Originally posted on March 6, 2013 at the New Economic Perspectives blog.

Many years ago, I had occasion to spend a long weekend at Ramuda Ranch in Arizona—a rehab facility where young women are helped to learn how to want to eat food again. Anyone who has had a personal encounter with Anorexia Nervosa knows what a mystifying and frightening experience it is. The young women I saw there—all of them well above average intelligence-wise, many of them stunningly beautiful in a physical sense—all suffered from the same delusion: they had convinced themselves that eating, taking nourishment into their bodies, was pathological. The delusion had variations: some of the adolescent girls looked into the mirror and—in spite of the fact they were five feet eight inches tall and weighed only 75 pounds—SAW a body that was grotesquely over-weight and fat. Others seemed to have a disconnected relationship with their bodies, as if they personally were one thing and their body another—and the “other” was something that, for complex, obscure, and compelling reasons, deserved punishment and starvation. For those of us who were visitors, observing this irrational and self-destructing behavior in young women, who otherwise seemed perfectly normal and healthy, was perplexing and painful.

I was reminded of Ramuda Ranch last Friday as I watched our nation’s leaders explain to the American people why America must now impose a new austerity upon itself. By what process, I wondered, have we convinced ourselves that we do not have enough U.S. Dollars to pay ourselves to create the goods and services we need to prosper as a society? What exactly is the “fiscal crisis” that we see when we look in the mirror? How is it that we view our national community with such detachment that we can knowingly impose upon it a painful—and unnecessary—deprivation? How can it be that we view the spending of our OWN sovereign currency to create public goods and services—the essential nourishment of our private economy—as creating a “deficit” that we must somehow repay to someone in the future? How have we bought into this massive delusion? And where is the rehab center, the clinical psychologists and counselors, who will help us overcome it?

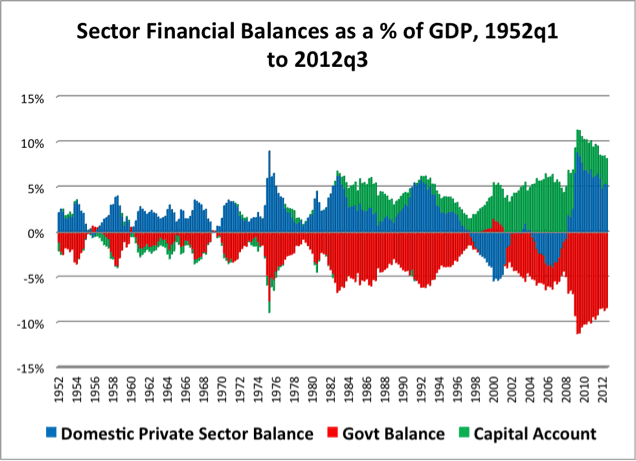

A few years ago, when the hysteria about the nation’s “deficit” first emerged, President Obama could have calmly pointed out that because the sovereign government issues the nation’s currency and spends it into the private sector, having a sovereign “deficit” is actually a GOOD thing. He could have shown the American people a simple chart and patiently explained that the federal government CAN’T limit its spending to what it collects back in taxes (creating a “balanced budget”) because that would mean no net new Dollars would remain in the private accounts of citizens and businesses—in a real sense, the private economy would begin starving.

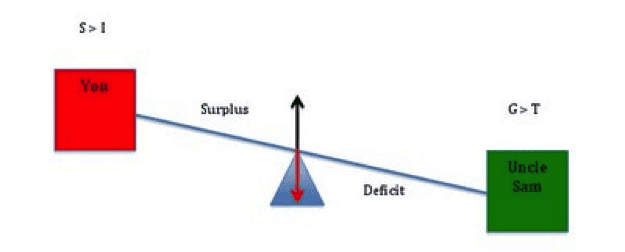

To back up that chart, he could have unveiled an even simpler one created by Dr. Stephanie Kelton at the University of Missouri Kansas City—a Teeter-Totter with numbers on it that explains the startlingly simple relationship between sovereign “deficits” and private wealth.

Choosing his words carefully, he could have helped the American people understand that the Clinton era government surpluses actually were a BAD thing because they subtracted trillions of dollars of wealth from the accounts of private citizens—forcing those citizens to BORROW more and more dollars to maintain their lifestyles, unleashing a borrowing spree that was happily accommodated by a deregulated financial industry with ever more clever and dangerous lending products. He could have compassionately commiserated with the millions of American families who lost their homes AND their jobs when this credit bubble burst just before he took office in 2008. He could have apologized for being forced to re-capitalize the U.S. banks that lost it all by defrauding American mortgage holders and then gambling their fraudulent proceeds with exotic bets. He could have declared a fierce determination to unwind the unfairness that was enabling the executives of those same banks to continue raking in personal fortunes, even as their institutions were being bailed out by the sovereign government. Finally, President Obama could have gently and courageously reminded us that our nation had been brought to its knees before by reckless financial titans—in 1929—and that we had, with Franklin Roosevelt’s guidance, learned the REAL lessons of how to recover and build ourselves back to prosperity.

But President Obama didn’t do any of those things. Instead he chose to make what I fear will turn out to be the biggest mistake of his political career: he decided to AGREE with the hysterical delusion that the U.S. sovereign government is broke. He decided to hold up the mirror and say, “Yes, we DO have to reduce our nation’s deficit. Yes, we ARE spending too much creating public goods and services. We ARE going to have to tighten our belts and get a little bit skinnier. But my promise to the American people is that we’re going to starve ourselves a little more slowly—and we’re going to do it in a ‘balanced way’ so the pain is distributed more fairly.”

I go back in my mind to that long week-end at Remuda Ranch. It was, in many ways, an experience that shattered my basic optimism about the power of rational thinking. Right now I’m having similar feelings—a kind of helplessness. The good news is, I know from personal experience that, with perseverance, delusions CAN be broken and health restored.

58 RESPONSES TO “OUR FISCAL ANOREXIA”

- financial matters | March 6, 2013 at 1:17 pm |Great article and analogies. We do have some good counselors. A few that come to mind: Michael Hudson ‘Beyond the Bubble’ , L. Randall Wray ‘Modern Money Theory: A Primer on Macroeconomics for Sovereign Monetary Systems’ and Stephanie Kelton ‘this blog’.

- y | March 6, 2013 at 1:28 pm |If an increase in government spending caused inflation to increase, would that increase private sector “wealth”, reduce it, or leave it the same overall?

- Frank | March 6, 2013 at 1:39 pm |Increases in the money supply, ceteris paribus, will cause inflation of the currency, which tends to increase the price of goods within an economy, since more money is chasing the same number of goods.

However, economies are dynamic: population growth, inappropriate income distribution, exchange rate variations and the supply and demand for particular goods also come into play.The increase of cost of living (which is not exactly the same as inflation of the currency) is a combination of many variables, some of which I have probably missed.- aj | March 6, 2013 at 3:04 pm |@ Frank

I think MMT disabuses us of this notion. Increases in the money supply don’t necessarily lead to inflation of the currency. MV = PQ. That is: Money Supply * Velocity of Money = Price * Quantity. Sure if you hold V and Q constant, more M leads to higher P, thus inflation. However, no reason is ever given why V and Q should remain constant. Q could just as easily change, especially when factories are under capacity. Or V could change (I interpret this as an increase in savings).Also, Randy frequently discusses the fact that the money supply is controlled more by bank lending than by any govt spending. I’ve yet to hear anyone argue that bank lending causes inflation other than asset bubbles.- F. Beard | March 6, 2013 at 3:27 pm |I’ve yet to hear anyone argue that bank lending causes inflation other than asset bubbles. ajI do but MMT folks often have a blind spot toward the counterfeiting cartel – deluded by A = E + L when the liabilities for the banking system as a whole are mostly virtual and the assets are in aggregate unsound because of the non-existent interest problem.

