Rishabh is a high school senior at Cambrian International Academy in San Jose, California. His passion for climate change solutions led to his interest in MMT, which he has continued studying since. Wanting to explore this subject further, he completed the MMT course offered by Bill Mitchell at the University of Newcastle, Australia. He has participated and presented in a book club about Stephanie’s Kelton’s The Deficit Myth, where he was the only youth member.

The current economic framework within which policy is developed seems incapable of addressing climate change. Even policymakers who acknowledge the magnitude of the problem are avoiding real solutions, not knowing how solutions can be funded. But is that the end of the debate? Are there other economic paradigms that we should seriously consider? Will climate change destroy the planet before we can come up with the money to pay for solutions?

Not finding answers in introductory economics courses, I stumbled upon Modern Monetary Theory (MMT), a new macroeconomic paradigm that shows how the government can actually fund solutions for the climate crisis. In introductory economics courses, we are taught that any government is financially constrained by how much it can raise through taxes or borrowing. MMT explains that currency-issuing governments (like the U.S. federal government) are not financially constrained, because their spending creates new money. MMT confused me initially because it overturned all the economics I had learnt in class.

As someone who has done introductory courses in Economics 101 (textbook economics) as well as MMT, I would like to show how the two approaches differ in their views on government spending, government debt, bank lending, interest rates, and money. Through this, I would like to show how MMT is a paradigm shift in economic thinking that can lead our generation to real climate solutions.

To organize the differences between the two approaches, I have created the table below:

Table 1: Differences between Textbook economics and MMT

| Textbook Macroeconomics | Modern Monetary Theory | |

| 1. | Governments finance spending through taxing, borrowing, or money creation. | Currency-issuing governments finance their spending through money creation. Taxing and borrowing drain money out of the economy. |

| 2. | Government deficits and debt are always a problem because they will need to be paid down eventually, leading to increased taxes. | Government deficits and debt create private sector surpluses which are good for the economy. Government debt in the currency issuer’s currency is not a problem, only government debt in other currencies is a problem. |

| 3. | Interest rates are set by an equilibrium of supply and demand for loanable funds. | The Federal Reserve sets the Fed Funds interest rate as a policy choice. |

| 4. | Money is always an asset in the economy. | Money is a financial asset to its holder but a financial liability to the currency issuer. |

| 5. | Banks lend money that was previously saved by depositors. | Banks create new money when they lend. |

Of the five key differences listed above, I will explain the first four in theory, and the last one using a simple model of the economy in the “Minsky” tool.

I. How governments finance their spending (covers row 1 from Table 1):

According to textbook economics, a government has three ways by which it finances its spending: taxing its residents, borrowing from the private sector, and creating new money. Each of these methods has its own problems – taxation is largely unpopular, borrowing means that the private sector now has less money to spend or invest, and money creation leads to inflation. In the textbook view, the government should first tax as much as politically feasible, then borrow as much as it can without affecting private sector borrowing, and then use money creation as a last resort.

On the other hand, MMT believes that a monetarily sovereign government finances itself only through the process of money creation (taxing and borrowing serve other purposes, which are described later). As described by L. Randall Wray in Alternative Paths to Modern Money Theory, the criteria for monetary sovereignty are the following:

- the National government chooses a money of account in which the currency is denominated;

- the National government imposes obligations (taxes, fees, fines, tribute, tithes) denominated in the chosen money of accou

- the National government issues a currency denominated in the money of account, and accepts that currency in payment of the imposed obligations; and

- if the National government issues other obligations against itself, these are also denominated in the chosen money of account, and payable in the national government’s own currency.

(Wray, 2019, pg. 5)

The U.S. Federal government meets these criteria because a) it has chosen the U.S. Dollar as the money of account, b) it imposes taxes, fees, fines, tribute, and tithes denominated in U.S. Dollars, c) it issues the U.S. Dollar and accepts it as payment for these obligations, and d) it issues obligations against itself (bonds, U.S. Treasuries, etc.) denominated in U.S. Dollars. In the rest of this paper, I will use the term “government” primarily in reference to the monetarily sovereign U.S. federal government and its institutions.

