currency continue to operate, we should be depriving German economic life of the media of circulation necessary and indispensable for trade, for salary and wage payments, etc., so that in a very short time the local authorities and the state itself would be unable to pay their creditors and workmen. Then in a few weeks not only the printing presses, but also the mines and factories, the railways, and post-offices, and the State and communal administration, in short, the entire communal and economic life, would be at a standstill. (Helfferich 1969 [1927]: 602, parentheses added)

Interestingly, Helfferich’s felt compelled to express his opposition to the Allies demands with this additional comment: ‘The collapse of economic life of the State, and of society would, however, do away with the insensate idea that the German nation is capable of meeting such tremendous reparation claims, and would thus destroy the root of the evil’ (Helfferich 1969 [1927]: 603-604).

Ending Weimar Hyperinflation

The inherent endogeneity of commercial bank money is constrained by government regulation and supervision of credit creation. Regulations include leverage constraints and credit and collateral requirements for borrowers. So, in that sense, spending supported by bank credit expansion as a consequence of state initiative is rightly classified as state spending. Therefore, when the state facilitates the payment of higher prices by private sector agents it is a case of the state redefining the value of its currency downward. During the hyperinflation period, the German state agreed to satisfy all demand for credit either directly, with respect to itself, or indirectly, by voluntarily relinquishing its regulatory standards and limits to private sector credit creation, which contributed to the price increases during the hyperinflation. Regaining control of both public and private sector credit creation was therefore a prerequisite for ending hyperinflation; a task recognised by Schacht when he took over the reins at the Reichsbank.

Schacht (1967: 68) saw the first problem as that of dealing with the ‘emergency money’,

‘The first step towards the stabilisation of the Mark was therefore a decree issued by the Reichsbank on 17 November, 1923, whereby it would not accept any emergency money after 22 November. Holders of these notes were given four days in which to redeem the emergency money lying in the safe deposits of the Reichsbank’ (Schacht 1967: 68). The Reichsbank had been unable to produce enough paper currency to meet demand during hyperinflation and had accommodated private firms producing the needed paper currency by agreeing to redeem their notes, giving those notes the status of state money9. Furthermore, the Reichsbank had not only outsourced control over the circulation of money but had also stopped regulating the credit system.

Schacht maintained his policy in the face of this intense criticism: ‘When I as currency commissioner had to attend the discussions of those emitting emergency money, I did not allow myself to be deflected from my purpose. The emergency money vanished. If my firmness did not make me popular with the industrialists and the municipalities, this was a cross I had to bear…This [policy] lost me much sympathy, and has not been forgotten even today’ (Schacht 1967: 68-9, parentheses added).

Schacht also moved to stabilise the mark by preventing the lending which allowed access to marks for speculative purposes and, additionally, he established a policy whereby the new currency, the Rentenmark, could not be used to settle debts abroad. Schacht also realised that ending the crisis would require a reduction in deficit spending by both the Reich and private industry. Schacht admired the government’s steadfastness in contributing to the success of the policy, in particular the Reich’s Finance Minister, arguing that the, ‘fact that the Reich government was no longer allowed to raise credits with the central bank contributed to this [policy] and the success of this restriction was in large part due to the Reich Finance Minister, Luther, who showed himself just as resolute in the face of pressure as the Reichsbank (Schacht 1967: 70, parentheses added). However, Schacht acknowledged that depriving industry of credit was hard to justify and, indeed, that such an approach seems to conflict with the core purpose of the central bank. Nevertheless, the Reichsbank was no longer in a position to meet industrial demand for credit under the new arrangements (Schacht 1967: 70-71).

These reductions in what had been private sector deficit spending, along with the reduction in state deficit spending (including substantial reductions in interest expense) were entirely successful in keeping the government from the necessity to spend at the increasingly higher prices of the recent past, and instead constrain prices paid by government, including, importantly, for foreign exchange:

There was a second obstacle to the stabilisation of the Mark. On 20 November, 1923 the Reichsbank decided to maintain a rate of exchange of 4.2 billion Marks to the Dollar10… The speculators, however, did not believe that the Reichsbank would be able to hold this rate of exchange rate for any length of time, and bought dollar after dollar on time bargains at a much higher rate of exchange. Towards the end of November the Dollar reached an exchange rate of 12 billion Marks on the free market of the Cologne bourse… In previous years such speculation had been carried on either with loans which the Reichsbank granted lavishly, or with emergency money which one printed oneself, and then exchanged for Reichsmarks. Now, however, three things had happened. The emergency money had lost its value. It was no longer possible to exchange it for Reichsmarks. The loans formerly easily obtainable from the Reichsbank were no longer granted, and the Rentenmark could not be used abroad. For amongst the stipulations governing the issue of the Rentenmark, there was one which forbade the surrender of Rentenmarks to foreigners. For these reasons the speculators were unable to pay for the Dollars they had bought when payment became due. They were forced to sell the Dollars back, and the Reichsbank was not prepared. to pay more than the official rate of 4.2 billion Marks to the Dollar. The speculators made considerable losses. A bare ten days later the rate of exchange of 4.2 billion fixed by the Reichsbank had re-established itself. That measure too was hardly designed to make me more popular. This was the first time that the Reichsbank brought hoarded foreign exchange back into its coffers (Schacht 1967: 69-70).

Schacht notes that it was the Reichsbank’s reluctance to restrain its willingness to support industrial demand for credit that threatened to undermine all his efforts. By the end of 1923, a new crisis was possible which effectively forced the Reichsbank to take an uncompromising stance towards industry, insisting that foreign exchange purchase orders must be fully-backed by German currency (an instruction which had been often ignored up to that point). Banks which failed to fall in line were threatened with exclusion from the Reichsbank’s bill discounting and clearing facilities. Such tough action was, unsurprisingly, not without controversy. Schacht stressed that, in 1924, the Reichsbank faced a difficult choice but stuck with the approach which had been successful and remained most likely to support the mark and reduce the scope for a future return of severe inflation. Fortunately, as Schacht notes, this approach was ultimately successful in bringing back price stability to Germany.

In the meantime the economy’s need for credit increased to such an extent that whatever decision the Reichsbank reached would have serious disadvantages. It had to face the question whether to grant an increasing amount of credit to the economy – which would have meant a fall in the value of the Mark and a new inflation – or whether to maintain the stability of the Mark. The Reichsbank plumped for the stability of the Mark. On 5 April, 1924, an edict was issued whereby as from 7 April no new credit of any kind would be granted, and all new discounting of bills of exchange would be suspended: from now on discounting would only take place to the extent to which repayment of credits would cause money to flow back into the Reichsbank’s cash reserves. Understandably enough this intervention, which contradicted all the traditions of central banking, caused a great outcry. The bank stood firm against this storm. It was vindicated by success11 (Schacht 1967: 72).

However, it must be noted that this ‘success’ did come at a high real cost, as unemployment increased significantly12 following the fall in aggregate demand resulting from the enactment of Schacht’s approach. In this context we would argue that Schacht ‘overshot’ in his efforts to set quantity (in terms of spending) and let the price level adjust. We suggest that this ‘hard landing’ might have been softened had the German state aimed to spend on a price constrained basis. For example, the Agent General could have been given limits for prices it could pay for foreign exchange, and the German government could have constrained prices it paid for goods and services. With the funds to pay German taxes originating directly and indirectly from German government spending, limiting increases in prices paid by the state to that of its inflation target would have worked to limit the rise in the price level accordingly, while at the same time limiting deficit spending (by constraining prices paid) to levels corresponding to the inflation target. In general, monopolists find it most advantageous to set price and let quantity adjust.

It should also be stressed here that the Dawes Plan of 192413 gave Schacht scope to operate his policies by rescheduling reparations to the Allies and ending the occupation of the Ruhr. The resulting increased confidence in the Weimar government’s ability to maintain the value of the currency supported the strong efforts made by Schacht and the Reich itself to achieve and sustain price stability (Schacht 1927: 166-88)14.

3. The MMT perspective

As noted in section 1, MMT recognizes that the currency itself is a public monopoly, and that the value of the currency is a function of prices paid by the government when it spends (Mosler 2020; Armstrong 2020). Therefore, when the government pays more for a particular thing than was previously the case it is redefining the value of its currency downward. This includes purchases of foreign currencies (and gold) by the central bank.