- joe | March 6, 2013 at 5:23 pm |May I ask a newbee question? So as M increases (higher deficit spending), V would also increase, but Quantity (assuming current underutilization) would increase much greater thus P would remain fairly constant, or go up less then M? Am I out to lunch with this assumption? Thanks all!

- y | March 7, 2013 at 5:45 am |“V would also increase”Why would V increase?

- Jordan | March 7, 2013 at 6:39 am |As M increases, people have more so they spend more, and with increased inflation people tend to save less so as not to let inflation reduces the value. Both of those tendencies increase V. Saving decreases V.

- joe | March 7, 2013 at 7:37 am |That what I was trying to say, as spending increased people spend more as consumer confidence grows and economic activity increases.

- joe | March 7, 2013 at 7:37 am |That what I was trying to say, as spending increased people spend more as consumer confidence grows and economic activity increases.

- Jordan | March 7, 2013 at 6:39 am |As M increases, people have more so they spend more, and with increased inflation people tend to save less so as not to let inflation reduces the value. Both of those tendencies increase V. Saving decreases V.

- Jordan | March 7, 2013 at 6:49 am |As M increases it afects all others, V, Q and P. Which will increase the most it depends on entrepenurial ability of the economy, ie economic flexibility. V and Q increase first and then in time when productive capacity is reached it requiers more debt (M) for investments into more capacity to prevent larger increase in P. Or in case of the free trade, it will increase imports instead of increasing P.

So, all depends on organizational quality of a society to organize needed production, which enables ease and price of credit for more capacity investment. It is a very dynamic system with many variables.- joe | March 7, 2013 at 9:56 am |Thanks! I appreciate the responses. I’m sure you are all much more well versed then I in this subject matter.

- joe | March 7, 2013 at 9:56 am |Thanks! I appreciate the responses. I’m sure you are all much more well versed then I in this subject matter.

- y | March 7, 2013 at 5:45 am |“V would also increase”Why would V increase?

- F. Beard | March 6, 2013 at 3:27 pm |I’ve yet to hear anyone argue that bank lending causes inflation other than asset bubbles. ajI do but MMT folks often have a blind spot toward the counterfeiting cartel – deluded by A = E + L when the liabilities for the banking system as a whole are mostly virtual and the assets are in aggregate unsound because of the non-existent interest problem.

- Joe Firestone (LetsGetitDone) | March 8, 2013 at 10:45 am |“Ceteris Paribus” means “all other things being equal or held constant.” But we always have to ask equal to what? In this case, a key assumption is that the economy is operating at or near its full capacity with no involuntary unemployment. We have never, never had that situation in America in the past 40 years. So, what good is a theory, the quantity theory of money that almost never applies to the conditions that have actually faced us or that face us now? Why even mention it? What’s your motive? Are yo trying to scare people? Are you deliberately trying to spread misleading ideas, Frank?Finally, at this blog we’ve been treated to Eric Tymoigne’s fine treatment of QTM. If you really want to be serious about this point, then I think you need to address his arguments.

- Frank | March 8, 2013 at 10:22 pm |Joe,I had no particular motive in describing the effect of adding more money into an economy, except to answer a fellow poster as best I could. I have no wish to mislead or scare anyone. In general though, inflation of the currency seems to be a built in feature of the fractional reserve banking system, which seems to come about due to the creation of more money as debt, which is necessary in order to pay the interest. I maintain that the the rate of inflation of the currency is the same as the average rate of interest. This is merely an observation: I have no proof. Since 1913 when the Federal Reserve was created, the purchasing power of the dollar has declined by 96%.I have been aware of inflation or the near constant erosion of the purchasing power of money, since I was young man. I recall my father, who was born in 1908 telling me that the price of a pint of beer was a penny a pint, when he was 20 years old. I put this information to good use in that I always took out the biggest mortgage I could back in the sixties, when I bought my first house in England. This would not have applied in the latest property boom, since incomes have not risen to cope with the increased property prices. I have not had a mortgage, since 1978.I do not disagree with deficit spending in times of recession in order to reduce unemployment. Since about 2007 we have seen the doubling of the price of crude oil and its derivatives, which essentially bumps up the cost of everything else we buy. Is this inflation of the currency that causes this ? Or is it the effect of supply and demand ? I suspect the latter, since the fall of house prices was essentially caused by a contraction of the money supply. Or was it the increased cost of energy that garnered more of the available money ?

- Frank | March 8, 2013 at 10:31 pm |I forgot to thank you for the link to Eric Tymoigne’s article. Very interesting.

- Frank | March 8, 2013 at 10:22 pm |Joe,I had no particular motive in describing the effect of adding more money into an economy, except to answer a fellow poster as best I could. I have no wish to mislead or scare anyone. In general though, inflation of the currency seems to be a built in feature of the fractional reserve banking system, which seems to come about due to the creation of more money as debt, which is necessary in order to pay the interest. I maintain that the the rate of inflation of the currency is the same as the average rate of interest. This is merely an observation: I have no proof. Since 1913 when the Federal Reserve was created, the purchasing power of the dollar has declined by 96%.I have been aware of inflation or the near constant erosion of the purchasing power of money, since I was young man. I recall my father, who was born in 1908 telling me that the price of a pint of beer was a penny a pint, when he was 20 years old. I put this information to good use in that I always took out the biggest mortgage I could back in the sixties, when I bought my first house in England. This would not have applied in the latest property boom, since incomes have not risen to cope with the increased property prices. I have not had a mortgage, since 1978.I do not disagree with deficit spending in times of recession in order to reduce unemployment. Since about 2007 we have seen the doubling of the price of crude oil and its derivatives, which essentially bumps up the cost of everything else we buy. Is this inflation of the currency that causes this ? Or is it the effect of supply and demand ? I suspect the latter, since the fall of house prices was essentially caused by a contraction of the money supply. Or was it the increased cost of energy that garnered more of the available money ?

- aj | March 6, 2013 at 3:04 pm |@ Frank

- Frank | March 6, 2013 at 1:39 pm |Increases in the money supply, ceteris paribus, will cause inflation of the currency, which tends to increase the price of goods within an economy, since more money is chasing the same number of goods.

- financial matters | March 6, 2013 at 2:11 pm |I think it’s useful to view inflation in light of whether or not there is full employment. If the govt stimulates the economy to provide more jobs then the wealth going into the private sector can be balanced by an increased production of goods.Once full employment is reached then the govt can back off as it got the economy functioning better and now it is more difficult to produce new goods for the increased wealth.

- Frank | March 6, 2013 at 2:28 pm |In our current monetary system, all money is created as interest bearing debt by the banks, but who wants to borrow to expand a business, when demand is stagnant or current productive capacity is under utilized ?Ben Bernanke is busy buying up corporate bonds to the tune of $40 billion per month. Where is this money going ? It does not seem to be entering the consumer economy.