Per MMT, the government finances itself through the process of money creation (not taxation or borrowing). As far as the government is concerned, it could take all the money it earned from taxes, burn it, and then issue new money to fund itself. So what is the purpose of taxing and borrowing? They are mechanisms by which the government drains money out of the economy. In addition, taxing creates demand for the government’s currency, can be used to reduce inequality, and can incentivize and de-incentivize certain activities. Meanwhile, borrowing allows the central bank to regulate interest rates through open market operations and creates a risk-free way for the private sector to save.

Taxing and borrowing do not finance the government. In fact, as the sole issuer of the currency, the government must first spend money into the economy before taxing or borrowing it out.

Since a currency-issuing government is not financially constrained, it is in a position to address societal challenges that the private sector might not take on. For example, the private sector will only work to solve climate change if it is profitable. The currency-issuing government can tackle such problems with the required urgency since it need not worry about profitability.

II. Government deficits and debt (covers rows 2, 3, and 4 in Table 1):

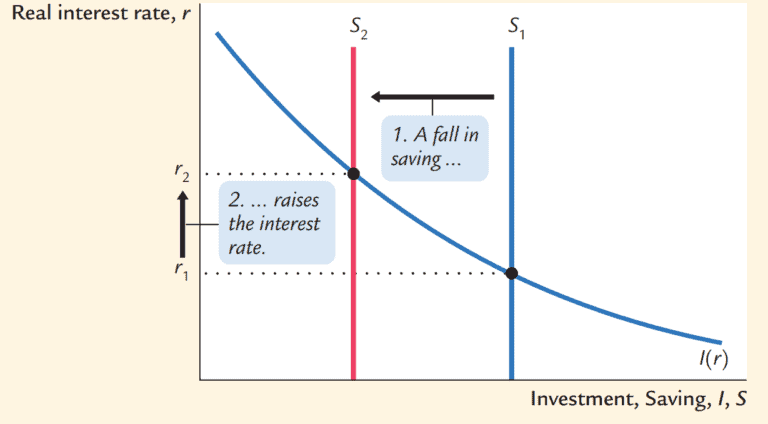

Per textbook economics, the government accrues debt when it borrows, and just as any other currency user (such as households, firms, and local and state governments), it has to eventually pay it back. In addition, when the government’s debt increases, it will need to raise taxes in the future to pay off that debt. This means creating debt now will push the tax burden onto future generations. Additionally, when the federal government spends by borrowing, it reduces the amount of remaining “loanable funds” for the private sector to use for investment, causing interest rates to rise. Textbook economics assumes that there is a fixed quantity of loanable funds created by depositors, which is available to borrow. Government borrowing “crowds out” private sector borrowers by increasing the interest rate, as shown below in Figure 1.

When the government borrows, the supply of loanable funds (savings) decreases, shifting the Savings curve to the left from S1 to S2. This causes the equilibrium interest rate (where the Savings and Investment curves intersect) to increase from r1 to r2.

While expansionary policies that put the government in debt may be necessary in the short run, they reduce growth by crowding out private sector investments in the long run. Further, if the interest rate on the government’s debt is higher than the growth rate of the economy, the debt is assumed to be unsustainable because it cannot be paid down.

In contrast, MMT argues that the government’s debt, if denominated in its own currency, is not a problem because a currency-issuing government can pay back any obligations denominated in its own currency. This means that the size of the government’s debt should not be a concern unless the debt is in a foreign currency.

MMT explains that when the government borrows, it is borrowing money it previously injected into the economy through government spending. This cannot lead to crowding out of private sector borrowers because it effectively is not reducing the money supply.