The reverse is also true; if the government refuses to pay higher prices the drop in government spending leaves the economy without the funds to meet its needs to pay taxes and desires to net save financial assets. Importantly, since the funds to pay taxes and net save come only from the government and its agents, market forces operating within the economy force lower prices upon what is sold to the government by the non-government sector as it seeks to obtain those required funds.

In contrast to the mainstream contention that the government’s spending of money ex nihilo is inherently inflationary, MMT contends that the critical factor is the price paid by the government. If the government net spends when sufficient spare capacity exists at current prices, that spending is not inflationary. However, if additional spending can only be carried out at higher prices, that spending is per se an increase in the price level. Inflation is the result of the government competing with the private sector via the payment of continuously higher prices. If the state can buy resources at the going level of prices, its purchases will be non-inflationary. However, at full employment, if the state wants to shift resources from the private sector to itself, it will need to raise its offer price, which redefines the currency downward.

In the case of Weimar hyperinflation, in common with Helfferich (1969 [1927]), Modern Monetary Theorists recognize that news of the acceptance of the London Ultimatum prompted heavy speculative selling and depreciation of the mark, and the German government’s purchase of foreign currencies (both directly from exporters and via the Agent General15) at the higher market prices was a continuing, downward redefinition of the value of the mark. And the corresponding increases in import prices and the government’s payment of the higher prices both directly to government employees and contractors, and indirectly through organized private sector wage increases that allowed the domestic sector to pay the higher prices, was the source of the inflation of the German domestic price level.

The German state, in competition with private sector buyers, directly and indirectly funded by the state, competed for the limited available output by increasing their offer prices. This process, exacerbated by German interest rate policy, further increased government budget deficits (see Appendix 1), as state revenue, levied in nominal terms, failed to keep in step with its spending (Hetzel 2002), and these ‘hyper-enlarged’ deficits supported the hyperinflation of the price level. Such deficits caused a significant increase in the net nominal income of the non-government sector, allowing private sector spending to occur at ever-increasing prices.

However, we would stress that budget deficits are not inherently inflationary; it is only if the government is prepared to compete for goods and services at these heightened prices that the inflationary process is supported and can persist. As noted above, should the government refuse to raise the prices it is willing to pay in line with the rises in market prices, inflation will be eliminated and that only when the government pays increased prices is it redefining the value of the currency downward and causing inflation.

4. Conclusion

The currency is a public monopoly, and monopolists are price setters. This makes the price level a function of the prices paid by the government. The Weimar inflation, as is necessarily the case, was driven by the German government’s policy of paying continuously higher prices to provision itself, thus continuously redefining the value of its currency downward. Once that policy changed, and the government limited its direct and indirect deficit spending, and ceased to continue paying higher prices, the price level stabilized. Inflation necessarily requires a state policy of continuously paying higher prices when it spends, and inflation ceases when that policy ends.

Appendix 1

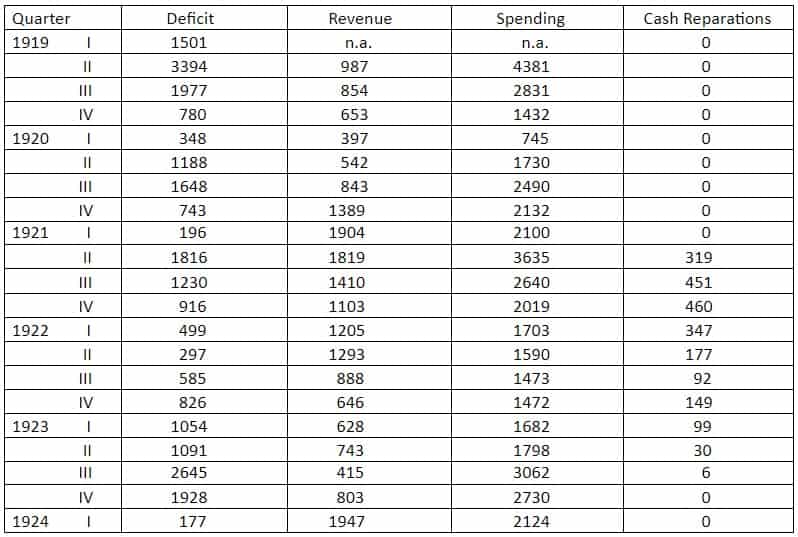

REAL GOVERNMENT DEFICITS, REVENUES, AND SPENDING

(million marks per quarter in 1913 values)

‘Notes: Each quarterly entry was summed from monthly figures that had been deflated with the monthly average wholesale price index, 1913 = 1.