- financial matters | March 6, 2013 at 2:55 pm |The Fed is buying a lot of worthless MBS. They are trying to provide some liquidity to the banking system and to prop up housing prices. It’s an inefficient battle over debt deflation but pretty much the only game in town because of the lack of Congress and the administration to provide better fiscal alternatives. Much of the private mortgage pool which was largely fraudulently origintated anyway should be written off and brought more in line with reasonable housing prices. An average home should be worth what an average person can pay with a reasonable percentage of their income. A far cry from where we were with NINJA loans being offered as everyone was hoping to benefit from capital appreciation.This would combat debt deflation in a healthier manner giving people more disposable income to feed demand.

- sgt_doom | March 6, 2013 at 3:50 pm |Not quite, financial matters, the Fed is pumping money to the banksters which owns it, it is really and truly that simple, no need to complicate the obvious.When we think back to how Lincoln did a runaround of the national bank at that time, and President Kennedy likewise did a runaround of the Fed, and through the Treasury, pumped $4.3 billion directly to the economy (i.e., the working people and families of America) and not to the banksters, perhaps events become a bit clearer for you?And FYI, big guy, the meltdown wasn’t solely, nor even somewhat, based upon the 4% foreclosure rate which was supposed to have initiated, it was based upon the largest insurance swindle in human history by AIG, which sold $460 billion in credit default swaps (unregulated insurance, purposely unregulated thanks to the massive lobbying and purchasing of laws by Goldman Sachs, Merrill Lynch, JPMorgan Chase, et al.) with the potential payout of $20 trillion to well over $40 trillion.Example: John Paulson got together with Goldman Sachs to design and create crappy CDOs (SEC investigated and fined GS for their Abacus CDO), with Paulson and Goldman purchase CDSes, at $1.4 million per, with the payout on each of $100 million per — quite the uber-financial fraud.

- financial matters | March 6, 2013 at 4:11 pm |Definitely, that’s what first got me interested in this problem about the time of the Lehman collapse in Sept 2008. How did a 10% correction in housing prices lead to a meltdown of Asian banks and then Iceland going bankrupt.That’s when we first started to hear of the CDOs, CDSs, NINJA loans and many other fraudulent activities. And as you mentioned the revolving door between our financial industry and politics leading to the oligarchic system we now have. We learned of risk models that had housing prices only going up. And we have a lack of justice in prosecuting people that understood the fallacy of these models and benefited from it. Their are many facets to derivative fraud (Traders, Guns and Money)Now we have debt deflation. We are seeing creditors being favored over national economic health. This is where I think we can benefit from an MMT approach to turn this around. Very similar to the Lincoln or Kennedy approach.

- Frank | March 7, 2013 at 9:22 am |Credit default swaps have existed since the early 1990s, and increased in use after 2003. By the end of 2007, the outstanding CDS amount was $62.2 trillion, falling to $26.3 trillion by mid-year 2010 but reportedly $25.5 trillion in early 2012. CDSs are not traded on an exchange and there is no required reporting of transactions to a government agency.http://en.wikipedia.org/wiki/Credit_default_swap

- Frank | March 8, 2013 at 8:11 am |“When we think back to how Lincoln did a runaround of the national bank at that time, and President Kennedy likewise did a runaround of the Fed ”And then they both got assassinated. Is there a connection?

- financial matters | March 6, 2013 at 4:11 pm |Definitely, that’s what first got me interested in this problem about the time of the Lehman collapse in Sept 2008. How did a 10% correction in housing prices lead to a meltdown of Asian banks and then Iceland going bankrupt.That’s when we first started to hear of the CDOs, CDSs, NINJA loans and many other fraudulent activities. And as you mentioned the revolving door between our financial industry and politics leading to the oligarchic system we now have. We learned of risk models that had housing prices only going up. And we have a lack of justice in prosecuting people that understood the fallacy of these models and benefited from it. Their are many facets to derivative fraud (Traders, Guns and Money)Now we have debt deflation. We are seeing creditors being favored over national economic health. This is where I think we can benefit from an MMT approach to turn this around. Very similar to the Lincoln or Kennedy approach.

- sgt_doom | March 6, 2013 at 3:50 pm |Not quite, financial matters, the Fed is pumping money to the banksters which owns it, it is really and truly that simple, no need to complicate the obvious.When we think back to how Lincoln did a runaround of the national bank at that time, and President Kennedy likewise did a runaround of the Fed, and through the Treasury, pumped $4.3 billion directly to the economy (i.e., the working people and families of America) and not to the banksters, perhaps events become a bit clearer for you?And FYI, big guy, the meltdown wasn’t solely, nor even somewhat, based upon the 4% foreclosure rate which was supposed to have initiated, it was based upon the largest insurance swindle in human history by AIG, which sold $460 billion in credit default swaps (unregulated insurance, purposely unregulated thanks to the massive lobbying and purchasing of laws by Goldman Sachs, Merrill Lynch, JPMorgan Chase, et al.) with the potential payout of $20 trillion to well over $40 trillion.Example: John Paulson got together with Goldman Sachs to design and create crappy CDOs (SEC investigated and fined GS for their Abacus CDO), with Paulson and Goldman purchase CDSes, at $1.4 million per, with the payout on each of $100 million per — quite the uber-financial fraud.

- Benedict@Large | March 7, 2013 at 9:10 am |To be technically correct, money is not created as interest-bearing debt. The money is simply created (out of nothing), but is OFFSET by the creation of interest-bearing government debt. The distinction is important, as the two do not occur at the same time (the debt is created; the money is spent into existence later,) and recognizing this separation allows us to better see that issuing the debt offset at all is unnecessary in terms of providing fiscal space for spending.

- Calgacus | March 7, 2013 at 6:02 pm |Frank: In our current monetary system, all money is created as interest bearing debt by the banks. NO. The government and only the government creates reserves, currency, cash, base money. Uncle Sam is in charge, not the banks.Benedict@Large: Money is simply created, and the “interest bearing government debt” is simply created, and the two might be exchanged for one another by government monetary operations, but they do not “offset” eachother. Do a $20 bill and a $10 bill offset each other in your wallet? The bond and the currency are both government debts that can be held by the private sector. That is ALL. Also, it is better, and generally more historically accurate to see the money being created first and the bonds later. As Warren Mosler says: “The funds to pay taxes and buy government securities come from government spending.”

- Cyrus Rex | March 7, 2013 at 6:23 pm |Calgacus, I can’t seem to get this central point across well enough — the government can create and spend all of the money it wants and, to a certain extent given current Fed regulations, so can banks for lending. The problem is not in the creation, it is in the hard fact that Congress legislated that all of the money that the Treasury issues has to be issued as interest bearing debt. The government is not free to issue “debt-free” money and the interest must be paid by either the government — which simply adds to the interest total — or by taxes extracted from the taxpaying public. Taxes are how the government extinguishes excess money in the economy, but the use of tax receipts to pay interest does not in any way boost the productive economy.There is simply no rational basis for the Congress (i.e., the government) to require that the government issue all of its money as interest bearing debt beyond its desire (never admitted) to provide Wall Street with a multi-billion dollar annual unearned subsidy — regardless of how the interest ends up being paid. What it creates is a sense of panic in the public which is used by the right and libertarians to foist off austerity programs on the vast majority of the citizenry while available money is moved to the top of the income pyramid. It is nothing more than a Ponzi scan to impoverish the majority of Americans.Just ask your local Congressperson why U.S. money is issued as debt and I’ll almost guarantee that the answer will be some variance on “well, that’s the way it’s always been done — it’s just the way money works.” And from the point of view of the banking establishment, that’s the way they want to keep it working. The Bank of England got it all started in 1694 and they’ve been raking it in ever since. But then it was necessary for the King to borrow gold in order to fight his wars. That is no longer necessary with fiat currency.