U.S. federal debt is held in debt instruments called U.S. treasuries, which are risk-free ways of saving for the private sector. The government’s debt is thus savings for the private sector. U.S. Treasuries are a crucial part of the Federal Reserve’s monetary policy, as the Federal Reserve sets the fed funds rate (the interest rate at which banks lend to other banks) by the purchase and sale of U.S. Treasuries. The Federal Reserve can always choose to set the interest rate below the economy’s growth rate, thus guaranteeing debt sustainability. An attempt to pay down the entire U.S. federal debt would be problematic because that would retire all outstanding Treasuries and end the entire U.S. treasury system.

MMT recognizes money as a financial asset, which is simultaneously a financial liability to the currency issuer. When the government runs a financial deficit, the private sector runs a financial surplus. To explain this, MMT economists often refer to “sectoral balances”, an accounting identity that captures the financial flows of major sectors in the economy.

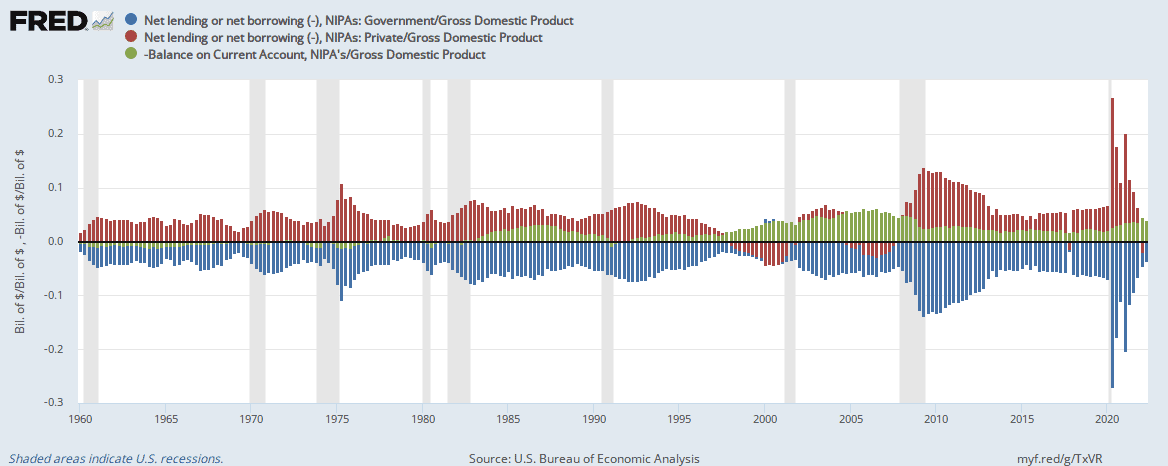

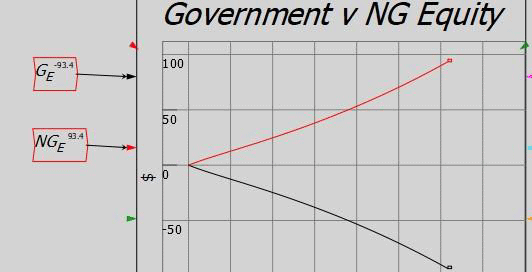

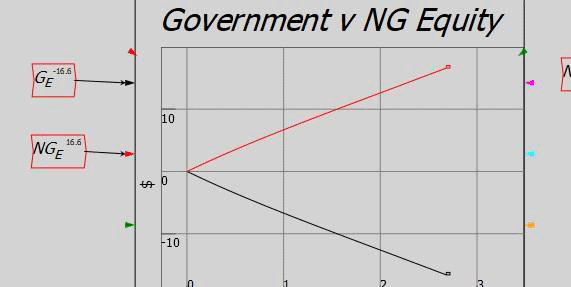

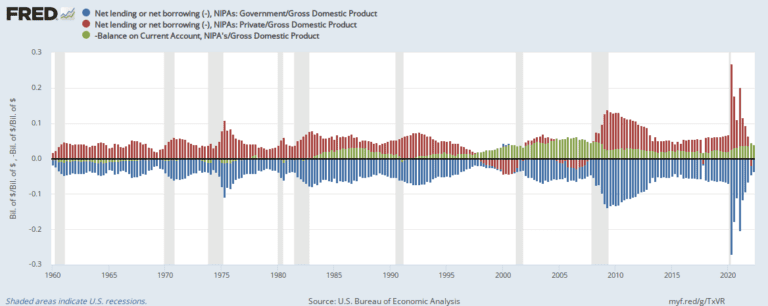

Sectoral balances is plotted in Figure 2 above. There are three main sectors (government in blue, private in red, and foreign in green), each of which is either in a state of financial surplus (taking in more than it spends) or financial deficit (spending more than it takes in). The sectoral balances accounting identity shows us that the overall financial deficits in the economy must mirror the overall financial surpluses. The mirror effect can be seen in Figure 2. The U.S. is a net importer, so its foreign sector has consistently been in financial surplus. In this state, if the government budget is balanced or in surplus (as recommended by textbook economics), the private sector will need to run a deficit. If, however, the government is the one in deficit, that means that the private sector is running a surplus.