Deficit: The change in the government debt, which was figured as the bonds and T-bills

outstanding, not counting those T-bills at the Reichsbank that were backing government deposits there. Monthly bond totals were interpolated linearly from the annual figures.

Revenue: Tax revenue (including forced loans-Zwangsanleihe) plus income of the state railroad and post.

Spending: Revenue plus deficit.

Cash reparation expenses: Monthly outlays for cash reparations.

[Primary] Sources: Allied Powers, Reparation Commission, Deutschlands Wirtschaft, Wahrung und Finanzen (Berlin, 1924), pp. 29, 62; Statistisches Reichsamt, Zahlen zur Geldentwertunq in Deutschland 1914 bis 1923, Sonderhefte 1 zu Wirtschaft und Statistik (Berlin, 1925), pp. 45-51; Wirtschaft und Statistik, 1-4 (1921-1924), passim; Armd Jessen, Finanzen, Defizit und Notenpresse 1914-1922 (Berlin, 1923), Table 6; Bundesarchiv, Koblenz [BAK] Reichsfinanzministerium R2/2659, R2/2795;BAK, Reichskanzlei R431/2357; Zentrales Staatsarchiv, Potsdam [ZSa] Reichsschatzministerium

22.01/3488. For further details, see Webb, “Revenue and Spending.”’

Source of table and notes: Webb (1989: 779, parentheses added).

Appendix 2

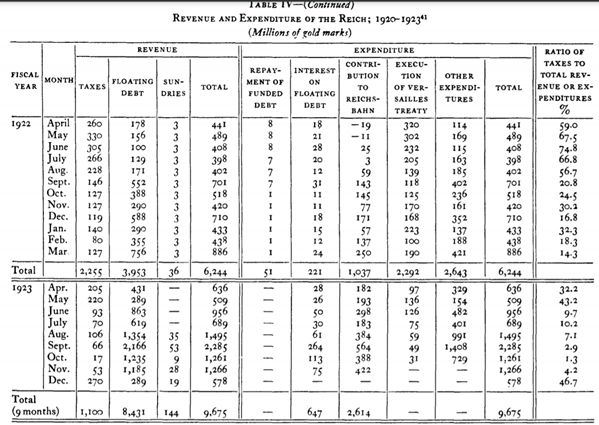

REVENUE AND EXPENDITURE OF THE REICH 1920-1923

‘This table is an average of three sets of figures calculated on the cost of living index, wholesale price index and dollar index, respectively. The original figures are given in millions and tenths of millions of gold marks. Since they run to the first decimal place only, slight discrepancies occur between the totals and the sums of the individual items when the average of the three sets is taken. The decimal place has been omitted in the above table and minor corrections made in order to secure consistent totals. The balancing of the original tables leaves something to be desired and some small adjustments were necessary on this account’ Graham (1930: 41).

Source of table and notes: Graham (1930: 41).

Appendix 3

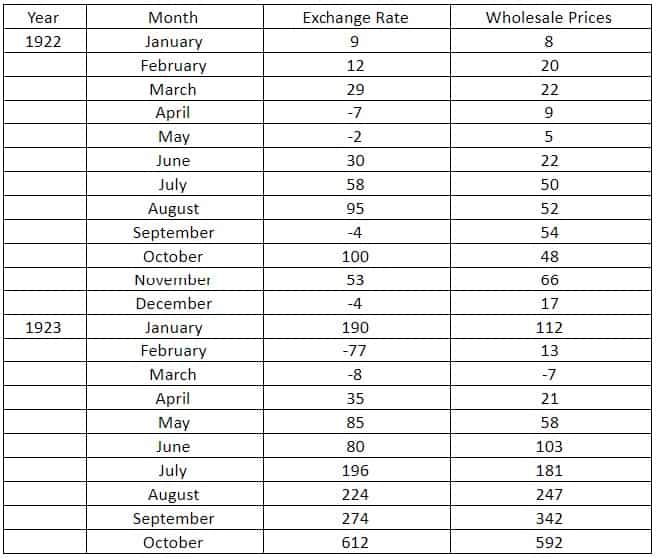

INFLATION IN WHOLESALE PRICES AND THE EXCHANGE RATE (monthly, 1922-23)

Monthly rate of increase (%)

Table adapted from Webb 1986: 776-77

‘Notes: Rates of Increases are continuously compounded (logarithmic) rates of change from the end of one month to the next. For wholesale prices the end of the month values are usually log-linearly interpolated’ (Webb 1986: 777, emphasis and parentheses in the original).