- Joe Firestone (LetsGetitDone) | March 8, 2013 at 10:51 am |This is factually incorrect. Platinum Coin Seigniorage is a current alternative to debt issuance. See here.

- Cyrus Rex | March 8, 2013 at 11:23 am |Joe, I completely understand platinum coin seiginorage and totally agree with you on that. But it is an irrelevancy as long as the President and the Secretary of the Treasury both say that there is no way they will even consider this option. There is no question that the debt could be paid off this way and ultimately made irrelevant, but unless and until we have leadership willing to take this step it doesn’t count for anything. Also, I would be willing to bet big money that, if it were tried, Congress would act with the speed of light to legislate it out of existence. All they would have to do is pass a law saying that no coin could be minted with a face value in excess of the value of the material of which it is made.

- Cyrus Rex | March 8, 2013 at 11:23 am |Joe, I completely understand platinum coin seiginorage and totally agree with you on that. But it is an irrelevancy as long as the President and the Secretary of the Treasury both say that there is no way they will even consider this option. There is no question that the debt could be paid off this way and ultimately made irrelevant, but unless and until we have leadership willing to take this step it doesn’t count for anything. Also, I would be willing to bet big money that, if it were tried, Congress would act with the speed of light to legislate it out of existence. All they would have to do is pass a law saying that no coin could be minted with a face value in excess of the value of the material of which it is made.

- Joe Firestone (LetsGetitDone) | March 8, 2013 at 10:51 am |This is factually incorrect. Platinum Coin Seigniorage is a current alternative to debt issuance. See here.

- Frank | March 8, 2013 at 8:20 am |“The government and only the government creates reserves, currency, cash, base money. Uncle Sam is in charge, not the banks.”You have it the wrong way round. The banks create the money as debt out of nowhere and the charge interest on it. They are allowed to create 14 times their assets according to the Basle accords. Lets say the interest they charge on a loan is 5%. Since they created the money out of nothing, their gross rate of return is 14*5=70% on their asset base.If the government created money, it would have no need to borrow and there would be no Federal debt.

- Calgacus | March 8, 2013 at 3:06 pm |Frank, I happen to have studied some MMT economics and some ‘Keynesian’ econ long before. And it makes sense to me. I think it is correct. And I think that what you and some of what Cyrus are saying is not correct, and some of it IMHO makes very little sense. And you would see that if you thought about it . Nobody else but the government can create reserves, currency, cash, base money. That is how it works now, that is how it has always worked. Why not try to read through the Modern Money Primer, or other works, without the preconception that your current ideas must be right – try to understand the actual mechanics of, operations of money.Of course banks can corrupt the government, but it is the government that must be corrupted, its agents refraining from enforcing the law, and allow institutions insolvent due to their own frauds to continue to have a banking licence. What you are saying sounds critical of the Big Bad Banks, but it is what the Evil Banksters would like people to believe. Knowing that right now Uncle Sam, the supposedly democratically elected sovereign government is very much financially in charge is something they want to keep secret.One of the first steps is to understand that as FDR said to the nation: that “government credit and government currency are one and the same thing.” Spending with subsequent bond issuance and positiive interest rates and printing currency directly, a ZIRP are only minutely different. The idea that one means “issuing money as interest-bearing debt” and the other is wonderful and nice is a fairy tale. They are the same thing. They are both debt, according to the dictionary meaning of debt. And they get even samer as rates get lower and maturities get shorter, and become absolutely identical.What happens now is that the Treasury or the Fed create money, reserves and then it is put into the government’s interest bearing savings vehicles. Big deal. Cyrus gets close to saying that the only problem is inflation, and that is the only conceivable problem. But in some conditions the mainstream obsession that positive interest can lower inflation and asset speculation might be right. So there are some conceivable non-super-evil, rational public purpose reasons for bonds, although a major plank, but not the most important one, in the MMT platform is ZIRP – what you and many others wrongly call “debt-free money”. But far more important than ZIRP is to understand that we have an MMT system RIGHT NOW. Just have Congress vote in a Job Guarantee (and stop the debt limit crap) and with NO systemic, structural change, we are most of the way to a just, rational system. Of course there are technical financial changes MMTers would like to have. But they are of lesser importance; just enforcing current laws against fraud would be more important.If the government created money, it would have no need to borrow and there would be no Federal debt. For the umpteenth time, the government created money would BE the Federal Debt. The government directly creates money right now and it is part of the Federal Debt, correctly understood.The money, the greenback issuance IS the borrowing essentially, the creation of a debt. Governments selling their own bonds for their own currency IS NOT borrowing, is nothing like, has nothing to do with borrowing the way the word is used anywhere else, appears differently on balance sheets from real borrowing. It is swapping an asset, not borrowing.

- Frank | March 8, 2013 at 8:32 pm |CalcagusI think that you are tying yourself in knots over your definition of the word debt.Lets agree then, that there is interest bearing debt and non interest bearing debt. In our present monetary system all money is created as interest bearing debt. What HR 2990 proposes, is that money be put into circulation directly by the US Treasury without the involvement of any bank and in doing so, would not incur any interest payments to anyone.This would save the taxpayer immense sums of money in interest payments

and at the same time obviate the need for taxation to fund government expenditure. Progressive taxation could be used, however, to destroy money in order to control inflation and redress the vast inequalities in our society.http://marketwatch666.blogspot.hk/2013/03/feudal-america-wealth-of-lords-vassals.html

- Frank | March 8, 2013 at 8:32 pm |CalcagusI think that you are tying yourself in knots over your definition of the word debt.Lets agree then, that there is interest bearing debt and non interest bearing debt. In our present monetary system all money is created as interest bearing debt. What HR 2990 proposes, is that money be put into circulation directly by the US Treasury without the involvement of any bank and in doing so, would not incur any interest payments to anyone.This would save the taxpayer immense sums of money in interest payments