As we have learned, the federal government is not constrained by its debt because it can issue currency to pay it off. The government can run as large a deficit as it needs in order to solve societal problems such as climate change. As the sectoral balances identity shows us, government deficits would lead to more savings in the private sector rather than higher taxes and interest rates. This means the government need not worry about its financial sustainability and can use its currency-issuing power to serve the public.

III. Modeling (covers rows 1 and 5 of table 1)

Up until this point, this paper has discussed the theoretical aspects of both textbook and MMT economics. Having discussed the theoretical aspects of both viewpoints regarding government spending and debt, I will now cover how both approaches model the macroeconomy.

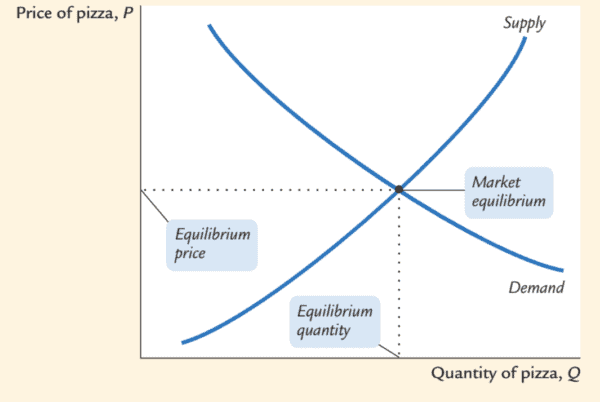

Textbook economics uses what are called “general equilibrium models”. As Kate Raworth describes in chapter 4 of Doughnut Economics, these models are inspired by physics and differential calculus. They are based on an intersection of lines, and the point where the lines intersect is where market forces bring the model to rest at equilibrium (Raworth, pg. 112). The textbook supply and demand model is shown below in Figure 3.

Textbook economic models largely ignore banks and debt and treat money as any other commodity in the economy. As Kate Raworth said, “Prior to 2008, many major financial institutions – from the Bank of England and the European Central Bank to the US Federal Reserve – were using macroeconomic models in which private banks played no role at all: an omission that turned out to be a fatal error.” (Raworth, 2021, pg. 125)

MMT recognizes that money is a financial instrument that is listed simultaneously as assets and liabilities across balance sheets in the economy. MMT recommends using “stock flow consistent (SFC)” models that are built as a set of interconnected balance sheets of various entities in the economy. These models are stock flow consistent because they keep track of accounts (stocks) and how money moves through them (flows). They make sure that whenever an account (a stock) gives or receives money (a flow), that is also recorded in the account of whoever then received or gave that money. SFC models are also dynamic, consider feedback loops in the economy, and do not assume that an “economy naturally moves to equilibrium” at its most optimal point, in contrast to standard economic thinking.