Footnotes

1 Consider two extreme examples to make the point. Assume the government decided it would not pay any more this year for goods and services compared to the price it paid last year. Further assume that the private sector increased all prices for goods and services offered to the government. Government spending would then go from, say, $5 trillion to 0. Economic agents would have no way to obtain the funds they need to pay taxes of, say, $4 trillion (and another $1 trillion needed to net save) which would impart a highly deflationary impulse that ends only when economic agents, however reluctantly, lower price to be able to effect the $5 trillion in sales to the government. Now assume that the government raises the pay of all employees and employees of contractors and vendors paid by the government to 1 million pounds per hour, without tax increases, allowing the size of the deficit to adjust accordingly. Clearly this would be a highly inflationary event that would alter the general price level accordingly.

2 MMT begins with the base case for analysis utilizing an employed buffer stock (Job Guarantee) for price stability.

3 The Agent General was an agency which both pressurised the German government to collect the payment and managed the conversion of the money received into the required foreign currency (Ormazabal 2008: 7).

4 The London Ultimatum of May 1921 set out the aggregate amount for reparations demanded by the Allies at 132 billion gold marks. Three categories of bonds (referred to as ‘Series A’, ‘Series B’, and ‘Series C’) were required to be issued and delivered to the Reparations Commission. Series A and B bonds required an unconditional payment of 50 billion marks (US$12.5 billion) from Germany. Payment due with respect to ‘C’ bonds was linked to an Allied assessment of Germany’s ability to pay (Federal Reserve Bulletin 1921).

5 ‘From the early days of the war till the end of June 1922 the Reichsbank rate remained unchanged at 5% ; it was raised to 6% in July, to 7% in August, 8% in September and 10% in November 1922, to 12% in January 1923, 18% in April, 30% in August and 90% in September. But these increases were as nothing when measured alongside the progressive lightening in the burden of a loan during the time for which it ran. Though, after September 1923, a bank or private individual had to pay at the rate of 900% per annum for a loan from the Reichsbank, this was no deterrent to borrowing’ (Graham 1930: 65). Schacht notes how interest rates fell after stabilization, ‘At the beginning of the year 1924 an interest rate of 100 per cent. per annum was nothing uncommon on the open market, and may almost be said to have been the normal rate. The Reichsbank, on the other hand, adhered, after stabilization, to its rate of 10 per cent., which rapidly compelled private rates to come into line’ (Schacht 1927: 202).

6 Interestingly, Helfferich’s PhD was supervised by Georg Friedrich Knapp, the author of The State Theory of Money (1905 [trans 1924]). ‘Das Geld [Money] was the German-language standard book on monetary issues at the beginning of the twentieth century…’ (Greitens 2020: 7-9, parentheses added).

7 Data provided by Helfferich (1969 [1927]: 617).

8 Helfferich notes (1969 [1927]: 601) that the number of paper marks per $US reduced from approximately 50000 in late January to 22000 in the months immediately following and its ‘approximate stabilisation at that figure’.

9 Schacht notes with regard to ‘emergency money’ or ‘Notgeld’, ‘While before the war the presses of the Reichsbank had printed all banknotes, in 1923 133 additional printing firms with 1783 machines were needed to supply the demand. More than thirty paper manufacturers worked at full capacity solely to provide paper for the Reichsbank notes. Yet even with this immense output the Reichsbank was unable to deliver enough banknotes to satisfy the demand. It often had to ask the provinces, municipalities and individual large concerns to print and put into circulation their own emergency money. In such cases it gave an assurance that it would redeem these emergency notes exactly as if they were its own banknotes. By the end of 1922 the amount of emergency money in circulation already amounted to one tenth of the Reichsbank notes, and by the end of 1923 there was as much emergency money as Reichsbank money (Schacht 1967: 68).