- Calgacus | March 8, 2013 at 3:06 pm |Frank, I happen to have studied some MMT economics and some ‘Keynesian’ econ long before. And it makes sense to me. I think it is correct. And I think that what you and some of what Cyrus are saying is not correct, and some of it IMHO makes very little sense. And you would see that if you thought about it . Nobody else but the government can create reserves, currency, cash, base money. That is how it works now, that is how it has always worked. Why not try to read through the Modern Money Primer, or other works, without the preconception that your current ideas must be right – try to understand the actual mechanics of, operations of money.Of course banks can corrupt the government, but it is the government that must be corrupted, its agents refraining from enforcing the law, and allow institutions insolvent due to their own frauds to continue to have a banking licence. What you are saying sounds critical of the Big Bad Banks, but it is what the Evil Banksters would like people to believe. Knowing that right now Uncle Sam, the supposedly democratically elected sovereign government is very much financially in charge is something they want to keep secret.One of the first steps is to understand that as FDR said to the nation: that “government credit and government currency are one and the same thing.” Spending with subsequent bond issuance and positiive interest rates and printing currency directly, a ZIRP are only minutely different. The idea that one means “issuing money as interest-bearing debt” and the other is wonderful and nice is a fairy tale. They are the same thing. They are both debt, according to the dictionary meaning of debt. And they get even samer as rates get lower and maturities get shorter, and become absolutely identical.What happens now is that the Treasury or the Fed create money, reserves and then it is put into the government’s interest bearing savings vehicles. Big deal. Cyrus gets close to saying that the only problem is inflation, and that is the only conceivable problem. But in some conditions the mainstream obsession that positive interest can lower inflation and asset speculation might be right. So there are some conceivable non-super-evil, rational public purpose reasons for bonds, although a major plank, but not the most important one, in the MMT platform is ZIRP – what you and many others wrongly call “debt-free money”. But far more important than ZIRP is to understand that we have an MMT system RIGHT NOW. Just have Congress vote in a Job Guarantee (and stop the debt limit crap) and with NO systemic, structural change, we are most of the way to a just, rational system. Of course there are technical financial changes MMTers would like to have. But they are of lesser importance; just enforcing current laws against fraud would be more important.If the government created money, it would have no need to borrow and there would be no Federal debt. For the umpteenth time, the government created money would BE the Federal Debt. The government directly creates money right now and it is part of the Federal Debt, correctly understood.The money, the greenback issuance IS the borrowing essentially, the creation of a debt. Governments selling their own bonds for their own currency IS NOT borrowing, is nothing like, has nothing to do with borrowing the way the word is used anywhere else, appears differently on balance sheets from real borrowing. It is swapping an asset, not borrowing.

- Charles Fasola | May 11, 2013 at 4:10 pm |The banks rule the roost in our current system; try as you may to support your delusions be and spread of disinformation. Though you and I and many others may wish the system to be as you describe, the legislative changes necessary to create the system you wish for are not now in place. You are providing a description of a monetary system which does not exist yet in reality. The majority of the funds created are done so by private banking.

- Cyrus Rex | March 7, 2013 at 6:23 pm |Calgacus, I can’t seem to get this central point across well enough — the government can create and spend all of the money it wants and, to a certain extent given current Fed regulations, so can banks for lending. The problem is not in the creation, it is in the hard fact that Congress legislated that all of the money that the Treasury issues has to be issued as interest bearing debt. The government is not free to issue “debt-free” money and the interest must be paid by either the government — which simply adds to the interest total — or by taxes extracted from the taxpaying public. Taxes are how the government extinguishes excess money in the economy, but the use of tax receipts to pay interest does not in any way boost the productive economy.There is simply no rational basis for the Congress (i.e., the government) to require that the government issue all of its money as interest bearing debt beyond its desire (never admitted) to provide Wall Street with a multi-billion dollar annual unearned subsidy — regardless of how the interest ends up being paid. What it creates is a sense of panic in the public which is used by the right and libertarians to foist off austerity programs on the vast majority of the citizenry while available money is moved to the top of the income pyramid. It is nothing more than a Ponzi scan to impoverish the majority of Americans.Just ask your local Congressperson why U.S. money is issued as debt and I’ll almost guarantee that the answer will be some variance on “well, that’s the way it’s always been done — it’s just the way money works.” And from the point of view of the banking establishment, that’s the way they want to keep it working. The Bank of England got it all started in 1694 and they’ve been raking it in ever since. But then it was necessary for the King to borrow gold in order to fight his wars. That is no longer necessary with fiat currency.

- Calgacus | March 7, 2013 at 6:02 pm |Frank: In our current monetary system, all money is created as interest bearing debt by the banks. NO. The government and only the government creates reserves, currency, cash, base money. Uncle Sam is in charge, not the banks.Benedict@Large: Money is simply created, and the “interest bearing government debt” is simply created, and the two might be exchanged for one another by government monetary operations, but they do not “offset” eachother. Do a $20 bill and a $10 bill offset each other in your wallet? The bond and the currency are both government debts that can be held by the private sector. That is ALL. Also, it is better, and generally more historically accurate to see the money being created first and the bonds later. As Warren Mosler says: “The funds to pay taxes and buy government securities come from government spending.”

- financial matters | March 6, 2013 at 2:55 pm |The Fed is buying a lot of worthless MBS. They are trying to provide some liquidity to the banking system and to prop up housing prices. It’s an inefficient battle over debt deflation but pretty much the only game in town because of the lack of Congress and the administration to provide better fiscal alternatives. Much of the private mortgage pool which was largely fraudulently origintated anyway should be written off and brought more in line with reasonable housing prices. An average home should be worth what an average person can pay with a reasonable percentage of their income. A far cry from where we were with NINJA loans being offered as everyone was hoping to benefit from capital appreciation.This would combat debt deflation in a healthier manner giving people more disposable income to feed demand.

- Frank | March 6, 2013 at 2:28 pm |In our current monetary system, all money is created as interest bearing debt by the banks, but who wants to borrow to expand a business, when demand is stagnant or current productive capacity is under utilized ?Ben Bernanke is busy buying up corporate bonds to the tune of $40 billion per month. Where is this money going ? It does not seem to be entering the consumer economy.

- jerry | March 6, 2013 at 2:34 pm |Deficit hysteria = fiscal anorexia.. good one!

- aj | March 6, 2013 at 2:49 pm |Good article JD. I often find myself thinking that the basic misunderstanding is that people are not aware of how a closed system works vs. an open system. Then, I realize that it’s not just that misunderstanding. It’s also trying to build and macro model on micro foundations. Plus, the all government is bad meme. Plus, 800 other false notions that people have.The real problem then is that there are so many false notions out there all contributing the problem that it is difficult to get someone to understand all that needs to be understood to accept the MMT veiwpoint. I’ve been reading NEP and other MMT material for over 2 years now and I still don’t understand it all. What hope do we have for people with 10 second attention spans and aversions to math? It seems overwhelming.

- Scott Hedlin | March 6, 2013 at 3:07 pm |What was it? on the menu when Obama and Romney had post election lunch together as opposed to the dinner fare when fortifying for the town hall debate. I think if the over-all nutritional and caloric comparisons are made,take the difference and divide it by the entire tab and tip, its private sector costs, it will prove only one thing. There is no honest conclusion we can draw except we are living with the consequences of the political enterprise. It’s remarkable that these menus by implication were assumed related to the characters and outcome of the debates as a legitimatizing factor. Steak and potatoes v.s. some kind of chicken variation and pilaf. The following media lunch, took the form of a lightweight, cosmopolitan, waistline conscious consolation meal. The real issue is the demoralization of the public attitude to make it vulnerable to the neo-liberal promise and generalizations. Look at the illusions of the food choices, red meat and potato, solid food choice synonymous with vigor, strength, endurance. Chicken ala’ mobility, strategy, digestible, not over filling. Now if it is assumed that food and character are related, denial of food is demoralizing by mere suggestion. Deficit hysteria and attrition are neo-liberal tools with privatization goals. Remaking public purpose, limiting the acceptable dialog, and predictably acting as if there is no alternative straight out of the oligarchs playbook invokes the specter of hunger. Hunger is a need and we eat so we can hunger again ; there really isn’t anything scary about normal hunger, but abnormal hunger and scarcity are frightening, and fear isn’t as rational as we’d like to believe when under its influence. Are well being and being rational needs? or are they secondary outcomes of having basic needs predictably filled. Tightening ones own belt is well, personal……tightening another’s belt is a completely depersonalizing act.