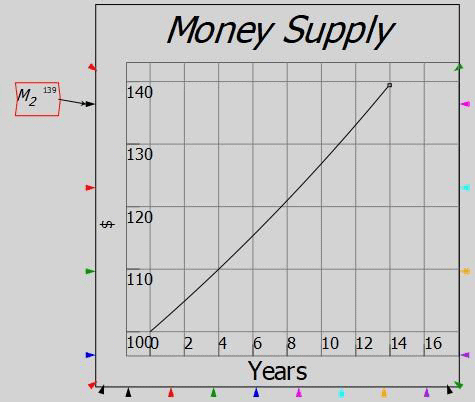

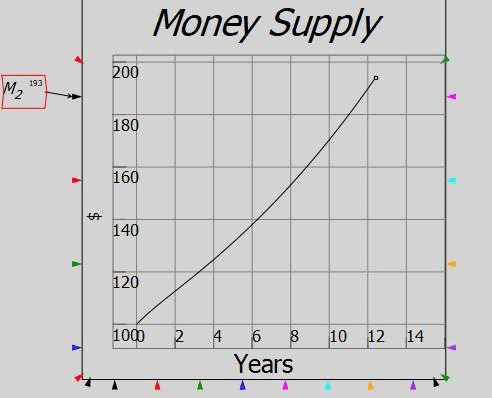

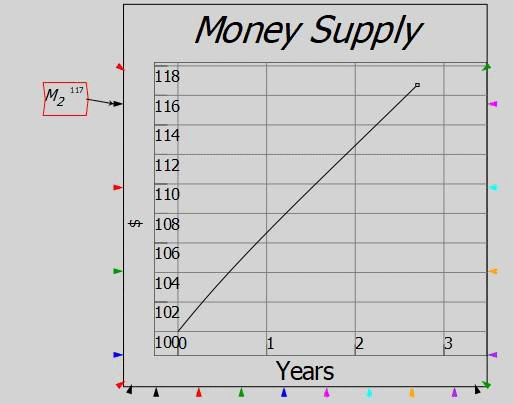

Minsky (named after economist Hyman Minsky) is a systems dynamics SFC modeling tool for the economy, suggested by Kate Raworth in Doughnut Economics (Raworth, pg. 126). I built a simple model of the economy in Minsky by following instructions provided by Professor Steve Keen here (Keen, 2020). There are three essential parts to the model: Godley tables, flow equations, and charts. Godley tables are accounting tables that keep track of each sector’s assets, liabilities, and equity, as well as any flows going in or out of those accounts. Flow equations determine flows and eventually impact stocks. The charts are visual representations of stocks/flows. For additional specifics on the model, refer to Appendix 2. Building and running this specific model in Minsky reveals the core ideas of MMT listed below:

- When banks lend, they add dollars to the money supply M2.

(Rate of lending exceeds the rate of borrowing, all else constant)

- When the government spends, it adds dollars to the money supply M2.

- Open Market Operations (where the Federal Reserve buys and sells government debt), have no effect on the money supply M2, it only swaps assets (Treasuries for Reserves) for the Banking sector.

(Open market operations are set as a nonzero fraction of government spending)

IV. Conclusion

Climate change is now a part of life for all of us. Nearly every day a new extreme weather event is headlined in the newspapers. Our government must do all it can to limit the impact of climate change, such as switching to renewable energy, retrofitting infrastructure for extreme weather, etc. This will require government spending. Economics textbooks explain that such spending will create unsustainable government debt and increase taxes. MMT explains that monetarily sovereign countries like the USA can spend their currency to address real social problems. Textbook economics worries that such spending will create an unsustainable financial debt burden. MMT explains that the U.S. government debt is not a public burden, and instead creates financial surpluses for the private sector. I hope the MMT perspective will soon be introduced into the economics curriculum in order for students to learn how urgent problems like climate change can be addressed.

Appendix 1:

Steps to create the sectoral balances graph on FRED:

- Open FRED here

- In the search bar, add the graph for government spending with code (AD01RC1Q027SBEA)

- To add the other two curves, go to the “edit graph” option and select “Add Line”, using code (W994RC1Q027SBEA) for the private sector and code (NETFI) for the foreign sector

- For each curve, go under “customize data” and add GDP as a series with code (GDP).

Then change the formulas to a/b for public and private and -a/b for foreign - For aesthetic, you can use the “Format” option to change how the bars look.