10 ‘This rate was chosen essentially for accounting reasons. The peace-time exchange rate had been 4.2 Marks to the Dollar. Thus it was now only necessary to remove the noughts from the 4.2 billion in order to achieve a simple conversion to the old gold Mark basis. By and large any other rate of exchange could have been chosen’ (Schacht 1967: 69).

11 Schacht (1967: 72) notes positively, ‘The difficult period of credit restriction lasted no more than two months. All speculators, who had once again hoarded Dollars, exchanged their holdings of foreign exchange for Reichsmarks and thus enabled them to be used to aid the economy. The bank’s action saved not only the currency, but also confidence in the currency. This confidence was not based on tedious expositions of proof or exhortations, but was supported by the weight of action. The wholesale price index, which in April had still stood at 124, was down by June tons. If on 30 May the bank could meet only one per cent of foreign exchange requirements, by 3 June it was in a position to satisfy the entire demand for dollars. For the first time since the previous decade the German foreign exchange market functioned smoothly and properly.’

12 In 1922, Weimar unemployment stood at 213,000, rising to 751,000 in 1923 and again to 978,000 in 1924 before falling again to 636, 000 in 1925. (Such figures were dwarfed by the huge rise in German unemployment which followed the Wall Street Crash). (Source: StJbDR [Statistisches Jahrbuch des Deutschen Reiches] https://www.mtholyoke.edu/courses/dvanhand/friedrich/arbeitslosigkeit.html). Schacht himself points out the effects of his credit restriction policy on bankruptcy in 1924, ‘Whereas in March the number of bankruptcies was only 68, in April it had risen to 133, in May to 322, in June to 579, and in July to 1.173’ (Schacht 1927: 163).

13 ‘Unlike the Treaty of Versailles, the Dawes Committee capped the amount of money that Germany had to transfer to the victors. The Committee stipulated that Germany had to pay the now determined sum in annual instalments, one fraction of which was invariable while the other was variable and depended on the performance of the German economy in the year in question’ Ormazabal (2008: 2).

14 Schacht notes that ‘One of the preliminary conditions for the definitive coming into force of the London Agreements [August 30, 1924] was the placing of the international loan to the amount of 800 million gold marks as proposed by the Experts for the support of the German currency and to facilitate the reparation payments of the first Dawes year’ (Schacht 1927: 184, parentheses added). He later contextualises and stresses the importance of the loan: ‘Three dates constitute landmarks in the recovery of the German currency. On November 20, 1923, the mark was stabilized at the rate of a billion [commonly, a trillion in current terms] paper marks to one gold mark; on April 7, 1924 , the enforcement of credit rationing finally assured the success of the stabilization; and, lastly, on October 10, 1924, the addition of the 800 million gold marks of the Dawes Loan to the working capital of the country provided just hat economic backing which the situation required’ (Schacht 1927: 189, parentheses added).

15 Although the details of German monetary management following on from the stabilisation of the mark are outside the scope of this paper, we would add that the principle that the Agent General should refrain from paying more than the agreed parity for foreign exchange and, indeed, that borrowed foreign capital should not be used to finance the acquisition of foreign exchange to settle reparations liabilities were set out by Schacht himself. ‘The idea at the bottom of the much-discussed settlement, for which the Dawes Committee was responsible, is that Germany should only transfer to foreign countries the surpluses which she is able to produce on her balance of payments. The Agent-General for the Reparations Payments is accordingly only to convert the reparation moneys accruing inside Germany into Devisen [foreign currency] i.e. into transferable form, within the limits set by the necessity of maintenance of the currency parity. Such conversion can therefore only take place with the surpluses arising out of the country’s economic activities: it may not and cannot be attempted with borrowed foreign capital’ (Schacht 1927: 231, parentheses added). Schacht then goes on to discuss the extent which this policy recommendation was actually followed in the years immediately following the adoption of the Dawes Plan (Schacht 1927: 231-36).

References

Armstrong, P. (2015), ‘Heterodox Views of Money and Modern Monetary Theory’,

https://moslereconomics.com/wp-content/uploads/2007/12/Money-and-MMT.pdf.

Armstrong, P. (2020), Can Heterodox Economics Make a Difference?: Conversations with Key Thinkers, Cheltenham: Edward Elgar.