- sgt_doom | March 6, 2013 at 3:42 pm |…when the hysteria about the nation’s “deficit” first emerged…I don’t remember such a thing, actually, I do remember the Obama appointed Rockefeller/Kissinger lackey (Kissinger hired him at private equity/leveraged buyout firm, Forstmann Little) Erskine Bowles, who sits on the BoD of Morgan Stanley while wifey sits on the BoD of JPMorgan Chase, and I do recall Bowles’ lies afterwards.But most of all, I recall this:http://www.sourcewatch.org/index.php?title=Portal:Fix_the_Debt

- Pingback: Our Fiscal Anorexia | Fifth Estate

- Cyrus Rex | March 6, 2013 at 7:42 pm |It seems to me that both sides in this debate are wrong. There is something very destructive in the continued build-up of debt and there is something even worse in solving this supposed problem by imposing austerity. Everyone seems to have forgotten just why it is that the U.S. has a debt “problem” to begin with. Yes, technically the U.S. is a sovereign issuer of its own currency — except for one small fact — in the Banking Act of 1935 Congress enacted legislation mandating that all money issued by the Treasury be sold as Treasury bonds or notes either to individuals or through primary dealers in New York. For the Treasury to actually spend this money the Federal Reserve has to purchase these bonds and notes from the primary dealers at interest — thus creating a totally unnecessary, but very real, debt burden.It is true that Congress could repeal this arcane act and relieve the nation from the threat of debt impoverishment, but just try to find a member of Congress who even knows that this mandate exists or that their institution brought it about. It may have made some sense (though that is doubtful) while the U.S. was still on the “gold standard”; but, after 1971, this continued policy of the issuance of money as debt became nothing but a needless and destructive subsidy of Wall Street by the taxpayers. So MMters can argue till the cows come home that the U.S. can issue all of the money it wants to satisfy government obligations — and that is true — but it does nothing to stave off the crisis of taxpayers being impoverished by the ultimate tax burden of paying off the nonsensical interest penalty imposed by our own representatives.Until such time as Congress can escape the clutches of Wall Street and come to its senses — and good luck with that one — we are still faced with an ultimate debt catastrophe because of the requirement that the interest on the national debt be paid by taxpayers. The issuance of additional money by the Treasury only adds to this unnecessary burden, yet no one on either side of this divide seems to recognize this simple fact. It seems to me that this is an issue which anyone even remotely familiar with fiscal policies should be publicizing and screaming to the media about with great regularity. Simply saying over and over again that the U.S. is a sovereign issuer of currency absent this caveat is a non-starter as far as I can see. The voters need to be educated that it was their representatives who put the nation in this bind and it can only be their legislators who can remedy the situation!

- Frank | March 6, 2013 at 11:33 pm |“The comfort of the rich depends upon an abundant supply of the poor.”― Voltaire

- aj | March 7, 2013 at 9:51 am |Scott Fullwiler had a recent 5 part series that dealt with sustainability of the defict/debt. While it was incredibly wonky, the simple conclusion was that as long as the interest rate on the debt is less than the growth rate of the economy, the debt-to-gdp ratio eventually stabilizes and then reverses itself. While it does seem counter-intuitive at first, a simple Excel experiment will confirm the results.The point being that even if MMTers concede to the (current) reality that the sovereign must continue to issue debt to finance itself, there is still NOT a sustainability issue.

- Frank | March 7, 2013 at 10:20 am |You might be ignoring the advances in manufacturing technology, offshoring of jobs and the real unemployment rate of around 18% when you say that increasing debt levels, whether private or public are sustainable. The exponentially increasing debt is only sustainable, if the debtors can pay the the interest and the principal, when it it is increasingly evident that they cannot. Real wages are declining in the face of cost of living increases, job losses are continuing and homes are being foreclosed. The US government has just reduced spending, which will cause more jobs to be lost.Meanwhile, the rich 1% are getting richer. Is the underlying cause of the economic slowdown the vastly unequal distribution of wealth and income ?The effects of inequality have a serious impact on the well being of any society.https://www.youtube.com/embed/cZ7LzE3u7Bw?version=3&rel=1&fs=1&autohide=2&showsearch=0&showinfo=1&iv_load_policy=1&wmode=transparent

- joe | March 7, 2013 at 6:23 pm |Loved his book on inequality from about 8 years ago?

- joe | March 7, 2013 at 6:23 pm |Loved his book on inequality from about 8 years ago?

- Frank | March 7, 2013 at 10:20 am |You might be ignoring the advances in manufacturing technology, offshoring of jobs and the real unemployment rate of around 18% when you say that increasing debt levels, whether private or public are sustainable. The exponentially increasing debt is only sustainable, if the debtors can pay the the interest and the principal, when it it is increasingly evident that they cannot. Real wages are declining in the face of cost of living increases, job losses are continuing and homes are being foreclosed. The US government has just reduced spending, which will cause more jobs to be lost.Meanwhile, the rich 1% are getting richer. Is the underlying cause of the economic slowdown the vastly unequal distribution of wealth and income ?The effects of inequality have a serious impact on the well being of any society.https://www.youtube.com/embed/cZ7LzE3u7Bw?version=3&rel=1&fs=1&autohide=2&showsearch=0&showinfo=1&iv_load_policy=1&wmode=transparent

- Frank | March 6, 2013 at 11:33 pm |“The comfort of the rich depends upon an abundant supply of the poor.”― Voltaire

- Jmarco | March 6, 2013 at 10:44 pm |Fear plays a big part in why Americans want their government to reduce its spending.Even though Greenspan and Bernanke both have appeared before Congress and stated that US government with its own sovereign currency cannot default on its debt and most of its spending occurs with just computer keystrokes not printing US dollars.All 70 yrs of my lifetime, I have been suspectible to the myth “US will spend itself into default unless it pays down its debt”. I knew that if I did not have enough money in the bank and could not get credit/loan. I had to be careful what I spend. And through all those 70 yrs I read/heard if US keeps having more deficits that:

(1) It will create a burden on future generations

(2) China/Japan will stop lending to the US.

(3) Inflation rate will skyrocket up.But of course if we have to fund a war, then “forget those deficits”. Most present-day Republicans signed off on no revenue(taxes) to pay for Bush’s Medicare Plan D coverage and fight two wars (Iraq & Afghanistan). They didn’t worry about all the above reasons/myths for having those deficits. Bush specifically asked that spending on both wars be kept out of Congressional budgets. A lot of US companies made a bundle off that non-budgeted spending. People were given jobs and they spent their wages on goods and services to raise US GDP.What if after WW II US had said we have payoff our debt instead of spending billions of US dollars on investments designed to rebuilt the German and Japan economies? Did they fear that future generations would be angry at them for leaving them with tons of debts to payoff?No, they knew that this spending is what would keep US and rest of world economies from going back into depression. That spending would produce benefits to US economy (creating buyers for US goods). Our leaders were looking forward insteading of worrying about paying off huge war debt. They knew the US economy had the ability to grow and that its debt would be smaller in relation to growing US economy/poplulation. Private enterprise did not provide that spending but US government did. US government provided money for servicemen to get educations that created better job offers.The US has to stop being a small-minded/frighten consumer nation and look to building an economy for all the young and future Americans. It will take more US government borrowing. Use those borrowings for investments to create more jobs/businesses. The US consumer is still too deep in credit/debt to provide the needed investments. In my twenties, my peers were buying homes with loans that would take 30 yrs to payoff. They took a risk on their futures by taking on debt. The US needs to take that kind of risk and let its growing GDP provide funds to payoff futue debt. - Ralph Musgrave | March 6, 2013 at 11:54 pm |The whole problem stems from that word “debt” as in “national debt”. That is, the economic illiterates who run Western countries think that a national debt is comparable to the debt of a household or firm, which of course it isn’t.If the “national debt” was called the “national elephant” the above illiterates would think the national debt really was an elephant, complete with trunk. And if you called it the “national apple pie” they’d all think the national debt was wonderful because as is well known, apple pie and mother’s milk are wonderful.