Appendix 2:

Opening the MMT model in Minsky:

- Open the Minsky installer file here and download it

- Open the completed Minsky model here, download, and open the file

For additional Appendix data and formulas, see original pdf of paper HERE.

References

Berkeley, A., et al. (2022). The self-financing state: An institutional analysis. UCL Institute for Innovation and Public Purpose https://www.ucl.ac.uk/bartlett/public-purpose/sites/bartlett_public_purpose/files/the_self-financing_state_an_institutional_analysis_of_government_expenditure_revenue_collection_and_debt_issuance_operations_in_the_united_kingdom.pdf

Board of governors of the Federal Reserve System. (n.d.). Retrieved from The Fed – Federal Open Market Committee (federalreserve.gov)

Driessen, G.A., Gravelle, J.G. (2019). Deficit financing, the debt, and “modern monetary theory” – congress. Deficit Financing, the Debt, and “Modern Monetary Theory” (congress.gov)

Keen, S. (2020). Introduction to the Minsky models of modern monetary theory. YouTube. Introduction to The Minsky Models of Modern Monetary Theory #TMMOMMT #MMT – YouTube

Kelton, S. (2020). The deficit myth: Modern monetary theory and the birth of the people’s economy. Public Affairs, Hatchette Book Group.

Mankiw, N. G. (2003). Macroeconomics. Worth Publishers.

Mcleay, M., et al. (2014). Money creation in the modern economy. Bank of England. Retrieved from Money creation in the modern economy | Bank of England

Mcleay, M., et al. (2014). Money in the modern economy: An introduction. Bank of England. Money in the modern economy: an introduction | Bank of England

Nikoforos, M., Zezza, G. (2017). Publications. Stock-flow Consistent Macroeconomic Models: A Survey | Levy Economics Institute. Stock-flow Consistent Macroeconomic Models: A Survey | Levy Economics Institute (levyinstitute.org)

Raworth, K. (2022). Doughnut economics: Seven ways to think like a 21st-century economist. Penguin.

Real-World Economics Review – paecon.net. (2019). whole89.pdf (paecon.net)

Wray, L.R. (2019). L. Randall Wray testimony before the House Budget Committee, 11/20/2019. .L. Randall Wray Testimony before the House Budget Committee, 11/20/2019 (levyinstitute.org)

FRED database: fred.stlouisfed.org

Minsky model links:

I would say Rishabh earned an “A” for factual information that was well-organized and resourced. This is a “keeper” that should be on everyone’s list of MMT info for social media teaching purposes as well as rebuttals to MMT ignorance, misinformation, and the ever-present disinformation campaign.

We’re always looking for clear, well-organized explanations of MMT. Creating a table comparing it to mainstream economics is especially useful. I recommend bookmarking this article.

Excellent work. Certain known MMT views are stated in a simple and lucid manner.

Giving my observations about certain points:

“Will climate change destroy the planet before we can come up with the money to pay for solutions?”

*Climate change alone is not a problem. The present exploitative system, that too with a supportive state structure, is nothing but open looting of masses.*

“MMT explains that currency-issuing governments”

*I would prefer to use supply mostly instead of issue.*

“Taxing and borrowing do not finance the government. In fact, as the sole issuer of the currency, the government must first spend money into the economy before taxing or borrowing it out.”

*Functionally, even under fixed exchange system, that is what happens because of the timing difference in receipts and payments. But, it is called WMA/Overdraft from CB.*

“Federal Reserve sets the fed funds rate (the interest rate at which banks lend to other banks)”

*Check what is stated in brackets is right.*

“The U.S. is a net importer, so its foreign sector has consistently been in financial surplus.”

*Being net importer, it is in trade deficit. But it should be current account surplus.*

“If, however, the government is the one in deficit, that means that the private sector is running a surplus.”

*Together with foreign sector.*

“As we have learned, the federal government is not constrained by its debt because it can issue currency to pay it off. The government can run as large a deficit as it needs”

*As long as real resources are available for sale*