Armstrong, P. and Siddiqui, K. (2019), “The case for the Ontology of Money as Credit: Money as bearer or basis of ‘value’”, Real World Economics Review, Issue 90.

Bell, S. (1998), ‘Can Taxes and Bonds Finance Government Spending?’, Levy Institute, Working Paper no. 244, http://www.levyinstitute.org/pubs/wp244.pdf

Cagan, P. (1956), ‘The Monetary Dynamics of Hyperinflation’. In M. Friedman ed., Studies in the Quantity Theory of Money, Chicago: University of Chicago Press.

Federal Reserve Bulletin (1921), ‘German Reparations’, June,

https://fraser.stlouisfed.org/files/docs/publications/FRB/pages/1920-1924/23855_1920-1924.pdf.

Friedman, M. (1956), ‘The Quantity Theory of Money-A Restatement’, In M. Friedman, ed., Studies in the Quantity Theory of Money, Chicago: University of Chicago Press.

Graham, F. (1930), Exchange, Prices, and Production in Hyperinflation: Germany 1920-1923, New York: Russell and Russell.

Greitens, J. (2020), Karl Helfferich and Rudolf Hilferding on Georg Friedrich Knapp’s State Theory of Money: Monetary Theories during the Hyperinflation of 1923’, Econstor,

https://www.econstor.eu/bitstream/10419/216102/1/Helfferich%20and%20Hilferding%20on%20Knapp.pdf’

Helfferich, K (1969/1927), Money, (Trans. Louis Infield), New York: Augustus M. Kelley.

Hetzel, R. (2002), ‘German Monetary History in the First half of the Twentieth Century’, Federal Reserve Bank of Richmond, Economic Quarterly Volume 88/1 Winter.

Keynes, J.M. (1919), ‘The Economic Consequences of the Peace’, London: Macmillan.

Keynes, J.M. (1949/1929), ‘The German Transfer Problem’, In Readings in the Theory of International Trade, Blakiston Series of Republished Articles on Economics, Vol. IV, Philadelphia: The Blakiston Company, 161-169.

Knapp, G. F. (1973/1924), The State Theory of Money. New York: Augustus M. Kelley.

Mantoux, E. (1946), The Carthaginian Peace or The Economic Consequences of Mr. Keynes, London: Geoffrey Cumberlege (Oxford University Press).

Mosler, W. (1993), ‘Soft Currency Economics’,

http://moslereconomics.com/mandatory-readings/soft-currency-economics/

Mosler, W. (2020), ‘White Paper: Modern Monetary Theory’ (MMT),

https://docs.google.com/document/d/1gvDcMU_ko1h5TeVjQL8UMJW9gmKY1x0zcqKIRTZQDAQ/edit.

Mosler, W. and Silipo. D. (2017), ‘Maximizing price stability in a monetary economy, Journal of Policy Modeling, Vol. 39, Issue 2, March–April, 272-289.

Ohlin, B. (1949/1929), ‘The Reparation Problem: A Discussion. Transfer Difficulties, Real and Imagined’, In Readings in the Theory of International Trade, Blakiston Series of Republished Articles on Economics, Vol. IV, Philadelphia: The Blakiston Company, 170-178.

Ormazabal, K. (2008), ‘The Ohlin-Keynes Debate on the German Interwar Reparations Revisited,” Ikerlanak, Working paper series IL. 32/08

https://addi.ehu.es/bitstream/handle/10810/6420/il2008-32.pdf?sequence=1&isAllowed=y

Rueff, Jacques (1929), ‘Mr. Keynes’ View on the Transfer Problem: A Criticism,’, Economic Journal 39, 388-399.

Schacht, H. (1927), The Stabilisation of the Mark, London: George Allen and Unwin.

Schacht, H. (1967), The Magic of Money, Paulton, Somerset: Purnell and Sons.

Tcherneva, P. (2002), ‘Monopoly Money: The State as a Price Setter’, Oeconomicus, Volume V, Winter

Webb, S. B. (1989), Hyperinflation and Stabilization in Weimar Germany, Oxford: Oxford University Press.

Webb, S. B. (1986), ‘Fiscal News and Inflationary Expectations in Germany After World War 1’, Journal of Economic History, Vol. 46, No. 3, Sept, pp. 769-794.

1 thought on “Weimar Republic Hyperinflation Through a Modern Monetary Theory Lens”