- Frank | March 7, 2013 at 12:02 am |The problem with debt is that it bears interest and no matter what rate of interest is charged, it causes the debt to increase exponentially. I don’t see why the US Treasury has to go into debt in order to obtain the money it needs.Why should government create a means for people with excess money to park their funds ? They should be either spending it or investing in some productive enterprise.

- Tristan Lanfrey | March 7, 2013 at 3:04 am |I don’t see why the US Treasury has to go into debt in order to obtain the money it needs.It doesn’t, a monetary sovereign government issues debt to drain private bank reserves and therefore maintain the target interest rate.Alternatively, the central bank could just pay interest on reserves to provide a floor on the interest rate (they do in most country nowadays).Now, agreed, most countries also have a self-imposed accounting constraint that forces them to match deficit spending with debt issuance, and some of them (most?) even go as far as saying they must borrow in advance. But these are unnecessary self-imposed constraints that could be removed by apropriate legislation.Why should government create a means for people with excess money to park their funds ? They should be either spending it or investing in some productive enterprise.You can’t force people into becoming venture capitalists, most of them (myself included) have no idea what a productive enterprise may or may not be. Allowing people to store IOUs provide incentive for being useful and productive, because their wealth storage full of IOUs allows them to redeem them in the future in exchange of goods and services. You can see that (positive) balance of funds as a form of payback for the (positive) difference between whatever goods and services they themselves produced and the ones they consumed in the past.If they consumed more goods and services than they produced in the past, then that difference of IOUs is negative, and it’s called debt. It’s only logical that they have to payback whatever goods and services they over consumed (compared to what they produced). It all makes sense.

- Jordan | March 7, 2013 at 6:09 am |In the last paragraph, you confalte the savings with production quantity. That would be ok, if wages correspond to the ammount of production. Don’t you know that those that produce nothing, make largest bonuses and income from dividends, while those in production make the least and save the least of all?

- Frank | March 7, 2013 at 9:35 am |“a monetary sovereign government issues debt to drain private bank reserves and therefore maintain the target interest rate.”What is so important about a target interest rate ? I assume you mean the inter bank lending rate or LIBOR. How do the credit card companies get away with charging 15 to 25% ?Last night I glanced throughhttp://www.archive.org/stream/NationalEconomyAndTheBankingSystemOfTheUnitedStates/NationalEconomyAndTheBankingSystem_djvu.txtwhere it states that banks were supposed to lend to borrowers at 6%.

- Jordan | March 7, 2013 at 10:45 am |By controling interest rates FED slows down creation of new credit/ money and by doing that it controls inflation. On the other hand if there is too much unemployment, FED lowers interest rate to incents creation of credit/ money by banks to employ those people.

If there is too much bank reserves FED has to drain it out of the system to force banks to come to the window where it sets desired rate. It is a dual mechanisam for FED to control: unemployment and inflation. In conditions of growth/growing credit creation by banks there is no need to drain reserves since the need for reserves grow by credit creation.

At least, that is the thinking behind FEDs policy even tough it is not possible to control bank’s side of credit issuance but only on borowers willingnes to pay such rates, so it is effective untill there is need for more employment but the interest rate is allready 0. Zero lower bound/ liquidity trap/ savings glut are all synonims when interest rate iz zero but unemployment rate requiers even lower then zero, but it is UNIMAGINABLE to have negative interest rates even tough it is possible operationaly.- Frank | March 7, 2013 at 1:45 pm |At one time the Swiss banks paid negative interest rates on their Swiss Franc deposit accounts, presumably because the Swiss Franc was becoming overvalued in the foreign currency markets, probably because so many people worldwide were using Swiss Bank accounts for tax avoidance. However, all this did, was to encourage the very same money to be deposited in the same Swiss Banks, but in US dollar accounts., which can be accessed with a debit card at any ATM worldwide.One attraction of US Treasury Bills is that they pay interest, which is US Federal income tax free, whereas on private bank accounts tax is payable on the interest.Anyway, what you are really telling me, is that the private banks have too much money on deposit, if Treasury Bills are necessary to drain the amount of deposits. Thus Treasury Bills drain the private sector of money and therefore supports government spending, which theoretically should make up for the lack in the private sector. However, since jobs are being cut in the public sector, something is out of whack.

- Jordan | March 7, 2013 at 2:00 pm |Oh, no, Frank. That last sentence has nothing to do with private sector or public sector accounting. Sectoral ballance is not about people employed there or where, it is only about accounting in public sector. Public sector in accounting has nobody, it is only accounting ballance. MMT is about nominal values and relations, how money flows. What matter to us is how public accounting affects private sector ie us, people, our wealth.

- Frank | March 7, 2013 at 2:06 pm |Your reply does not make any sense to me.

- Jordan | March 8, 2013 at 10:15 am |You said:”since jobs are being cut in the public sector”.

When somone talks about jobs then you have public sector jobs.

But, when someone talks about sectoral ballance, there is no jobs, only about accounting.

MMT is about accounting, so there is never talk about diferentiaton between public or private sector jobs. MMT does not care about sectoral jobs, only about sectoral ballance/ money relation. WHen MMT talks about public sector, it never, never means public sector job.

- Jordan | March 8, 2013 at 10:15 am |You said:”since jobs are being cut in the public sector”.

- Frank | March 7, 2013 at 2:06 pm |Your reply does not make any sense to me.

- Jordan | March 7, 2013 at 2:00 pm |Oh, no, Frank. That last sentence has nothing to do with private sector or public sector accounting. Sectoral ballance is not about people employed there or where, it is only about accounting in public sector. Public sector in accounting has nobody, it is only accounting ballance. MMT is about nominal values and relations, how money flows. What matter to us is how public accounting affects private sector ie us, people, our wealth.

- Frank | March 7, 2013 at 1:45 pm |At one time the Swiss banks paid negative interest rates on their Swiss Franc deposit accounts, presumably because the Swiss Franc was becoming overvalued in the foreign currency markets, probably because so many people worldwide were using Swiss Bank accounts for tax avoidance. However, all this did, was to encourage the very same money to be deposited in the same Swiss Banks, but in US dollar accounts., which can be accessed with a debit card at any ATM worldwide.One attraction of US Treasury Bills is that they pay interest, which is US Federal income tax free, whereas on private bank accounts tax is payable on the interest.Anyway, what you are really telling me, is that the private banks have too much money on deposit, if Treasury Bills are necessary to drain the amount of deposits. Thus Treasury Bills drain the private sector of money and therefore supports government spending, which theoretically should make up for the lack in the private sector. However, since jobs are being cut in the public sector, something is out of whack.

- Jordan | March 7, 2013 at 10:45 am |By controling interest rates FED slows down creation of new credit/ money and by doing that it controls inflation. On the other hand if there is too much unemployment, FED lowers interest rate to incents creation of credit/ money by banks to employ those people.

- Jordan | March 7, 2013 at 6:09 am |In the last paragraph, you confalte the savings with production quantity. That would be ok, if wages correspond to the ammount of production. Don’t you know that those that produce nothing, make largest bonuses and income from dividends, while those in production make the least and save the least of all?

- Tristan Lanfrey | March 7, 2013 at 3:04 am |I don’t see why the US Treasury has to go into debt in order to obtain the money it needs.It doesn’t, a monetary sovereign government issues debt to drain private bank reserves and therefore maintain the target interest rate.Alternatively, the central bank could just pay interest on reserves to provide a floor on the interest rate (they do in most country nowadays).Now, agreed, most countries also have a self-imposed accounting constraint that forces them to match deficit spending with debt issuance, and some of them (most?) even go as far as saying they must borrow in advance. But these are unnecessary self-imposed constraints that could be removed by apropriate legislation.Why should government create a means for people with excess money to park their funds ? They should be either spending it or investing in some productive enterprise.You can’t force people into becoming venture capitalists, most of them (myself included) have no idea what a productive enterprise may or may not be. Allowing people to store IOUs provide incentive for being useful and productive, because their wealth storage full of IOUs allows them to redeem them in the future in exchange of goods and services. You can see that (positive) balance of funds as a form of payback for the (positive) difference between whatever goods and services they themselves produced and the ones they consumed in the past.If they consumed more goods and services than they produced in the past, then that difference of IOUs is negative, and it’s called debt. It’s only logical that they have to payback whatever goods and services they over consumed (compared to what they produced). It all makes sense.

- Frank | March 7, 2013 at 12:02 am |The problem with debt is that it bears interest and no matter what rate of interest is charged, it causes the debt to increase exponentially. I don’t see why the US Treasury has to go into debt in order to obtain the money it needs.Why should government create a means for people with excess money to park their funds ? They should be either spending it or investing in some productive enterprise.

- Jordan | March 7, 2013 at 4:17 am |y asks important question:

“If an increase in government spending caused inflation to increase, would that increase private sector “wealth”, reduce it, or leave it the same overall?”Let’s concede, for the sake of an argument, that government spending cause inflation to increase but leaves the private sector wealth the same. Higher inflation reduces the debt burden under fixed rate but not under adjustable rates unless inflation growth is pervasive. Under fixed rates, savers loose some of the wealth, while debtors gain. That would be a moral issue then, not the issue of what benefits society as a whole.This is about what benefits society as a whole against individual savers loosing some of the saving values. Savings come from inability to spend all of the income of a person and from desire to save for rainy days(retirement). More savings someone have, more they loose with the inflation, therefore those small number of people with incomes so large that can not ever spend it all would loose much more nominaly then those that save for retirement. But they would not loose in real values since they have so much saving that they willl never use it anyway so they do not loose any real value, only nominaly. Those that have 40% of wealth in the USA would loose mostly their pride, nothing of real value. For them, inflation is a moral and status question.Times when inflation does not change Velocity and Quantity is called stagflation. In sovereign systems, it can be caused only by external pressure on comodity prices, so, it is not controllable since it is external. But still, for the sake of an argument, let’s agree that overall wealth is not changed by inflation.If wealthy 1% loose only nominaly with inflation, debtors gain. Debtors are huge portions of a society, so huge portion of society would gain while very small portion would loose with inflation even if Q doesn’t change. Those with smaler savings would loose but also gain considering that most of them are in debt also. It is redistribution quality of inflation that matters a lot and it’s requierd to prevent huge inequalities building over time which makes political and institutional instability to appear.Redistribution is a huge stabilizing factor for a system that is highly distributive towards wealthy. High marginal taxes and inflation are crucial for stability of a society in a long term. We have to have redistribution process no matter how imoral it might seem to the private property idealists. Without it, you get instabilities and wars.

If inflation does not grow Q, then at least you get less suffering within society as a whole, but we know that times of stagflation are extremely rare, so inflation almost always grows Q. Reducing suffering is higher moral goal then of those private property idealists. - Ian | March 7, 2013 at 10:58 am |I’m SHOCKED, just SHOCKED that a neo-liberal president would pursue a neo-liberal policy agenda. How could he? He promised us that he would continue the Clinton legacy and here he is following Clintonite budgetary policy. Why won’t he just abandon everything he believes in, abandon the financial interests that help elect him and do the right thing?The president and the democratic party do not like us. We’re “[expletive deleted by admin]”. It’s time to move on. Obama’s not going to educate the american people, and we can’t check him into rehab. He’s not deluded. This is not some temporary passing affliction. Obama is not the teenager who got a distorted body image from popular culture and magazines, he’s the editor of Cosmo.

- Teejay | March 7, 2013 at 2:08 pm |S>I and G>T. What do S,I,G and T symbolize?

- LD | March 7, 2013 at 3:53 pm |Guess since I don’t have a reference as to where this is notated:

Savings > Investment

Government Spending > Taxes- Frank | March 7, 2013 at 6:20 pm |How does one define investment ?many people think that when they buy a stock certificate, they are “investing” in the corporation. whereas in fact they are just buying a piece of paper from some other person, who is cashing in his chips. The money is not flowing to the corporation and hence it is not being “invested.” It is merely a bet that the stock price of the corporation will go up and/or that the corporation will pay dividends.The only people who actually invest in corporations are the people who start the enterprise and any venture capitalists, who inject money in order for the business to expand.Investing in corporate bonds is also real investing, in that the money to buy the bonds flows directly to the corporation.

- Frank | March 7, 2013 at 6:20 pm |How does one define investment ?many people think that when they buy a stock certificate, they are “investing” in the corporation. whereas in fact they are just buying a piece of paper from some other person, who is cashing in his chips. The money is not flowing to the corporation and hence it is not being “invested.” It is merely a bet that the stock price of the corporation will go up and/or that the corporation will pay dividends.The only people who actually invest in corporations are the people who start the enterprise and any venture capitalists, who inject money in order for the business to expand.Investing in corporate bonds is also real investing, in that the money to buy the bonds flows directly to the corporation.

- LD | March 7, 2013 at 3:53 pm |Guess since I don’t have a reference as to where this is notated:

- Joe Firestone (LetsGetitDone) | March 8, 2013 at 11:07 am |JD, I think you did a great job here in putting things simply. I couldn’t agree more.For various commenters, many of you have been arguing about the very negative effects of public debt politically. I agree that with the MMT economic argument, that the level of debt and the level of the debt-to-GDP ratio don’t matter for the capacity of a nation sovereign in its own currency to keep issue new debt. But I also agree with the political argument that the debt is perceived badly and that it prevents activist fiscal policy from gaining traction.So, I think we should get rid of the debt and continue and increase the deficit spending. My previous bog posts here, and this book, explain how to do both from an MMT point of view within the present legal framework.

- Frank | March 8, 2013 at 10:46 pm |Hey Joe, hope you like this video- it is one of my favorites.

http://www.youtube.com/watch?v=-vsNQE-I6E4Your statement that we should get rid of the debt and increase the deficit does not seem entirely logical, but I have yet to read the book 😉Best regards, Frank

- Frank | March 8, 2013 at 10:46 pm |Hey Joe, hope you like this video- it is one of my favorites.